Overview

- European Re/Insurers Brace Themselves for Tariff Tremors

- Non-life Insurers Faces Softening Reinsurance Premium

- European Insurance Ratings Carry Stable Outlooks

- TOP Risks for European Insurers

- Operating performance of European insurers and reinsurers

- Non-Life Insurers’ Growth

- Life insurers’ lapse ratios remain low

- Financial Strength Ratings

Most European life and non-life insurers report solid margins. However, life insurers must deliver attractive products while managing rising reinvestment rates, unrealized losses on long-term bond holdings, and declining short-term interest rates, according to S&P Global Ratings. Beinsure analyzed the S&P Global Ratings and Fitch Ratings’ data, and highlighted the key points.

S&P believes there is a high degree of unpredictability around policy implementation by the U.S. administration and possible responses – specifically with regard to tariffs – and the potential effect on economies, supply chains, and credit conditions around the world.

As a result, S&P baseline forecasts carry a significant amount of uncertainty, magnified by ongoing regional geopolitical conflicts.

Key Highlights

- European life insurers maintain solid margins but must offer attractive products while managing rising reinvestment rates, unrealized losses on long-term bonds, and falling short-term interest rates, which strain profitability.

- Most European insurers hold financial strength ratings in the ‘A’ category, with 82% carrying stable outlooks. This stability reflects strong diversification, capital buffers above regulatory requirements, and favorable refinancing conditions.

- Uncertainty from tariffs and geopolitical conflicts continues to weigh on insurers. S&P stress tests show equity market stress would most significantly impact European re/insurance ratings, while diversified groups are better positioned to absorb shocks.

- Non-life insurers confront softening reinsurance rates, high attachment points, rising claims inflation—particularly in motor insurance—and more frequent natural catastrophes, which limit margin potential despite premium increases.

- Insurers are adapting to new regulations, including the Financial Data Access regulation, DORA, Solvency II updates, Corporate Sustainability Reporting Directive, and European Sustainability Reporting Standards, while structural risks from climate change and cyberattacks persist but remain manageable through premium adjustments and operational improvements.

European Re/Insurers Brace Themselves for Tariff Tremors

Due to the pronounced effect of tariffs on capital markets in the U.S., Asia, and Europe, re/insurers’ investments could be more affected by tariffs than by other risks.

S&P stress test revealed that equity market stress would have the most pronounced effect on European reinsurance companies‘ ratings.

According to Fitch Ratings, European life insurers have limited direct exposure to financial market volatility as most of the investment risk is borne by policyholders.

Investment guarantees to customers are largely backed by highly rated bonds of similar durations. These are typically held to maturity, so the main risk as economic growth weakens is a potential increase in defaults.

Pockets of higher risk exist, particularly in alternative and illiquid investments, with UK life insurers more exposed.

Gross Premiums by Country

| Country | Gross Premiums ($mn) |

|---|---|

| France | 388,878 |

| Germany | 248,232 |

| Italy | 103,894 |

| Switzerland | 174,005 |

| United Kingdom | 119,011 |

| Spain | 26,202 |

| Netherlands | 51,281 |

| Austria | 13,410 |

For non-life insurers, the pricing cycle has peaked in most countries and we expect pricing to remain adequate for the rest of 2025.

Weaker economic growth may constrain revenue growth but may also reduce claims frequency. The German non-life sector stands out with an unchanged ‘improving’ outlook due to strong pricing momentum, which supports expectations for underwriting margins to improve more than in other countries.

Largest European Insurers

Ranking the largest European insurance companies and groups by gross premiums written, along with their respective countries. Top 30 insurers’ premiums totaled $1.1 tn.

