Overview

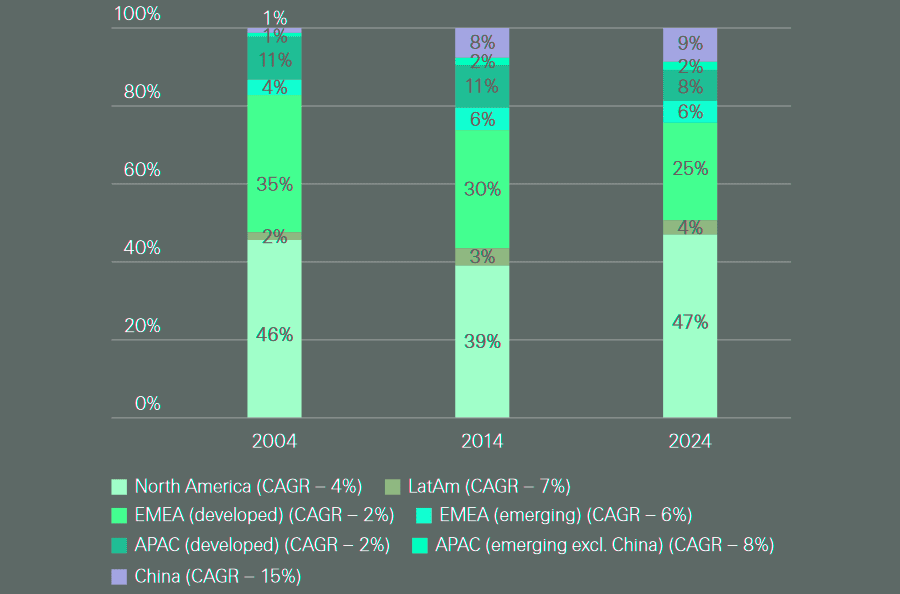

- P&C premium growth matches growth in nominal GDP globally

- Specialisation and outsourced underwriting unlock efficiency

- New dependencies on capital markets and investor sentiment

- Regional dynamics in advanced and emerging markets

- Reinsurance cession rates are rising, and retrocession

- The strategic reset of Insurtech Sector

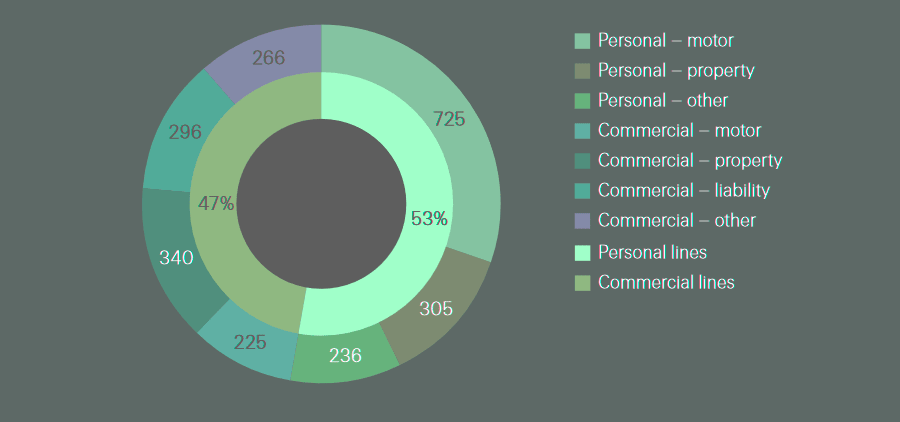

The global P&C insurance market has doubled in size over the past 20 years to $2.4 tn. Two decades of innovation resulted in broader access to coverage through a blend of conventional and alternative structures than 20 years ago, according to Swiss Re Institute’s sigma report. Beinsure analyzed report and highlighted key points.

