Overview

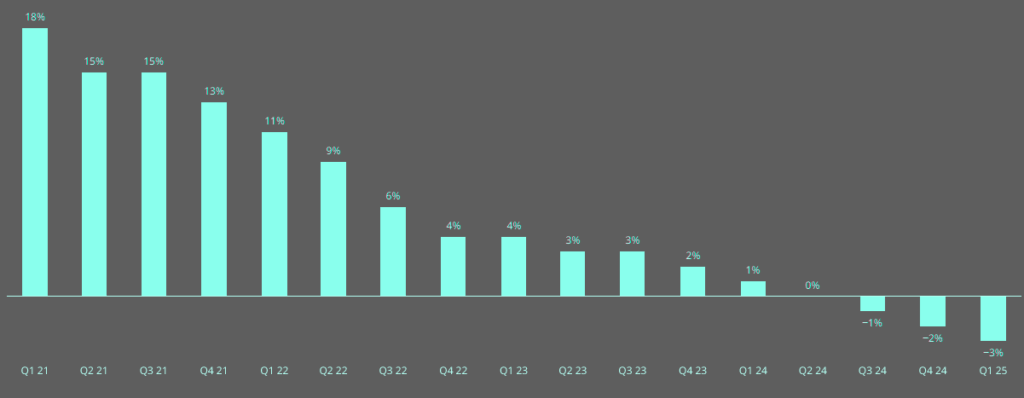

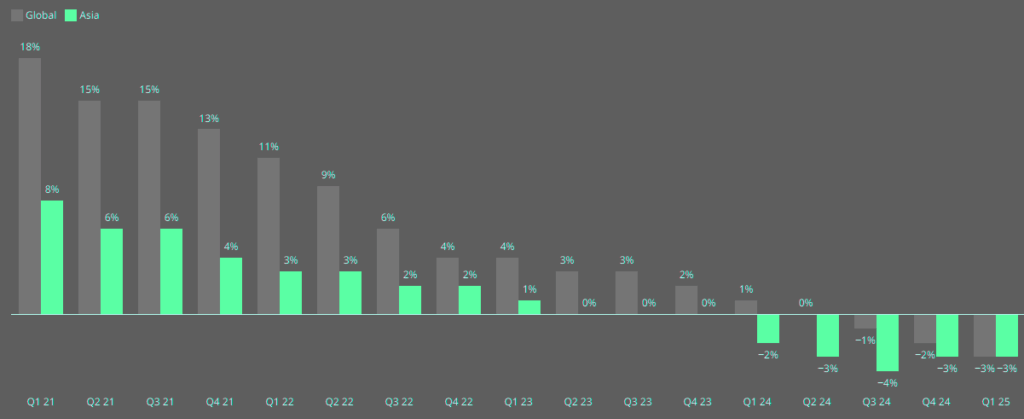

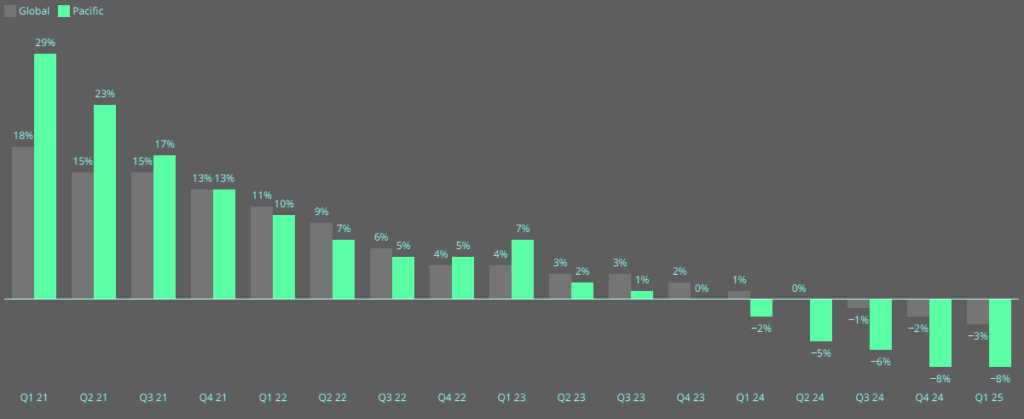

Global commercial insurance rates declined by 3% in Q1 2025, the third consecutive decrease in the composite rate following seven years of increases, according to the Marsh Global Insurance Market Index. Beinsure analyzed the report and highlighted the key points..

A continuing increase in insurer competition was the main catalyst behind rate trends, which declined globally in every region and across all major product lines other than casualty.

