Overview

Global reinsurance market has entered a post-peak pricing phase, with earnings expected to moderate in 2025–2026. Even as rates soften, the ratings agencies maintains a stable outlook on the reinsurance sector, pointing to strong capitalization, underwriting discipline, and sustained profitability above the cost of capital.

Beinsure analyzed reports from S&P Global Ratings, Moody’s, AM Best and Fitch Ratings and highlighted key points.

Key Highlights

- S&P and AM Best maintain stable views, Moody’s shifted to stable from positive, while Fitch downgraded to “deteriorating,” highlighting growing competition and margin pressure.

- Reinsurance rates have been declining since mid-2024, especially in property lines. January 2026 renewals are expected to bring further softening, with policy terms easing from the strict standards of 2023.

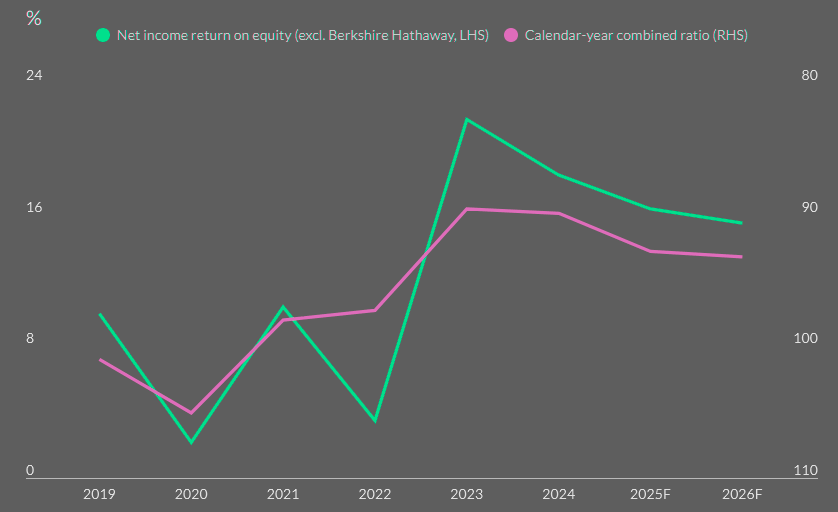

- S&P projects combined ratios of 94–96% in 2025 and 95–98% in 2026, with ROEs between 11–14%. Fitch also sees a modest deterioration but still expects adequate returns supported by investment income.

Dedicated reinsurance capital reached $500 bn in 2024, bolstered by robust underwriting, higher investment yields, and retained earnings. Abundant traditional and alternative capital continues to provide ample capacity for cedants. - Reserve adequacy in U.S. casualty lines remains the biggest vulnerability, with $6 bn in reserve strengthening recorded in 2024. On the investment side, increased allocations to private credit, private equity, and commercial property introduce added volatility.

Despite pressure to broaden coverage and lower attachment points, S&P noted that underwriting discipline across the global reinsurance industry has remained intact, and reinsurers have retained strong capitalisation.

As of August 31st, 2025, S&P’s outlook on 15 of the top 19 global reinsurers was stable. Of the remaining 4, its outlook on 3 was positive and just one had a negative outlook.

Global Reinsurance Market Outlook

- S&P stable outlook is supported by reinsurers’ robust capital, sound underwriting margins, strong investment returns, and still-favourable earnings prospects above the sector’s cost of capital.

- Moody’s has changed its outlook on the global reinsurance sector to stable from positive, noting that pricing for property reinsurance is declining as the supply/demand balance shifts toward reinsurance buyers.

- Fitch Ratings has revised its global reinsurance sector outlook to ‘deteriorating’ from ‘neutral,’ anticipating moderately weaker, but still sound, operational and business conditions in 2026.

- AM Best noted that dedicated reinsurance capital rose 7% in 2024, reaching $500bn, supported by strong underwriting results, higher investment yields, and retained earnings despite heavy catastrophe losses.

The sector’s operating performance is expected to remain strong through 2026. While natural catastrophe events weighed on H1 2025 results, reinsurers are on track to meet their cost of capital for the year, and S&P anticipates similar outcomes in 2026.

