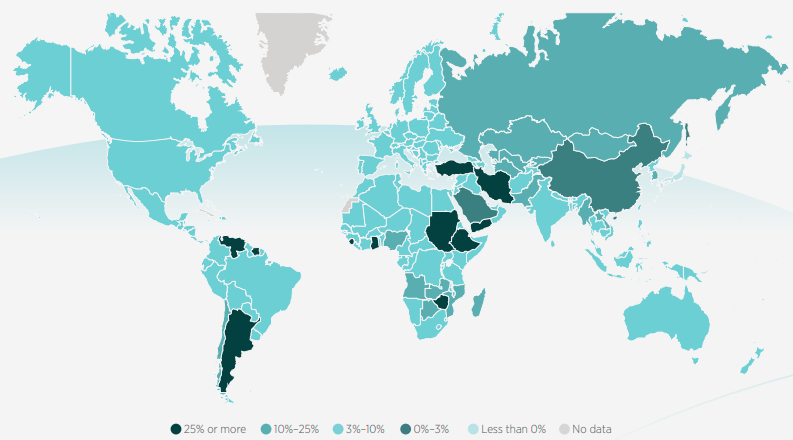

The global economy is going through a phase featuring peaking inflation and low growth. The IMF forecasts that global growth will fall from 3.4% in 2022 to 2.9% in 2023, before recovering to 3.1% in 2024.

The growth in advanced economies is projected to be even more stagnant (1.2% in 2023 and 1.4% in 2024), according to Gallagher Re Report.

Lapse reinsurance originally emerged as a capital optimisation solution following the implementation of Solvency II, with lapse risk and especially mass lapse risk perceived to be a theoretical risk.

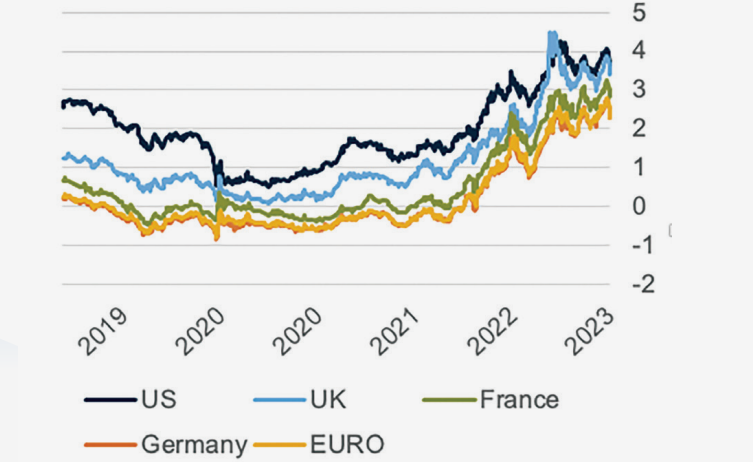

However, since 2021, the substantial increase in interest rate has driven down the market value of fixed income assets, which has resulted in the value of underlying portfolios falling below the statutory technical provisions or surrender value of the policies (see How Insurers Respond to Inflationary Shocks?).

Every re/insurer should closely monitor price developments, focusing on the drivers relevant to the respective insurance coverages, such as repair costs, construction prices or medical inflation. Acording to The Geneva Association Report, naturally, insurers have to react to sustained cost increases by adjusting premiums. However, the balance of an increase in premiums on the one hand, and potential adverse selection effects on the other, must always be kept in mind.

The same logic applies to reserving, especially in long-tail business. In this context, rising interest rates can mitigate selection issues by making it easier to finance long-term guarantees.

Life insurers’ customers experiencing the resulting cost-of-living crisis

This has made insurers across Continental Europe much more aware of the lapse risk, and reinsurance is now purchased more for risk management purpose to limit the downside exposure of lapse experience deteriorating.

Amid this gloomy economic outlook, life insurance companies across many countries face the challenge of their end customers experiencing the resulting cost-of-living crisis.

Product design should also be reviewed. Lump-sum benefits, maximum sums insured, caps and deducti-bles help to limit maximum loss exposure, while also reducing the extent of required premium adjustments (see How Does Inflation Challenging Insurer Profitability).

Tighter monetary policies of all central banks to tame inflation have led to interest rate hikes.

Higher interest rates being offered in new insurance products as well as alternative non-insurance savings vehicles all serve to make existing in-force policies less attractive.

Such an operating environment means lapse risk is perceived as a more prominent risk by life insurers.

This is particularly true for insurers in continental Europe. Since 2021, the substantial increase in interest rates has driven down the market value of fixed income assets, which has resulted in the value of underlying portfolios falling below the statutory technical provisions or surrender value of the policies.

For quite a few European insurers, we observed the FY2022 lapse SCR doubling from FY2021, mainly driven by increases in the lapse SCR in traditional savings portfolios with guarantees that are now out of money.

Under the current economic conditions, if a policyholder lapses, an insurer may have to realize capital losses to fund surrender values, which are higher than the market value of the assets, while also losing the value of future profits expected from the future premiums of the policy. This has left insurers increasingly exposed to higher lapses.