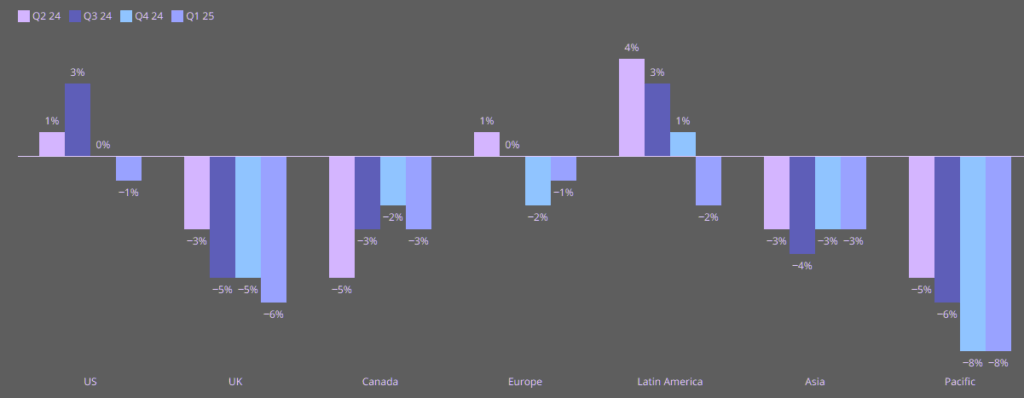

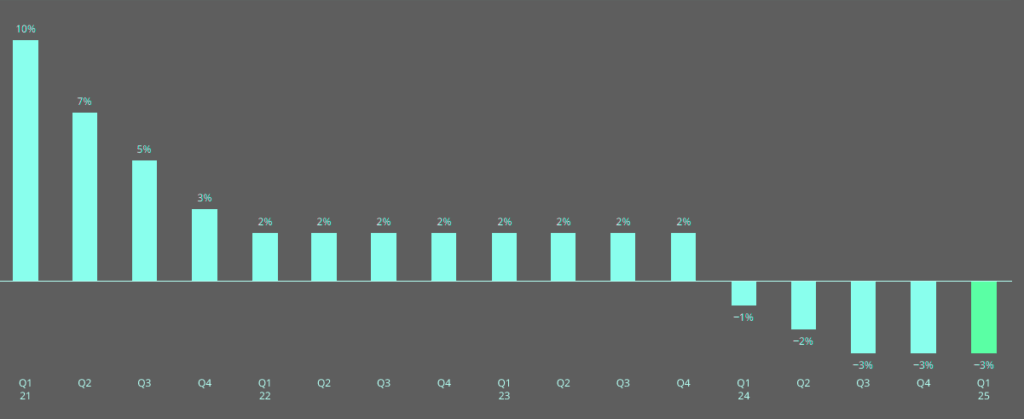

The UK and the Pacific regions experienced the largest composite rate decreases, at -6% and -8%, respectively, while US rates declined 1%.

Global commercial insurance rates dropped 2% in Q4 2024, marking the second straight quarterly decline after seven years of increases.

Q1 2025 marked the third consecutive quarter of global rate decline (-3%) in Marsh’s Global Insurance Market Index, following seven years of quarterly increases. The breadth of declines — seen in all regions and product lines apart from casualty — is a positive for our clients.

It’s important to keep in mind that insurance pricing trends can, at any given time, be suddenly reversed due to a variety of factors, including a major catastrophe or series of catastrophes. For example, every year brings a keen eye on the North American tropical storm/hurricane season.

5 Key Highlights – Global Commercial Insurance Rates

- Commercial insurance rates dropped 2% globally in Q4 2024, marking a second straight quarterly decrease after seven years of continuous increases.

- The Pacific region led declines with an 8% drop, followed by a 5% decrease in the UK, 3% in Asia, and 2% in both Canada and Europe. In contrast, rates rose by 1% in Latin America, the Caribbean, and IMEA, while U.S. rates stayed flat.

