Overview

Fitch Ratings says the UK’s proposed reforms to insurance risk transformation and captive insurance will not affect the credit quality of London market insurers ahead of the 2027 implementation.

However, the agency warned that systemic risks could rise if risk transfers shift into less transparent areas of the market. Beinsure analyzed the report, and highlighted the key points.

Key highlights

- Credit Profiles Remain Stable Through 2027. Fitch Ratings confirmed that the UK’s proposed reforms to insurance risk transformation and captive insurance will not impact the credit quality of London market insurers in the short term. Existing regulatory structures remain in force until mid-2027.

- Systemic Risk May Rise Post-Reform. While reforms aim to attract ILS and captive business, Fitch warns of potential long-term risks. If capital shifts into less regulated segments, market transparency could weaken, complicating risk aggregation and oversight.

- Record Growth in Catastrophe Bond Market. Aon reported $6.5bn in new catastrophe bond issuance in Q1 2025, followed by a projected $10.35bn in Q2. Investors showed strong demand, with over 60% of tranches upsized and spreads tightening despite larger volumes.

- Expanded Market Access and Lower Barriers. The reform package includes reduced capital requirements, faster authorisation, and simplified reporting. New structures such as transformer vehicles and protected cell companies will offer smaller firms easier access to alternative risk transfer solutions.

- Defined Limits and Two-Tier Captive Regulation. The UK will restrict captives from writing direct life or compulsory insurance lines. A split regulatory approach will apply: direct-writing captives face tighter scrutiny, while reinsurance captives receive lighter oversight when risk flows through authorised insurers.

Reform Without Immediate Credit Impact

Fitch Ratings stated that the UK government’s proposed reforms to insurance risk transformation and captive insurance will not change the credit profile of London market insurers ahead of 2027.

Existing regulatory requirements remain in force, ensuring continuity. However, Fitch flagged potential longer-term risks tied to increased activity in less transparent areas of the market.

The reforms are part of a broader push to enhance the UK’s position in financial services. Announced alongside banking sector adjustments, the initiative targets competitiveness in global ILS and captive markets.

Bermuda and the U.S. dominate ILS, while France and Canada lead in captive activity. The UK seeks to reclaim relevance through regulatory streamlining.

Catastrophe Bonds Issuance

Aon reports that Q1 2025 saw $6.5bn in new catastrophe bond issuance, setting a first-quarter record and surpassing the previous high by over $2.6bn.

Issuers accelerated their transactions to take advantage of favorable pricing and abundant capital, pulling spring deals into the early part of the year.

Investor appetite remained strong

Over 60% of issued tranches were upsized, driven by robust demand in a market where spreads continued to tighten.

Issuers who moved early secured better terms and capacity ahead of expected seasonal pressure.

Q2 2025 is on pace to reach $10.35 bn in new issuance across 32 transactions, according to Aon. Average deal sizes have grown nearly 24% compared to Q2 2024, reflecting continued demand from insurers and other risk-transfer buyers.

The quarter included two landmark transactions, each exceeding $1.5bn—the largest ever seen in the catastrophe bond market.

Despite this significant issuance volume, market spreads declined approximately 3% from Q1 levels, indicating sustained investor confidence and capacity availability.

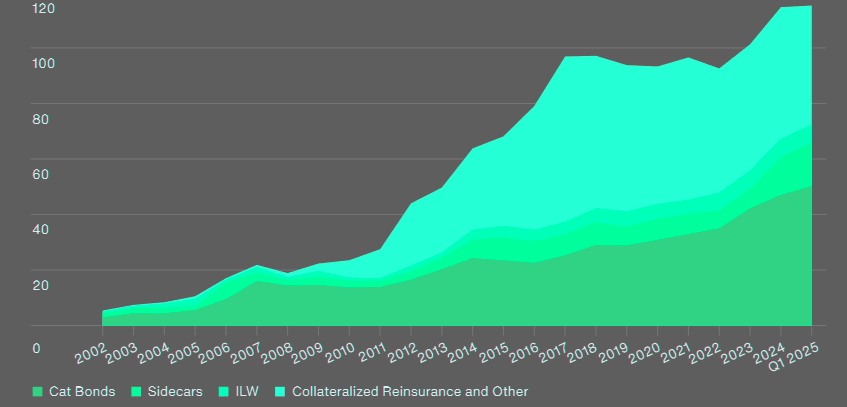

Alternative capital deployment (limit in $ bn)

Market expansion

Market expansion is not only being driven by existing participants scaling up but also by new sponsors entering the space.

After factoring in maturities, the outstanding catastrophe bond market is expected to grow by $4.0bn in Q2 and $7.2bn in H1 2025—an increase of 15% since the end of 2024.