| № | Insurance Company / Group | Countries | Gross Premiums, $mn |

| 1 | AXA | France | 106,147 |

| 2 | Allianz | Germany | 100,569 |

| 3 | Assicurazioni Generali | Italy | 85,169 |

| 4 | Munich Reins Co | Germany | 71,679 |

| 5 | Zurich Ins Group | Switzerland | 58,848 |

| 6 | Lloyd’s | United Kingdom | 56,334 |

| 7 | HDI | Germany | 56,053 |

| 8 | Chubb | Switzerland | 51,978 |

| 9 | Swiss Re | Switzerland | 47,889 |

| 10 | CNP Assurances | France | 38,491 |

Largest Reinsurers in Europe (Life & Non-Life)

| № | Reinsurers | GWP, mn $ | NWP, mn $ |

| 1 | Munich Re | $51,331 | $48,550 |

| 2 | Swiss Re | $39,749 | $37,302 |

| 3 | Hannover Re | $35,528 | $29,672 |

| 4 | SCOR | $21,068 | $17,055 |

| 5 | PartnerRe | $8,689 | $7,544 |

| 6 | MAPFRE Re | $3,849 | $3,273 |

| 7 | Assicurazioni Generali | $3,822 | $3,822 |

| 8 | AXA XL | $3,385 | $2,812 |

| 9 | R+V Versicherung | $3,158 | $3,158 |

| 10 | Caisse Centrale de Reassurance | $2,206 | $2,007 |

| TOTAL | $172,785 | $155,195 |

Non-life Insurers Faces Softening Reinsurance Premium

Primary non-life insurers continue to face elevated but gradually softening reinsurance premium rates and high attachment points, which limit their margin potential, S&P said.

While this supported profits in years with fewer natural catastrophes, the growing frequency of floods, hailstorms, and wildfires reduces the chance of higher earnings. Claims inflation in motor insurance also remains significant.

European insurers are adjusting to regulatory changes, including the Financial Data Access regulation, the Digital Operational Resilience Act (DORA), and Solvency II.

European Insurance Ratings Carry Stable Outlooks

Most European insurers benefit from strong diversification and hold capital well above the level required to maintain current ratings, supporting a stable sector outlook for both life and non-life insurance.

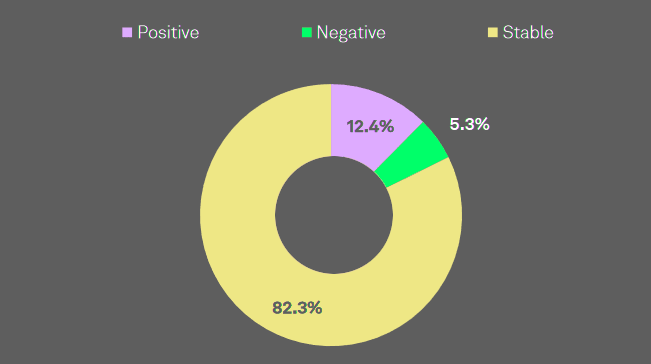

Currently, 82% of European insurance ratings carry stable outlooks, following five upgrades so far this year.

Since the start of the Russia-Ukraine war, the frequency of cyberattacks has increased. However, no successful attacks have been identified that created reputational damage to rated insurers.

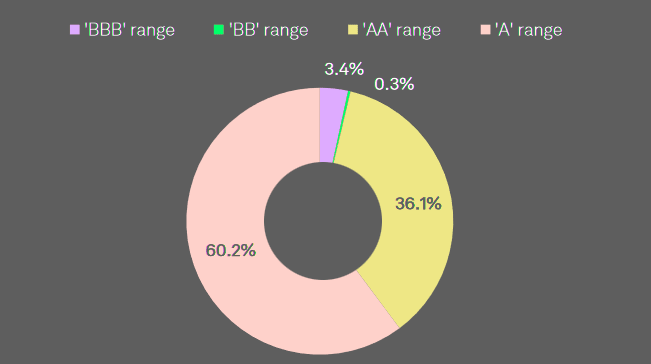

EU Insurers’ Ratings Distribution

EU Insurers’ Outlook Distribution

European insurance sector outlook remains ‘neutral’

The European insurance sector outlook remains ‘neutral’ at mid-year 2025, reflecting stable business conditions despite a weaker economic outlook and heightened financial market volatility, Fitch Ratings says.

They also face new reporting obligations under the Corporate Sustainability Reporting Directive and the European Sustainability Reporting Standards. Insurance groups operating internationally must additionally transition to the Insurance Capital Standard.

