Overview

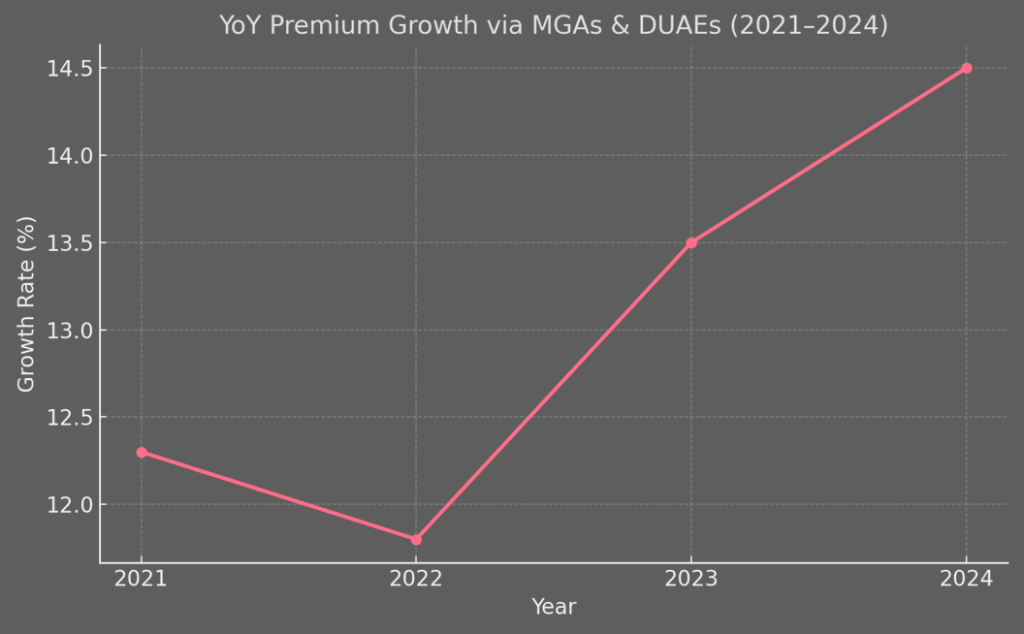

Based on National Association of Insurance Commissioners data, total direct premiums written sourced by insurance MGAs grew by 14.5% to about $90 bn from $78.6 bn. This represented the fourth consecutive year that growth exceeded 10%.

According to AM Best report, MGA premiums show double-digit growth for a fourth consecutive year. Beinsure analyzed report and highlighted key points.

Direct premiums written by the Top 20 Non-Exclusive MGAs and Top 20 Exclusive MGAs in the U.S. property and casualty insurance sector reached a combined $38 bn in 2025.

Insurers must have an adequate level of understanding of artificial intelligence and machine learning models used by MGAs.

