U.S. homeowners’ insurance is poised to post a statutory underwriting loss for reported results, as insurers continue to face above-average catastrophe losses and claims cost uncertainty from persistently high inflation and heightened macroeconomic volatility, according to Fitch Ratings.

However, further material rate increases in most jurisdictions support strong premium growth in 2023, with segment results likely to improve going forward.

Uncertainty related to catastrophe experience and claims severity patterns may inhibit a near-term return to an underwriting profit.

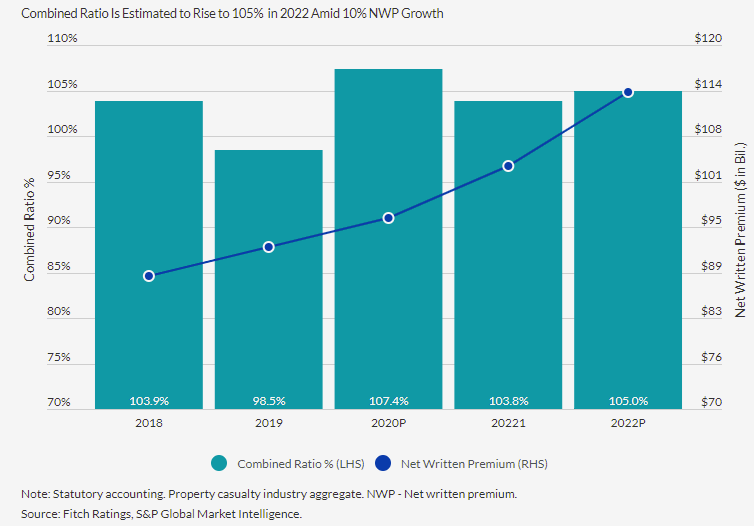

Fitch anticipate the property & casualty insurance industry will post a statutory underwriting loss in homeowners for the year, with a segment combined ratio projected at 105%. The segment combined ratio exceeded 100% for five of the last six years.

Volatility in performance continues to hinge on catastrophe loss experience

Larger underwriters benefit from capabilities in managing catastrophe exposures and risk aggregations, and garnering efficiency from technology investments.

Aon’s recent catastrophe report estimates insured catastrophe losses in the U.S. exceeded historical averages at $99 billion in 2022, the third consecutive year that losses exceeded $90 billion.

Insured losses from Hurricane Ian may ultimately represent approximately half of all 2022 catastrophe losses. Additional U.S. events with insured losses in excess of $1 billion in 2022 include multiple inland storms, and wildfire and drought in western states.

Natural disasters resulted in global economic losses of USD 275 billion, of which USD 125 billion were covered by insurance, the fourth highest one-year total on sigma records. Beyond the natural catastrophes themselves, other factors such as the impacts of economic inflation and financial market losses have also fed into market hardening, according to Swiss Re’s sigma report “Natural Catastrophes and inflation: a perfect storm”.

An additional contributing factor has been the need for more discipline in the modelling and underwriting of secondary perils in particular. This has led to mismatches of risk assessment and actual exposures and, in turn, insufficient market capacity.

This reaffirms the trend of a 5–7% average annual increase in insured losses over the past three decades (see Top 10 Global Economic & Insured Loss Events).

Insurers must to renew market focus

Given the more fragile economic environment homeowners’ writers will need to renew focus on several areas including: insuring properties to value under unique housing and construction market conditions, factoring inflation and tight labor market conditions in pricing and claims estimation and utilizing information technology to boost operating efficiency and customer experience in the application and claims process.

Property catastrophe reinsurance rates rose to 20-year highs in the January 2023 renewals, continuing a trajectory that began in 2018. Demand for covers has grown as natural disasters continue to wreak property damage across the world.

Segment net written premiums increased by approximately 10% in 2022 to $114 billion. High single-digit premium growth is likely to continue through 2023.