The global reinsurance sector has undergone a notable transformation since the market reset in 2023, drawing sustained attention from investors and analysts.

Rather than a surge of new start-up reinsurers, capital has returned through more deliberate channels, according to AM Best.

Global Reinsurance Agency Outlooks

| Agency | Outlook 2025 | Key Focus |

| S&P | Stable | Capital strength, underwriting discipline |

| Moody’s | Stable (from Positive) | Declining property pricing |

| Fitch | Deteriorating (from Neutral) | Competition, weaker margins |

| AM Best | Stable | Capital + underwriting support |

Global reinsurance groups are moving toward more diversified and balanced business models. Capital is increasingly allocated to primary and specialty lines rather than heavily concentrated in property catastrophe risk.

This evolution provides earnings stability and allows more agile capital deployment across cycles, though it reduces capital dedicated to traditional reinsurance.

Casualty lines remain pressured by adverse reserve development tied to social inflation and shrinking margins, but strong property results and improved investment income offset those strains.

Reinsurance Market Conditions

For 2025, S&P forecasts a combined ratio of 94%–96% and ROE of 12–14%. In 2026, those measures are expected to ease to 95–98% and 11–13%, respectively.

While short-tail pricing is projected to decline by about 5% at the 2026 renewals, terms and conditions are likely to hold firm.

Property catastrophe remains attractively priced, ensuring that reinsurers continue to allocate significant capacity to peak perils.

Financial Forecasts (S&P)

| Year | Combined Ratio (%) | ROE (%) |

|---|---|---|

| 2025 | 94–96 | 11–14 |

| 2026 | 95–98 | 11–13 |

According to Moody’s, abundant traditional market capacity and rising inflows into alternative markets, especially catastrophe bonds, are exerting downward pressure on prices.

Nonetheless, risk-adjusted returns in property reinsurance remain attractive and we expect profitability to be strong over the next year.

It added that property catastrophe pricing during the 2025 renewals has been “largely stable” for coverage attaching at lower return periods (e.g., 1-in-10, 1-in-20 years).

Reinsurance rates for more remote layers have reportedly fallen amid the aforementioned increased capital deployment from traditional reinsurers and record cat bond issuance.

“However, solid balance sheets and strong investment income will help reinsurers manage the volatility arising from catastrophe losses and the uncertainty associated with reserve adequacy in US casualty lines,” Moody’s analysts added.

Softer Pricing to Pressure Reinsurer Margins

Fitch Ratings expects competition in reinsurance to remain largely price-driven, with policy terms likely to loosen from the strict levels imposed during 2023.

The agency projects combined ratios and return on equity will deteriorate slightly in 2026, assuming major losses stay within budgeted expectations.

Softer reinsurance pricing since mid-2024 and rising claims costs will drive the shift. Offsetting factors include continued underwriting discipline, active portfolio adjustments, and steady investment returns.

Fitch said sector capitalisation remains strong, leaving reinsurers with significant headroom to manage shocks. Property and casualty reserve buffers have strengthened over the past two years, improving balance-sheet resilience and providing flexibility to smooth earnings when volatility increases.

According to AM Best, reinsurers continue to transition toward more diversified and balanced business models, including a growing allocation to primary and specialty insurance lines, reflecting a deliberate move away from purely relying on property catastrophe risk.

Softer pricing at reinsurers’ June and July reinsurance renewals supports view that abundant capacity and rising competition will continue to pressure prices.

Declining reinsurance prices, increased claims severity from natural catastrophe events, and slightly looser terms and conditions (T&Cs) in property lines are expected to reduce underwriting margins in 2025, AM Best’s analysts note.

Investment and Reserving Risks

On the investment side, higher allocations to private credit, private equity, hedge funds, and commercial property add volatility and liquidity risk. Interest rate swings continue to weigh on mark-to-market values, though liability durations are shortening.

On the liability side, geopolitical risks are shaping exposures in aviation, political risk, and trade credit. Reinsurers already absorbed losses from the Russia-Ukraine conflict and 2025 U.S. tariff-related volatility.