This growth underscores continued capital inflows, either from reinvestment by current investors or allocations from new entrants.

Aon’s data shows that the market has steadily grown since 2016, reflecting a structural shift in how risk capital is sourced and deployed.

Limited Shift in Risk Appetite

Fitch does not expect insurers to materially expand their risk appetite under the new framework. Most of the new business is projected to relocate from other jurisdictions, not emerge from newly created risk (see Natural Catastrophes Drive Record-High Economic and Insured Losses).

Insurers will likely remain as arrangers, not direct risk takers, maintaining influence over structuring, underwriting, and risk management standards.

The proposals include reduced capital buffers, faster authorisation, lower compliance costs, and simplified reporting for ILS vehicles and captives.

Regulators—the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA)—plan to consult publicly in 2026, with implementation expected by mid-2027.

Risk Migration and Transparency Concerns

Once active, the new framework may shift risk away from regulated insurers and toward institutional investors and corporate captives.

ILS investors will absorb risk through less regulated vehicles, while corporates will retain exposure within their own structures.

Fitch warned this setup could reduce visibility across the market and make it harder to monitor risk aggregation and concentration.

The regime introduces a split approach:

- direct-writing captives will remain under tighter scrutiny as they provide insurance within corporate groups;

- reinsurance captives, which cede risk via an authorised intermediary, will face lighter regulatory demands.

This two-tier structure aims to apply regulation proportionally based on exposure to policyholder obligations.

Expanded Structures, Defined Boundaries

The reform expands the scope of ILS and captive tools. Transformer vehicles may take on risk from multiple sources, including non-insurers.

Protected cell companies can now support multiple clients, making it easier for SMEs to access structured risk transfer without forming standalone captives.

However, Fitch warned that cross-cell exposure must be managed carefully to prevent contagion.

The insurance-linked securities ILS market reached a record $107 bn in capacity by the end of 2024.

AM Best Director of ILS Matt Tuite attributes this expansion to strong investor returns, rising catastrophe bond issuance, and shifting investor appetite. However, uncertainties, such as the impact of California wildfires, could influence market dynamics in 2025.

Certain limits remain

Captives domiciled in the UK will not be permitted to write direct life insurance, due to liability concerns. Exceptions may apply to specific products such as group life term cover.

Captives also cannot write compulsory lines like motor or employer’s liability directly, though they may reinsure such risks through authorised insurers.

Fitch concluded that while the reforms promote market access and efficiency, regulators must remain alert. If risk migration goes unchecked, transparency will erode, and accurate risk assessment across the insurance ecosystem will become more difficult.

FAQ

No. Fitch Ratings confirmed that the proposed changes to insurance risk transformation and captive insurance will not impact the credit profiles of London market insurers before implementation in 2027. Current regulatory standards will remain in place until then.

Fitch warns that as the reforms expand, risk may shift into less regulated segments of the financial system. This could reduce market transparency and make it harder to track risk concentration across institutional investors and corporate captives.

The reforms aim to boost the UK’s position in the global financial services sector, specifically in ILS and captive insurance. Competing jurisdictions such as Bermuda, the U.S., France, and Canada currently lead these markets. The UK intends to attract business back through regulatory simplification and lower compliance costs.

Aon reported $6.5bn in Q1 2025 catastrophe bond issuance—a record high. Issuers brought forward deals to capitalize on strong pricing and deep investor demand. Over 60% of tranches were upsized. Q2 2025 is projected to reach $10.35bn across 32 deals, featuring the two largest catastrophe bond transactions on record.

No. Fitch does not expect a major shift in insurer risk appetite. Most new business is anticipated to be relocated from other jurisdictions rather than generated through new exposures. Insurers are expected to continue as arrangers, preserving oversight of underwriting and risk standards.

The reforms introduce a dual regulatory approach. Direct-writing captives, insuring group risks, will remain under stricter supervision. Reinsurance captives, which cede risks through authorised insurers, will operate under lighter rules. The ILS framework will also allow transformer vehicles to assume risk from various sources and enable protected cell companies to support multiple clients.

Yes. UK-domiciled captives cannot write direct life insurance due to long-term liability risks, though exceptions like group term life may be reviewed. They are also barred from directly covering compulsory lines such as motor and employer’s liability, but reinsurance of those risks through licensed carriers is permitted.

……………….

AUTHORS: Robert Mazzuoli, CFA – Director, Insurance at Fitch Ratings – a branch of Fitch Ratings Ireland, David Prowse – Senior Director, Credit Commentary and Research at Fitch Ratings

Edited by Yana Keller — Editor at Beinsure Media