Overview

U.S. health insurers administering state Medicaid coverage will encounter revenue pressure from OBBBA, which Fitch Ratings expects to weigh on earnings.

New work requirements could increase acuity in the Medicaid pool, requiring states to raise capitation rates to maintain already thin profit margins in this segment.

Over time, heightened market uncertainty and insufficient returns may lead to industry consolidation and exits from unprofitable markets.

Medicaid will experience a sharp drop in enrollment and premium revenue

Medicaid enrollment stood at 78.6 mn as of March 2025, comprising 71.3 mn in Medicaid and 7.3 mn in the Children’s Health Insurance Program (CHIP).

Medicaid will experience a sharp drop in enrollment and premium revenue under the One Big Beautiful Bill Act (OBBBA) as stricter, more frequent eligibility reviews and new work requirements take effect in expansion states by the end of 2026 (see US Health Insurance Market Trends: Rates, Price and Coverage).

Key highlights

- Medicaid Enrollment Decline: Medicaid enrollment at 78.6 mn as of March 2025 is expected to drop sharply due to stricter eligibility reviews and new work requirements under OBBBA.

- Revenue Pressure on Insurers: OBBBA and the expiration of enhanced PTCs at year-end 2025 will reduce premium revenue and increase risk acuity, straining already thin margins.

- Higher Acuity in Medicaid Pools: Work requirements may remove healthier individuals from Medicaid, increasing average acuity and pushing states to raise capitation rates.

- Market Consolidation Risks: Persistent uncertainty and inadequate returns could drive insurers to exit unprofitable markets and accelerate consolidation in the Medicaid segment.

- Impact on Hospitals: Reduced Medicaid funding and higher uninsured care threaten hospital financial recovery, particularly for providers with high Medicaid and self-pay exposure.

The most recent CBO estimates indicate that nearly 8 mn fewer people will have Medicaid coverage over the next 10 years, and 4 mn Affordable Care Act (ACA) exchange enrollees will lose coverage because of the bill’s provisions.

A further 4.2 mn ACA enrollees will lose coverage if the enhanced Premium Tax Credits (PTCs) expire at the end of 2025.

We expect the potential adverse effects on acuity in the Medicaid and ACA exchange pools to outweigh the revenue impact to insurers from OBBBA and the expiration of the enhanced PTCs.

Medicaid enrollees who lose coverage due to unmet work requirements will likely be healthier than average due to the 19-64 year age range and the stipulation that they be ‘able bodied’.

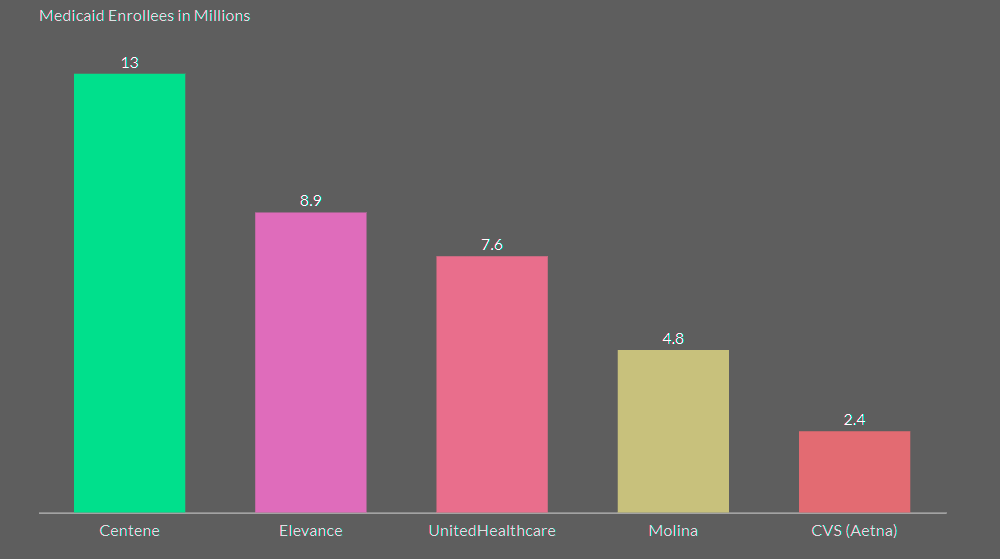

Top 5 Insurers account for 50% of Medicaid Managed Care Enrollment

If enhanced PTCs are allowed to expire, ACA exchange premium rates are likely to increase significantly. As a result, healthier individuals who need coverage less may be more likely to forego coverage, leading to higher acuity in the ACA pools.

Weaken Medicaid funding

A cap on provider taxes will further weaken Medicaid funding, which already delivers very thin margins for insurers.

States impose provider taxes on hospitals and other healthcare providers to obtain federal matching funds, but the rate will gradually drop from 6% of providers’ net patient revenue to a 3.5% cap in expansion states.

This adjustment will require states to fund a larger share of Medicaid directly (see Costs for Employer Healthcare & Insurance. Top Trends).

Last month we downgraded the outlook for the U.S. health insurance sector to ‘deteriorating’ from ‘neutral’ due to reductions in government-funded healthcare programs, primarily Medicaid, included in OBBBA, and higher growth in healthcare utilization.