Inflation Rate, Average Consumer Price, Annual Percent Change

10-Year Government Bond Yield (%)

Lapse Risk

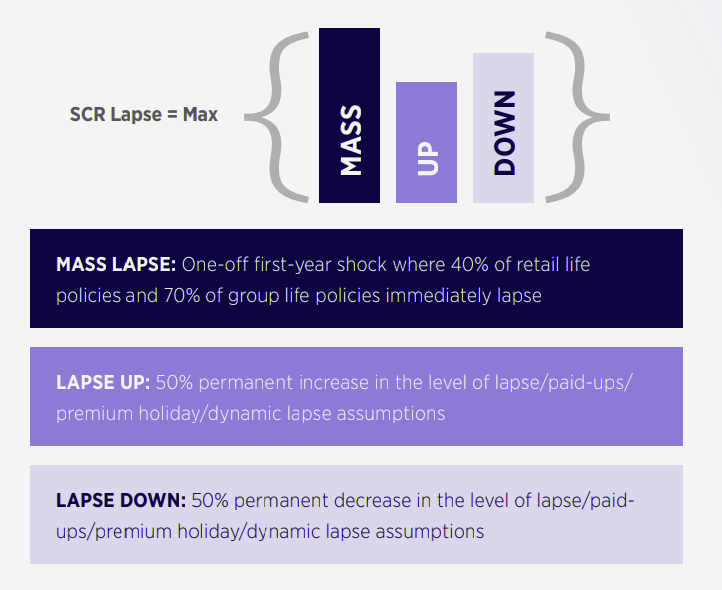

Lapse risk is defined as the rate of surrenders, as well as paid-up and other discontinuances, being higher or lower than the insurer’s best estimate assumptions, where such difference results in a diminution of own funds.

Under the Solvency II framework, this can be measured as the loss in own funds under a lapse scenario due to the resulting lower net present value of future profits when lapse rates differ from best estimate.

The standard formula defines the lapse SCR as the maximum loss under three lapse scenarios: a mass lapse scenario, a lapse-up scenario, and a lapse-down scenario (details are following).

Internal model users may have designed their internal model differently, with their own calibration of the one-in-200 stresses, which are typically less onerous compared to the standard formula.

However, recently we have observed significant increases in lapse SCRs across both standard formula and internal model users in Europe.

Solvency II Standard Formula Shocks

Lapse Reinsurance

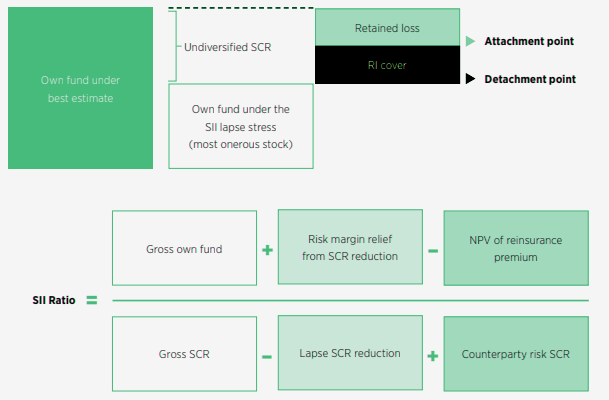

Lapse reinsurance is a key risk mitigation tool for insurers. Reinsurance has been structured to transfer lapse risk to reinsurers, where the policy responds if lapse rates are higher or lower than expected.

The common structure in the market is focused on transferring the tail risk using a stop-loss structure, with the insurer retaining a layer of loss within their own risk appetite and transferring the more remote layer of risk to the reinsurer, which leads to favourable terms.

The biting lapse stress scenario can be mass lapse, lapse up or lapse down. Should two out of the three lapse stresses lead to similar amounts of loss, a reinsurance cover can be structured combining a 1-year mass lapse cover with a multi-year lapse up or lapse down cover.

The cover also leads to substantial Solvency II benefit via both lapse SCR reduction and risk margin relief, and can often be achieved with a premium rate below 2%.

Illustration of Reinsurance Structure

Regulatory Landscape and Evolving Purpose of Lapse Reinsurance

In the recent llow-interest-rate environment, many long-standing savings portfolios had savings guarantees that were deep in the money, with the result that mass lapse was often the biting stress under Solvency II.

This risk was perceived to be a theoretical risk only, and the purpose of lapse reinsurance has been seen as a capital optimisation rather than a risk transfer.

This has led to some concerns from regulators. In November 2020, EIOPA published a consultation paper on risk mitigation techniques in which they specifically discussed mass lapse reinsurance (see Global Reinsurance Market Report).

For instance, multiyear increases of lapse rates are observed in cases of unemployment, interest rate movements, and mis-selling practices…

A hedge or reinsurance of only the mass lapse scenario leaves the insurance undertaking vulnerable to such kinds of lapse patterns, while the capital requirement following from the standard formula has been lowered by the mass lapse risk mitigation techniques. The insurance undertaking should analyse within its ORSA these risks, which are not included within the standard formula.

EIOPA

However, with the changes in economic environment previously highlighted, insurers’ thinking regarding mass lapse risk has evolved as they realized the risk is far more tangible and the economic consequences could be very material if such risk were to materialize.

Therefore, rather than designing specific interactions with the Solvency II formula to gain a capital advantage that might obviate some of the concerns raised by regulators, insurers are increasingly focusing on risk management of lapse risk, and this evolved thinking regarding lapse reinsurance has been encouraged by regulators.

Indeed, we are seeing the (already long) list of European countries where transactions have been executed extending, with more and more first precedents of lapse reinsurance transactions with the local regulators’ blessings.

………………

AUTHOR: James Kent – Global CEO, Gallagher Re