Overview

The insurance and reinsurance industry is showing strong momentum. Global premiums climbed 8.6% to €7 tn, the sharpest annual rise since before the financial crisis, according to Allianz report. Growth cut across life, non-life, and health segments. Beinsure analyzed report and highlighted key points.

Reinsurers matched the upswing, reporting combined ratios of 86.8%—their best margin in ten years—alongside average returns on equity of 17%, a level comfortably above funding costs, according to Gallagher Re.

But the surface numbers hide strains. Systemic shocks have exposed weaknesses that still run through the market.

Global reinsurance dedicated capital totaled $769 bn at full-year 2024, a rise of 5.4% versus the restated full-year 2023 base. Growth was driven by both the INDEX3 companies and non-life alternative capital.

PwC’s research, Reinsurance 2035: Rethinking the Risk Business, sets out a vision of reinsurers playing a central role in the financial system over the next decade. Beinsure analyzed report and highlighted key points.

The firm points to the Fund and Insure domain as the big opportunity—potentially generating $17 tn in gross value by 2035, depending on how climate disruption and technological shifts play out.

Key Highlights

- Global insurance premiums rose 8.6% in 2024 to €7tn, the fastest pace since before the financial crisis. Reinsurers reported combined ratios at 86.8% and ROE of 17%. Yet the resilience is uneven—systemic shocks, climate-linked disasters, and capital pressures continue to test traditional models.

- Global dedicated reinsurance capital climbed 5.4% to $769bn in 2024. Nearly $115bn is now deployed via ILS, cat bonds, and sidecars, fueled by pension funds, sovereign wealth, and asset managers.

- After the hard market reset of 2023, capacity expansion and record cat bond issuance are softening pricing. June–July 2025 renewals showed pressure, with slightly looser terms in property lines. Analysts expect underwriting margins to compress into 2025–26, even as ratings agencies keep a stable outlook.

- PwC’s Reinsurance 2035 argues reinsurers are shifting toward prediction, prevention, and resilience orchestration. Fund and Insure could reach $17tn GVA by 2035, acting as financial infrastructure across domains like Care, Move, and Fuel & Power. Insurers are embedding services into mobility, healthcare, and energy ecosystems, enabled by AI, analytics, and data platforms.

- Insurers need to allocate capital across entire ecosystems, co-develop tech with hyperscalers and insurtechs, and rebuild talent pools. Senior hires from mobility, infrastructure, and digital health can sharpen product insight. AI must be integrated into talent and underwriting strategy, improving decision-making while maintaining transparency and trust.

The pandemic revealed the fragility of health and liability frameworks. Monetary tightening forced a reset of solvency models and capital distribution. Climate-linked disasters—from Canadian wildfires to Brazilian floods—kept stressing traditional approaches to risk.

Softer pricing at reinsurers’ June and July reinsurance renewals supports view that abundant capacity and rising competition will continue to pressure prices.

Declining reinsurance prices, increased claims severity from natural catastrophe events, and slightly looser terms and conditions (T&Cs) in property lines are expected to reduce underwriting margins in 2025.

The global reinsurance sector has undergone a notable transformation since the market reset in 2023, drawing sustained attention from investors and analysts. Rather than a surge of new start-up reinsurers, capital has returned through more deliberate channels, according to AM Best’s Market Segment Report.

Global Insurance Sector Growth

Global growth is slowing at a time of large macroeconomic regime shifts. Extreme policy uncertainty is set to persist with the highest US goods tariffs since the Great Depression, according to Swiss Re report.

Trade wars and protectionism leave no winners and over the long term will relocate trade and production into new patterns globally. In this more fragmented world, firms and consumers face greater risks, including more volatile exchange rates and asset prices.

Global Insurance & Reinsurance Performance

| Metric | Value | Notes |

| Global premiums | €7 tn (+8.6% YoY) | Fastest annual growth since before financial crisis |

| Reinsurer combined ratio | 86.8% | Most profitable level in a decade |

| Reinsurer return on equity (ROE) | 17% | Well above cost of capital |

| Dedicated reinsurance capital | $769 bn (+5.4% YoY) | Driven by INDEX companies + alternative capital |

| Alternative capital | $115 bn (~20% capacity) | Includes ILS, cat bonds, sidecars; broader investor base |

Swiss Re expects global GDP growth to slow to 2.3% in 2025 and 2.4% in 2026, adjusted for inflation, from 2.8% in 2024, and to be an average 40 basis points (bps) lower in advanced markets this year at 1.3%.

