Frequency perils – what the industry once called secondary perils – are now running the show. Their share of modeled insured losses climbed 12% in Verisk’s latest global catastrophe model, with severe thunderstorms making up a hefty 42% of that slice.

Tropical cyclones sit second, with 25% of annual insured losses.

According to Verisk’s Modeling Insured Catastrophe Losses: A Global Perspective for 2025, the market is at a turning point.

The analytics firm said insurers must brace for losses far beyond its newly modeled $152 bn global average annual insured property loss.

“Unprecedented natural catastrophe losses are no longer statistical outliers but the new reality,” the report said.

Rob Newbold, president of Verisk Extreme Event Solutions, said the modeled data shows “a fundamental shift in the risk landscape.” He noted that frequency perils now drive sustained, high-impact losses across geographies, and carriers have to adapt fast.

Natural catastrophe losses are no longer statistical anomalies – they’re the new normal

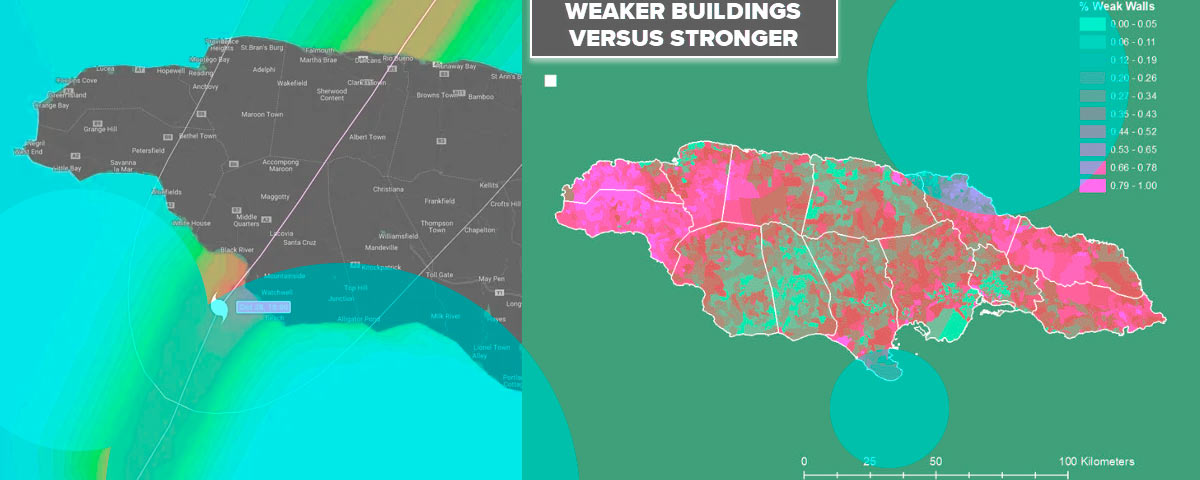

Inflation and unchecked development in high-risk zones have ramped up global exposure. Verisk data shows insured exposure grew 7% annually between 2019 and 2024, with climate change adding another 1% per year.

- In North America, insured losses now make up 48% of total economic losses, as wildfire risk keeps intensifying.

- Europe and Oceania are seeing the same upward drift, with exposure up more than 8% in certain areas thanks to urban expansion and price inflation.

Earthquakes rank third among frequency perils at 10%, followed by winter storms at 8%, and both flood and wildfire at 7%. Verisk said climate change is slowly but clearly reshaping global hazard patterns.

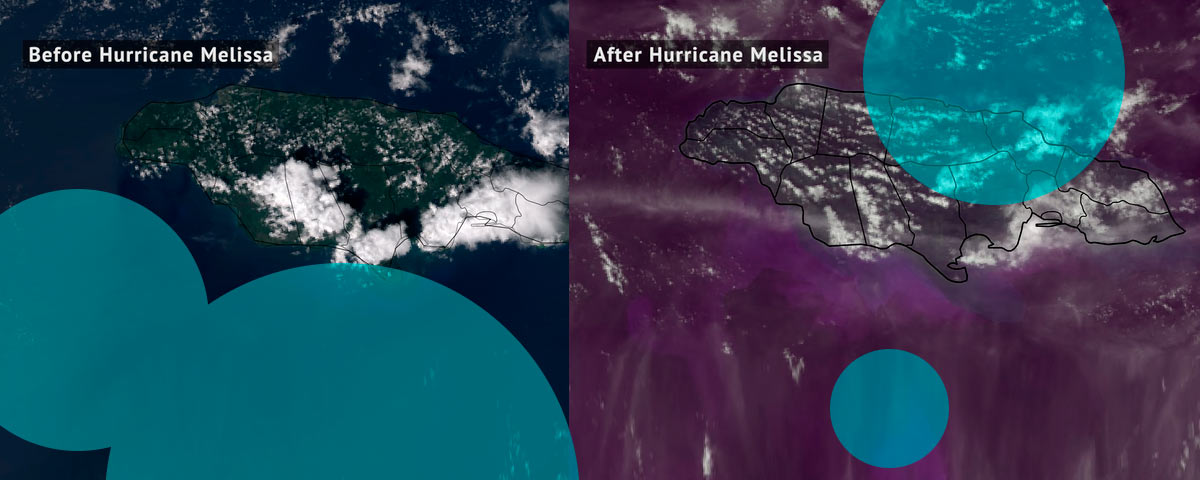

Recent disasters highlight the point. Hurricane Helene’s widespread flooding and California’s Eaton and Palisades fires illustrate how modern events outstrip old benchmarks.

The two California fires alone carry a 35-year return period and burned through some of the most valuable real estate in the U.S.

Wildfire exposure has climbed sharply as housing spreads deeper into the wildland-urban interface. Between 2010 and 2020, California added nearly 240,000 homes in those zones. Nationwide, the number of houses destroyed by wildfire has doubled since 1990.

Verisk said persistent drought across the western U.S., Australia, and parts of Europe has boosted wildfire activity while intensifying thunderstorm systems and pushing them east into more densely developed regions.

Severe thunderstorms, in particular, have exploded in frequency. Verisk found a 59% increase in such events from 2020 through 2024, though it hasn’t yet pinned down the precise environmental triggers.

Maybe the takeaway isn’t subtle: old assumptions are breaking. Insurers relying on historical precedent to guide catastrophe risk are already playing catch-up.