Overview

Higher interest rates improve the outlook for life insurers. Demand for savings-related products is surging, with US fixed annuity sales in 2023 more than twice as high as in any other year other than 2022. Insurers expect record sales in 2024 too.

Profitability is improving as well, with greater room for margins in new spread-based products and opportunity to reinvest assets backing legacy liabilities at a higher rate, according to Swiss Re sigma 2/2024. This is possible when the duration of assets is shorter than liabilities, as is the case for the industry in general.

Higher rates also raise risks, by creating incentives for policyholders to shop around for new policies at the same time that rising rates reduce the asset values.

The combination of lapse risk and asset risk can create liquidity or solvency concerns. With a few exceptions, these risks are contained. On net, life insurers materially benefit from the current rate environment as demand and profitability rise in tandem.

Insurance consumers receives the benefits

Life insurance consumers stand to receive the majority of the benefits through higher crediting rates and more generous guarantees.

The monetary policy tightening cycle initiated in 2022 has shifted the competitive and operational environment for life insurers from low yield and return to higher yields and returns, especially for asset-intensive businesses.

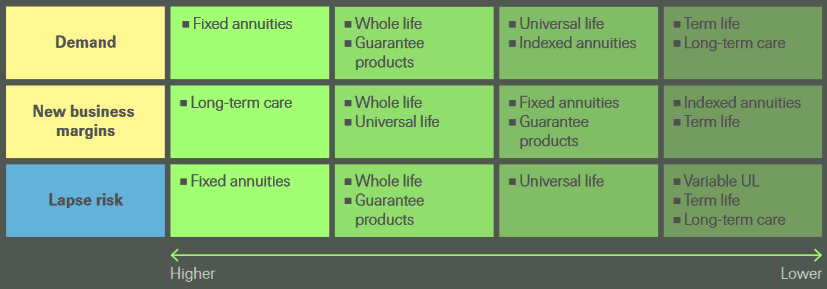

Higher yields increase demand for savings-related products and enhance the potential profitability of both savings- and protection-related products.

Insurers experience rising sales and profits but must prepare for emerging risks. Higher rates increase liability and asset risks and elevate regulatory solvency capital requirements to address lapse and capital stresses.

Sensitivity of life insurance products to rising interest rates

New regulatory frameworks like IFRS17 account better for interest rate volatility and allow insurers to capture the long-term benefits of holding illiquid assets, improving profit recognition patterns.

Higher interest rates boosts savings insurance products

Demographic shifts increase the need for life insurance savings products as well, with a historically large, and growing, share of the population in many countries above the age of 65.

Swiss Re expect strong, annuity-driven growth in the life savings market as the interest rate reset makes savings products more attractive, a growing global middle class adopts retirement planning and incomes rise in emerging markets.

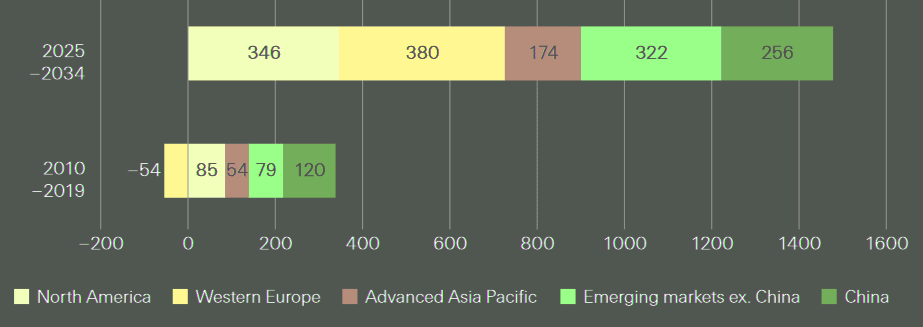

Analytics forecast significantly higher global life insurance premium growth in the coming decade (2.3% average annual real-terms growth 2025–2034), with upside risk potential

Based on these baseline forecasts, global savings premiums will reach USD 4.0 trillion by 2034. Starting from USD 2.5 trillion of savings premiums in 2024, this translates into USD 1.5 trillion of additional savings premiums over the next decade (2025–2034), compared to less than USD 300 billion in the post-global financial crisis decade (2010–2019).

