Overview

Global growth is decelerating as US tariff policy reduces trade and heightens uncertainty. Consumers and firms have likely already begun cutting spending and investments in response to the uncertainty, which may not be fully visible in the economic data yet.

According to Swiss Re Institute‘s World Insurance sigma, global GDP growth (inflation adjusted) is expected to slow to 2.3% in 2025 and 2.4% in 2026 from 2.8% in 2024. Beinsure analyzed the report and highlighted the key points.

The global insurance industry is expected to follow the trend with total premiums expected to slow to 2% this year from 5.2% in 2024, picking up marginally to 2.3% in 2026.

“While insurers’ profitability outlook is still benefiting from rising investment income, we expect tariffs to slow global GDP growth, and consequently weigh on insurance demand,” says Jérôme Haegeli, Swiss Re’s Group Chief Economist.

Global growth is slowing at a time of large macroeconomic regime shifts. Extreme policy uncertainty is set to persist, the main driver being US goods tariffs.

Trade wars and protectionism leave no winners, but over the longer term will relocate trade and production globally. In this more fragmented world, firms and consumers face greater risks, including more volatile exchange rates and asset prices, heightened further by new developments in the Middle East conflict.

Key Highlights

- Global GDP growth is forecast to slow to 2.3% in 2025 and 2.4% in 2026, down from 2.8% in 2024, due to US tariffs reducing trade and raising uncertainty. Insurance premiums are expected to mirror this trend, growing 2% in 2025 after 5.2% growth in 2024, then improving slightly to 2.3% in 2026.

- US GDP growth is projected to decline to 1.5% in 2025 from 2.8% in 2024, as tariffs drive higher inflation and dampen household spending. A modest recovery to 1.8% growth is forecast for 2026 as the economy adjusts to a higher-tariff environment and labor market conditions stabilize.

- Premium growth in both life and non-life insurance sectors is slowing. Non-life premiums are projected to grow 2.6% in 2025, down from 4.7% in 2024. Life insurance growth is expected to drop to 1% in 2025 from 6.1% in 2024, before improving to 2.4% in 2026.

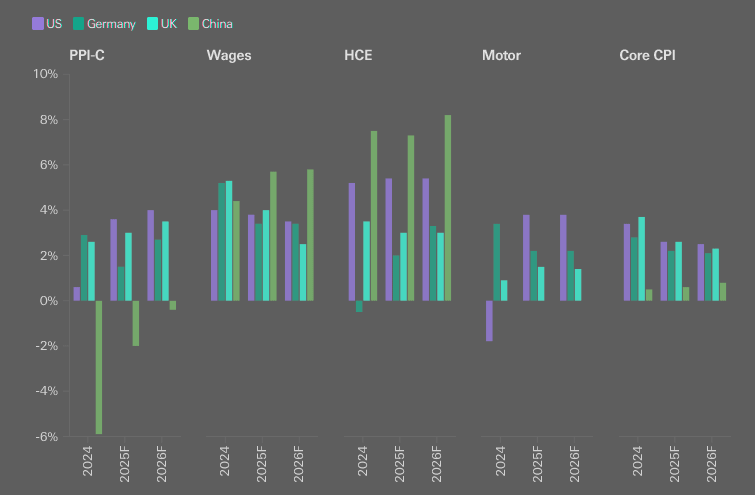

- US motor physical damage insurance faces the largest tariff-related pressures due to higher import costs for auto parts and vehicles. Claims severity is projected to rise moderately, with motor repair and replacement costs increasing 3.8% in 2025, far below the 14% and 13% increases seen in 2021 and 2022.

- While tariffs and market fragmentation raise inflation and claims costs, they also heighten risk awareness, creating opportunities in credit, surety, and marine insurance. Long-term, however, restricted trade and capital flows may increase insurance costs and reduce insurability of peak risks globally.

In the long term, US tariff policy is another move towards more market fragmentation, which would reduce the affordability and availability of insurance, and so diminish global risk resilience.

EMEA insurers, while not directly impacted by US tariffs, face considerable exposure to secondary effects, according to Fitch Ratings’ report.

These tariffs, along with related geopolitical tensions and retaliatory measures, are expected to slow global economic growth and contribute to financial market volatility.

This will place pressure on insurers’ investment performance and underwriting outcomes.

Tariffs in the single digits aim to transform a supply chain but double-digit tariffs are destructive, intended to replace supply chains. The great majority of goods consist of components from different sources, like autos and homes.

Tariffs will be a stagflationary shock for the US

The volatile nature of US policy changes under the current administration has ushered in a paradigm shift of diminished confidence in the US government, eroding its status as a “safe haven” for global capital.

After several years of the fastest growth in the US (compared to Canada, UK, Germany, Italy, France, Japan, Australia) post-pandemic, US GDP growth is forecast at 1.5% this year (slowing from 2.8% in 2024).

Consequently, Swiss Re Institute has lowered growth expectations for most major economies in 2025.

