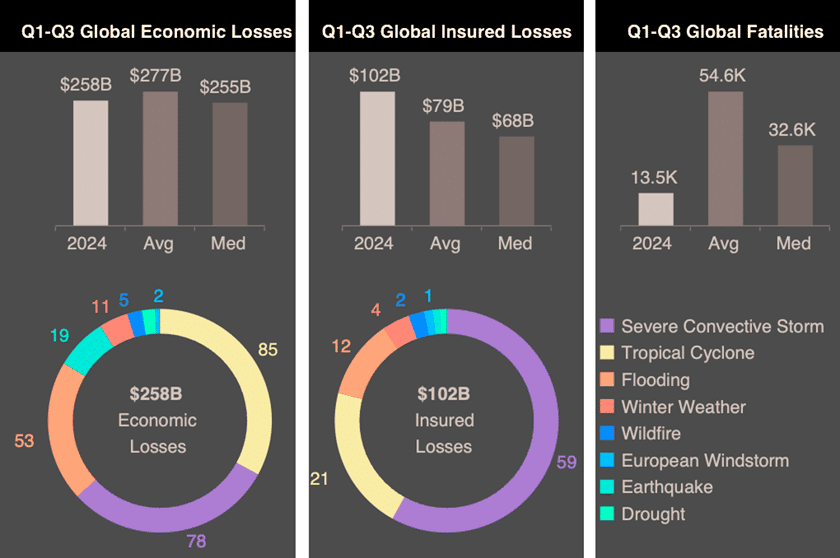

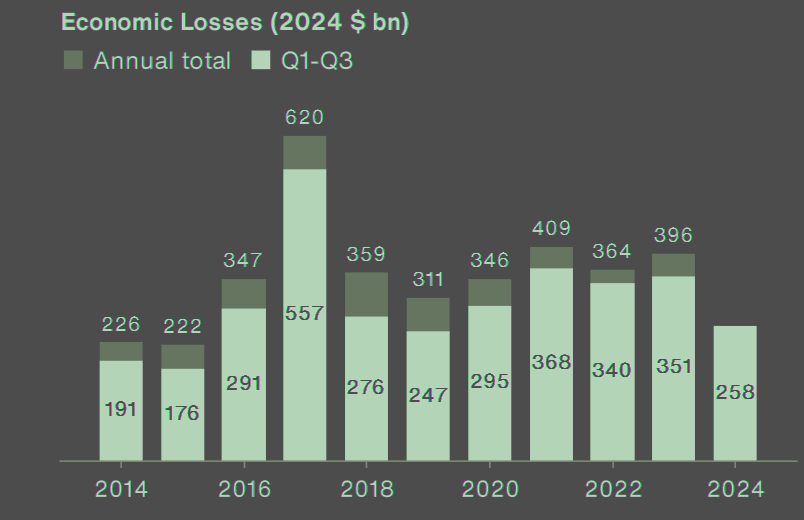

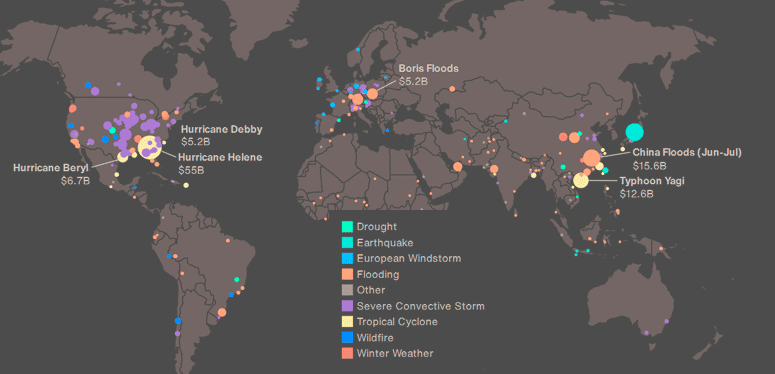

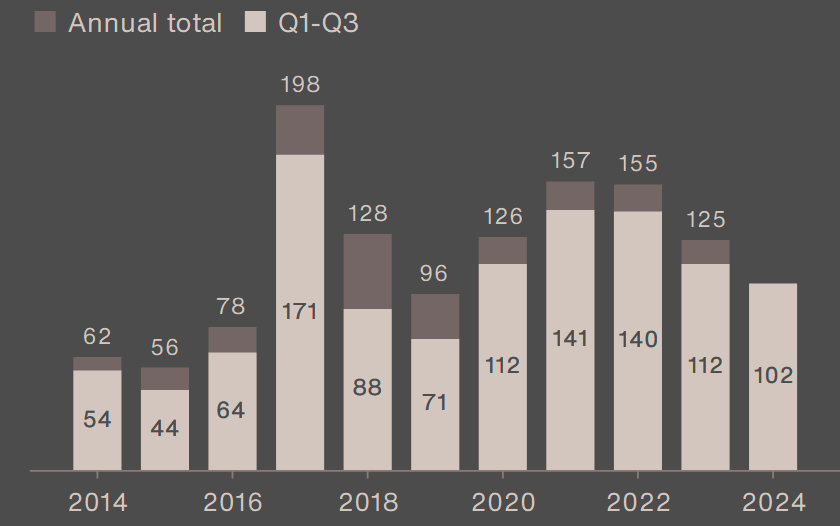

Q3 2024 saw a number of significant disaster events, which drove total economic losses from natural catastrophes above at least $258 bn. This was lower than the 21st-century Q1-Q3 average of $276 bn and significantly lower than losses in the same period of last year ($351 bn).

According to Aon’s Q3 Global Catastrophe Recap – October 2024 report, the Q3 losses were driven by three costly Atlantic hurricanes, flooding in Central Europe and China, as well as a number of significant severe convective storm events across North America. Insured losses were expected to reach at least $102 bn by the end of September, well above the 21st-century average of $79 bn.

Losses from Hurricane Milton and additional events expected in the rest of the calendar year will likely push total annual insured losses above the 2023 level ($125 bn).

