Overview

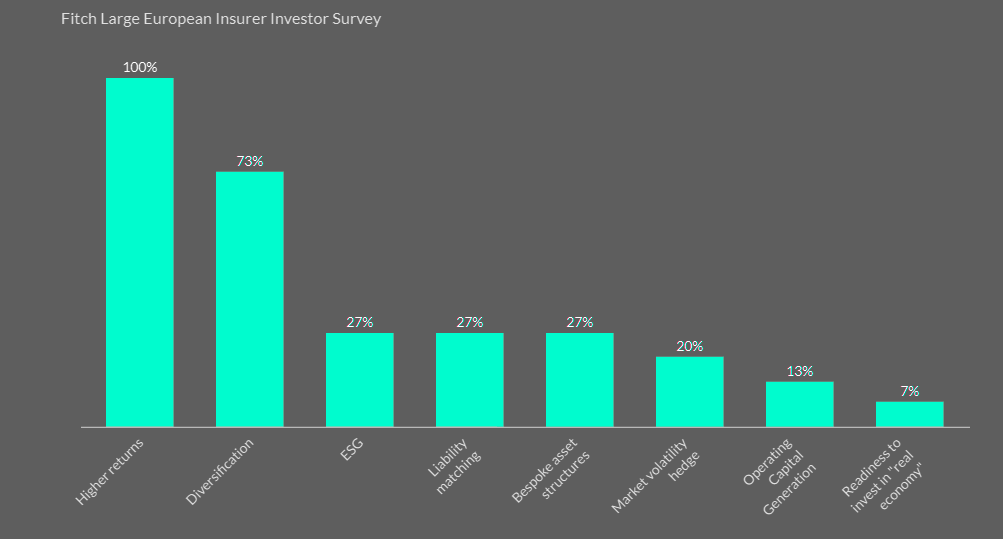

According to Fitch’s recent survey of European insurers, the primary motivation for investing in private assets is higher returns through illiquidity premiums, which was cited by all 15 respondents. Beinsure analyzed the report and highlighted key trends.

Appetite for private credit was generally higher among life insurers and non-life and reinsurance firms with meaningful long-dated liabilities.

Portfolio diversification was the second most common reason, cited by 73% of respondents. Respondents also cited hedging against market volatility and operating-capital generation.

Key Highlights

- All insurers in Fitch’s survey cited illiquidity premiums as the main reason for private credit investment.

- Life insurers with long-dated liabilities, including life and reinsurance companies, showed stronger interest in the asset class.

- 73% of respondents named portfolio diversification as a priority, alongside ESG considerations, liability matching, and hedging.

- Global private credit assets stood at $1.6 tn in 2024 and are projected to reach $2.7 tn by 2029 with 11% annual growth.

- Valuation uncertainty, sourcing suitable assets, competition, macro volatility, and the need for specialized skills remain top concerns.

Other major motivations include ESG considerations, liability matching, and access to innovative/bespoke asset structures not available in public markets.

European Insurers Target Better Yields with Private Credit Investments

Note: based on Fitch’s survey of 15 rated insurers in the U.K., France, Italy, Germany, Bermuda, the Netherlands.

Insurers Shielded from Private Credit Risks

Fitch Ratings does not expect insurers to come under ratings pressure even if the private credit sector weakens.

The agency notes that insurance ratings rest on factors beyond asset performance alone – including portfolio quality, deal structure, risk management, and the impact on liabilities and capital.

Private credit remains small relative to the broader financial system. It poses no systemic threat to insurers at this stage.

European Insurers & Private Credit – Key Insights

| Category | Details |

|---|---|

| Primary Motivation | Higher returns from illiquidity premiums – cited by 100% of survey respondents |

| Other Motivations | Diversification (73%), ESG, liability matching, bespoke structures, hedging, capital generation |

| Who Invests More | Life insurers and reinsurers with long-dated liabilities |

| Market Size (2024) | $1.6tn in global private credit assets |

| Growth Projection | 11% annual growth to $2.7tn by 2029 |

| Key Risks | Valuation uncertainty, covenant-lite structures, illiquidity, macroeconomic headwinds |

| Top Challenges | Sourcing suitable assets, competition, regulatory changes, need for specialist skills, stronger risk management |

Growth in insurers’ allocations has largely followed the expansion of the asset class itself rather than a sharp change in strategy.

Preqin data shows global private credit assets at $1.6 tn by year-end 2024, with annual growth projected at 11%, pushing the market toward $2.7 tn by 2029.

That expansion will likely draw more insurer participation, but Fitch suggests the risk to ratings stays contained under current conditions.

Key Private Asset Risks

Private credit is typically offered through funds with committed capital, limited redemption risk and without excessive fund-level leverage.

Key private asset risks include valuation uncertainties, especially for life insurers facing higher direct risks related to private investments given their significant and growing illiquid investment exposure.

However, evolving asset classes, structures and growing interconnectedness require close monitoring as borrowers face rising debt service burdens from higher, albeit easing, policy rates and volatile profitability amid macroeconomic headwinds.