Life and annuity savings business

Advanced markets will generate about 60% of all additional premiums in absolute terms in the next decade; 40% from emerging markets.

Fixed-rate business is the first and most noticeable beneficiary of higher interest rates. Sales of fixed-rate products increase, and net spreads widen above guaranteed crediting rates. In the US, the impact has been immediate: individual fixed-rate annuity sales jumped 63% in 2022 and 36% in 2023 as interest rates rose.

US individual annuity sales in 2023 reached USD 385 billion, 23% above the record set in 2022.

Boost to individual annuity sales was strong in Spain and the UK

In Europe, higher rates significantly boosted annuity sales, especially in Spain, where annuities and traditional savings products dominate the life insurance market. Individual life annuity premiums in Spain increased by nearly 70% in 2023, according to UK Life Insurance Sector Outlook.

This rise was driven by higher rates, employment growth, improved job stability, and slow bank pass-through on deposit rates. In the UK, individual annuity sales grew by 46% in 2023, reaching GBP 5.2 billion, according to the ABI.

Demand for protection products remains less responsive to higher rates. Consumers find the investment returns in fixed-rate annuities more transparent than the implicit returns in protection products, which react slower to rate changes.

Additionally, savings products like mutual funds and bank certificates of deposit offer more alternatives. Higher interest rates also reduce demand for credit-related insurance by lowering mortgage and loan issuance.

This trend is particularly noticeable in European insurance markets, such as France, where bancassurance is a dominant distribution method.

A simple regression of net spreads on 10-year Treasury yields indicates that a 100bps increase in the 10-year yield is associated with nearly 30 basis points (bps) higher net spreads.

At a 10x leverage ratio, this suggests 300bps improvement in life insurers’ return on equity (ROE) for each 100bps increase in yields. This implies that the increase in insurer profitability on liabilities with guaranteed rates of payout easily outpaced the corresponding rise in cost of capital, which moves roughly in line with yields, from 2020.

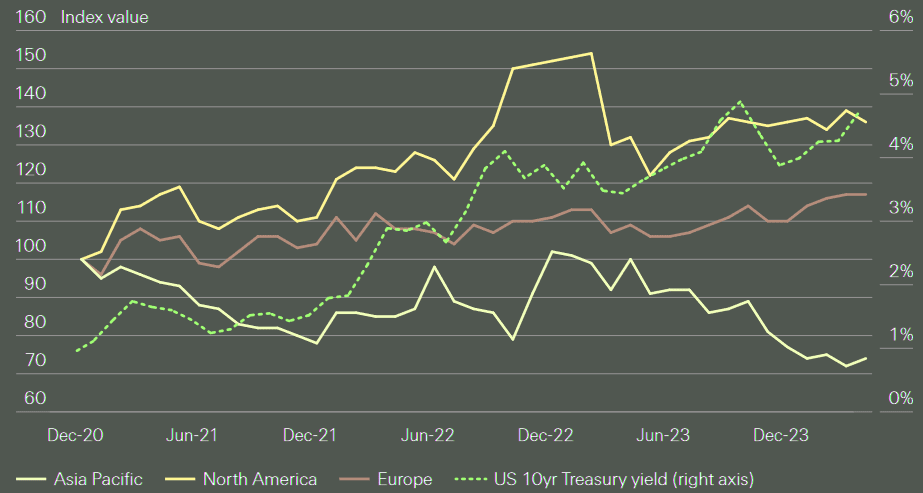

Life insurance sector total shareholder returns relative to broader market index

The long-term care line of business became synonymous with legacy liability issues during the low interest rate period. The line severely underperformed after the late 1990s as all major determinants of profitability went in the wrong direction.