Aon projected global reinsurer capital at nearly $700 bn as of June 30, with growth expected into 2025, barring significant catastrophic events.

Global natural disaster losses in H1 2024 reached $120 bn, down from 2023, which saw $140 bn in losses due to a severe earthquake in Turkey and Syria. However, 2024’s losses still surpassed the 10 and 30-year averages, according to Munich Re.

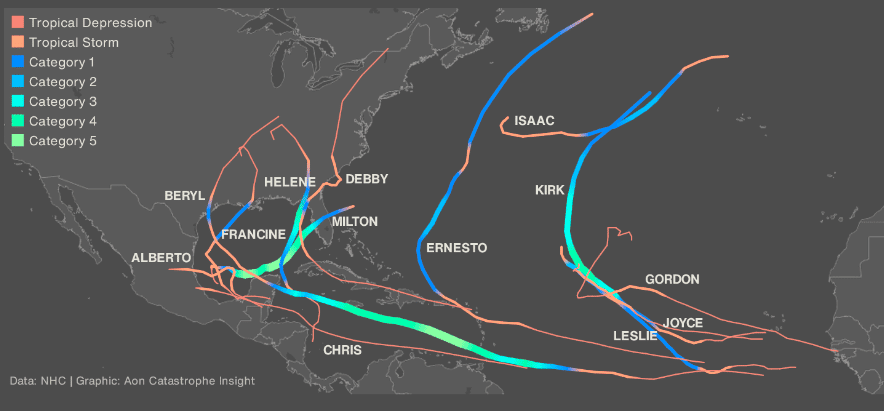

Elevated North Atlantic hurricane activity, which was initially anticipated, only intensified in the latter half of the season with Hurricanes Helene and Milton.

The insurance protection gap

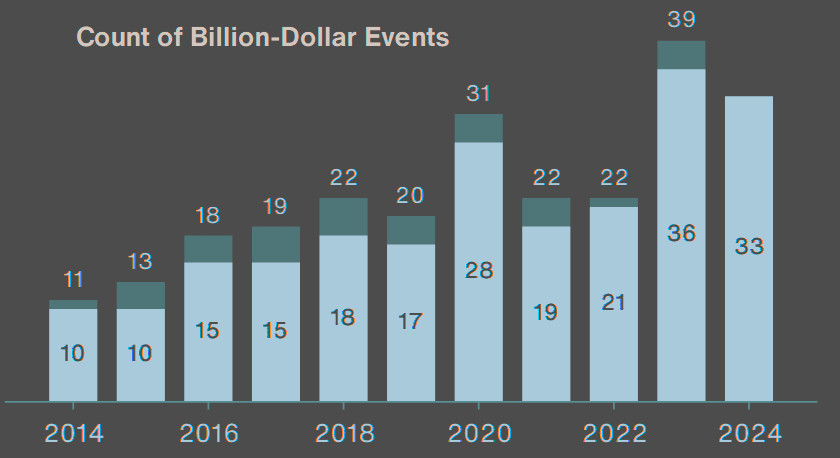

The insurance protection gap reached an estimated 60% in Q1–Q3, one of the lowest recorded levels, largely due to increased insured losses in the U.S. Fatalities totaled approximately 13,000, the lowest since 1986.