The protection gap sits at $1.83 tn, leaving households and businesses underinsured against major shocks. Yet the shortfall doesn’t end there.

A growing pension gap adds further strain, leaving millions without adequate financial security in retirement.

Macro Outlook & Pressures

| Factor | Projection / Impact |

| Global GDP growth 2025 | 2.3% (vs 2.8% in 2024) |

| Global GDP growth 2026 | 2.4% |

| Protection gap | $1.83 tn |

As exposures rise, the cost of inaction grows. Yet, in many instances, the risk–return profile remains unattractive to private capital. Reinsurers are now exploring alternative models that aim to make coverage both scalable and investable, such as blended finance, public–private structures and sustainability-linked risk pools.

The reinsurance sector also faces widening gaps in resilience, talent, and funding. These challenges strike directly at the industry’s ability to deliver coverage in a world of rising volatility.

Next Decade Will Redraw the Boundaries of Insurability

Risks are becoming more complex, more interconnected, and more costly. In this shifting landscape, reinsurers are moving to the center of the equation.

Acting as stabilisers and capital shock absorbers, their role in sustaining the system’s resilience is only growing.

This changing landscape demands a twin response.

- First, it means investing more in the industry’s core disciplines—risk selection, pricing and capital management—which are more essential than ever. That’s especially true for reinsurers, given the role they play in the system. Most firms are rightly focused on strengthening their underwriting discipline and their core franchises across property and casualty, life and health.

- Second, in a world reshaped by climate change, technology and other megatrends, a growing number of insurers—including reinsurance firms—are beginning to redefine their role. Instead of just responding to losses, they are emerging as enablers of growth, transition and resilience. They are shifting their focus upstream, towards prediction and prevention to help mitigate risks before they materialise.

Beyond traditional underwriting, firms are investing in data infrastructure, advanced analytics and integrated services. Insurance is being embedded into wider ecosystems—including mobility, energy and healthcare—supporting capital flow and operational continuity.

This change represents not only a shift in distribution

It is a rethinking of the risk business itself: a transition from selling point-in-time to enabling resilience and stability.

Below, PwC explores how reinsurers can understand the new world of interconnected domains; address critical gaps in protection, resilience, talent and funding; and embrace the strategic actions needed to stay relevant and drive the industry forward.

Global reinsurance market moves beyond peak price levels

Global reinsurance market has entered a post-peak pricing phase, with earnings expected to moderate in 2025–2026.

Even as rates soften, the ratings agencies maintains a stable outlook on the reinsurance sector, pointing to strong capitalization, underwriting discipline, and sustained profitability above the cost of capital.

Reinsurance rates for more remote layers have reportedly fallen amid the aforementioned increased capital deployment from traditional reinsurers and record cat bond issuance.

Re/Insurance Must Adapt to Climate, AI & Capital Shifts

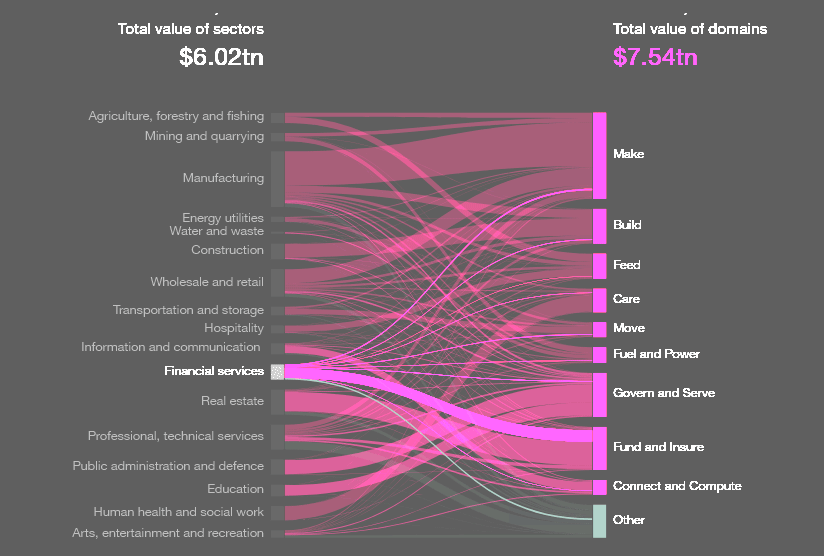

The insurance industry faces a fundamental rethink of how it defines the markets it serves. Old sector boundaries no longer hold. Climate transition, generative AI, and shifting capital flows are pulling firms into ecosystems that cut across traditional lines.

