Overview

Insurers maintained strict underwriting discipline, focusing on industries perceived as high risk, distressed businesses, and those with losses. They placed strong importance on accurate valuations, according to the Marsh Global Insurance Market Index. Beinsure analyzed the report and highlighted the key points.

The presence of international and wholesale markets supported a competitive environment and improved outcomes for clients with local, regional, and global insurance programs.

Clients reviewed deductibles and self-insurance options more closely, which led to greater interest in alternative risk transfer solutions, including parametric and captive insurance.

Key highlights

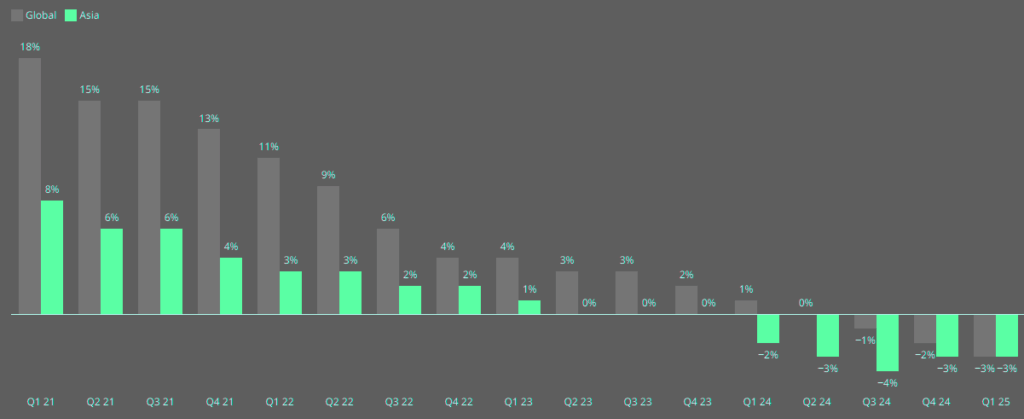

- Insurance rates in Asia dropped by 3% in Q1 2025, with competitive conditions supported by international and wholesale markets and stricter underwriting standards targeting high-risk sectors.

- Property insurance rates decreased 3%, while casualty rates fell 2%. Organizations without losses and those accessing London market capacity saw casualty rate reductions of 5% to 10%, whereas businesses with high US exposure faced rising rates for primary and umbrella coverage.

- Financial and professional lines rates fell by 8%, driven largely by D&O liability rate reductions of 10% to 20%. Professional indemnity (PI) and financial institutions (FI) rates declined 5% to 10%, reflecting intense competition amid limited new business opportunities.

- Cyber insurance rates in Asia dropped 8%, reinforcing the overall downward trend in the region’s composite insurance rates.

- Clients increasingly reviewed deductibles and self-insurance options, turning to alternative risk transfer solutions like parametric and captive insurance. Insurers applied strict underwriting discipline and diversified PFAS-related risk exclusions while offering more long-term agreements with rate reductions and low-claims bonuses.

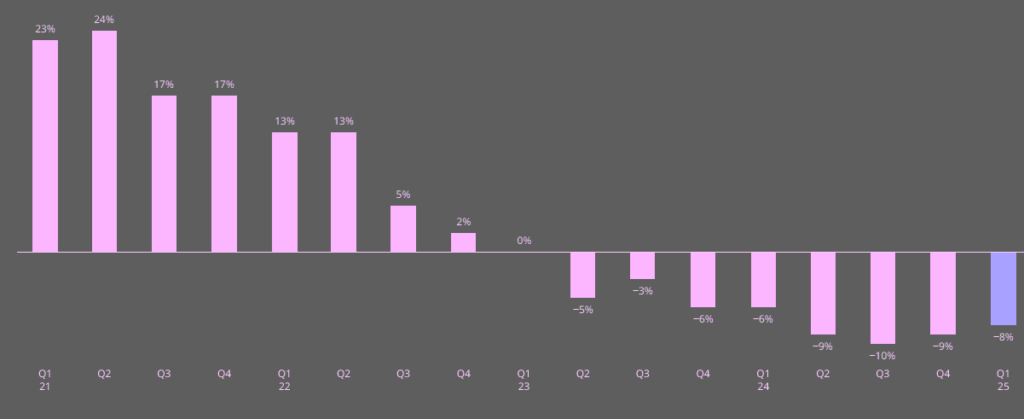

Asia composite insurance rate

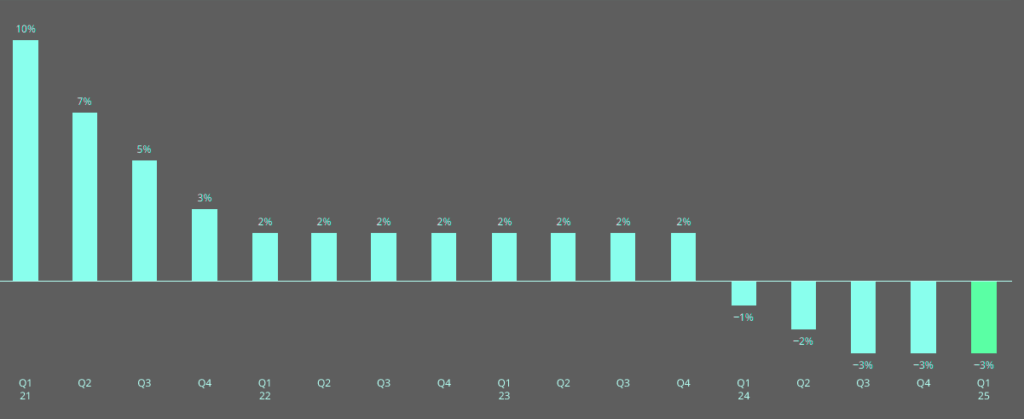

Property insurance rates decline

In the first quarter of 2025, insurance rates in Asia fell 3%, with property rates also declining 3%.