Casualty reserving remains the most pressing issue: U.S. liability claims have driven $6 bn of reserve strengthening among S&P’s top 19 reinsurers in 2024, while the buffer of prior-year releases continues to shrink.

For insurers and reinsurers, labor and materials inflation is slowing down, while medical costs and litigation and settlement expenses continue to rise.

Risk-adjusted returns remain attractive for reinsurers, but will likely be lower than last year because of reduced pricing and margins in property and property cat reinsurance.

“Assuming average global insured catastrophe losses, we expect good underwriting results and solid investment income to support strong profitability metrics for the reinsurance sector,” Moody’s said.

Capacity and Capital

Despite earnings pressure, capital supply is strong. Ample retrocession and catastrophe bond issuance supported cedants during 2024–2025 renewals, with alternative capital now an embedded part of the market.

S&P expects similar conditions at the 2026 renewals, supported by strong investor appetite for cat risk.

Fitch Ratings expects abundant capacity and rising competition across most property lines to gradually erode prices, while rising claims costs—driven by more frequent and severe catastrophe losses and persistent social inflation—will pressure underwriting margins in its base case.

We expect capital supply from traditional and alternative sources, currently at a record high, to further outpace incremental demand from cedants over the next 12 months, increasingly shifting pricing power in favour of reinsurance buyers.

More competitive market conditions will lead to continued market softening – particularly in property catastrophe – absent a very significant loss event in 2H2025. Competition is likely to remain price-driven, but we anticipate policy terms will loosen from the very high standards established in 2023.

Financial Performance Reducing from Peak

Capital supply from traditional and alternative sources, which is currently at a record high, is projected to further outpace incremental demand from cedants over the next 12 months, shifting pricing power increasingly in favour of reinsurance buyers.

More competitive conditions are expected to continue market softening—particularly in property catastrophe—unless a very significant loss event occurs in the second half of 2025.

Strategic Focus Drives Profitable Growth

Aon said its latest analysis of $2 tn in premiums shows that insurers with clear strategic focus and global relevance consistently deliver stronger financial outcomes, regardless of market conditions.

The firm compared compound annual growth rates with returns on average equity across 120 re/insurers between 2013 and 2024.

The study found that the group of top performers delivered a 14.7% RoAE in 2024, up from the long-term average of 8.7%.

Their combined operating ratio also improved, dropping to 93.6% — the best result since 2006 and 3.4 percentage points below the 10-year average.

Gross written premiums climbed 7.5% in 2024 to $1.9 tn, exceeding the 10-year CAGR of 6.4% but marking a third year of slowing growth after peaking at 10.2% in 2021.

Aon noted wide profitability gaps across property and casualty lines, with globally diversified and specialised segments again leading returns for the third consecutive year.

Assuming major losses remain within budgeted levels, Fitch expects combined ratios and return on equity to slightly deteriorate in 2026, primarily driven by lower pricing since mid-2024 and rising loss costs, but mitigated by preserved underwriting discipline, active portfolio optimisation and supportive investment returns.

Fitch expects capitalisation to remain generally very strong, providing headroom to absorb market shocks

P&C reserve buffers have generally strengthened over the past two years, enhancing balance-sheet resilience, while providing flexibility to smooth the earnings profile.

Strategic Implications

Reinsurers face a balancing act. Softer pricing will narrow underwriting margins, but robust investment returns (3.5–4%) and capital discipline should keep the sector profitable.

The challenge lies in reserving adequacy for U.S. casualty and managing volatility in alternative assets.

Those that maintain strict underwriting standards and carefully calibrate portfolio risk are best positioned to sustain performance.

Several US insurance companies have been able to secure increased amounts of aggregate reinsurance coverage this year, underscoring the more competitive environment in the sector.

Moody’s noted that the inflationary pressures on insured values and portfolio growth among ceding companies can act as a reduction in the effective attachment point on an inflation and risk-adjusted basis.

To the extent profitability in property reinsurance lines comes through as expected this year, we think policy terms and conditions could slip further in 2026

Positive performance in short-tail lines has offset the need to strengthen reserves in certain long-tail lines and, in aggregate, its top 19 global reinsurers have continued to release reserves from prior years.

