Overview

In virtually all U.S. states, motorists are legally obligated to purchase bodily injury liability and property damage liability. A handful of states also require drivers to purchase extras, such as uninsured & underinsured motorist coverage and personal injury protection (PIP). Penalties for non-compliance range from small fines to suspension of license and/or registration, vehicle impoundment, and in some cases imprisonment.

Thirty-eight states are what is known as “fault” insurance states, whereby the driver who is at fault in an accident is legally responsible to cover damages through their bodily-injury and property-damage liability coverage.

The remaining 12 states are “no-fault” states, whereby policyholders claim losses from their own insurance provider – regardless of which driver was at fault (see New Trends that Will Disrupt US Auto Insurance Market).

Car Insurance in United States

The best auto insurance companies in each state provide liability, comprehensive, collision, PIP, and uninsured & underinsured motorist coverage, plus a range of paid add-ons.

Car insurance is a neccessary expense that comes with being a driver in the United States, but it doesn’t have to be complicated or overpriced. It’s essential that you choose a reliable insurer that you know will pay your claim if you ever need it, and comparing multiple insurers means that you will get the best rate possible for your driving needs.

How much is car insurance in the U.S.?

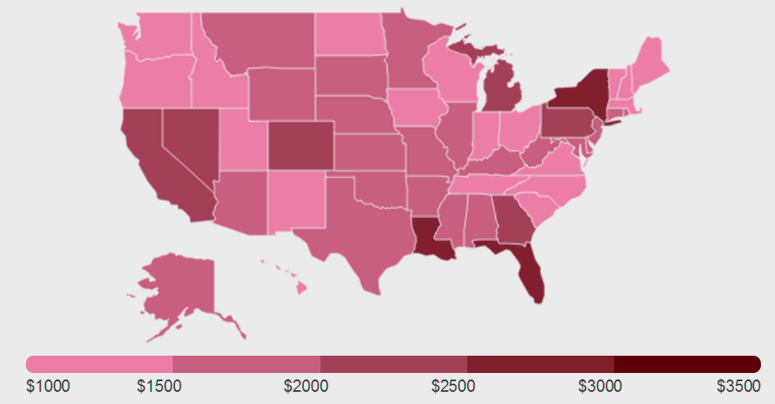

The average cost of car insurance in August 2024 is $1,895, but how much you’ll pay depends largely on where you live. The state you reside in is one of the biggest factors influencing the price of your auto insurance premium

But because auto insurance premiums are based on more than a dozen individual rating factors, the actual cost will differ for every driver (see U.S. Auto Insurance Performance & Underwriting Results).

- Maine is the cheapest state for car insurance at $1,175 annually, or $97 monthly, for a full coverage policy.

- Louisiana is the most expensive state for car insurance at $2,883 annually for a full coverage policy.

- Car insurance premium spikes in 2023 were attributed to inflation, weather and accident claims, poor driving habits and population density.

- USAA, Geico and Erie offer some of the cheapest full coverage car insurance, but are not all available to all drivers.

- Having a severe infraction like a DUI on your motor vehicle record could increase your car insurance premium by 93% on average.

- Teen male drivers may pay $807 more for car insurance on average compared to teen female drivers.

How much does car insurance cost by state?

However, when determining “how much does car insurance cost” in a specific area, the answer can vary depending on a variety of factors. The state where you live, individual rating factors, accident and claim reporting frequency, and even cost of labor and parts can cause one city or state to be more expensive than others.