Most companies selling these policies in the early 2000s eventually exited the market as lapse, morbidity and mortality rates they experienced were worse than assumed. However, in a sensitivity testing, the impact of unexpectedly low interest rates outweighed the negative impact of the other assumptions combined.

Profitable growth in life insurance industry

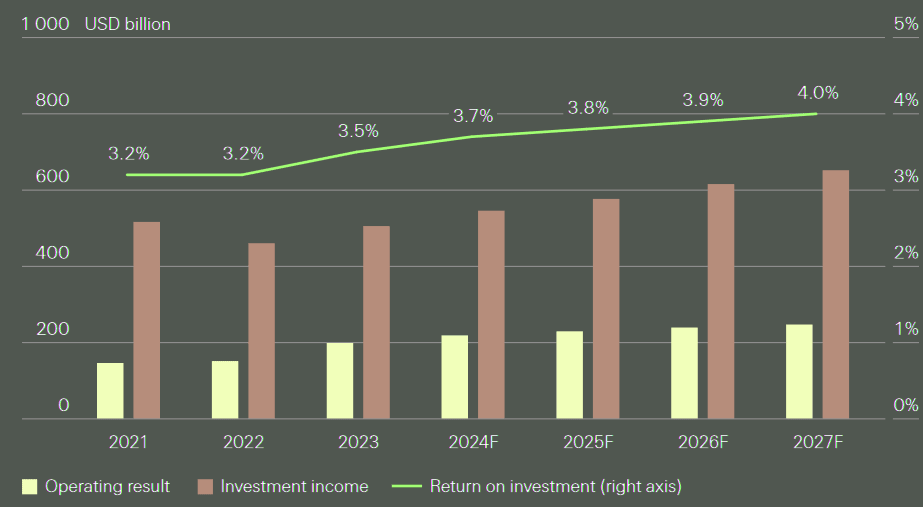

Higher demand for attractive savings products and increased margins will drive strong, profitable growth in the insurance industry. In the eight largest markets, this trend will lead to steady improvements in investment returns and operating results. A reduction in in-the-money guarantees will further support this growth.

While immediate effects on industry returns on equity may not be visible due to factors like asset-liability matching, variable investment income, and a significant amount of legacy business, the interaction of higher interest rates and leverage will eventually strengthen the traditional life insurance model.

From 2022 to 2027, we anticipate a more than 60% rise in operating results for insurers in these markets, driven by a 40% increase in investment income.

Life insurer operating results and investment return

Liability risks: higher rates lead to lapse stresses

A surge in policy terminations for their cash value is one of the biggest risks of any liability-driven investment strategy. Life insurers’ investment strategy relies on the assumption that multidecade contracts lock-in assets and thus allow for long-term investments.

Rising rates challenge the assumption that policyholders will retain existing contracts, as they may instead seek higher-yielding alternatives.

Additionally, rising rates introduce risks such as credit cycle downturns, liquidity crunches, and valuation mismatches, all of which can undermine life insurers’ ability to meet their liabilities.

Lapse risk is closely tied to asset risks, including interest rate, credit, and liquidity risks. Economic conditions that increase lapses often decrease asset values. For instance, a sharp rise in interest rates can prompt policyholders to withdraw funds from old contracts to invest in new, higher-yielding products.

Simultaneously, higher rates lower the market value of the supporting assets, potentially creating net hidden liabilities. Such lapse events strain liquidity and capital reserves when insurers must liquidate these assets.

Policyholder redemption activity has risen since 2021 in many countries. In Italy, lapses rose sharply as customers cashed in old savings contracts to seek better returns or to bear living costs.

In France and Germany, surrenders have been contained due to fiscal incentives in place and a relatively high level of profit-sharing reserves supporting back-book crediting rates. In Japan, the cancellation of foreign currency-denominated policies caused an uptick in lapses as customers locked-in profits after large exchange rate movements.

