Overview

North American insurance brokers have leaned hard into bigger acquisitions over the past two years. Slowing organic growth has forced the move.

Fitch Ratings says debt-financed M&A boosts credit risk, but strong cash flow and the industry’s ability to weather recessions let large brokers stretch leverage further than most corporates. Beinsure analyzed the report and highlighted key points.

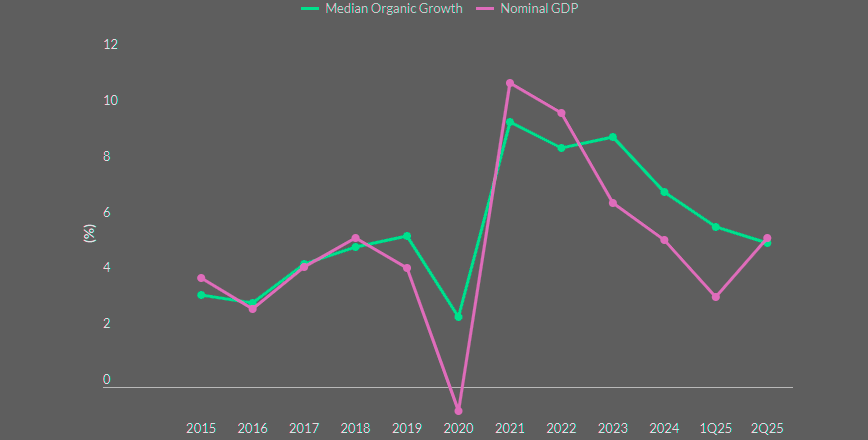

Growth isn’t falling off a cliff, just easing. Swiss RE pegs U.S. property and casualty premium growth at 4%–5% in 2025–2026. That’s decent, though slower than the hot streak since 2020.

Brown & Brown and Arthur J. Gallagher both slid into low- to mid-single digit organic gains during the first half of 2025, down from the high-single digit surge of the past few years.

Key Highlights

- Bigger M&A deals – North American brokers executed $60 bn in large acquisitions over the past two years, far above the $2 bn–$20 bn annual range of the prior decade.

- Organic growth slowdown – U.S. P&C premium growth is expected at 4%–5% in 2025–2026, down from the stronger high-single digit levels since 2020.

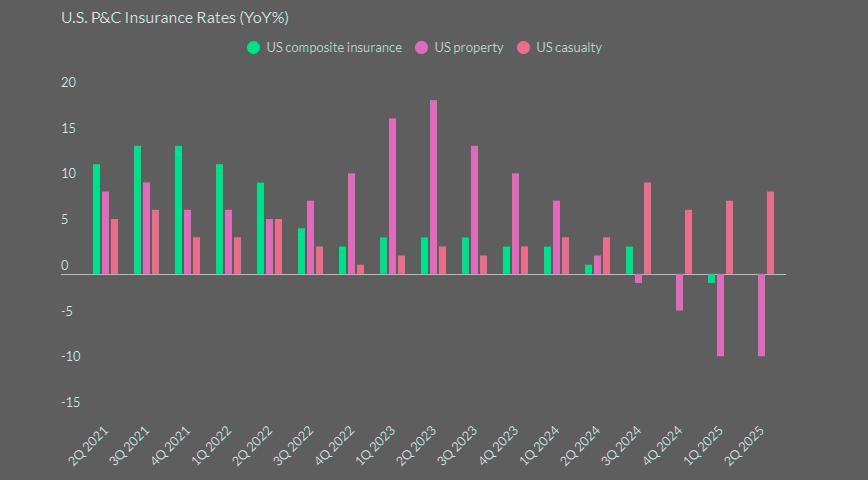

- Property pricing headwinds – Inflation previously boosted premiums, but falling property values and still-elevated interest rates now weigh on growth prospects.

- Financial risk from leverage – Some private brokers carry 8x–10x EBITDA leverage and interest coverage below 1.5x, leaving them vulnerable if organic growth weakens.

- Resilient large players – Investment grade firms like Marsh, Aon, and Gallagher benefit from strong cash flow, diversification, and cost flexibility, enabling them to manage downturns more effectively.

We think the industry can keep pushing positive organic expansion, but the easy years are gone.

Inflation Played a Big Role in the Run-Up

Higher prices pushed P&C insurance premiums well ahead of GDP through 2023 and 2024. But tailwinds fade fast. Property price appreciation flipped in 2025, turning into a drag.

With interest rates still elevated, even if moderating, property values may stay under pressure through 2026. That makes near-term pricing acceleration unlikely.

Other cracks are visible too. Cybersecurity and financial/professional lines look weaker. Casualty remains the bright spot, still generating healthy growth and giving brokers at least one reliable engine.

U.S. Insurance Brokers M&A and Growth Trends

| Highlight | Details |

| Bigger M&A deals | North American brokers executed $60 bn in large acquisitions over the past two years, exceeding the $2 bn–$20 bn annual range of the prior decade. |

| Organic growth slowdown | U.S. P&C premium growth projected at 4%–5% in 2025–2026, compared to stronger high-single digit levels since 2020. |

| Property pricing headwinds | Inflation boosted premiums earlier, but falling property values and elevated interest rates weigh on growth prospects. |

| Financial risk from leverage | Some private brokers carry 8x–10x EBITDA leverage and interest coverage below 1.5x, leaving them exposed if growth slows further. |

| Resilient large players | Investment grade firms such as Marsh, Aon, and Gallagher benefit from strong cash flow, diversification, and cost flexibility to manage downturns. |

Insurance Brokers Organic Growth Decelerating

Offsetting slowing organic trends is M&A, which has been central to broker strategies across cycles historically.