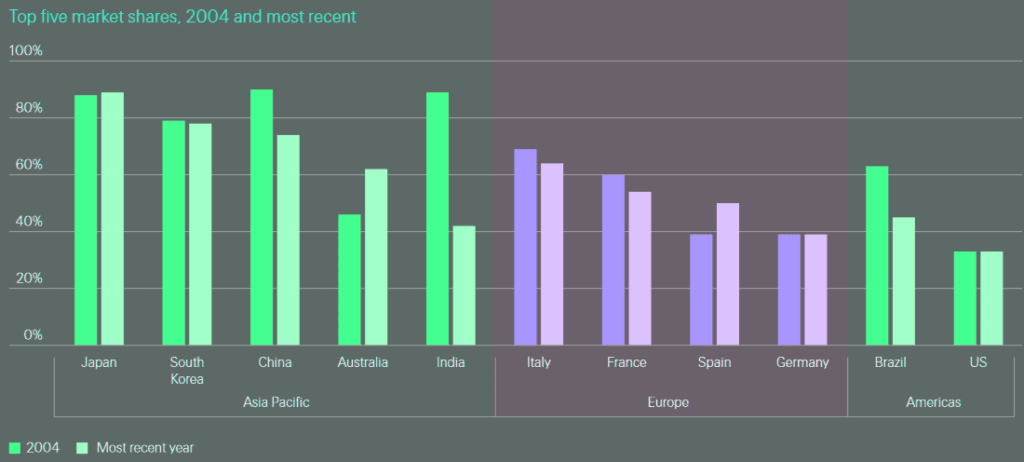

Global P&C premiums are projected to grow broadly in line with GDP over the next 10 years, with total premiums set to almost double by 2040. At the same time, market concentration is easing as competition increases.

A growing number of smaller, specialised players drive efficiency gains, while robust reinsurers and alternative risk solutions help improve capacity in view of a riskier world.

Key Highlights

- The global P&C insurance market has doubled in size over the past 20 years to $2.4 tn, fueled by new players, broader coverage access, and alternative risk-transfer mechanisms.

- Market concentration is declining, as smaller, specialised insurers, MGAs, and captives gain share, unlocking efficiency and expanding niche coverage.

- Reinsurance premiums grew ~7% CAGR over the past decade, compared to 4.2% for primary P&C, reflecting structural reliance on layered risk transfer.

- In advanced markets, property lines have outpaced GDP as natural catastrophe exposures rise. In emerging markets, P&C premiums remain 20% of the global total, with growth tied to motor penetration and corporate exposures.

- After failing to deliver structural disruption, many insurtechs are pivoting from “challenger” models to capital-light enablers of data, distribution, and specialty underwriting.

“The rapid expansion of the P&C market is not only about scale, but also about greater capability and resilience. Insurers have become more efficient at pricing, managing and transforming risk, supporting capacity even in times of heightened uncertainty,” Jérôme Jean Haegeli, Swiss Re’s Global Chief Economist, says.

P&C premium growth matches growth in nominal GDP globally

The USD 2.4 tn global P&C insurance market has doubled in 20 years as new players and risk-transfer channels emerge to better provide capacity, improve pricing, and broaden coverage.

Global P&C premiums evolution by key market, 2004-2024

Global P&C premiums by line of business, 2024

U.S. P&C insurance industry underwriting performance

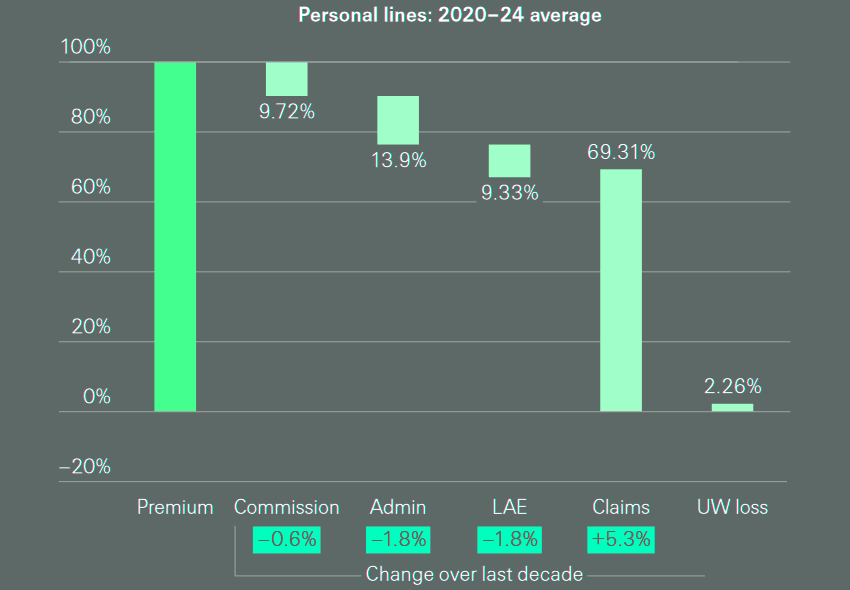

The U.S. property and casualty insurance industry achieved its best underwriting performance in over 15 years in 2025 (see TOP 100 P&C Insurance Companies in the U.S.). After 2 years of weak results, the industry has turned a corner.