US tariffs impact the primary insurance industry through premium growth, claims and investment returns, with differing effects by geography. We see the greatest and most direct impact on non-life claims severity in the US, most notably in US motor and construction.

Outside the US, tariffs are more likely to be disinflationary, reducing pressure on claims.

CPI inflation by market and sub-category, year-on-year

As global supply chains become less efficient and domestic US industries more protected from international competition, US inflation will likely move structurally higher on average.

US consumers will be hit hardest by US’ tariff policy and cut their spending as a consequence of higher prices. This in turn will weigh on US growth which mostly depends on household consumption.

Later in 2026, Swiss Re Institute forecasts a rebound from the 2025 tariff shock, with somewhat firmer growth of 1.8% as the US economy adjusts to a “new normal” of higher tariff rates, supported by a stabilisation in labour market conditions.

J.P. Morgan recently examined how US tariffs could affect the insurance sector. The analysis shows that personal lines insurers, such as those offering auto and home insurance, face higher direct risks than commercial insurers or reinsurers.

Tariffs have raised the costs of auto parts, vehicles, and building materials. These inputs are central to underwriting in personal lines.

Higher repair costs and rising used car prices are expected to narrow their profit margins.

Commercial insurers face different risks and often operate with broader geographic exposure, making them less sensitive to tariff-driven price increases.

Over the medium to long term, however, the reduced flow of goods, services, capital and people is expected to pose a structural headwind to potential growth.

In Europe, policy uncertainty alone will weigh on economic activity, and result in unchanged growth at 0.8% this year.

US-EU trade negotiations are the main risk to the baseline outlook. However, weaker 2025 growth could give way to a brighter picture in 2026.

A more expansionary fiscal stance by the new German government as well as supportive credit conditions due to further interest rate cuts from the ECB should push euro area growth to 1.3% next year.

Meanwhile, China’s GDP growth is expected to slow to 4.7% compared to 5.0% in 2024 as tariffs and persistent uncertainty disrupt economic activity.

The risks and costs of the accelerating fragmentation of economies and markets may be serious for insurance.

Trade barriers and supply chain disruption or reshoring may push up inflation for prolonged periods, feeding into higher claims costs.

Restrictions on cross-border capital flows for re/insurers can lead to inefficient capital allocation and higher capital costs, ultimately leading to higher insurance prices and possibly curtailing the insurability of peak risks.

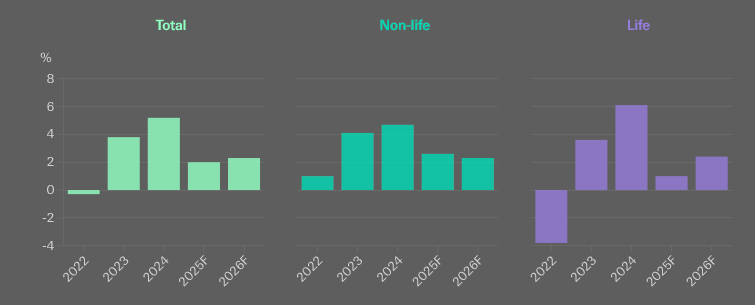

Global insurance premium growth slows

After a strong 2024, growth in the global insurance industry is slowing in both life and non-life sectors. Swiss Re Institute forecasts 2% year-on-year total premium growth in 2025 and 2.3% in 2026, about half the growth rate of 2024.

In non-life insurance, intensifying competition in personal lines and softening market conditions across commercial lines, are driving significantly lower premium growth, down to 2.6% this year from 4.7% in 2024.

After delivering 6.1% premium growth in 2024, life insurance will slow significantly to 1% as interest rates moderate, with growth to improve to 2.4% in 2026.

Real premium growth, total, non-life and life, 2022‒2026F

Premium growth will likely slow as the global economy weakens, more so in trade-exposed areas such as marine and trade credit insurance, and in sectors like construction.

Life insurance sees primarily indirect consequences via financial and labour markets. After a strong showing in 2024, premium growth in the world’s insurance industry is slowing on both the non-life and life sides, impacted by the global economy and unstable policy environment.

World’s 20 largest insurance markets by nominal premium volumes

| Rank | Country | Premium 2024 ($ bn) | % change | Market share |

| 1 | United States | 3,497 | 8.1% | 44.8% |

| 2 | China | 792 | 9.4% | 10.2% |

| 3 | United Kingdom | 485 | 6.8% | 6.2% |

| 4 | Japan | 339 | –6.6% | 4.4% |

| 5 | France | 292 | 10.8% | 3.8% |

| 6 | Germany | 266 | 5.0% | 3.4% |

| 7 | Canada | 181 | 4.7% | 2.3% |

| 8 | Italy | 180 | 14.6% | 2.3% |

| 9 | South Korea | 176 | –0.8% | 2.3% |

| 10 | India | 141 | 4.0% | 1.8% |

| 11 | Netherlands | 99 | 7.0% | 1.3% |

| 12 | Brazil | 89 | 3.8% | 1.1% |

| 13 | Taiwan | 84 | 8.2% | 1.1% |

| 14 | Spain | 81 | –1.4% | 1.0% |

| 15 | Australia | 75 | 0.3% | 1.0% |

| 16 | Hongkong | 74 | 11.3% | 1.0% |

| 17 | Switzerland | 63 | 3.2% | 0.8% |

| 18 | Sweden | 53 | 18.9% | 0.7% |

| 19 | Mexico | 51 | 13.5% | 0.7% |

| 20 | Belgium | 50 | 5.0% | 0.6% |

| Top 20 markets | 7,068 | 6.9% | 90.6% | |

| World | 7,799 | 7.2% |

At the same time, insurers’ profitability outlook remains positive due to continuing gains in investment income.