PwC’s Value in motion framework frames this reality through economic domains—broad, interconnected systems defined by human needs rather than narrow sectoral silos. That perspective matters, because disruption is already reshaping the ground insurers stand on.

Climate change is the most visible driver. The IMF estimates the world must lift annual low-carbon investment to around $5tn by 2030 to stay aligned with net-zero goals by 2050.

Generative AI is another force, with potential to add as much as 15% to global GDP within a decade if it is deployed responsibly and earns public trust.

Taken together, these shifts are rewriting the conditions for growth, resilience, and risk. The industry can’t just bolt on new tools—it has to operate differently, across domains that don’t fit old definitions.

Financial services, including insurance, are a major player in the new Fund and Insure domain

GVA is the total value of goods and services produced by a sector of the economy, and it provides insights into that sector’s contribution to overall economic output.

By 2035, the Move domain, which encompasses transport, infrastructure, energy systems and mobility platforms, is projected to contribute $5.86 tn in gross value added (GVA).

The Care domain, integrating life sciences, health technology, insurers and care delivery, is forecast to exceed $9.31 tn GVA by 2035.

The Fuel and Power domain, encompassing energy generation, distribution and storage, is expected to reach $6.19 tn GVA in that timeframe, reflecting the scale of investment required to support global electrification and transition efforts.

How the Fund & Insure Sector Drives Transformations

Fund and Insure is emerging as the financial backbone for channeling capital, managing risk, and keeping transactions flowing across the global economy.

That includes underwriting the trillions in low-carbon investment required for the climate transition.

PwC projects the domain could generate $17.04tn in gross value by 2035, positioning it as a critical enabler of other sectors and a field where traditional and non-traditional players can collaborate on new models for capital allocation and financial services.

One sign of this shift is the $115bn in alternative capital now circulating through insurance-linked securities, catastrophe bonds, and sidecars. That pool accounts for nearly one-fifth of global reinsurance capacity.

Domains & 2035 Projections (PwC Value in Motion)

| Domain | 2035 GVA Projection | Scope/Notes |

| Fund & Insure | $17.04 tn | Financial backbone, capital allocation, underwriting low-carbon |

| Care | $9.31 tn | Life sciences, health tech, insurers, delivery |

| Move | $5.86 tn | Transport, infrastructure, energy, mobility platforms |

| Fuel & Power | $6.19 tn | Energy generation, distribution, storage, electrification |

Behind it sits a far more diverse investor base: pension funds, sovereign wealth funds, and global asset managers. Access is widening as digital platforms mature, risk models sharpen, and regulators clarify rules.

Key Strategic Challenges

| Gap / Pressure | Description |

| Protection gap | $1.83 tn shortfall in insurance coverage |

| Resilience gap | Models strained by climate volatility, pandemics, systemic shocks |

| Talent gap | Need for AI, cyber, data science, and cross-sector expertise |

| Funding gap | Traditional balance sheets insufficient for climate transition costs |

The pace of reconfiguration brings both opportunity and tension

PwC’s BMR Pressure Index, which tracks stress points in business models, shows the transition already shaping market behaviour.

In 2025 alone, an estimated $604bn in enterprise value could change hands across financial services as firms reposition.

17 of 22 global sectors are under the highest level of transformation pressure in a quarter-century. For insurance, the strain ranks second only to its peak, underscoring how deeply the industry is being pushed to change.

As the industry adapts to more interconnected, fast-moving ecosystems, the talent profile it needs is changing

Traditional product and technical expertise is still relevant, but future-fit firms also require capabilities in AI, data science and cyber risk as well as industry-specific knowledge.

Just as crucial are professionals who can navigate complex stakeholder environments and collaborate across sectors. Increasingly, firms are looking for people who understand how different industries operate and can translate that insight into practical, customer-focused solutions.

Underwriting Tomorrow’s Risks

Underwriting tomorrow’s risks—digital, physical or systemic—will require a more integrated, data-driven approach. Capital, data and technology must be mobilised together.

From smart underwriting in cyber and climate to collaborative platforms for risk transfer, the future of insurance lies in its ability to orchestrate, not just underwrite, resilience.

According to PwC’s AI Jobs Barometer, generative AI is already changing how insurers work. Emerging use cases include improved underwriting, faster claims processing and more effective fraud detection.