Individual countries’ life and non-life sector outlooks are also ‘neutral’, except for Italian life and German non-life, which are still ‘improving’.

For life insurers, we generally expect net flows into savings products to be steady, supported by declining returns on competing products, such as bank savings accounts.

European Insurance Sector Outlooks

| Sector Outlooks | Non-life | Life |

| Europe overall | Neutral | Neutral |

| France | Neutral | Neutral |

| Germany | Neutral | Improving |

| Italy | Improving | Neutral |

| Netherlands | Neutral | Neutral |

| Spain | Neutral | Neutral |

| UK | Neutral | Neutral |

The ‘improving’ sector outlook for Italian life insurance reflects Fitch’s expectation that net flows will continue to rise due to Italian government bonds being less competitive for retail investors as interest rates decrease.

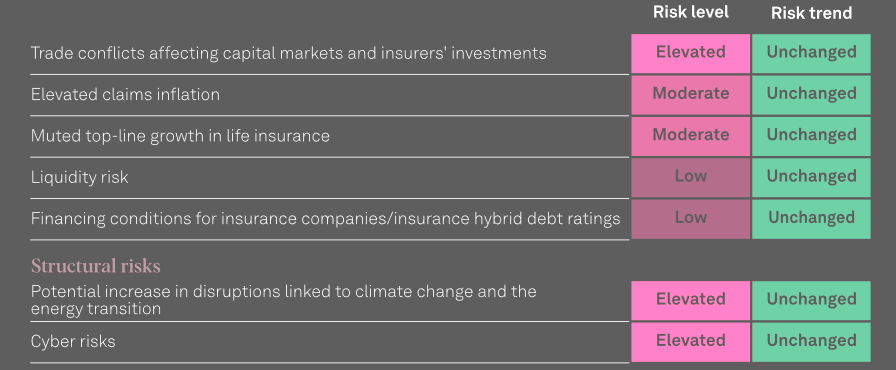

TOP Risks for European Insurers

Cyberattacks on external suppliers remain a risk, as many insurers rely on third-party providers for various functions. The Digital Operational Resilience Act (DORA) addresses this risk but adds to insurers’ workload.

- Geopolitical risks are expected to persist through the second half of 2025. Even so, the base case assumes operating performance will remain consistent with first-half results.

- Long-term structural risks from climate change and the transition to net zero are expected to continue, but their impact on the insurance sector remains limited because insurers can adjust premium rates as needed.

The rising cost of natural catastrophes, including floods in Central, Eastern, and Southern Europe in 2024, is not expected to materially affect the profitability of European property and casualty insurers.

Operating performance of European insurers and reinsurers

External challenges such as geopolitical risks related to the various military conflicts within and outside of Europe, as well as tariff announcements and subsequent capital market volatility left the operating performance of many rated European insurers and reinsurers mainly unaffected.

For 2025, our economists expect GDP growth of 0.8% in the eurozone and 0.9% in the U.K. Consumer price index (CPI) inflation is forecast at 1.9% and 3.1%, respectively. We anticipate slightly lower long-term interest rates of 6.5% and expect unemployment in Europe will remain stable at a low 4.6% in 2025.

Non-Life Insurers’ Growth

“While we rarely view top-line growth as a key aspect in our credit rating analysis of insurers in developed European markets, we closely monitor claims inflation, which exceeded CPI inflation in recent years”, S&P analysts said.

Given the negligible effects of recent tariff and geopolitical developments on CPI expectations, we expect claims inflation will remain the main concern for European primary non-life insurers.

Claims inflation results from higher costs for car parts and garage repairs. In some markets, including the U.K., most motor insurers have already increased premiums to compensate for the rise in claims. In countries such as Germany, however, motor insurers still have some way to go to adjust premium rates.

In addition to claims inflation, primary non-life insurers face high, albeit partially reducing, reinsurance costs and high attachment points.

Diversified insurance groups can absorb any negative effects

While diversified groups can absorb any negative effects relatively easily, regionally focused peers must pay significantly higher premium rates than before and retain a relatively larger share of regional natural catastrophe risk exposure on their balance sheets.