Ongoing underwriting changes and premium rate increases position the homeowners’ market for continued revenue growth in 2023 and a return to approaching a break-even underwriting result, barring further unusually high catastrophe losses.

According to Climate & Global Natural Catastrophe Insight, since 1992, insured losses have grown by 5‒7% on an average annual basis. This includes the period 2012‒16 when losses were at a lower annual mean. Irrespective of yearly volatility, insured losses will likely continue to grow at trend, even when real-time amplifying factors such as current high levels of inflation recede.

The re/insurance rate gains of recent years coincide with a trend period of heightened natural catastrophe activity and elevated losses that started in 2017. The 2022 insured loss outcome reaffirms a 5‒7% annual growth trend in place since 1992, this based mostly on rising severity of losses resulting from primary and secondary peril events (see Listing of Global Events & Economic Loss).

Homeowners’ Liability Underwriting Performance

Questions remain as to the effectiveness of recent legislative and regulatory changes in the Florida homeowners’ market to temper claims trends and improve the underwriting environment.

Homeowners underwriting losses for the industry show that 2022 losses are tempered by a substantial portion of Ian losses borne by Florida state sponsored entities and global property reinsurers.

Still, individual carrier results are materially influenced by geographic mix relative to the location of recent weather events, and more limited Florida market participation versus other states.

Compiling statutory results of the largest homeowners’ writers reveals that State Farm Group retains a strong lead in market share with 20% of industry premiums followed by Allstate with approximately 10% (see Top 10 U.S. Homeowners’ Insurers).

While these two underwriters experienced sharp increases in personal auto losses in 2022, homeowners’ results were relatively favorable as Allstate reported a GAAP segment combined ratio of 94% for the year.

State Farm reported a 3% underwriting margin in its homeowners and commercial multi-peril business combined.

Top 10 U.S. Homeowners’ Insurers 2023 Results

10 U.S. Homeowners’ Insurers by Net Written Premium

| NWP $ mn | Share | Change | |

| State Farm | 22,946 | 20.2% | 9.9% |

| Allstate | 11,075 | 9.8% | 15.4% |

| USAA | 8,398 | 7.4% | 12.0% |

| Liberty Mutual | 8,283 | 7.3% | 4.2% |

| Travelers | 6,336 | 5.6% | 17.0% |

| American Family | 5,709 | 5.0% | 15.4% |

| Farmers Group | 5,164 | 4.5% | 12.0% |

| Nationwide | 3,630 | 3.2% | 7.5% |

| Chubb | 2,969 | 2.6% | 6.4% |

| Erie Insurance Group | 2,191 | 1.9% | 12.7% |

| P&C Industry | 113,511 | 100.0% | 9.8% |

10 U.S. Homeowners’ Insurers by Incurred Loss Ratios

| Insurer | Loss Ratios 2022 | 5Y Avg. |

| Erie Insurance Group | 77.1% | 66.4% |

| Nationwide | 75.9% | 64.2% |

| USAA | 75.0% | 60.8% |

| Liberty Mutual | 73.0% | 71.6% |

| Travelers | 71.2% | 61.5% |

| American Family | 69.9% | 64.5% |

| Farmers Group | 67.3% | 64.3% |

| Allstate | 65.4% | 66.6% |

| State Farm | 61.5% | 65.8% |

| Chubb | 56.0% | 73.8% |

| P&C Industry | 68.0% | 65.8% |

Statutory homeowners’ combined ratios by company will be available shortly in insurance expense exhibit (IEE) data.

The segment incurred loss ratio for 2022 increased by 1.6 points from the prior year to 68%.

Among the top 10 homeowners’ writers, Chubb reported the lowest loss ratio for the year at 56% followed by State Farm (62%). Erie Insurance, Nationwide and USAA each reported a loss ratio of 75% or higher.

…………………

AUTHORS: James Auden – Managing Director, Insurance at Fitch Ratings, Christopher Grimes – Director at Fitch Ratings, Laura Kaster – Senior Director of North and South American Financial Institutions at Fitch Ratings