Overview

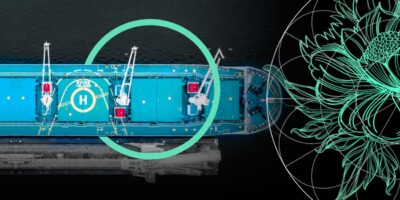

Across Europe, coastal states are tightening oversight of tankers suspected of carrying sanctioned Russian crude oil by demanding proof of valid insurance. This “shadow fleet” often consists of aging vessels operating under obscure ownership, switching flags frequently, and relying on low-tier or state-backed insurers that may not cover major oil spills or costly salvage operations.

By targeting insurance—a weak link for the shadow fleet—authorities make opaque operations less viable and raise the cost of non-compliance.

- Norway’s new six-month pilot, led by the Ministry of Trade, Industry and Fisheries, asks tankers in its Exclusive Economic Zone to voluntarily disclose insurance details. The Norwegian Coastal Administration contacts vessels, while the Norwegian Maritime Authority verifies documents. Though no penalties apply for refusal, noncompliant ships risk deeper inspections when entering ports.

- Similar measures are already in place in Sweden, Finland, Denmark, Germany, and the UK. These countries share data to identify high-risk vessels, closing gaps in enforcement. Early results show more than 90% of contacted ships eventually submit documentation, helping regulators assess environmental and safety risks.

This coordinated approach aims to protect marine ecosystems, critical infrastructure, and regional security from the growing risks posed by poorly regulated tankers.

Norway Verifies Insurance Coverage for “Shadow Fleet” Tankers

Starting August 11, 2025, Norway has launched a new oversight mechanism requiring foreign tankers operating in its Exclusive Economic Zone to voluntarily disclose insurance details—particularly if they may be transporting sanctioned Russian crude oil.

The initiative, led by the Ministry of Trade, Industry and Fisheries, responds to what the government describes as direct threats to maritime safety and the environment posed by the “shadow fleet.”

It begins as a six-month pilot, after which authorities will evaluate its effectiveness and consult with industry stakeholders.

The Norwegian Coastal Administration (Kystverket) will contact vessels, while the Norwegian Maritime Authority (Sjøfartsdirektoratet) will verify submitted insurance documentation.

Trade Minister Marianne Sivertsen Næss emphasized that the move aligns with broader European cooperation to curb risks associated with shadow fleet tankers.

How the Insurance Verification Will Work

The Coastal Administration will request proof of valid insurance from tankers involved in Russian oil transport.

Although there are no formal penalties for noncompliance, authorities expect the inquiry and subsequent verification to act as a deterrent, discouraging voyages operated under questionable insurance providers.

Norway joins a coordinated regional effort already underway in Denmark, Sweden, Finland, Germany, and the UK, where similar transparency measures are in force.

Regional Precedents and Escalating Oversight

Sweden, for example, has since July 1 been collecting insurance data not only from ships entering ports but also those transiting its territorial waters and EEZ.

The Swedish government justifies the step as necessary to manage risks posed by aging vessels operating outside traditional P&I (Protection and Indemnity) clubs and often concealing ownership structures.

Similar measures have been announced by authorities in Helsinki and Copenhagen. In December 2024, Baltic and North Sea coastal states committed to joint efforts to regularly check tankers’ oil spill liability coverage.

Early Impact Already Noticed

Analysts report that more than 90% of vessels approached eventually provide insurance documentation.

Estonia issued over 1,000 requests since June 2024, receiving responses in most cases. Finland, which began systematic checks in December 2024, reports similar results.

These outcomes suggest that even voluntary oversight compels shadow fleet operators to reveal at least minimal documentation, enabling regulators to assess risk exposure on a case-by-case basis.

