Overview

Reinsurance pricing in the European reinsurance market has started to ease after several years of steep increases. Still, underwriting standards remain strong, and reinsurers are proceeding with caution.

Autonomous, an independent research firm, has released its latest assessment of the European reinsurance market following the 1 July 2025 reinsurance renewals. Beinsure analyzed the reinsurance report, and highlighted the key points.

The market, Autonomous notes, is showing rational behaviour despite the shift in pricing dynamics.

Europe reinsurance rates nearly doubled

Since 2017, reinsurance rates nearly doubled, with 2022 marking a peak in pricing momentum. Now, as reinsurers reinvest recent profits into the market, upward pressure on rates has started to decline.

However, this adjustment hasn’t led to a weak environment. Terms remain favourable, and capacity is widely available, though reinsurers are selectively growing portfolios without compromising standards.

The 1 July renewals, one of four major annual treaty events, serve as a key indicator of current market sentiment.

Autonomous reports that conditions have remained stable since the January renewals, with rate declines occurring within a steady and orderly framework.

Europe insurance market rates

Property insurance rates remained stable, reflecting increased capacity and improved coverage terms following a strong reinsurance renewal season.

Insurers prioritized key clients, offering long-term agreements while maintaining scrutiny over high-risk industries such as food and beverage, waste and recycling, and wood and paper.

Property insurance rates in Europe flat, continuing pricing moderation

Property insurance rates were flat, continuing a moderation in the pace of increases.

- A positive reinsurance renewal season led to increased capacity, improved pricing, and better coverage terms.

- Incumbent insurers focused on retaining key clients, limiting opportunities for new entrants in favorable risk segments.

- Long-term agreements (LTAs) and rollovers were available as insurers sought to secure key clients and maintain pricing levels. Insurers continued to scrutinize distressed businesses including food and beverage, waste and recycling, and wood and paper.

Reinsurance rate change figures hard to pin down

While precise reinsurance rate change figures remain hard to pin down due to numerous influencing factors, Autonomous views 2023 as the peak of the current hard market.

The softest point in recent memory occurred in 2014–2015. The present landscape, they argue, reflects a normal transition—pricing is cooling, but market fundamentals remain intact.

Property catastrophe renewals in Japan reinforced the positive trends seen in the U.S., with pricing flat to slightly reducing, while South Korea, China and India also saw increased competition for catastrophe business, to varying degrees (see Global Reinsurance Rate for Property Catastrophe Forecasts).

While pricing renewed flat to down modestly for property catastrophe reinsurance across the region, certain Asia Pacific markets and product lines remain challenged and subject to a tightening of terms and conditions, including property per-risk reinsurance, industrial fire accounts, certain natural catastrophe loss-affected regions, and U.S. exposed casualty treaties.

European reinsurers recorded stronger return on equity

European reinsurers recorded stronger return on equity (ROE) in 2023 and 2025, exceeding their cost of equity in three of the last four years, according to Goldman Sachs. Beinsure analyzed the report and highlighted the key points.

Between 2017 and 2022, the sector only met or exceeded this benchmark in two years. ROE lagged materially behind in 2017, 2018, 2020, and 2022.

Key pressures included large losses from hurricanes such as Irma, Harvey, and Maria in 2017, and Ian in 2022. But systemic issues also played a role.

Although reinsurance rates began increasing in 2017, they remained below loss cost trends for several years. Hurricane Ian in 2022 marked a turning point (see Global Reinsurance Companies by Net Written Premium).

Rates rose sharply, coinciding with higher interest rates and a reduction in industry capital. Carriers responded by adjusting attachment points and reducing proportional business, which lowered exposure to frequent losses and improved combined ratios.

January reinsurance renewal premiums increased by 4.5%, primarily driven by volume. Reinsurers experienced stable reinsurance renewals at 1.1 due to greater prudence and selective focus in underwriting.