Insured losses from primary perils in the first nine months of 2024 were mild overall, with no single event likely to impact the broader reinsurance market.

Most losses, including those from severe convective storms, remained with insurers in Q3, maintaining exceptional returns for reinsurers.

Global economic and insured losses from natural catastrophes

Economic Losses Increased by $120 bn+

Natural disasters led to an estimated $258 bn in global economic losses for Q1–Q3 2024, about 7% below the long-term average of $277 bn since 2000 and slightly above the median of $254 bn (see Major Natural Disasters in H1 2024: Insights for Insurance Industry).

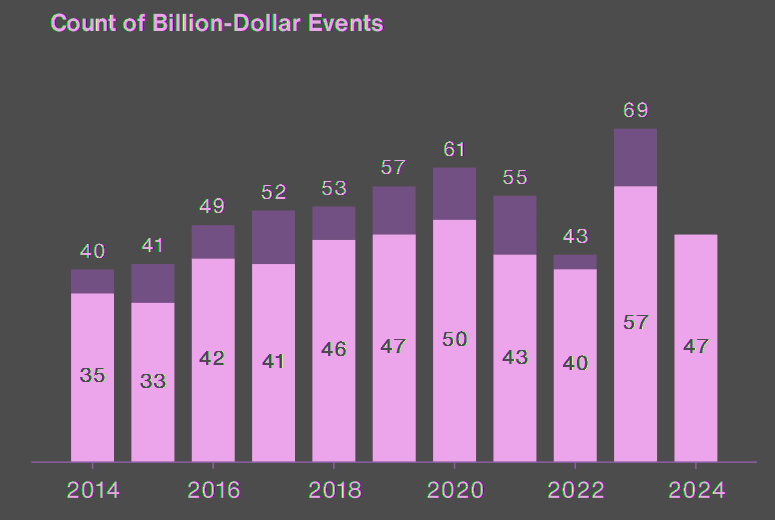

There were 47 events causing losses over $1 bn, with 32 in North America, eight in Asia, four in EMEA, and three in South America. These figures remain provisional, as individual event loss estimates often change months after occurrence. This analysis excludes Hurricane Milton.

Global Economic Losses

Hurricane Helene is by far the costliest event of the Q1-Q3 period, with losses from Hurricane Milton (a Q4 event) still being assessed. Most of the economic losses from Helene occurred due to catastrophic flooding in North Carolina; the state officials preliminarily determined the amount of direct physical damage in the state at $41 bn.

Typhoon Yagi in September resulted in estimated losses of $12.6 bn in Southeast Asia, another significant Q3 event in top five was extensive flooding in China in June and July ($15.6 bn).

Super Typhoon Yagi has caused substantial insured losses, estimated at 3.5 bn yuan ($500 mn) in China, according to Guy Carpenter, a reinsurance broker. The storm also set a record for strength in Vietnam, according to BestWire.

By September 16, China’s insurance industry had received 92,000 claims linked to Yagi, with 1.48 bn yuan in payouts, as reported by China Banking and Insurance News.

Yagi, the 11th named tropical cyclone of 2024 in the Western North Pacific, reached Category 4 intensity. It is the strongest typhoon on record to strike Vietnam and the second strongest to hit China.

Guy Carpenter highlighted the damage as of September 10. In China, four regions were severely affected: Wenchang City, Haikou City, Chengmai County, and Lingao County, according to the Hainan Province Department of Emergency Management.

2024 Economic Loss Events

According to preliminary estimates, economic losses in the United States in the first three quarters of 2024 reached at least $120 bn were above the average since 2000 ($92 bn). Losses in all other regions were below their long-term averages.

Top 5 Costliest Economic Loss Events in 2024

| Event | Fatalities | Economic Loss, $ bn |

| Hurricane Helene | 227 | 55.0 |

| Noto Earthquake | 299 | 17.9 |

| South & Central China Floods | 315 | 15.6 |

| Typhoon Yagi | 829 | 12.6 |

| Severe Convective Storm | 6 | 7.0 |

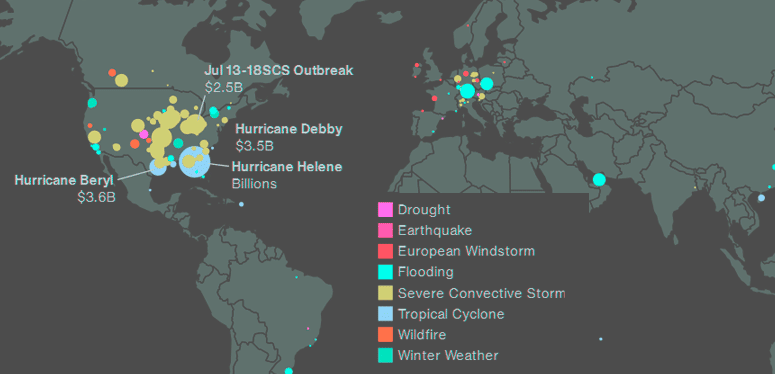

Insured Losses on Track to Surpass 2023

Global insured losses from natural disaster events in Q1-Q3 2024 are estimated to reach at least $102 bn, above the average since 2000 ($79 bn) and the median of the same period ($68 bn).