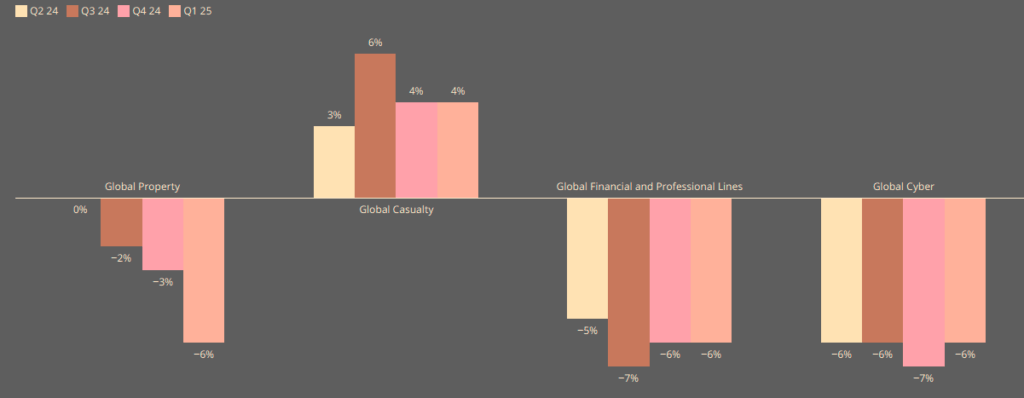

- Property rates declined 3% globally, casualty rates rose 4% (down from 6% in Q3), financial and professional lines fell 6%, and cyber insurance dropped 7%. U.S. casualty rates climbed 7%, mainly due to excess and umbrella coverage.

- In the U.S., property rates declined 4% because of increased insurer capacity and competition, while casualty rose 7% amid litigation and reserve concerns. The UK saw property rates down 4%, casualty (excluding motor) down 6%, and financial and professional lines down up to 8%, with motor insurance increasing 7%.

- Stronger competition, higher capacity, and greater underwriting flexibility helped lower rates in most regions and product lines. Insurers tightened terms in high-risk sectors, adjusted capacity to litigation challenges, and pursued retention through long-term agreements and favorable policy terms.

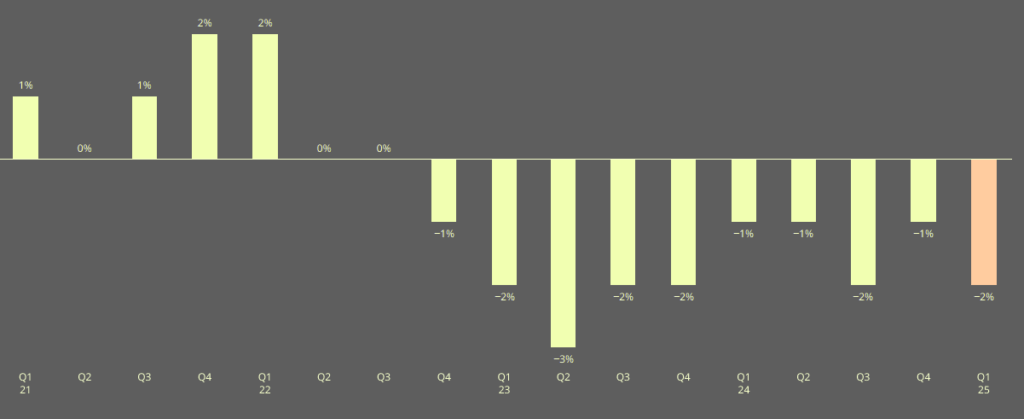

Marsh’s analysis shows global property insurance rates fell 3% in Q4, with the Pacific region experiencing the sharpest decline at 8%. The U.S. and UK saw 4% reductions, while Canada, Latin America, the Caribbean, and Asia reported slight decreases.

Financial and professional lines rates fell 6% globally, with declines in every region. Cyber insurance also dropped 7%.

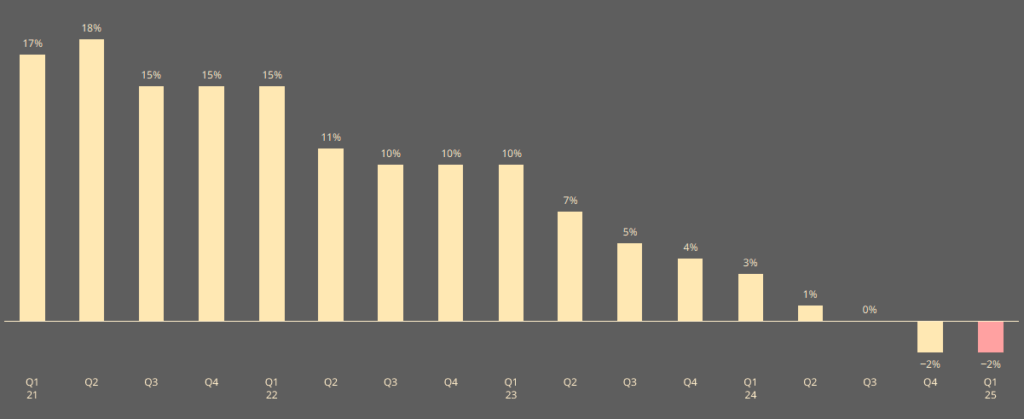

Property insurance rates fell 3% globally. Casualty insurance remained the only major category to rise, increasing 4%, compared to 6% in the prior quarter.