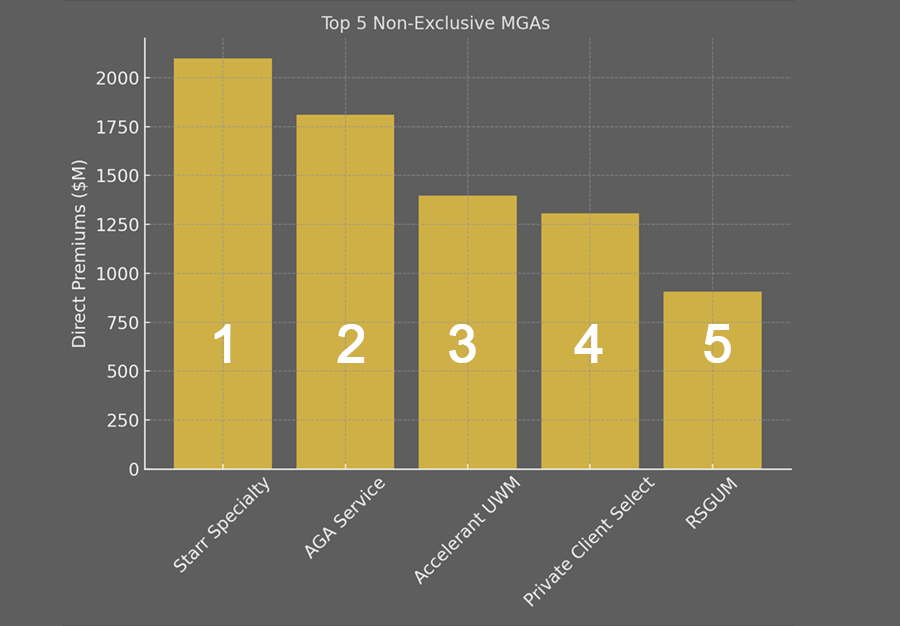

- The Top 20 Non-Exclusive MGAs in the U.S. property and casualty industry collectively wrote about $15.9 bn in direct premiums. The segment is led by Starr Specialty Agency, AGA Service Company, and Accelerant Underwriting Managers, each crossing the billion-dollar mark.

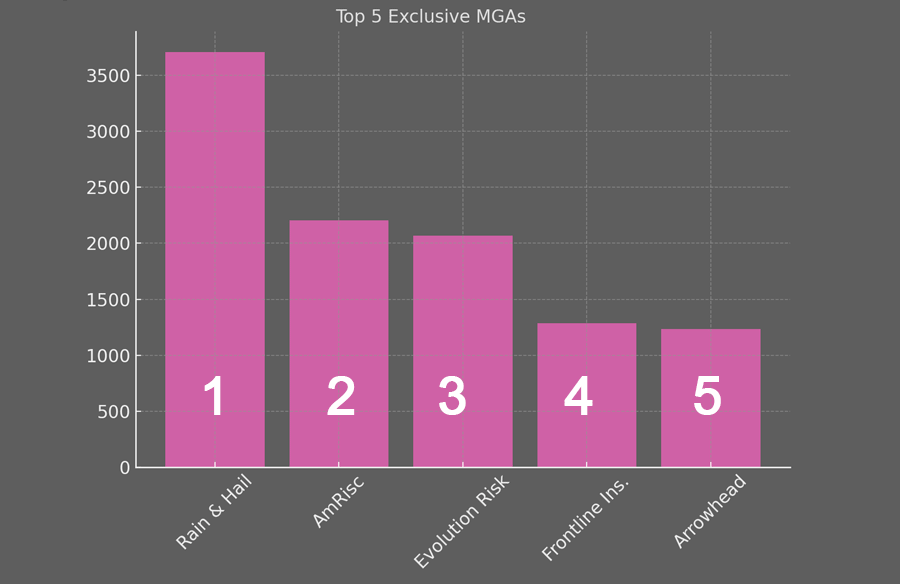

- The Top 20 Exclusive MGAs recorded an even larger footprint, with a combined $22.1 bn in direct premiums. Rain and Hail tops the list at $3.7 bn, followed by AmRisc and Evolution Risk Advisors, both above $2 bn.

Together, these figures highlight the growing influence of MGAs—both exclusive and non-exclusive—in shaping distribution, underwriting, and premium flows within the U.S. P&C insurance market.

Key highlights

- MGA-sourced premiums climbed 14.5% to $90bn in 2025, the fourth straight year of double-digit expansion.

- Non-Exclusive MGAs wrote $15.9bn, while Exclusive MGAs captured $22.1bn, bringing their combined share to $38bn of direct premiums in the U.S. P&C market.

- Starr Specialty Agency ($2.1bn) leads Non-Exclusive MGAs, while Rain and Hail tops the Exclusive list at $3.7bn, nearly doubling the largest non-exclusive writer.

- MGAs and DUAEs deliver micro-specialization in niche and complex risks, driving growth in specialty commercial and E&S markets, and attracting reinsurer capacity.