Withthe significant impact of Hurricane Milton in October and additional disaster activity expected in the rest of the calendar year, it is very likely that total annual losses will eventually surpass the total industry losses of $125 bn recorded in 2023.

North Atlantic Hurricane activity produced several costly events in the third quarter, led by Hurricane Helene, which resulted in severe wind and flood-related losses in the southeastern United States.

Global Insured Losses

Additionally, Hurricane Beryl resulted in approximately $3.6 bn in industry impacts, while Debby’ effects in Canada and the United States cost insurers roughly $3.5 bn. While the severe convective storm peril generated roughly $13 bn of insured losses globally, none of those events reached $3 bn mark.

2024 Insured Loss Events

Natural catastrophes in the United States accounted for nearly 80 percent of global insured losses in the first three quarters of 2024, reaching nearly $80 bn. This was roughly one-third higher than the long-term average since 2000.

Meanwhile, insured losses in EMEA are comparable to the long-term average, while APAC and Americas losses are significantly lower.

Top 5 Costliest Insured Loss Events in 2024

| Event | Fatalities | Insured Loss, $ bn |

| Hurricane Helene | 227+ | Bn |

| Severe Convective Storm | 6 | 5.2 |

| Severe Convective Storm | 3 | 4.8 |

| Severe Convective Storm | 5 | 4.0 |

| Hurricane Beryl | 70 | 3.6 |

The 2024 Atlantic hurricane season

The 2024 Atlantic hurricane season was initially forecast to be exceptionally active. By mid-October, however, only 13 named storms had formed, just under the seasonal average of 14 (based on 1991–2020 mean). Among these, nine reached hurricane status – two above average – and three became major hurricanes, a number in line with long-term statistics. This raised some questions about the reliability of early- and mid-season hurricane forecasts.

The reality was very different from expectations through the climatological peak of the season on September 10. There were several reasons for this; for example, extremely high sea surface temperatures, one of the main drivers of the aggressive forecasts, have indeed persisted throughout the season.

However, high temperatures in the upper levels of the troposphere likely resulted in some vertical stabilization and suppression of the expected effect.

Another important factor was the monsoon through that shifted too far north, which resulted in African easterly waves emerging in higher latitudes than expected throughout the first half of the hurricane season, where sea surface temperatures were relatively lower.

While the activity was under expectations through mid-September, it ramped up later and generated two very costly storms in relatively quick succession: Hurricanes Helene and Milton.

Initial expectations from these events do not suggest that they would not be substantial industry-changing events for the re/insurance as a whole.

The worst-case scenario for Milton, which would likely occur if the storm tracked slightly north of Tampa, did not materialize. It is however worth noting that the hurricane season is far from over.

FAQ

Total economic losses from natural catastrophes in Q1–Q3 2024 reached at least $258bn, lower than the 21st-century average of $276bn for the same period but above 2024’s median.

Major events included three costly Atlantic hurricanes, flooding in Central Europe and China, and multiple severe convective storms across North America, contributing to substantial losses.

Insured losses for Q1–Q3 2024 were projected at $102bn, surpassing the 21st-century average of $79bn. By year-end, these losses could exceed 2023’s total of $125bn.

The insurance protection gap, representing uninsured economic losses, was estimated at 60% in Q1–Q3 2024, one of the lowest levels recorded, largely due to higher insured losses in the US.

Hurricane Helene was the costliest event in Q1–Q3 2024, with North Carolina alone reporting $41bn in direct physical damages due to catastrophic flooding.

Aon projected global reinsurer capital at nearly $700bn as of June 2024, with expected growth into 2025 if significant catastrophic events are avoided.

No, while initially expected to be highly active, the season saw only 13 named storms by mid-October, slightly below the average. Activity intensified later in the season with Hurricanes Helene and Milton.

……………

AUTHORS: Michal Lörinc – Aon’s Head of Catastrophe Insight, Ondřej Hotový – Catastrophe Analyst, Antonio Elizondo – Aon’s Senior Scientist, Tomas Cejka – Aon’s Catastrophe Analyst