Private Credit for Insurers – Opportunities vs. Risks

| Opportunities | Risks & Challenges |

|---|---|

| Higher returns through illiquidity premiums | Valuation uncertainty in illiquid assets |

| Portfolio diversification across asset classes | Structural complexity, e.g. covenant-lite deals |

| Liability matching for long-dated obligations | Illiquidity constraints and limited redemption options |

| Access to bespoke and innovative asset structures | Rising debt service burdens amid higher policy rates and volatile profitability |

| ESG-driven investment opportunities | Increased competition for quality assets |

| Hedging against market volatility | Macroeconomic uncertainty and regulatory changes |

| Operating-capital generation | Need for specialist skills and stronger risk management frameworks |

Sourcing suitable assets and increased competition were cited as top challenges by survey participants, along with structural complexity (e.g. covenant-lite deals), illiquidity, macroeconomic uncertainty, regulatory changes, and need for specialist skills and robust risk management.

The global economy is poised for further solid expansion. We forecast global real GDP growth at 2.8% in 2025 and 2.7% in 2026, roughly in line with 2024.

However, the distribution of risks is tilted to the downside, driven by geopolitical risk, the potential for disruptive policy changes, and financial market vulnerabilities. Growing divergence between regions will likely be accentuated by the policy direction of the next US government.

Private capital has become the linchpin of this financing push

Unlisted infrastructure assets under management have jumped from less than $25bn in 2005 to more than $1.5 trn in 2024, according to Global Economic and Insurance Market Outlook.

Investors are pivoting away from traditional transport and utilities toward energy-transition projects and digital networks.

Beyond cash, private players bring lifecycle discipline, delivery expertise, and risk-sharing models via public-private partnerships, direct ownership, and infrastructure debt. Their strategies now tilt toward steady, inflation-linked returns of 6–10%, rather than private-equity-style upside.

The Role of Investing in the Insurance Industry

Insurers offer savings and retirement products that include guarantees and risk coverage, meeting consumer needs through various distribution channels.

Increasing retail savings through insurance products, coupled with regulatory improvements, will significantly advance the SIU’s objectives.

The savings and investments union aims to create better financial opportunities for EU citizens, while enhancing our financial system’s capability to connect savings with productive investments.

This will lead to more choice for savers who wish to grow their household wealth and allow businesses across Europe to grow.

Europe’s capacity to address current challenges – such as climate change, rapid technological shifts and new geopolitical dynamics – demands significant investments, which the Draghi report estimates at an additional €750‑800 bn per year by 2030, and which is further impacted by increased defence needs.

Much of these additional investment needs relate to small and medium sized enterprises (SMEs) and innovative companies, which cannot rely solely on bank financing/

Large European Bank Earnings

Most of the 20 large European banks performed well in 2025. Revenue generation was resilient to declining interest rates, and cost and asset quality pressures were generally contained.

Fitch expects profitability to remain robust in 2025, but that metrics will fall to slightly below 2024 levels for most banks.

The main driver of this will be smaller net interest margins (NIMs), partially offset by growing lending volumes and strong trading income.

NIMs have already begun to decrease and are likely to fall further through the rest of 2025, mainly due to tighter deposit spreads.

French banks will continue to have some of the tightest NIMs, while margins will be higher than average for Spanish and Italian banks. We expect lending growth to pick up, as credit demand increases on the ongoing interest rate reduction cycle and increased clarity on global trade policies.

Corporate and Investment Banking

Corporate and investment banking divisions have performed strongly due to heightened market volatility.

Trading income is likely to remain robust in coming quarters and will partially offset lower net interest income, following a trading revenue surge at most universal banks – with client activity reaching multi-year highs.

Asset quality remains sound, with the median impaired loans ratio stable at 2.3% at end-June 2025. Fitch forecasts only a slight rise to 2.5% by end-2025 as sector-specific challenges persist.

We expect loan impairment charges to increase, but to stay within banks’ guidance, reflecting moderate pressures and continued geopolitical uncertainty.

FAQs on European Insurers and Private Credit Investments

According to Fitch’s survey, the top reason is the pursuit of higher returns through illiquidity premiums. All respondents cited this as a primary motivation.

Life insurers and non-life or reinsurance companies with long-dated liabilities demonstrated greater interest in private credit, as it aligns well with their balance sheet structures.

Portfolio diversification was cited by 73% of participants. Other key drivers include ESG considerations, liability matching, bespoke asset structures, hedging against volatility, and operating-capital generation.

Fitch does not see systemic risk at this stage. Private credit remains relatively small within the global financial system, and insurer exposure is modest in proportion to their total assets.

Preqin reported $1.6tn in global private credit assets at year-end 2024. The market is expected to grow 11% annually, reaching $2.7tn by 2029.

Valuation uncertainty, structural complexity in covenant-lite deals, and illiquidity are key concerns. For life insurers, larger illiquid exposures add direct risk. Insurers also face challenges from rising debt service burdens and volatile profitability across borrowers.

Survey participants pointed to sourcing suitable assets, intense competition, macroeconomic uncertainty, regulatory changes, and the need for specialist expertise and stronger risk management capabilities.

…………………

AUTHORS: Laura Kaster, CFA – Senior Director at Fitch Ratings, Rishikesh Sivakumar, CFA – Associate Director, Insurance Fitch Ratings, Graham Coutts, ACA – Senior Director, Insurance at Fitch Ratings.

Edited by Yana Keller — Lead Insurance Editor of Beinsure Media