S&P do not expect any ratings impact from the tax cuts related to the U.S. administration’s budget reconciliation bill, which was signed into law on July 4, 2025.

But some European insurers are primarily exposed to second-order effects from US tariffs, according to Fitch. In particular, non-life insurers may face a pick-up in claims inflation due to trade tariffs and related supply-chain disruptions, particularly affecting construction materials and motor spare parts.

European insurers have low to moderate exposure to potential weaknesses in the US economy, US dollar and US operating conditions.

The most directly exposed are Europe-based global (re)insurers and London market insurers.

Life insurers’ lapse ratios remain low

This does not come as a surprise, considering the genera products’ inherent disincentives against lapses, including the loss of terminal bonuses, tax incentives, and insurance cover.

The payout amount reduces if policies are cashed out early. We believe the currently low unemployment rate in Europe will further reduce the risk of high lapse ratios.

Financial Strength Ratings

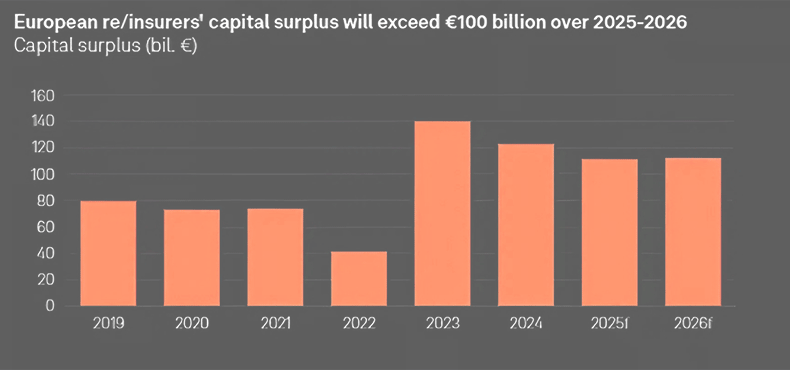

Financial strength ratings on European insurers remain mostly in the ‘A’ category, with the majority of outlooks stable. These ratings benefit from a significant capital surplus above the level required to support current ratings.

In addition to strong capital adequacy under the risk-based capital model, most insurers also show substantial regulatory solvency buffers compared to standard requirements.

Refinancing conditions for European re/insurers have been favorable so far this year.

Elevated Interest Rates Increase U.K. Life Insurers’ Annuity Volumes

Annuity volumes in both bulk and individual U.K. markets are expected to remain high, as rising interest rates have increased demand for pension schemes and annuities.

The market’s concentration on annuities means longevity risk is higher than in continental Europe. However, widening gilt spreads have reduced capital strain for most U.K. life insurers.

Non-Life Insurers Benefit From Improved Conditions in Retail Lines

P&C commercial insurers will face more pressure in 2025. As the market softens and reinsurance rates stay elevated, margins will likely narrow, though combined ratios are expected to stay below 100%.

- Retail pricing trends will vary between motor and home insurance.

- Motor insurance prices are projected to fall by about 5%, but underwriting should remain profitable due to price increases implemented in 2024.

- Home insurance prices are expected to stay high as insurers manage claims inflation.

Significant price increases at the end of 2024 could help insurers break even, barring extreme weather events. Price comparison websites in motor and home insurance reduce operational barriers and intensify competition from new entrants.

German Life Insurers Reduce Product Risk

German life insurers are projected to grow modestly by 1%–2% in the near term, with moderate profitability.

They continue phasing out higher guarantees on back-book contracts, reducing average guarantees to about 1.10% in 2025 from 1.15% in 2024.

This reflects the positive effect of the additional reserve (Zinszusatzreserve) requirement. Many insurers have introduced capital-light products with low or no guarantees and focus on risk-based offerings to lessen reliance on investment returns.

The mismatch in asset-liability management has also declined, reducing product risk in portfolios.

Germany’s P&C Sector Maintains Profitability Despite Catastrophe Losses

The German P&C sector continues to face challenges from claims inflation, increased losses from more frequent natural catastrophes, higher net retention, and high reinsurance costs.