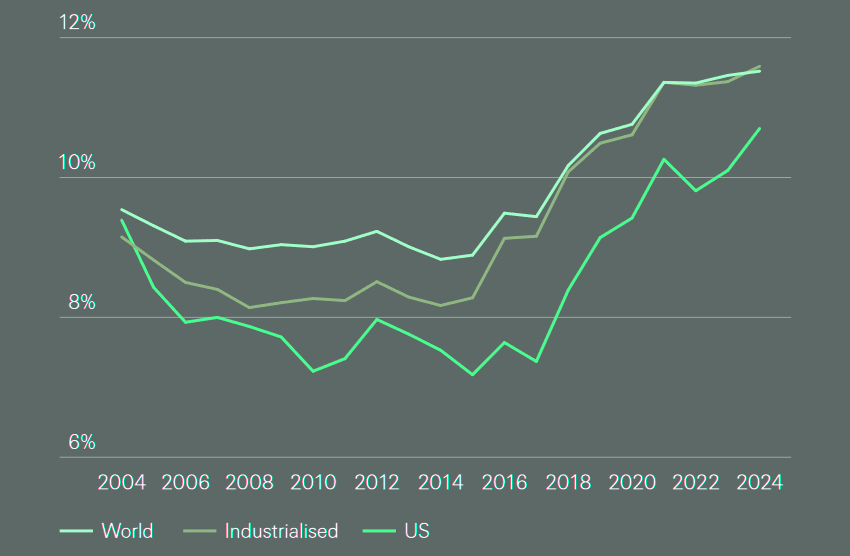

The P&C insurance industry’s return on equity (ROE) reached 14%, with full-year forecasts projecting an ROE of 9.5% in 2024 and 10% in 2025, along with premium growth of 8% and 5%, respectively, according to U.S. Property and Casualty Insurance Industry Outlook.

Personal lines continue to drive growth and profitability improvements, while competition is reemerging in personal auto. However, growth in commercial lines, including property, is slowing.

Insurers are passing on a larger share of the risk to reinsurers. This is a recognition of the demand for risk transfer and a trend that is set to continue given the risk landscape.

Jérôme Jean Haegeli, Swiss Re’s Global Chief Economist

A key pillar for reinsurers to fulfil their indispensable role as a shock absorber is a strong capital base.

Robust reinsurance and alternative risk solutions are further broadening capacity and helping keep protection accessible and affordable in an increasingly uncertain world.

Specialisation and outsourced underwriting unlock efficiency

A key driver of unlocking efficiency is the continuing disaggregation of the industry’s value chain. Brokers and Managing General Agents are taking on a greater role in distribution and underwriting, allowing insurers to tap into specialist skills and scale.

Captive insurers now represent an estimated $60 bn to $80 bn in global premiums, enabling corporates to self-insure higher-frequency risks while leveraging reinsurance capacity for peak exposures.

At the same time, the market is increasingly complementing traditional insurance with alternative risk solutions to keep pace with rising exposures, especially in catastrophe-prone regions.

Public, private or public-private insurance pools and residual market mechanisms, such as FAIR (Fair Access to Insurance Requirements) and wind pools in the US, are playing a growing role in sustaining availability where volatility or loss experience would otherwise constrain supply.

P&C insurance markets are becoming more diffuse

Top-five insurer market shares and concentration ratios (CR-5) are declining as the diffusion of risk carriers rises. Only two of the 11 large markets show CR-5s higher today than in 2004.

For 2025, the U.S. P&C insurance sector holds a neutral outlook across both commercial and personal lines, expecting stable or better results, especially with the anticipated recovery in personal auto and steady performance in commercial lines.

The growth of the P&C insurance market is testament to its ability to navigate a complex risk landscape. Looking ahead, the adoption of AI in underwriting could steer the industry towards data-rich global insurers versus nimbler specialists.

Gianfranco Lot, Swiss Re’s Chief Underwriting Officer P&C Reinsurance

This shift is accompanied by a structural trend of transferring more risk to reinsurers, who remain a pillar of stability and an enabler of transformation.