Insurers increased the offering of long-term agreements (LTAs), which often included rate reductions and low-claims bonuses.

- Insurers continued to exercise strict underwriting discipline — particularly for industries perceived as high risk, distressed businesses, and those impacted by losses — and emphasized the importance of accurate valuations.

- The involvement of international and wholesale markets has contributed to the competitive environment, leading to generally improved outcomes for clients across local, regional, and global insurance programs.

- There was an increase in the offering of long-term agreements (LTAs), which now frequently include provisions for rate reductions and low-claims bonuses.

- Clients actively reviewed deductibles and self-insurance options, resulting in a growing interest in alternative risk transfer solutions, such as parametric insurance and captive insurance.

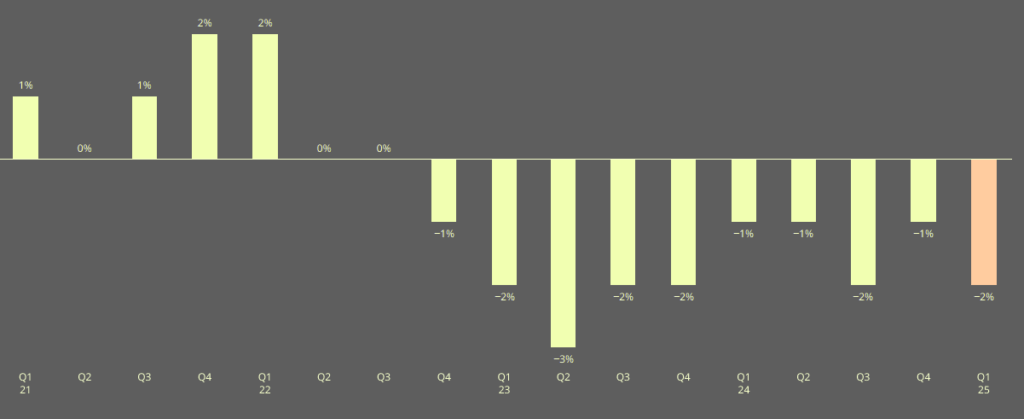

Casualty rates decline, capacity stable

Casualty insurance rates declined 2%, while capacity remained stable. Organizations without losses and those accessing competitive capacity in London markets experienced rate decreases of 5% to 10%.

Businesses with significant US exposure faced higher rates because of increases in primary and umbrella coverage.

Insurers took a varied approach to underwriting risks from per- and polyfluoroalkyl substances, applying either broad or selective exclusions.

- Organizations without losses and those benefiting from competitive capacity in London markets typically experienced more significant rate decreases, ranging from 5% to 10%.

- Businesses with substantial US exposure faced rising rates, driven by increases for primary and umbrella coverage.

- Workers’ compensation rates remained stable.

- Auto liability rates were generally stable, although increases of 5% to 10% were experienced in Japan and Thailand, indicating regional variations in risk assessments.

- Insurers adopted a diversified approach to underwriting risks associated with PFAS, with some applying broad exclusions while others opted for selective or partial exclusions.

Financial and professional lines rates decline

Financial and professional lines rates dropped 8%, while limited capital markets activity constrained new business opportunities for insurers and intensified competition for renewals.

Directors and officers (D&O) liability insurance continued to influence rate changes significantly, with average reductions of 10% to 20% across Asia.

Professional indemnity (PI) and financial institutions (FI) rates also moderated, showing decreases of 5% to 10% in response to the competitive market.

- Limited activity in capital markets restricted new business opportunities for insurers, and increased competition for renewal business.

- Directors and officers (D&O) liability insurance rates were, again, a significant factor in overall rate changes, with average reductions ranging from 10% to 20% across the region.

- Professional indemnity (PI) and financial institutions (FI) rates moderated, with decreases ranging from 5% to 10%, reflecting the competitive market.

FAQ

Insurance rates in Asia declined by 3% during the first quarter of 2025, reflecting competitive conditions across several insurance lines.

Property insurance rates fell by 3%, supported by competitive international and wholesale markets, increased use of long-term agreements with rate reduction provisions, and disciplined underwriting focused on high-risk sectors.

Casualty insurance rates declined by 2%, with organizations free of losses and those accessing London market capacity achieving reductions of 5% to 10%. Businesses with high US exposure saw rate increases due to rising primary and umbrella coverage costs.

Workers’ compensation rates remained stable. Auto liability rates were generally stable as well, though Japan and Thailand experienced increases of 5% to 10%, showing regional variation in risk assessments.

Financial and professional lines rates decreased by 8%. Directors and officers (D&O) liability insurance rates dropped 10% to 20%, while professional indemnity (PI) and financial institutions (FI) rates declined 5% to 10% amid strong competition for renewal business and limited capital markets activity.

Cyber insurance rates decreased by 8% in the region during Q1 2025, contributing to the overall reduction in composite rates.

Clients reviewed deductibles and self-insurance options more actively and showed increased interest in alternative risk transfer solutions, such as parametric and captive insurance. Insurers maintained strict underwriting for high-risk and loss-affected industries and diversified their approach to PFAS-related risks through various exclusions.