Increasingly, we’re seeing industry participants move beyond experimentation, deploying GenAI to streamline decision-making, reduce manual intervention, and enhance both operational efficiency and risk accuracy, particularly in high-volume, data-intensive environments.

Some reinsurers are already commercialising their in-house climate models, offering platforms that combine forward-looking simulations with advanced analytics for insurers, corporates and investors.

By improving access to high-resolution risk intelligence, these tools are helping embed climate-adjusted decisions across the insurance value chain.

Strategic Priorities for Re/Insurers

| Area | Recommended Action |

|---|---|

| Domain ecosystems | Allocate capital across ecosystems; co-invest in platform players |

| Technology | Partner with hyperscalers/insurtechs; build bespoke AI tools |

| Workforce | Recruit cross-sector leaders (mobility, infra, digital health); AI in HR |

| Underwriting core | Strengthen risk selection, pricing, capital management |

| Capital innovation | Explore blended finance, public-private pools, sustainability-linked risk |

Artificial intelligence also offers substantial upside

PwC estimates that AI could boost global economic output by up to 15% over the next decade. But this potential will only be realised if the technology is underpinned by trusted governance and transparent application.

Nowhere is this more urgent than in insurance, where explainability and fairness must sit alongside performance. In a sector reliant on third-party capital and public confidence, opaque algorithms are not a viable trade-off.

The scale of future risk, especially risks linked to climate adaptation, energy transition and infrastructure resilience, will likely outstrip what traditional balance sheet models can support.

The challenge is not about capital supply, but aligning it with evolving risks.

Top 3 Strategic Shifts for Re/Insurers

1. The time to act on domains is now

Innovation in AI, mobility, energy, and agriculture is already reshaping how risk gets structured, priced, and transferred. Reinsurers can’t limit themselves to underwriting single firms.

They should think about allocating capital across entire domain ecosystems—sometimes as backers, sometimes as direct participants. These arenas offer space for reinventing business models, whether through co-investing in platform players or building portfolios designed around shared exposure pathways.

2. The next wave of innovation requires sharper focus

Insurers need agility, but also greater precision in execution. That means partnering with hyperscalers and insurtechs to co-develop technical capabilities.

Bespoke AI tools for supply chain analytics, portfolio optimisation, or loss prediction can deliver both competitive advantage and improvements in underwriting and capital models.

3. Workforce strategy can’t be separated from these structural changes

As sector boundaries blur, rigid organisational charts start to lose relevance. Pulling senior operators from client industries—mobility, infrastructure, digital health—into product, risk, or innovation teams can tighten insight and accelerate delivery.

AI adoption should be built into talent planning from the start, ensuring workforce transformation evolves alongside the technology.

FAQ

Premiums rose 8.6% to €7tn, driven by growth across life, non-life, and health. The pace reflected both pricing momentum from 2023 and underlying demand, making it the fastest increase since before the global financial crisis.

Reinsurers reported combined ratios of 86.8%—the most profitable in a decade—and average ROE of 17%, well above the cost of capital. These figures highlight strong underwriting discipline and favorable investment income.

Systemic shocks continue to expose vulnerabilities. The pandemic revealed fragility in health and liability systems. Monetary tightening reshaped solvency. Climate-linked events such as wildfires and floods tested traditional risk models.

Dedicated global reinsurance capital grew 5.4% to $769bn in 2024. Alternative capital reached $115bn, almost one-fifth of total capacity, as pension funds, sovereign wealth funds, and asset managers broadened their exposure through ILS, cat bonds, and sidecars.

No. The hard market reset of 2023 has given way to softer conditions. Renewals in mid-2025 showed increased competition, looser terms in property, and declining rates in remote layers, driven by abundant capacity and record cat bond issuance.

Reinsurers are shifting from pure backstops for loss to orchestrators of resilience. They are embedding services into ecosystems like mobility, healthcare, and energy, while investing in data, analytics, and AI-driven platforms to predict and prevent losses.

Industry leaders should: allocate capital across domain ecosystems, co-build tech with hyperscalers and insurtechs, and revamp workforce strategy by blending AI capabilities with cross-sector talent from industries like infrastructure, digital health, and mobility.

……………

AUTHORS: Richard de Haan – Global and US Risk Modeling Services Leader at PwC, Partner, Keith Palmer – PwC US Principal, Arthur Wightman – PwC Bermuda Territory Leader, Matthew Britten – PwC Bermuda Partner

Edited by Yana Keller — Lead Insurance Editor of Beinsure Media