Average car insurance cost by state in 2024

| State | Average annual rate full coverage | Average annual rate liability |

| Alaska | $1,676 | $508 |

| Alabama | $1,860 | $639 |

| Arkansas | $1,957 | $589 |

| Arizona | $1,812 | $764 |

| California | $2,416 | $864 |

| Colorado | $2,337 | $717 |

| Connecticut | $1,725 | $783 |

| Washington, D.C. | $2,157 | $785 |

| Delaware | $2,063 | $1,022 |

| Florida | $2,694 | $1,629 |

| Georgia | $1,970 | $789 |

| Hawaii | $1,517 | $572 |

| Iowa | $1,630 | $320 |

| Idaho | $1,428 | $440 |

| Illinois | $1,532 | $471 |

| Indiana | $1,515 | $498 |

| Kansas | $1,900 | $471 |

| Kentucky | $2,228 | $810 |

| Louisiana | $2,883 | $1,266 |

| Massachusetts | $1,726 | $655 |

| Maryland | $1,746 | $756 |

| Maine | $1,175 | $341 |

| Michigan | $2,266 | $645 |

| Minnesota | $1,911 | $512 |

| Missouri | $1,982 | $582 |

| Mississippi | $2,008 | $637 |

| Montana | $2,193 | $540 |

| North Carolina | $1,741 | $523 |

| North Dakota | $1,665 | $370 |

| Nebraska | $1,902 | $373 |

| New Hampshire | $1,265 | $416 |

| New Jersey | $1,902 | $915 |

| New Mexico | $2,049 | $658 |

| Nevada | $2,060 | $1,042 |

| New York | $1,870 | $827 |

| Ohio | $1,417 | $446 |

| Oklahoma | $2,138 | $657 |

| Oregon | $1,678 | $710 |

| Pennsylvania | $1,872 | $504 |

| Rhode Island | $2,061 | $808 |

| South Carolina | $2,009 | $925 |

| South Dakota | $2,280 | $338 |

| Tennessee | $1,677 | $547 |

| Texas | $2,043 | $774 |

| Utah | $1,825 | $756 |

| Virginia | $1,469 | $477 |

| Vermont | $1,319 | $324 |

| Washington | $1,608 | $731 |

| Wisconsin | $1,664 | $425 |

| West Virginia | $2,005 | $585 |

| Wyoming | $1,758 | $331 |

Top 5 cheapest states for car insurance

Drivers in Maine, Vermont, Idaho, New Hampshire and Ohio pay the cheapest annual full coverage car insurance rates in the nation, on average. Factors like cheaper cost of living, lower probability of accidents and claims, and less traffic congestion could be contributing to these states’ lower average premiums (see Global Auto Insurance Market Outlook).

| Maine: $1,175 |

| New Hampshire: $1,265 |

| Vermont: $1,319 |

| Ohio: $1,417 |

| Idaho: $1,428 |

Top 5 most expensive states for car insurance

Based on our research, drivers in New York, Louisiana, Florida, Nevada and Michigan have the highest average annual cost of full coverage car insurance. This could be due in part to frequent claims for common losses in these states, making drivers riskier to insure overall.

| Louisiana: $2,883 |

| Florida: $2,694 |

| California: $2,416 |

| Colorado: $2,337 |

| South Dakota: $2,280 |

How much does car insurance cost by age and gender?

Insurers typically consider age as a significant factor in setting auto insurance rates, with young drivers paying the highest premiums on average based on 2024 rates.

Auto insurers use actuarial data to determine that teens and young adult drivers — as well as the elderly — are more likely to get in an accident, so the car insurance costs that these drivers pay are typically higher to compensate for the greater risk.

Note that your age will not affect your premium if you live in Hawaii or Massachusetts, as state regulations prohibit auto insurers from using age as a rating factor (see Who Should Be Listed on Car Insurance Policy?).

Additionally, gender impacts your premium in most states. Men typically cost more to insure than women. This is because men generally engage in riskier driving behaviors than women and have a higher rate of accident severity, according to the Insurance Information Institute (Triple-I).

However, not all states allow gender to be a factor in rates. If you live in California, Hawaii, Massachusetts, Michigan, North Carolina or Pennsylvania, your gender does not affect how much you pay for car insurance because of state regulations prohibiting this rating factor.

Insurance cost by age and gender

| Age | Male | Female | Difference | Percent difference between rates |

|---|---|---|---|---|

| 16 year old | $4,004 | $3,669 | $335 | 8.7% |

| 17 year old | $3,740 | $3,420 | $320 | 8.9% |

| 18 year old | $5,694 | $4,946 | $748 | 14.1% |

| 19 year old | $4,440 | $3,819 | $621 | 15.0% |

| 20 year old | $4,060 | $3,504 | $556 | 14.7% |

| 21 year old | $3,188 | $2,822 | $366 | 12.2% |

| 22 year old | $2,931 | $2,627 | $304 | 10.9% |

| 23 year old | $2,759 | $2,491 | $268 | 10.2% |

| 24 year old | $2,614 | $2,374 | $240 | 9.6% |

| 25 year old | $2,196 | $2,059 | $137 | 6.4% |

| 30 year old | $1,888 | $1,854 | $34 | 1.8% |

| 40 year old | $1,778 | $1,764 | $14 | 0.8% |

| 50 year old | $1,661 | $1,652 | $9 | 0.5% |

| 60 year old | $1,612 | $1,597 | $15 | 0.9% |

| 70 year old | $1,755 | $1,729 | $26 | 1.5% |

FAQ

In nearly all U.S. states, motorists must carry bodily injury liability and property damage liability. Some states also require uninsured/underinsured motorist coverage and personal injury protection (PIP).

Penalties vary but may include fines, suspension of license and/or registration, vehicle impoundment, or even imprisonment in some cases.

In “fault” states, the driver responsible for an accident must cover damages through liability insurance. In “no-fault” states, each driver’s own insurance covers their losses, regardless of who caused the accident.

The average annual cost of full coverage car insurance in August 2024 was $1,895. Costs vary based on factors like location, driving history, age, and coverage level.

The cheapest state is Maine at $1,175 annually for full coverage. The most expensive is Louisiana at $2,883 annually. Rates are influenced by factors like accident frequency, population density, and state regulations.

Yes, younger drivers and teen males generally pay higher premiums due to higher accident risk. Gender impacts rates in most states, but regulations in places like California and Michigan prohibit using gender as a factor.

Premiums rose due to inflation, increased accident claims, severe weather events, poor driving habits, and factors like population density. Social inflation and litigation funding trends continue to drive up costs.

……………………….

AUTHORS: Mark Friedlander – Director of corporate communications at Insurance Information Institute, June Sham – Insurance Writer and Mariah Posey – Insurance Editor at Bankrate