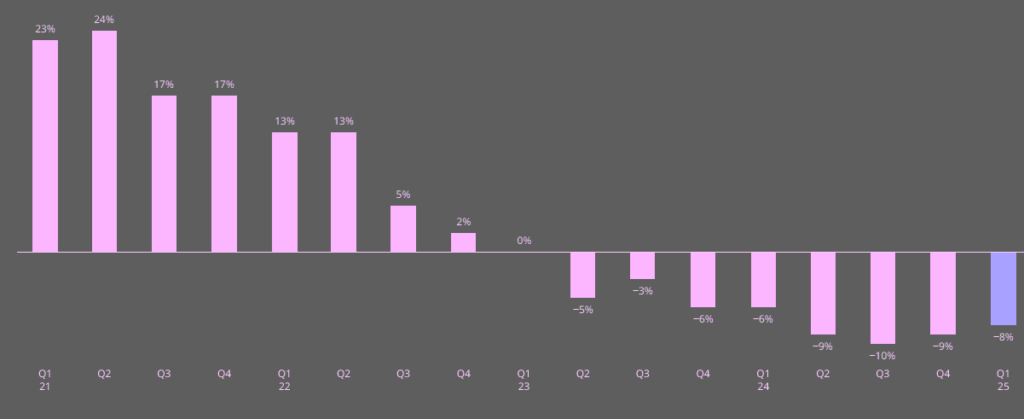

Casualty insurance rates increased 4% globally, though the rise slowed from 6% in Q3. U.S. casualty rates had the sharpest increase at 7%, driven by excess/umbrella coverage. Latin America and the Caribbean saw a 5% rise, while other regions ranged from a 2% decline to a 1% increase.

The main product line bucking the trend was US casualty, where rates rose 8% in the first quarter, contributing strongly to a 4% global increase.

Due largely to the severity of claims and large jury verdicts — sometimes called “nuclear verdicts” — available capacity tightened, with underwriters continuing to reduce their line sizes. US casualty market conditions typically impact rates and coverage in other regions.

John Donnelly, President, Global Placement at Marsh Specialty and Global Placement

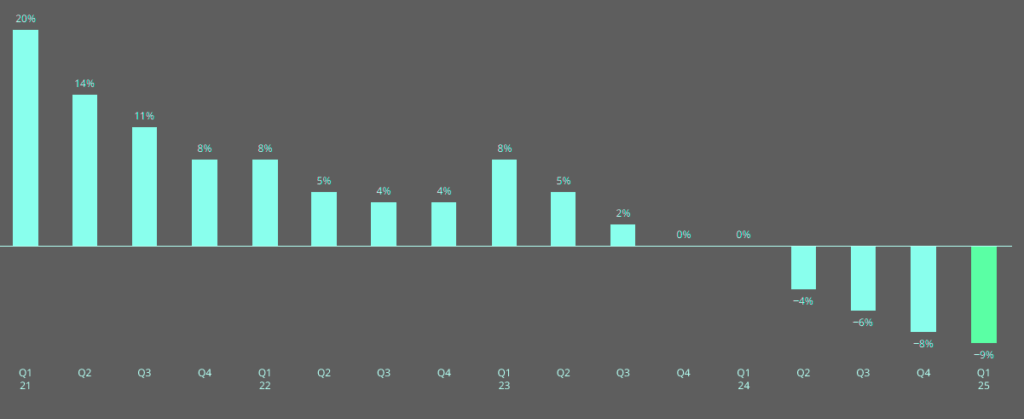

In the US, the overall composite rate declined by 1%, driven by a 9% decline in property insurance. Globally, property rates decreased by 6%, including by 9% in the Pacific, 6% in the UK, and low single digits in other regions.

The pace at which rates in some product lines decreased slowed or flattened in some regions compared to prior quarters. For example, financial and professional lines globally declined 6% the same as in the prior quarter; cyber declined 6% compared to a 7% decline in the prior quarter.

Global composite insurance rate change

All references to rate and rate movements in this report are averages, unless otherwise noted. For ease of reporting, we have rounded all percentages regarding rate movements to the nearest whole number.