New dependencies on capital markets and investor sentiment

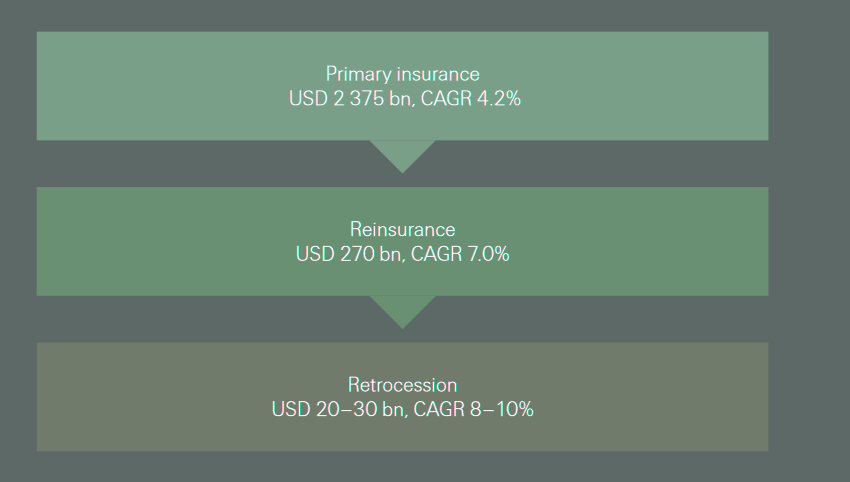

With more risk moving up the value chain, reinsurance premiums grew at around 7% CAGR (compound annual growth rate) over the past decade compared to 4.2% for primary P&C.

This layered architecture of risk transfer – from capital-light originators to reinsurers to alternative-capital-backed retrocession – has enhanced capital efficiency and market resilience but also introduced new dependencies on capital markets and investor sentiment.

Risk modeling, across domains such as natural catastrophes, motor, liability and cyber, is a key driver of making the disaggregated model work.

Advances in risk modeling facilitate the valuation, packaging and wholesale transfer of risk from capital-light originators to full-stack insurers and reinsurers. The growth and consolidation of wholesale brokers complement this trend.

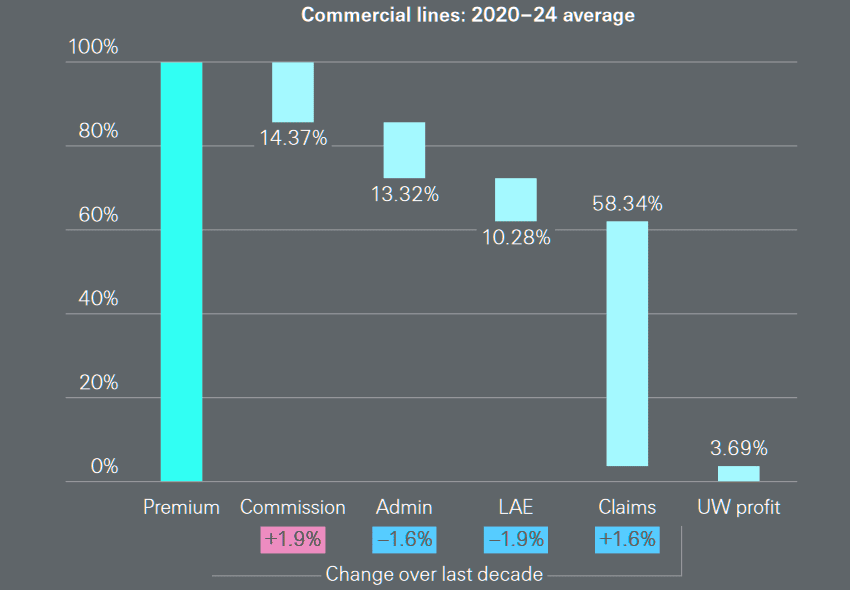

The expanding role of brokers and MGAs is also seen in the expense structure

The cost of broking commercial insurance has shown a structural up-trend (+1.9ppts) in the US over the past 10 years, measured as commission paid by insurers as a percentage of direct premiums written.

Expense structure for US insurers as a percentage of premiums, 2020-2024 averages

Whether the recent growth of smaller players proves a lasting shift or a cyclical effect of hard markets will depend on pricing conditions, wholesale appetite and regulatory tolerance for capital-light models.

Regional dynamics in advanced and emerging markets

In advanced markets, both personal and commercial P&C premiums almost doubled in the two decades to 2024.