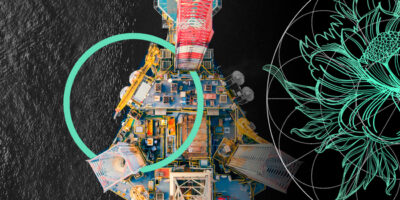

Beyond Paperwork: Real-World Risks

Several Baltic Sea region criminal investigations involve vessels associated with the shadow fleet.

Finland, for instance, filed charges against the captain and senior officers of the Eagle S tanker after it damaged five submarine cables, including the EstLink 2 power line.

Whether the damage was intentional remains under investigation, but the incident highlights compounding risks—technical decay, poor crew training, and substandard navigation practices—underscoring the importance of verified insurance not just as a legal formality but as a safeguard in emergencies.

Why Insurance Disclosure Has Become a Focal Point

With major Western P&I clubs having exited the Russian trade, many shadow fleet operators now rely on low-tier or state-backed Russian insurers. These policies often fail to cover major spills or complex salvage operations.

While Norway has not yet imposed mandatory penalties, officials expect that systematic documentation and policy verification will reduce the economic viability of opaque operations and help authorities quickly identify high-risk ships.

Another driver is tighter EU coordination. In June 2025, 14 European countries, including Norway, called for unified actions against the shadow fleet, citing its rapid expansion. Think tanks have identified hundreds of tankers operating in the shadows—frequently switching flags, names, and managers, and often disabling transponders.

Against this backdrop, even voluntary insurance checks contribute to a wider enforcement strategy—from port controls to choke-point inspections—designed to increase the cost of non-transparent activity.

Operational Rollout: What Norway Will Do

Norway plans to:

- Systematically contact tankers and collect insurance data.

- Cross-check policies with national and international databases.

- Share findings with neighboring countries to close gaps in oversight across territorial boundaries.

Though framed as “voluntary,” the policy is seen as de facto standard-setting. Absence of documentation may trigger deeper inspections upon port entry or in adjacent waters.

This layered approach reflects an emerging regional consensus, as noted by both Norwegian and international maritime sources.

While the initiative is just one part of a larger enforcement puzzle, it targets a major vulnerability in the shadow fleet—insurance.

The more operators are forced to present real policies and identify genuine insurers, the less room remains for murky transshipments and unmanaged risk to coastal ecosystems and infrastructure.

The pilot aims to test that hypothesis in practice. Its outcome will determine whether the temporary procedure becomes a permanent feature of maritime regulation in the region.

FAQ

Norway, through its Ministry of Trade, Industry and Fisheries, has launched a six-month pilot program asking tankers operating in its Exclusive Economic Zone (EEZ)—particularly those suspected of carrying sanctioned Russian crude oil—to voluntarily provide proof of valid insurance.

The Norwegian Coastal Administration (Kystverket) will reach out to tankers to request insurance details. The Norwegian Maritime Authority (Sjøfartsdirektoratet) will then verify those documents against national and international databases.

Participation is officially voluntary, and there are no direct fines for not providing documents. However, lack of cooperation could lead to deeper inspections upon entering Norwegian ports or when operating in neighboring waters.

Many “shadow fleet” tankers rely on low-tier or state-backed Russian insurers after major Western P&I clubs left the Russian trade. These policies often provide inadequate coverage for oil spills or salvage operations, creating risks to maritime safety, the environment, and coastal infrastructure.

Norway’s initiative is part of a coordinated approach with Denmark, Sweden, Finland, Germany, and the UK, all of which have adopted similar transparency measures. Information gathered will be shared with these partners to close oversight gaps.

Yes. In Sweden, Estonia, and Finland, more than 90% of vessels contacted have provided insurance documentation, enabling authorities to identify high-risk ships and act accordingly.

The Norwegian government will evaluate the program’s effectiveness, consult industry stakeholders, and decide whether to make insurance verification a permanent requirement or integrate it into broader maritime safety regulations.

……………..

AUTHORS: Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media, Nataly Kramer — Editor at Beinsure Media