Gross premiums are expected to grow by 5%–6%, outpacing GDP growth. Combined ratios should improve to 95%–98% in 2025–2026 due to premium adjustments and gradually rising investment income.

Outlook Revision on France

The outlook on France was revised to negative from stable in February, affecting ratings of insurers rated ‘AA-’ or higher and considered less resilient to sovereign stress scenarios.

Strong capital buffers and tax advantages support France’s life insurance market. Premium growth in unit-linked and euro fund products is expected to stabilize at 5% in 2025.

Favorable tax policies and reduced competition from bank term deposits will continue to drive demand for life insurance. The sector remains able to build capital buffers and adjust crediting rates, supported by low guaranteed minimum bonuses and strong Solvency II ratios.

French motor insurance continues to struggle with profitability due to rising catastrophe costs. Price increases are expected to support premium growth and keep the net combined ratio near 99%.

Strong technical results in commercial lines will help offset competitive pressures in motor insurance. The cost of natural catastrophe claims has risen since the 1990s.

France’s public insurance scheme serves as a backstop to manage these costs, with the public sector’s contribution to the state reinsurance scheme for natural catastrophe risks rising to about 5% of P&C gross written premiums in 2025, compared to 3% in prior years.

Swiss life insurers shift to higher-margin semi-autonomous products

Switzerland’s life insurance market is transitioning to higher-margin semi-autonomous products that are less interest rate-sensitive.

We expect Swiss life insurers will maintain profitability, with pre-tax ROA improving to 0.6-0.7%. We forecast that an increase in premiums from individual life products will offset declines in the group life business and stabilize gross premiums growth in 2025.

Overall, Swiss life insurers invest more in real estate than their P&C peers to generate long-term rental income and liquidity. Since most assets are in Switzerland to ensure consistent returns, asset concentration is a potential risk.

S&P predicts that growth in the P&C market will continue to outpace Switzerland’s GDP growth. We forecast that premiums will rise 2.5-4% in 2025, compared with GDP growth of 1%.

The increase in premiums results from pricing adjustments to counter inflation and higher reinsurance costs.

FAQ

Most European insurers maintain ‘A’ category financial strength ratings with stable outlooks, supported by strong diversification and capital buffers well above requirements. About 82% of ratings carry stable outlooks, reflecting resilience despite external pressures.

Life insurers must offer competitive products while managing rising reinvestment rates, unrealized losses on long-term bonds, and falling short-term interest rates. These factors complicate their ability to sustain profitability even though margins remain solid.

Tariffs and regional conflicts create significant uncertainty, affecting capital markets, supply chains, and credit conditions. S&P stress tests indicate that equity market stress, driven by such risks, could have the strongest impact on European re/insurance ratings.

Life insurers typically back investment guarantees with highly rated, long-duration bonds held to maturity, limiting exposure to market volatility. However, risks persist in alternative and illiquid investments, particularly for UK life insurers. Many have shifted to capital-light products with lower guarantees and improved asset-liability management to reduce product risk.

Non-life insurers face softening reinsurance premium rates, high attachment points, and rising claims inflation—particularly in motor insurance due to higher costs for parts and repairs. Natural catastrophes and intense competition in retail lines further constrain margin potential.

Insurers must comply with new rules, including the Financial Data Access regulation, the Digital Operational Resilience Act (DORA), Solvency II adjustments, and reporting obligations under the Corporate Sustainability Reporting Directive and European Sustainability Reporting Standards.

Germany’s non-life sector shows improving margins driven by pricing momentum, while Italian life insurers benefit from rising net flows due to declining competitiveness of government bonds. France’s outlook was revised to negative for insurers rated ‘AA-’ or higher, reflecting sovereign stress risks. Switzerland’s life insurers shift to higher-margin semi-autonomous products to maintain profitability, with property investments providing steady returns despite concentration risks.

……………………………

AUTHORS: Yana Keller — Editor at Beinsure Media, Volker Kudszus – Managing Director & Sector Lead, Insurance Ratings with S&P Global Ratings (Frankfurt)