- AM Best views the DUAE segment positively, citing resilience from tech investment, data analytics, and innovation that strengthen their role as core distribution engines.

In the U.S. P&C insurance industry, managing general agents (MGAs) continue to play an increasingly important role in premium growth and distribution.

Annual premium growth through managing general agents (MGAs) and other delegated underwriting authority enterprises (DUAEs) remained strong in 2025, marking the fourth straight year of double-digit expansion.

These entities continue to serve as critical channels for specialty expertise and access to underserved risks, making them increasingly valuable partners for both insurers and reinsurers.

Best Non-Exclusive and Exclusive Insurance MGAs

Among non-exclusive MGAs, Starr Specialty Agency led the rankings in 2024 with $2.1 bn in direct premiums written, followed by AGA Service Company at $1.8 bn.

Accelerant Underwriting Managers and Private Client Select Insurance Services both crossed the $1 bn threshold with $1.4 bn and $1.3 bn respectively, while RSGUM rounded out the top five at $907 mn.

These players highlight the scale of capital flowing through MGAs operating across diverse carriers rather than tied to a single insurer.

Top 20 Non-Exclusive MGAs for P&C Insurance in the US

| Rank | Company/Group | Direct Premiums Written |

| 1 | Starr Specialty Agency | $2,098M |

| 2 | AGA Service Company | $1,810M |

| 3 | Accelerant Underwriting Managers | $1,397M |

| 4 | Private Client Select Insurance Services | $1,307M |

| 5 | RSGUM | $907M |

| 6 | Next First Insurance Agency | $842M |

| 7 | GEICO Discovery Corporation | $790M |

| 8 | Travelers Texas MGA | $744M |

| 9 | Trupanion Managers USA | $672M |

| 10 | Midwestern Insurance Alliance | $670M |

| 11 | United Group Underwriters | $568M |

| 12 | Velocity Risk Underwriters | $551M |

| 13 | Pets Best Insurance Services | $520M |

| 14 | Policy Services Holding | $474M |

| 15 | E-Risk Services | $456M |

| 16 | HCC Global Financial Products | $446M |

| 17 | Security First Managers | $438M |

| 18 | Knight Management Company | $414M |

| 19 | Burns & Wilcox | $396M |

| 20 | Cabrillo Coastal General Insurance Agency | $379M |

Top 5 Large Non-Exclusive MGAs in the US

On the exclusive MGA side, the figures are even larger. Rain and Hail dominated the 2025 rankings with $3.7 bn in direct premiums written—nearly double the top non-exclusive writer. AmRisc and Evolution Risk Advisors followed closely with $2.2 bn and $2.1 bn respectively.

Frontline Insurance Managers and Arrowhead General Insurance Agency completed the top five with $1.3 bn and $1.2 bn.

Top 20 Exclusive MGAs for P&C Insurance in the US

| Rank | Company/Group | Direct Premiums Written |

| 1 | Rain and Hail | $3,707M |

| 2 | AmRisc | $2,203M |

| 3 | Evolution Risk Advisors | $2,070M |

| 4 | Frontline Insurance Managers | $1,284M |

| 5 | Arrowhead General Insurance Agency | $1,234M |

| 6 | Tower Hill Insurance Group | $1,231M |

| 7 | Windward Risk Managers | $1,226M |

| 8 | Direct General Insurance Agency | $1,162M |

| 9 | Slide MGA | $1,048M |

| 10 | Hagerty Insurance Agency | $920M |

| 11 | Summit Consulting | $786M |

| 12 | Heritage MGA | $765M |

| 13 | American Integrity MGA | $663M |

| 14 | Bowhead Specialty Underwriters | $660M |

| 15 | Bristol West Insurance Services | $584M |

| 16 | Aspire General Insurance Services | $581M |

| 17 | Homeowner’s Choice Managers | $541M |

| 18 | Fred Loya Insurance Agency | $511M |

| 19 | Arch Underwriters | $456M |

| 20 | Olympus MGA | $450M |

Top 5 Large Exclusive MGAs in the US

Together, these rankings underscore the growing weight of MGAs—both exclusive and non-exclusive—in shaping the flow of premiums across the U.S. P&C insurance market, with exclusive MGAs capturing some of the largest concentrations of premium volume.