US-motor most tariff-impacted insurance sector

Swiss Re Institute forecasts the greatest tariff impacts on the insurance industry in the US, while effects outside the US remain relatively limited. These impacts should stay manageable.

Tariffs are expected to raise prices for auto parts used in repairs, as well as new and used vehicle prices for replacements.

Although claims severity in US motor insurance will rise, this increase remains modest compared with the post-COVID-19 inflationary surge. For example, US motor repair and replacement costs are projected to grow by 3.8% in 2025, well below the annual increases of 14% in 2021 and 13% in 2022 (see Rising Auto Insurance Costs in 2025: Tariffs, Claims, Market Impact).

The main direct transmission of tariffs into insurance occurs through claims severity, as higher import costs raise losses, especially in US motor and construction insurance.

US motor physical damage insurance remains the most exposed to tariffs. Increased import costs make repairs and replacement more expensive, directly affecting insurers’ claims payouts in these sectors.

Tariffs and the uncertainty they create could also generate opportunities for insurers. Greater risk awareness generally benefits insurers if the economic shock remains contained.

This is evident in business lines offering protection against economic and financial disruption, such as credit and surety insurance.

Outside the US, marine insurance could benefit if supply chain realignment increases trade among other economic blocs. Additionally, insurance demand may grow with fiscal stimulus in regions like China and the EU, alongside potentially looser monetary policies.

FAQ: Global Growth, Tariffs, and the Insurance Industry

US tariff policy is reducing trade and increasing uncertainty, prompting consumers and firms to cut spending and investment. Global GDP growth (inflation-adjusted) is expected to slow to 2.3% in 2025 and 2.4% in 2026 from 2.8% in 2024. Total global insurance premiums are projected to grow just 2% in 2025, down from 5.2% in 2024, and then slightly recover to 2.3% in 2026. Tariffs weigh on GDP growth and subsequently on insurance demand.

After leading global growth post-pandemic, US GDP growth is forecast to slow to 1.5% in 2025 from 2.8% in 2024. Tariffs are creating a stagflationary shock, raising inflation and reducing household consumption. This affects insurance demand, particularly as US growth relies heavily on household spending. Swiss Re Institute expects a moderate rebound to 1.8% GDP growth in 2026 as the economy adjusts to higher tariffs and the labor market stabilizes.

Global premium growth is slowing in both life and non-life insurance. After strong growth of 5.2% in 2024, premiums are forecast to grow just 2% in 2025, improving slightly to 2.3% in 2026. In non-life insurance, intensified competition in personal lines and softening conditions in commercial lines are expected to reduce growth from 4.7% in 2024 to 2.6% in 2025. Life insurance premiums are forecast to drop from 6.1% growth in 2024 to 1% in 2025, recovering to 2.4% in 2026.

In 2024, the largest markets by nominal premiums were the US at $3.5 tn (44.8% market share), China at $792 bn (10.2%), and the UK at $485 bn (6.2%). The top 20 markets accounted for $7.1 tn in premiums, or 90.6% of the global total of $7.8 tn.

US motor physical damage insurance is the most exposed. Tariffs increase the cost of imported auto parts, repairs, and vehicle replacements. US motor repair and replacement costs are projected to rise 3.8% in 2025, still much lower than the 14% and 13% increases seen in 2021 and 2022. Claims severity in this sector will increase due to higher import costs but remain modest compared to earlier inflationary spikes.

Yes. Heightened risk awareness can boost demand for products protecting against economic and financial disruptions, such as credit and surety insurance. Outside the US, marine insurance could gain from supply chain realignment and increased trade between other economic blocs. Fiscal stimulus in China and the EU, along with potentially looser monetary policy, could also support insurance demand.

Long-term US tariff policy and global market fragmentation reduce trade, capital, and labor flows. This lowers potential GDP growth and makes supply chains less efficient, increasing inflation and claims costs. For insurers, restricted cross-border capital flows can raise capital costs and reduce the affordability and availability of coverage, especially for peak risks.

………………

AUTHORS: Dr Jérôme Jean Haegeli – Head Swiss Re Institute and Swiss Re Group Chief Economist, James Finucane – Senior Economist Reinsurance company Swiss Re, Loïc Lanci – Economist, Swiss Re Institute, Erik Gogola, Roopali Aggarwal, Ashish Dave and others.