However, the size of the positive run-off has been shrinking since 2018, mainly due to adverse developments in U.S. casualty.

Reinsurance Profits Fall as Competition Builds Into 2026

Fitch Ratings reported that underwriting profits for the non-life reinsurers it tracks declined in H1 2025, with the aggregate combined ratio deteriorating to 92.7% from 88.3% a year earlier. The agency warned that premium growth in 2026 may be constrained by intensifying competition and global economic uncertainty.

Reinsurance buyers generally experienced a more competitive reinsurance market at the July 1 reinsurance renewal compared to recent years, with capacity available even where demand increased.

The California wildfires accounted for the largest single loss event in the first half, while aviation losses—including the Air India crash in June and the American Airlines collision in Washington in January—also weighed on results.

Non-life reinsurance net premiums fell slightly compared with H1 2024, reflecting softening conditions across multiple lines.

Fitch expects underwriting results to deteriorate further into 2026, though pricing should remain adequate to sustain favourable returns. Fitch anticipates continued market softening at the January 2026 renewals, particularly for loss-free business, with reinsurers differentiating pricing based on client performance.

Despite rising claims costs, profitability has been underpinned by robust investment income, equity market gains, and the strong underwriting environment of 2023 and 2024, which lifted industry capitalisation to record levels.

Fitch said this provides reinsurers with a solid buffer to absorb shocks.

Reinsurance supply remains abundant, with capacity readily available to meet growing demand. Primary insurers continue to purchase additional cover to manage higher insured values, climate-related risks, casualty costs, and geopolitical uncertainty.

Fitch noted that while competitive pressure will trim margins, disciplined capital deployment should still support favourable, if lower, risk-adjusted returns compared with the peak conditions achieved in 2023.

FAQ

Despite softer pricing, the major rating agencies maintain that reinsurers remain well-capitalised and broadly profitable. S&P, Moody’s, and AM Best hold stable views, while Fitch has revised its outlook to “deteriorating.” Underwriting discipline and strong investment income are expected to support sector performance, but earnings will moderate as competition intensifies.

S&P sees a stable outlook backed by robust capital and underwriting margins. Moody’s also shifted to stable but warned of weakening property reinsurance pricing. Fitch forecasts weaker conditions in 2026, citing competitive pressures and rising claims, while AM Best highlights stronger capitalisation and diversification into primary and specialty lines.

S&P projects combined ratios of 94–96% in 2025 and 95–98% in 2026, with ROE in the 11–14% range. Fitch also expects combined ratios and ROE to deteriorate modestly but remain adequate for favourable returns. Investment yields of 3.5–4% should help offset underwriting margin pressure.

Pricing has softened since mid-2024 and is expected to decline further in 2026, particularly in short-tail property lines. Capacity from traditional reinsurers and record catastrophe bond issuance has increased competition, shifting leverage toward buyers. Terms and conditions, tightened in 2023, are gradually loosening.

Capital supply is at record levels, with AM Best estimating dedicated reinsurance capital at $500 bn in 2024. Traditional and alternative markets remain flush, allowing cedants to secure more aggregate cover. Ample retrocession and strong cat bond inflows support abundant capacity at upcoming renewals.

Casualty reserving remains the largest concern, with U.S. liability losses prompting $6 bn in reserve strengthening in 2024. Geopolitical shocks—such as the Russia-Ukraine conflict and U.S. tariff volatility—continue to affect aviation, trade credit, and political risk. On the investment side, higher exposure to private credit, private equity, and commercial property raises volatility.

Diversified and specialised insurers continue to outperform, according to Aon’s analysis of $2 tn in premiums. Firms with global reach and strategic focus achieved a 14.7% RoAE in 2024, well above the long-term average. Property catastrophe remains attractively priced, while casualty lines are pressured by social inflation and reserve volatility.

…………….

AUTHORS: Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media and Insurance TOP Ratings (25+ years of professional experience in Rankings, Insurance & Media), Yana Keller — Lead Insurance Editor of Beinsure Media