Property outpaced every other sub-line as exposures grew faster than GDP and mandatory natural catastrophe schemes proliferated,yet cat bond and reinsurance inflows prevented capacity crunches.

Since 2019, commercial liability lines have shifted from low-single-digit growth to high-single-digit CAGRs. Its rapid expansion in the US due to litigation inflation remains a key claims and demand driver.

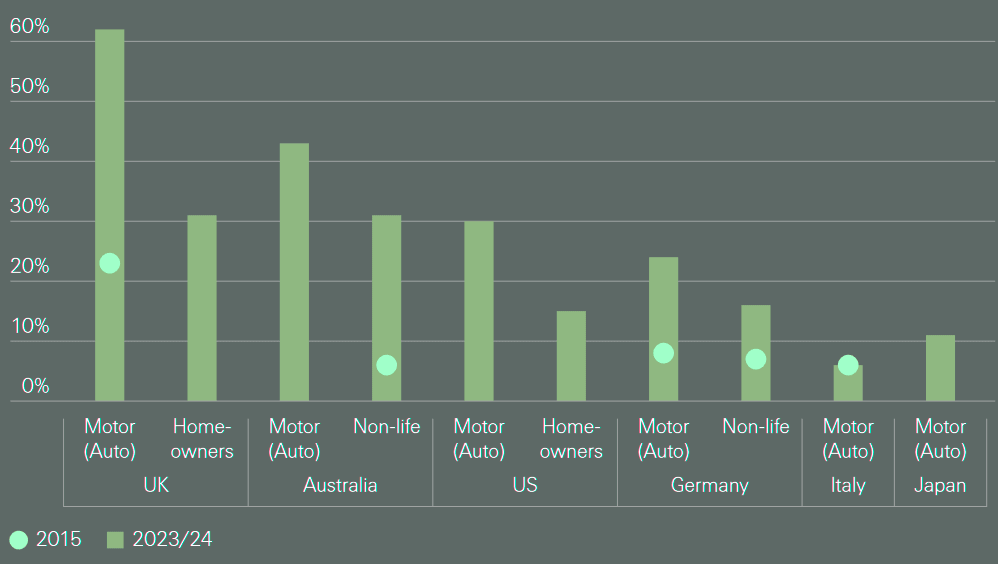

Digital and direct distribution channels in select personal lines markets

Reinsurance cession rates are rising, and retrocession

Cession rates are rising, reflecting structural shifts in the market. Retrocession volumes have grown by about 8 to 10% CAGR, reflecting growth in demand for natural catastrophe coverage in particular, including via alternative capital.

Layers of risk transfer and their growth rates; P&C cession rates

On the personal side, property and niche products offset a long-term declining motor share, reflecting the steeper claims trend for property losses. Swiss Re Institute expects these mega trends to continue with both property and liability lines expanding at roughly the same pace.

In emerging markets, the global split between commercial (46%) and personal (54%) lines is expected to hold, with commercial growth driven by expanding corporate exposures and personal lines supported by motor-penetration catch-up in emerging markets.

Emerging markets already account for 20% of the world’s P&C premium, unchanged since 2014. Rising technical capabilities mean that this share can climb beyond today’s 20% according to the sigma report.