US redemption activity has been manageable so far. Many policyholders already voluntarily terminated their policies and reinvested surrendered assets into higher-yielding policies.

About a third of US individual annuity reserves either did not allow discretionary withdrawal or had a surrender charge of 5% or more, a level relatively stable in recent years.

Capital buffers against lapse risks

Economic risk-based capital (RBC) regimes require life insurers to maintain capital buffers to protect against lapse risks (see Table 2). Europe implemented this with Solvency II in 2016, and Asian markets are adopting similar RBC frameworks.

The required capital amount is typically determined through stress tests on underlying portfolios.

In Japan, these tests are conducted separately for domestic and foreign currency portfolios. In the US, there are no explicit RBC charges for lapse scenarios.

In Europe, the solvency capital requirement (SCR) for lapse risks has risen in most markets, while the market risks capital has decreased due to higher interest rates.

Solvency II treats lapse risk as a sub-module of the life underwriting SCR. In Italy and France, the life underwriting risk SCR more than doubled between 2021 and 2022. This increase has led to a rise in the use of mass lapse reinsurance to manage life underwriting SCR, gaining regulatory approval in some countries, including Italy and the Nordics.

At the same time, market risk SCR has decreased in all countries, both relatively and absolutely. This decrease is driven by the interest risk sub-module, which addresses the mismatch risk between assets and liabilities due to fluctuations in the nominal rate curve.

Higher interest rates have reduced asset-liability management (ALM) risks, particularly when liabilities have a longer duration than assets, thereby lowering market risk SCR.

New IFRS17 rules better capture rate and illiquidity effects

Interest rate movements lead to volatile economic valuations for life insurer equity when the durations of assets and liabilities are unmatched. Asset durations are typically shorter than liability durations in the life industry globally, on aggregate, known as the negative duration gap.

A negative duration gap means that assets decrease less in value than liabilities when interest rates rise, which explains why some insurers saw a positive impact on their solvency positions when interest rates were rising.

The increase in interest rates led to a decline in equity for insurers filing under US GAAP since prior to the implementation of Long-Duration Target Improvements (effective 1/1/2023), GAAP rules generally did not reflect the impact of rate changes on liabilities.

In Europe, new IFRS17 accounting rules help to neutralise some of the economic volatility in equity created by rising interest rates.

IFRS17 offers three mitigators:

- the Other Comprehensive Income (OCI) option to report unrealised fair value movements;

- a new focus on IFRS17 adjusted shareholder’s equity, which includes the contractual service margin (CSM), a relatively stable component showing discounted future profits;

- the possibility to include an illiquidity premium into the discounting of insurance liabilities that reflects the liquidity of the insurance contracts. This can improve profit recognition patterns.

IFRS17 illiquidity assumptions support better profit recognition patterns

IFRS17 accounting rules provide some leeway in determining the discounting approach and liquidity assumptions used to estimate the present value of future cashflows. Yet, these are key factors that eventually influence the level of technical provisions and the timing and volatility of profit recognition.

Under the bottom-up approach, the discount rate is determined as the (liquid) risk-free yield, adjusted to reflect the illiquidity of the underlying insurance liabilities.

The liquidity of insurance liabilities is typically considered from a policyholder standpoint and focuses on the predictability of cash flows. A liability can be considered illiquid when cash flows are highly predictable (e.g., annuities, term life, disability) and its backing assets are thus held to maturity.

……………………

AUTHORS: Germante Boncaldo – Head of Reinsurance Business Development at Swiss Re, James Finucane – Senior Economist, Swiss Re Institute, Thomas Holzheu – Chief Economist Americas, Swiss Re Institute, Loïc Lanci – Economist, Swiss Re Institute, John Zhu – Chief Economist Asia Pacific Swiss Re Institute