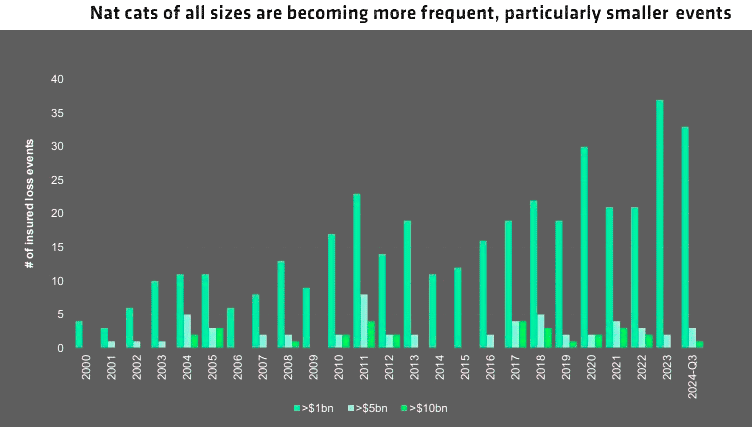

New normal of annual catastrophe losses

With the key 1/1 renewal season now passed, the team explored how reinsurers are responding to the challenges of a “new normal” $150bn of annual catastrophe losses, and the changing relationship of risk-sharing between insurer and reinsurer.

Reinsurance pricing, often expressed as “rate-on-line,” depends on multiple variables including past loss experience, the reliability of the cedant, and expected future claims. The firm warns against oversimplified conclusions, especially for U.S. reinsurance rates and property-catastrophe exposures.

Natural catastrophes insured loss

Reinsurance premium growth in 2024 was driven more by volume than rate, as rising exposure—particularly in property—pushed up demand for reinsurance. Natural catastrophe pricing declined slightly, while casualty pricing remained stable or increased. This was due to a cautious inflation outlook and updated loss models.

California wildfires triggered speculation about a hardening U.S. market

Although recent California wildfires triggered speculation about a hardening U.S. market, Autonomous finds no strong evidence supporting that shift.

Outcomes continue to vary by geography, loss history, contract structure, and existing pricing levels. Discrepancies between broker estimates and actual results from reinsurers reflect these complexities.

The July renewals are heavily concentrated in U.S. property-catastrophe risk, particularly hurricane-related exposures in the Gulf of Mexico.

These contracts are typically written on an excess-of-loss basis, although quota share deals remain common for broader books. Despite the exposure concentration, reinsurers have stayed cautious and disciplined in their underwriting approach.

Relationship-based reinsurance

Autonomous reiterates that reinsurance is fundamentally built on relationships. Cedants prefer reinsurers with stable track records and the ability to handle complex placements.

Those offering support across multiple business lines are often favoured over competitors with narrow or opportunistic strategies.

Historically, price-driven buyers have been targets for new market entrants, but recent years have seen few new participants, keeping the market from becoming overcrowded.

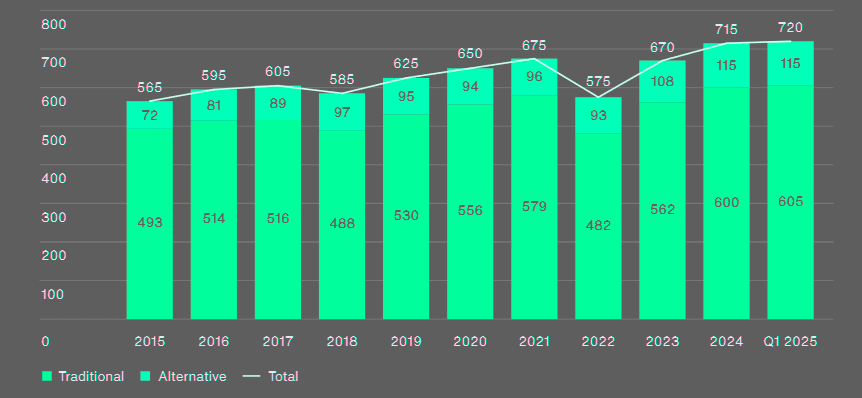

Reinsurance capital continues to be deployed cautiously

No disruptive new capacity has entered. Underwriting remains selective. This is not a breakdown, but a rebalancing. Market players appear more focused on long-term viability than on chasing near-term expansion.