By region, the Pacific recorded the steepest overall decline at 8%, followed by the UK at 5%, Asia at 3%, and Canada and Europe at 2%. Offsetting these decreases, Latin America, the Caribbean, and IMEA saw 1% increases. U.S. rates remained flat in Q4 after rising 3% in Q3.

Global composite insurance rate change – by region

Marsh attributes the trend to increased competition in commercial property insurance, slower casualty rate increases, stable financial lines pricing, and accelerated cyber rate reductions.

The softening of rates across property, financial lines, and cyber is positive for clients, though challenges persist, particularly in U.S. casualty. We remain focused on managing costs, protecting balance sheets, and guiding clients through market shifts

John Donnelly, Global Head of Placement at Marsh

Global product line trends

- Property rates declined by 6% globally, with rate movement varying by region. The US and Pacific regions experienced the largest decreases, at -9%; while the UK declined 6% and all other regions experienced low single-digit declines.

- Casualty rates increased 4% globally, led by an 8% increase in the US, driven largely by excess/umbrella rates. Other regions varied between 2% increases and 2% decreases.

- Financial and professional lines rates decreased 6% globally, declining in every region, including by 10% in the UK and Pacific.

- Cyber insurance rates declined 6%, with declines seen in every region, including 10% in Europe.

US Insurance Market Rates

Below are insights into the US insurance market rates. U.S. property insurance rates dropped 4%, a sharper decline than the 1% recorded in the previous quarter.

Increased insurer capacity, driven by strong financial results over the past three years, contributed to the trend. Casualty insurance rates rose 7%, with an 11% increase when excluding workers’ compensation.

US property insurance rate change

Property insurance rates declined 4%, compared to a decline of 1% in the prior quarter

- Increased insurer capacity and competition were driven by strong financial performance in the property sector over the past three years, along with cost reductions and stable reinsurance structures.

- Insurers began to show greater underwriting flexibility and considered movements favorable to insureds on sub-limits, coverage definitions, and natural catastrophe deductibles.

- Clients in high-risk areas, like the Gulf of Mexico, Atlantic coast, or California, experienced above-average rate decreases due to increased capacity and new capital.

- Insurer scrutiny of valuation and COPE data was generally lessened compared to previous years.

- Insurer appetite for business increased in sectors including warehousing, food and beverage, and technical risk, which had seen sizable rate increases over the past five years.

The property market remains sensitive to loss events, particularly the ongoing Los Angeles wildfires, which will impact aggregate catastrophe losses in 2025.

Casualty rate in the US increases driven by auto liability

Casualty insurance rates increased 7%; excluding workers’ compensation, the increase was 11%.

Workers’ compensation continued to be the primary casualty line of interest for most insurers; however, concerns continued regarding increasing reserves and rising medical costs.

Auto liability continued to pose profitability challenges for insurers due to larger jury verdicts nationwide and rising auto physical damage costs. General liability rates remained relatively stable, with average increases of approximately 3%.

In the umbrella and excess liability market, risk-adjusted rates increased 15% compared to 21% in the prior quarter.

- Rates for lead umbrella programs with favorable loss experience and low-hazard exposure trended higher by 12% to 15%.

- Clients with adverse loss development and exposure concerns typically experienced changes to limits, attachments, coverage, and/or pricing, with rate increases exceeding 30%. Many clients sought alternative program structures such as captives and structured deals.

- Some insurers capped individual risk capacity at a maximum of $15 mn (median $10 mn) due to adverse developments in the US litigation environment, even in jurisdictions previously viewed as favorable.

Financial and professional lines in the US: D&O continues to lead rate decline

Financial and professional lines rates decreased 3%.

Directors and officers D&O liability insurance pricing for publicly traded companies declined by 5 in the fourth quarter, compared to a decline of 9% in the third quarter. Post-transaction renewals, such as those coming one or two years out from an IPO, led the pricing decreases. Competition was strong from both new insurers and legacy markets as they sought a strong finish. Retentions decreased for approximately 10% of clients.

Pricing for D&O stabilized, with single-digit decreases in both primary and total program rates; the gap between primary and excess layer pricing narrowed. Some insurers either opted out of renewals or reduced capacity due to an inability to renew at current premium levels.

UK Insurance Market Rates

The UK insurance market experienced a shift in 2025, with property, casualty, and financial lines seeing notable rate declines, while motor insurance remained an exception. UK insurance rates dropped 4% due to strong insurer competition and expanded capacity.