In the latest economic cycle, M&A was supported by access to low-cost debt capital but this has become riskier given larger deals and higher borrowing costs.

Larger, well-capitalized brokers such as Aon (BBB+/Stable), Marsh & McLennan (A-/Stable), and Arthur J. Gallagher have been active buyers but benefit from sufficient financial flexibility as well as business and geographic diversification.

This enables them to pursue strategic acquisitions and weather softer market conditions.

U.S. Property Insurance Rates Declined in Recent Quarters

M&A deal size accelerated materially over the past two years. Five large deals among Fitch-rated entities totaled $60 bn.

By comparison, from 2013-2023, aggregate annual deal value ranged from a couple billion dollars to near $20 bn across hundreds of transactions.

Global players such as Marsh and Aon, among others,still show reasonably healthy balance sheets despite large recent deals. These transactions reduced rating headroom but did not trigger downgrades to date.

For issuers operating outside of rating sensitivities, Fitch expects leverage to return within rating tolerances 18-24 months after closing.

These companies also have strong records of successful M&A integration and reducing leverage following acquisitions.

Recent Insurance Broker M&A Transactions

| Date Closed | Acquirer | Target company | Gross Purchase Price ($ billion) | EV/ EBITDA (X) |

|---|---|---|---|---|

| Apr 2024 | Aon plc | NFP | 13.0 | 15.0* |

| May 2024 | Stone Point Capital | CRC Insurance Group, LLC (Truist Insurance) | 15.5 | 18.0 |

| Nov 2024 | Marsh & McLennan Companies, Inc. | McGriff Insurance Services, LLC | 7.8 | N/A |

| Aug 2025 | Brown & Brown, Inc. | Accession | 9.8 | 12.0 |

| Aug 2025 | Arthur J. Gallagher & Co. | AssuredPartners, Inc. | 13.5 | 14.3 |

Over the past 2 years, aggregate M&A value from five large deals alone reached $60 bn in value.

Top 10 Global Insurance & Reinsurance Brokers by Revenue

| Rank | Broker | Revenue ($bn) | Market Share (%) |

| 1 | Marsh McLennan | 24.46 | 22.33 |

| 2 | Aon | 15.70 | 14.33 |

| 3 | Arthur J. Gallagher & Co. | 11.30 | 10.31 |

| 4 | WTW | 9.93 | 9.06 |

| 5 | Alliant Insurance Services | 5.07 | 4.63 |

| 6 | Hub International | 4.81 | 4.39 |

| 7 | Brown & Brown | 4.81 | 4.39 |

| 8 | Acrisure | 4.59 | 4.19 |

| 9 | Lockton | 4.00 | 3.65 |

| 10 | Howden | 3.60 | 3.29 |

Debt-Driven M&A Pushes Risk Higher for U.S. Insurance Brokers

Fitch says the real problem comes if organic growth keeps fading. Issuers leaning on debt-fueled M&A face the sharpest pressure, especially those with private equity backers and looser financial discipline.

Some Fitch-rated private brokers carry EBITDA leverage of 8x–10x, sometimes more, and interest coverage scraping below 1.5x. Those numbers look fragile. A downturn could expose the cracks.

The industry’s resilience, though, tempers the risk. Insurance demand doesn’t vanish in recessions. Large public brokers proved it during 2008, when revenue and earnings fell modestly but never collapsed.

Flexible costs and limited cash outflows—mainly taxes and interest—gave them room to adjust. Strong free cash flow still provides that cushion.

So even if P&C pricing drifts into a multi-year soft cycle, the higher-rated investment grade players should ride out volatility.

Diversified operations, broader geographic spread, and disciplined cost management all help. Yet M&A has a way of glossing over weak fundamentals. Fitch argues investors should keep eyes on organic growth—because if that story keeps deteriorating, leverage math gets ugly fast.

FAQ

Organic growth has slowed, pushing brokers to rely more on acquisitions. Fitch Ratings notes that M&A sizes have grown sharply in the past two years, often financed with debt.

Swiss RE projects P&C premium growth at 4%–5% for 2025–2026. That’s slower than the high-single digit gains seen since 2020 but still steady compared with GDP.

Brown & Brown and Arthur J. Gallagher both reported low- to mid-single digit organic growth in the first half of 2025, down from stronger levels in prior years.

Inflation boosted premiums in 2023–2024, but property price appreciation turned negative in 2025. Elevated interest rates could keep property values under pressure through 2026, limiting any near-term pricing rebound.

Over the last two years, five major deals among Fitch-rated brokers totaled $60 bn. That’s far above the $2 bn–$20 bn annual range seen between 2013 and 2023.

Issuers with private equity backing often run high leverage, sometimes 8x–10x EBITDA or more, with weak interest coverage. If organic growth deteriorates further, these financial structures could look exposed.

Yes. The industry proved resilient during the 2008 crisis, and firms like Marsh, Aon, and Gallagher benefit from diversification, strong cash flow, and flexible cost bases. Fitch believes these factors allow investment grade players to manage through a softer P&C cycle.

……………….

AUTHORS: Robert Galtman, CFA – Senior Director, North American Corporates at Fitch Ratings, Sukaina Dosani – Associate Director / Primary Rating Analyst at Fitch Ratings, Yee Man Chin, CFA – Senior Director, Credit Commentary & Research at Fitch Ratings

Edited by Tetiana Mykhailova — CFO Beinsure / Commercial Director Finance Media