Zego, the UK’s first insurtech unicorn, is taking a swing at traditional telematics. Instead of relying on black box devices fitted to cars, the company has rolled out an app-based system that uses smartphone sensors to track driving behaviour in real time.

For years, black box cover has been a route for younger and high-risk drivers to access fairer pricing.

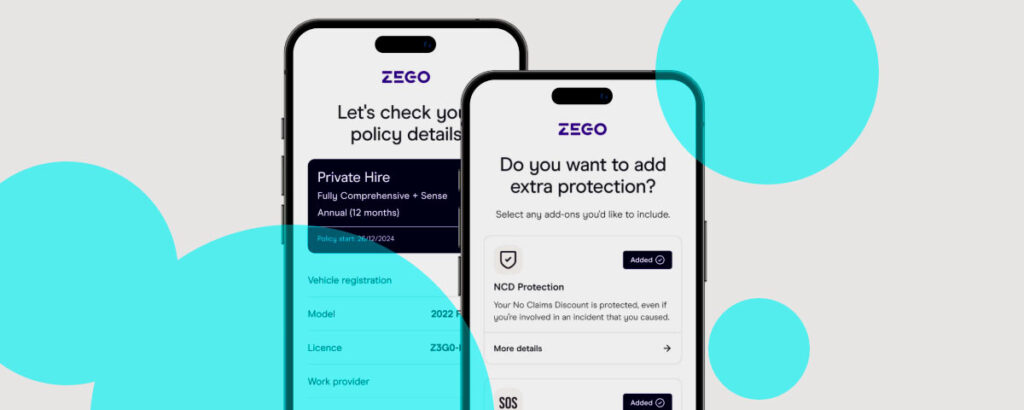

But it came with drawbacks: installation costs, hardware hassles, and limited visibility into how data shaped premiums. Zego argues its new model strips away that complexity while giving drivers more control over the process.

The app records speed, braking, and cornering directly through the phone’s sensors. Each journey feeds into a driver profile, creating a data trail that reflects actual behaviour behind the wheel.

Speed, acceleration, braking and cornering are monitored through the phone itself, giving drivers near-instant feedback on how their actions affect both safety and cost.

Unlike conventional black box policies, feedback is immediate—drivers can see how their actions affect both safety and potential costs.

Zego’s current focus for this technology is on new driver insurance, a demographic that has historically faced some of the highest premiums in the UK.

The company’s app-based telematics is intended to give new drivers the opportunity to prove their safe driving habits, rather than being assessed solely on factors like age, postcode, or lack of experience.

The idea: let them prove safe habits on the road rather than be judged solely on blunt risk factors like age, postcode, or lack of history. Over time, this profile can feed into fairer renewal pricing and more tailored cover.

CEO Sten Saar framed it as overdue change. Car insurance in the UK has relied on outdated models for too long, leaving drivers paying more than they should.

Zego is redefining the market with telematics insurance that is app-based, simple, and safety-focused, giving people cover that reflects how they really drive.

Sten Saar, CEO of Zego

“For new drivers in particular, it’s about proving yourself on the road and being recognised for it. That’s what sets Zego apart,” Sten Saar commented.

The broader mission is clear. By shifting telematics from hardware boxes to apps, Zego wants to modernise car insurance in a way that lowers barriers, increases transparency, and rewards good driving in real time.

Zego is replacing traditional “black box” car insurance with a new app-based telematics system that uses smartphone sensors to track driving behavior.

This move aims to make insurance more accessible, transparent, and safety-focused by giving drivers immediate feedback and enabling them to build a driving profile based on real journeys, rather than relying on factors like age or postcode.

Zego built its reputation by rethinking how car and commercial motor insurance is structured and priced. Instead of relying on traditional black box telematics hardware, the company shifted to an app-based model that uses smartphone sensors to capture driving behaviour in real time.

The system helps drivers, particularly new ones who face high premiums, demonstrate safer habits to potentially earn a fairer price.

Its business model revolves around flexibility. Cover can be arranged for private drivers, ride-hailing and private hire operators, couriers, delivery drivers and business vans, all of which can be managed through a mobile app.

Unlike conventional models that lean heavily on demographic proxies like postcode or age, Zego links pricing more directly to actual behaviour. Safer driving translates into fairer renewal terms and lower premiums, rewarding drivers for measurable risk reduction.

In recent performance milestones, Zego reached profitability in late 2024, reporting a combined operating ratio of around 90%, a clear signal of operational discipline and revenue stability.

At the same time, the company broadened its scope beyond gig-economy drivers, positioning itself as a wider motor insurance provider that now caters to both consumer and business markets. This evolution reflects not only a maturing business but also its intent to establish a stronger role in reshaping the mainstream insurance market.

Zego has raised a total of $282 mn across six funding rounds, which include two seed rounds, two early-stage rounds, one late-stage round and one debt round.

Its largest raise came in March 2021, when the company secured $150 mn in a Series C led by DST Global Partners, giving Zego a post-money valuation of $1.1 bn.

Earlier, the company pulled in $42 mn in a Series B in 2019, with backing from Target Global, Balderton Capital and Taavet Hinrikus, among others.

In 2017, Zego had already attracted $7.9 mn in Series A funding, and prior to that it raised $1.6 mn in a seed round led by LocalGlobe and Singular Ventures. Its earliest outside capital dates back to 2016 with a $186k angel round.

The company also secured venture debt in early 2019 through TriplePoint Capital.

In total, Zego counts 49 investors — 24 institutional, including Balderton Capital, General Catalyst and Latitude, and 25 angel investors.

The progression of capital raises, capped by unicorn status in 2021, reflects strong investor conviction in Zego’s telematics-driven insurance model and its broader expansion from gig-economy coverage into the wider motor insurance market.