OBBBA changes to Medicaid funding will pose some challenges and create uncertainty for HCIT companies, as Medicaid accounted for 18% of total national healthcare expenditure in 2023, according to the Centers for Medicare & Medicaid Services.

The Congressional Budget Office estimates the bill will cut federal healthcare spending by more than $1.1 trillion over the next 10 years, and result in around11.8 million fewer people covered under Medicaid by 2034.

Healthcare spending impacts will also depend on potential state offsets to federal spending cuts and private insurance replacement of lost Medicaid coverage.

The revision also accounts for the scheduled expiration of enhanced PTCs at year-end 2025, unless an increasingly unlikely extension is granted.

These credits provide substantial financial support for eligible individuals to purchase health insurance through ACA marketplace exchanges. With these subsidies ending at year-end, health insurers will experience negative effects on premium revenue over the next 12 months.

Major cuts to Medicaid would negatively affect

Major cuts to Medicaid would negatively affect U.S. not-for-profit (NFP) hospital operating margins and revenues. Slower revenue growth or a revenue decline leading to sustained cash flow reduction could pressure ratings and potentially the sector outlook.

The House’s recently passed budget proposal calls for $1.5 trillion-$3 trillion in spending cuts over the next decade. It includes a directive to the Energy and Commerce Committee to reduce spending by $880 bn over the next 10 years, according to U.S. Employers Health Care Insurance Costs.

The Senate will likely propose changes to the House plan, which would require another vote on a final budget resolution before work on budget details can commence.

Although the House plan does not mention specific programs, Medicaid and Medicare are the largest under the Energy and Commerce Committee’s purview. Achieving the budget cuts would be difficult without changing Medicaid eligibility or Medicaid funding.

Greater exposure to self-pay and Medicaid reimbursement reduces a hospital provider’s capacity to recover its operating costs from other payor sources.

Safety-net hospitals, with combined self-pay and Medicaid payers of more than 30% of gross revenues, have ‘very weak’ revenue defensibility. Providers with 25-30% exposure have ‘weak’ revenue defensibility assessments.

It is uncertain what Medicaid changes, if any, will be in the final budget bill and how they would affect funding and enrollment. Approximately one in five Americans are covered by Medicaid.

A decrease in Medicaid reimbursement

A decrease in Medicaid reimbursement and/or an increase in uninsured care would hinder hospitals’ nascent financial recovery from weak sector-wide post-pandemic performance due to higher labor costs and elevated inflation.

Median operating margins, which are lower than pre-pandemic levels, are improving along with revenue growth due to increased patient volumes.

However, lower revenues and higher unreimbursed expenses from more self-pay patients could reverse recent improvements. This is particularly true for hospitals with a higher share of Medicaid patients, which inherently have thinner margins.

FAQ

Medicaid enrollment stood at 78.6 mn as of March 2025, including 71.3 mn in Medicaid and 7.3 mn in the Children’s Health Insurance Program (CHIP). Under the One Big Beautiful Bill Act (OBBBA), stricter and more frequent eligibility reviews along with new work requirements in expansion states by the end of 2026 will sharply reduce enrollment and premium revenue. The Congressional Budget Office (CBO) projects nearly 8 mn fewer people with Medicaid coverage and 4 mn fewer Affordable Care Act (ACA) exchange enrollees over the next 10 years due to these provisions.

If enhanced PTCs expire at the end of 2025, an additional 4.2 mn ACA enrollees are expected to lose coverage. Premium rates on ACA exchanges will likely increase, causing healthier individuals, who need less coverage, to forgo insurance. This would lead to higher acuity in ACA pools and negatively affect premium revenue for insurers over the following 12 months.

We expect the adverse effects on risk acuity in Medicaid and ACA exchange pools to outweigh the revenue gains from OBBBA and the expiration of enhanced PTCs. Medicaid enrollees losing coverage due to unmet work requirements are likely healthier than average because of their age range (19–64) and the stipulation that they be ‘able bodied’.

The top five insurers account for 50% of Medicaid managed care enrollment, according to Fitch Ratings. This concentration may influence consolidation and exits from unprofitable markets as funding and enrollment decline.

States impose provider taxes on hospitals and other healthcare providers to secure federal matching funds. The cap on these taxes will gradually drop from 6% of providers’ net patient revenue to 3.5% in expansion states. This change increases the share of Medicaid funding that states must directly provide, pressuring their budgets and insurers’ margins.

Major cuts would negatively affect not-for-profit hospital margins and revenues. Slower or declining revenue growth could strain cash flows and ratings. Safety-net hospitals, which rely heavily on Medicaid and self-pay patients, already have weak or very weak revenue defensibility, and further reductions would worsen their financial positions.

A decrease in reimbursement or more uninsured care would slow hospitals’ financial recovery from post-pandemic pressures. Rising self-pay and uninsured patient volumes, combined with thin Medicaid margins, could reverse recent improvements in operating margins, particularly for hospitals with a large Medicaid patient base.

………………….

AUTHORS: Bradley S. Ellis, CFA – Senior Director at Fitch Ratings (North American Insurance), Laura Kaster, CFA – Senior Director, Risk North and South American Financial Institutions, Credit Commentary & Research at Fitch Ratings