Clients who engaged insurers early secured better pricing. Despite a challenging renewal season following major storms, insurers aggressively pursued retention strategies and offered long-term agreements. Cyber clauses remained a focal point in policy discussions.

UK property insurance rates decline; insurer capacity increases

Property insurance rates decreased 4% as insurer competition remained strong.

- Early access to insurers was key for clients to achieve favorable rates.

- Several major storms impacted the Caribbean and US mainland, leading to a challenging renewal season.

- Secondary peril activities, such as flooding in Dubai and California wildfires, may challenge insurers in 2025.

- Property insurers were increasingly aggressive, with incumbents seeking to retain clients and new entrants expanding capacity.

Property Insurance Rates in the UK

The UK home insurance market is forecast to scrape a profit in 2024, as it reels from severe weather in Q1 – including the wettest month on record in February – before falling into unprofitable territory in 2021.

Casualty insurance rates in the UK decrease

UK casualty insurance rates decreased 1%; excluding motor liability, casualty rates decreased 6%. Insurers are focused on growth, creating a competitive environment. Insurer competition was strong, and capacity increased in general liability and employers’ liability; insurers remained cautious regarding US exposure (see TOP 10 Largest UK Car Insurance Companies).

The motor insurance market experienced a 7% rate increase, which may ease going forward.

- In 2024, the UK motor insurance market loss ratio is forecast to improve to 6% due to reduced claims costs; this follows its worst performance in over a decade in 2023.

- The motor market was bifurcated, with regular increases in sectors like passenger transport, while competition remained high for private car and van fleets.

- Care inflation reached 25% due to provider shortages, impacting individual injury claims.

- Insurers raised minimum excess levels on comprehensive policies.

- Clients generally sought higher retentions and lower premiums, prompting some insurers to pursue new business.

Insurers stressed the importance of maintaining accurate Motor Insurance Database (MID) records to avoid claims exposure from disposed vehicles.

UK financial and professional lines rates decline, led by D&O

Financial and professional lines rates declined 8%. Directors and officers (D&O) liability rates declined between 5% and 10%. The UK D&O market provided ample capacity and showed increased competition. The number of clients receiving rate reductions decreased.

- Capacity was abundant in the financial institution (FI) market.

- Capacity was also abundant in the commercial crime market, with insurers typically offering greater line sizes, broader terms, and lower retentions.

Europe Insurance Market Rates

Property insurance rates remained stable, reflecting increased capacity and improved coverage terms following a strong reinsurance renewal season.

Insurers prioritized key clients, offering long-term agreements while maintaining scrutiny over high-risk industries such as food and beverage, waste and recycling, and wood and paper.

Property insurance rates in Europe flat, continuing pricing moderation

Property insurance rates were flat, continuing a moderation in the pace of increases.

- A positive reinsurance renewal season led to increased capacity, improved pricing, and better coverage terms.

- Incumbent insurers focused on retaining key clients, limiting opportunities for new entrants in favorable risk segments.

- Long-term agreements (LTAs) and rollovers were available as insurers sought to secure key clients and maintain pricing levels. Insurers continued to scrutinize distressed businesses including food and beverage, waste and recycling, and wood and paper.

Retention levels and loss limits remained generally stable, with clients typically focused on reducing rates and improving policy conditions.

Casualty rates in Europe flat after 21 quarters of increase

Casualty insurance rates in Europe flattened after 21 consecutive quarters of increases. Greater capacity, particularly in the Mediterranean, fueled competition. Major insurers provided competitive terms, with some clients securing three-year agreements.

- Insurer competition was driven by improved capacity availability from local insurers, particularly in the Mediterranean region.

- Major insurers offered favorable terms to drive growth, though level of aggressiveness varied.

- Insurers generally were less restrictive regarding risks with minimal US exposure.

- There was an increase in quota-share placements due to oversubscriptions.

D&O insurance rates in Europe continue to decline

Financial and professional lines rate decreased 7%, with more significant reductions in excess layers compared to primary layers.

- Approximately 80% of directors and officers (D&O) liability coverage renewals benefited from rate decreases, while crime insurance rates fell due to increased competition.

- The professional indemnity (PI) market remained fragmented, with overall rate decreases generally less than in D&O.

- Insurers generally prioritized retention over new account growth. Capacity generally exceeded demand due to new entrants and incumbents deploying more capacity.

- Large D&O programs renewed with LTAs that included pre-agreed rate decreases for the second year, adjusted at mid-term to reflect then-current conditions.