Reinsurance buyers entered the June and July 2025 renewals in a stronger bargaining position than they have enjoyed in years, according to Aon.

The report to show a continued shift towards buyer-friendly conditions amid record levels of industry capital and resurgent investor appetite.

Global reinsurance capacity surpassed $720bn in the first quarter of 2025, up from $715bn at year-end 2024, according to the reinsurance broker, creating a competitive environment even in the face of elevated catastrophe losses.

Global reinsurer capital ($ bn)

Alternative capital is estimated to have remained at a record high of $115 bn, with attractive market conditions encouraging existing participants to reinvest profits and new entrants to commit funds.

Increased investor appetite is allowing many traditional reinsurers to expand their sidecar and/or catastrophe bond programs, enabling the deployment of additional capacity.

The current reinsurance market conditions

According to its renewals study, the ample capital, driven primarily by retained earnings and buoyed by alternative capacity from catastrophe bonds, allowed insurers to push for improved pricing, broader terms, and new coverage options.

The current reinsurance market conditions create opportunities for insurers to address specific issues, or to adjust program structures and coverage to reduce volatility in both property and casualty

Steve Hofmann, US CEO of Aon Reinsurance Solutions

The increase was principally driven by retained earnings, recovering asset values and new inflows to the catastrophe bond market, according to Aon’s Report about the Reinsurance Market Dynamics.

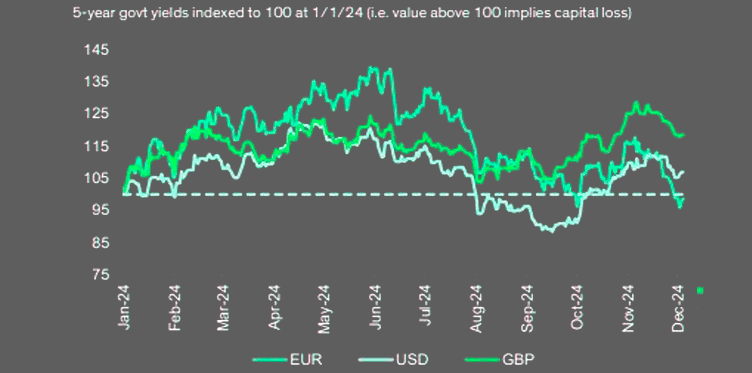

Rates performance has been stronger

According to European Credit Outlook 2025 review on Banks and Insurance, 2024 was a remarkable year for European bank credit with a decent performance driven by robust flows into the fixed income space including private credit.

FAQ

No. Reinsurance rates in Europe have started to ease after nearly doubling between 2017 and 2022. While 2023 marked the peak of the hard market, recent renewals reflect a stable and measured pricing environment.

No. Although pricing has moderated, market fundamentals remain solid. Capacity is ample, underwriting remains selective, and incumbent reinsurers continue to prioritize quality over volume.

Flat. Property insurance rates have stabilized, supported by a strong reinsurance renewal season. Capacity has increased, and pricing terms have improved, though insurers remain cautious with higher-risk sectors.

Cautiously. Despite July renewals being concentrated in U.S. hurricane-exposed property-catastrophe risk, reinsurers maintained strict underwriting discipline. Quota shares and excess-of-loss contracts remain common, with terms tailored by geography and past loss history.

No. Despite speculation after the California wildfires, there is no strong evidence of a broad hardening. Conditions vary by region and risk profile. Discrepancies between broker data and reinsurer reports remain common.

Yes. Global reinsurance capital rose to $720 bn in H1 2025, up from $715 bn at the end of 2024. Alternative capital remains at a record $115 bn, helping support pricing stability and increasing buyer leverage.

Prudent capital deployment, strong ROE, and restrained competition. Reinsurers continue to reinvest profits cautiously, with limited new entrants. Long-term client relationships and portfolio quality remain top priorities.

…………………………

AUTHORS: Chris Hartwell – European Insurance, Senior Insurance Research Analyst at Autonomous Research, Joseph Theuns, CFA – Associate at Autonomous Research

Edited by Yana Keller — Editor at Beinsure Media