MGAs and DUAEs bring micro-specialization to the insurance market

MGAs and DUAEs bring micro-specialization to the insurance market, often focusing on niche segments and complex exposures. Their ability to tailor solutions has positioned them as key contributors to growth in specialty commercial and excess-and-surplus lines.

Strategic partnerships between carriers and DUAEs have supported this momentum, and reinsurers are showing heightened interest in MGA-produced business because of its reach into unique and sometimes volatile markets.

At the same time, the market faces constraints. Overall P&C insurance sector growth is expected to moderate in the near term, potentially slowing MGA expansion and increasing competitive pressure, particularly on newly formed entities.

P&C insurance companies are also being urged to strengthen oversight—understanding how MGAs deploy AI and machine learning in underwriting, as well as their cybersecurity posture, is becoming a critical part of risk management.

The DUAE model has evolved significantly over the past decade. It now plays an essential role in diversifying distribution, broadening access to reinsurance capacity, and connecting insurers with alternative capital providers.

Fronting companies have further amplified the impact of MGAs, extending their ability to generate premium and offering reinsurers and carriers additional routes to portfolio diversification.

Together, these dynamics reinforce why MGAs and DUAEs have moved from niche players to core distribution engines in the global insurance market.

Their ability to deliver specialization, access, and growth opportunities makes them indispensable partners, even as the broader industry adjusts to slowing premium growth and shifting capital requirements.

AM Best’s outlook on the global DUAE segment

AM Best’s outlook on the global DUAE segment remains Positive owing to the resilience of these organizations, as they have effectively used strategic investments in technology and talent to expand premiums in the specialty commercial market.

Significant technology investment, combined with leveraging data analytics, has helped insurers make better risk selection decisions, thus enabling DUAEs to become more ingrained as key partners in building new programs and developing creative new products.

These products allow insurers to address evolving risk in real time as exposures grow more complex across different industries and geographies, in a highly interconnected world.

The varied capabilities of DUAEs have also allowed them to build different types of programs to meet the needs of both policyholders and insurance company partners while streamlining operations to remain nimble in the competitive specialty commercial marketplace.

FAQ

MGA premiums rose by 14.5% to $90bn from $78.6bn, marking the fourth consecutive year of double-digit annual growth.

The Top 20 Non-Exclusive MGAs and Top 20 Exclusive MGAs combined wrote $38bn in direct premiums in 2025, underscoring their growing role in U.S. P&C distribution.

Starr Specialty Agency ($2.1bn), AGA Service Company ($1.8bn), and Accelerant Underwriting Managers ($1.4bn) topped the Non-Exclusive segment, each surpassing $1bn in premiums.

Rain and Hail dominated with $3.7bn, followed by AmRisc ($2.2bn) and Evolution Risk Advisors ($2.1bn). Exclusive MGAs collectively wrote $22.1bn, outpacing their Non-Exclusive peers.

They bring micro-specialization, focusing on niche and complex risks, and provide access to underserved markets. This makes them attractive to reinsurers, surplus lines carriers, and alternative capital providers.

With overall P&C market growth expected to moderate, MGAs may face slower expansion and tighter competition. Insurers also need to ensure oversight of MGAs’ use of AI, machine learning, and cybersecurity.

Positive. AM Best highlights resilience driven by strong technology investment, data analytics, and talent, which help DUAEs expand specialty programs, improve risk selection, and deliver innovative products.

……………

AUTHOR: Nataly Kramer — Lead Insurance Editor of Beinsure Media