Some clients reallocated savings to increase limits and enhance other programs, such as crime insurance. Opportunities existed for renegotiating policy wording and improving coverage, particularly in D&O and environmental, social, and governance (ESG) exposures.

Canada Insurance Market Rates

Canada property insurance rates fell 3%, driven by strong market capacity and increased competition. Clients with solid risk profiles secured greater rate reductions, while underwriting remained focused on secondary perils and key industries.

Casualty insurance rates in Canada declined 2%, reflecting a competitive environment where insurers expanded limits and introduced new products. Claims inflation, particularly tied to U.S. exposures, remained a concern.

Financial and professional lines saw a 3% rate drop, with D&O liability insurance remaining favorable for clients. Cyber insurance rates declined 3%, with new market capacity driving lower costs. The clients secured broader coverage and reduced retentions without higher premiums.

Property insurance rates in Canada decline, capacity ample

Property insurance rates declined 3%. Larger clients typically were offered long-term agreements (LTAs) featuring built-in rate reductions based on performance.

- Ample capacity led to insurer competition; clients typically secured additional coverage limits.

- Clients with favorable risk characteristics generally benefited from above-average rate reductions, particularly from higher-rated insurers and new entrants.

- Terms and conditions remained stable, with underwriting practices focused on managing secondary perils and specific industries like warehousing, food and beverage, and recycling.

Casualty insurance rates in Canada decline

Casualty insurance rates decreased 2%. The casualty insurance market remained competitive, with traditional insurers and new entrants seeking growth through larger limits, new business classes, and innovative products.

- Insurers were typically more open to negotiating terms than in previous years.

- Insurers managed limits in umbrella layers, but were increasingly willing to deploy more capacity in excess layers, often with ventilation. Traditional excess insurers showed interest in lower attachments and primary layers.

- Claims inflation remained a significant concern, particularly related to US exposures.

- Canadian clients with US exposures generally experienced lower rate decreases than those without US exposure; however, they benefited from access to the Canadian market, which tended to offer more flexible local treaties.

Some insurers established minimum price per million for capacity at any attachment point, particularly in the first US$100 million, recognizing that clients were purchasing higher limits for US exposures.

Financial and Professional Lines Rates in Canada

Financial and professional lines rates declined 3%.

- The directors and officers (D&O) liability insurance market remained generally favorable for clients, with rates continuing to decrease, though at a moderating pace.

- Rate pressures in the D&O market are driving insurers to seek new business and to aim to write clients’ policies in ancillary lines.

- Fiduciary excessive fee litigation has been a primary concern; prudence of investment choices is now emerging as a key underwriting theme.

Asia Insurance Market Rates

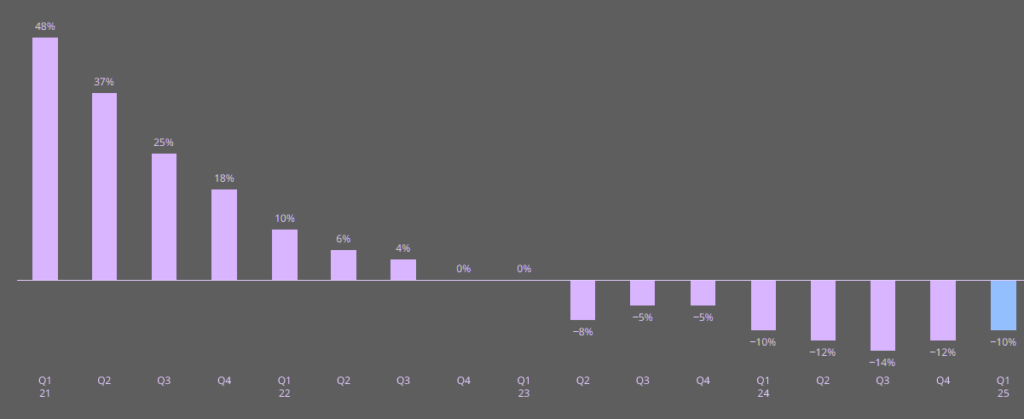

Insurance rates in Asia declined 3% in the Q1 of 2025. Property insurance rates declined 3%, casualty insurance rates declined 2%, financial and professional lines rates declined 8%, cyber insurance rates decreased 8%.

Asia composite insurance rate

Property insurance rates decline

- Insurers continued to exercise strict underwriting discipline — particularly for industries perceived as high risk, distressed businesses, and those impacted by losses — and emphasized the importance of accurate valuations.

- The involvement of international and wholesale markets has contributed to the competitive environment, leading to generally improved outcomes for clients across local, regional, and global insurance programs.

- There was an increase in the offering of long-term agreements (LTAs), which now frequently include provisions for rate reductions and low-claims bonuses.

- Clients actively reviewed deductibles and self-insurance options, resulting in a growing interest in alternative risk transfer solutions, such as parametric insurance and captive insurance.

Casualty rates decline, capacity stable

- Organizations without losses and those benefiting from competitive capacity in London markets typically experienced more significant rate decreases, ranging from 5% to 10%.

- Businesses with substantial US exposure faced rising rates, driven by increases for primary and umbrella coverage.

- Workers’ compensation rates remained stable.

- Auto liability rates were generally stable, although increases of 5% to 10% were experienced in Japan and Thailand, indicating regional variations in risk assessments.

- Insurers adopted a diversified approach to underwriting risks associated with per- and polyfluoroalkyl substances (PFAS), with some applying broad exclusions while others opted for selective or partial exclusions.

Financial and professional lines rates decline

- Professional indemnity (PI) and financial institutions (FI) rates moderated, with decreases ranging from 5% to 10%, reflecting the competitive market.

- Limited activity in capital markets restricted new business opportunities for insurers, and increased competition for renewal business.

- Directors and officers (D&O) liability insurance rates were, again, a significant factor in overall rate changes, with average reductions ranging from 10% to 20% across the region.

Pacific Insurance Market Rates

Insurance rates in the Pacific region declined 8% in the first quarter of 2025. Property insurance rates declined 9%, casualty insurance rates declined 2%, the second consecutive quarter of decline, financial and professional lines pricing decreased 10%, cyber insurance rates decreased 8%.

Pacific composite insurance rate change

Property rates decline for fourth consecutive quarter

- Property insurers actively sought new business and typically offered increased capacity on existing policies as competition continued into 2025.

- Incumbent underwriters primarily competed on price, with limited changes to retentions, limits, and coverages.

- Clients with larger limits were encouraged to request alternative retentions, limits, and program structures, generating greater competition for lead terms.

- Some clients are accepting long-term agreements (LTAs) for certainty on future rate movements.

Casualty rates decline as competition increases

- Insurers competed on price, terms, and conditions as the market shifted to an increasingly competitive landscape.

- Larger accounts typically experienced significant improvements in terms.

- The approach to underwriting polyfluoroalkyl substances (PFAS) exposures continued to vary across territories and occupations.

- The challenging conditions in the US casualty market were reflected in Australian placements involving US-domiciled risks.

Financial and professional lines rates continue to decline

- Rate decreases continued across most classes, but at a moderating pace compared to prior quarter.

- Rates for large directors and officers (D&O) liability programs have moderated from peak levels, allowing for retention adjustments.

- Large D&O claims, such as shareholder class actions, remained.

- Strong primary alternatives were generally available for large D&O programs.

FAQ

Global commercial insurance rates fell by 2% in Q1 2025, marking the second consecutive quarterly decline after seven years of increases, according to the Marsh Global Insurance Market Index.

The Pacific recorded the largest decline at 8%, followed by the UK at 5%, Asia at 3%, and Canada and Europe at 2%. In contrast, Latin America, the Caribbean, and the IMEA region saw 1% increases. Rates in the U.S. remained flat.

Globally, property insurance rates decreased 3%. The Pacific experienced the steepest decline at 8%, followed by 4% decreases in the U.S. and UK, and low single-digit decreases in Canada, Latin America, the Caribbean, and Asia.

Casualty insurance was the only major line to rise globally, increasing 4%, down from a 6% increase in Q3. The U.S. recorded the largest rise at 7%, driven mainly by excess and umbrella coverage. Latin America and the Caribbean saw a 5% increase, while other regions ranged from a 2% decrease to a 1% increase.

Financial and professional lines rates declined 6% globally, with reductions in every region. Cyber insurance rates fell 7%, continuing a trend of rate softening across these product lines.

Marsh attributed the trends to increased competition in commercial property insurance, slower casualty rate increases, stable financial lines pricing, and accelerated reductions in cyber insurance rates. In the U.S., insurer capacity grew due to strong financial results, leading to sharper property rate declines.

In the U.S., property rates declined 4% and casualty rose 7%, reflecting increased capacity, insurer flexibility, and ongoing litigation challenges. In the UK, property rates dropped 4%, casualty (excluding motor) decreased 6%, and financial and professional lines fell up to 8%, driven by strong competition, ample capacity, and proactive client engagement with insurers.

……………….

Quote: John Donnelly – President, Global Placement for Marsh