The strategic reset of Insurtech Sector

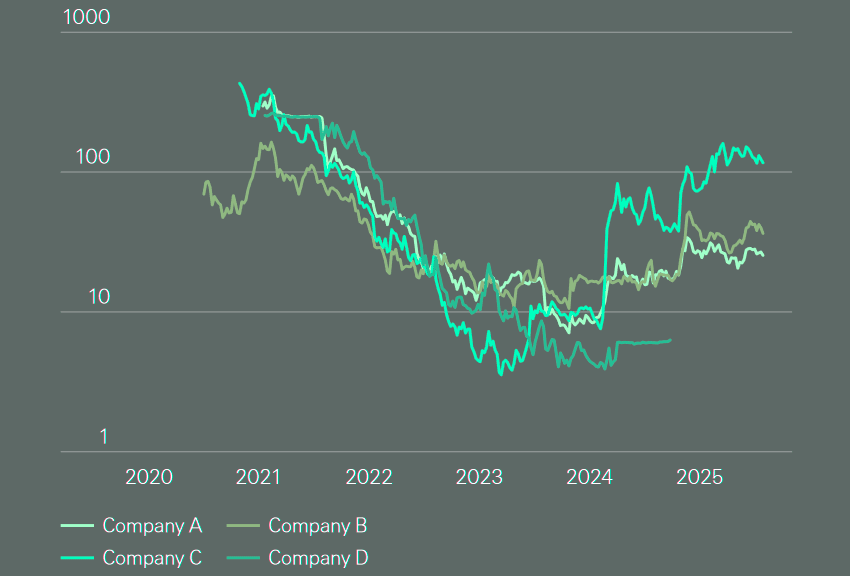

The Insurtechs suffered from high expectations and did not deliver structural change to the market structure. Insurtech digital MGAs and full-stack carriers raised billions in equity from VC funders. However, by 2022, many had failed to reach sustainable underwriting margins.

Poor market performance has followed several high-profile IPOs since 2021 after the firms revealed challenges in loss ratios, customer retention and scale.

As a result, the Insurtech sector is undergoing a strategic reset, moving out of its “disrupt-the-incumbents” phase and supplying data, distribution and speciality underwriting that enlarge overall market capacity.

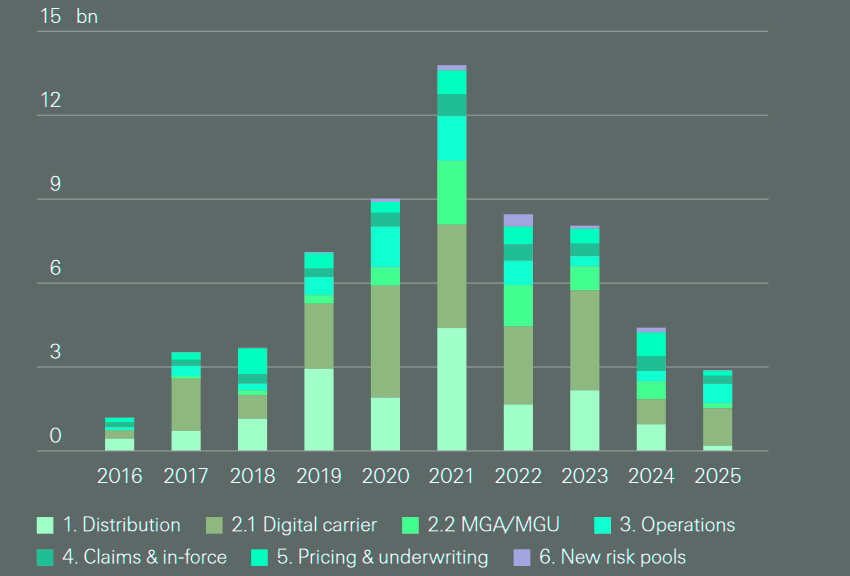

Total insurtech funding, 2016‒2025

Global InsurTech funding dropped 16.7% quarter over quarter to $1.1 bn in Q2 2025, marking one of the weakest quarters in recent years. The downturn was driven by sharp declines in property and casualty (P&C) InsurTechs, which posted their lowest funding totals since Q1 2018.

Capital keeps flowing into insurance tech, but the pace has slowed. With $1.6 tn pumped into AI since 2013, the gap highlights where investors now see the next big return.

Selected Insurtech US share price history since IPO

Most Insurtechs will likely stay “capital-light” by fronting through rated carriers and placing quota share/stop-loss treaties with global reinsurers.

InsurTech funding crossed a significant milestone in Q2 2025, with $60.8bn raised since records began in 2012. The figure reflects both the scale of investor appetite over the past decade and the ability of insurance technology firms to secure capital for ambitious growth strategies, according to Gallagher Re’s Report.

Funding patterns have shifted dramatically over time. It took five years to reach the first $10 bn, then only two years for the next $10 bn.

At the peak of activity, $20 bn flowed into InsurTechs in just 18 months — matching the total of the previous seven years combined (see Largest InsurTech Unicorn Startups by Valuation).

Another $10 bn arrived within a little more than a year. But from 2022 onward, a market correction slowed momentum. The latest $10 bn has taken three and a half years to raise, reflecting a cautious shift among investors.

FAQ

The global property and casualty (P&C) insurance market has doubled in 20 years, now valued at $2.4tn, according to Swiss Re Institute

Global P&C premiums are expected to expand roughly in line with GDP growth, nearly doubling again by 2040, while competition eases market concentration.

Smaller, specialised players, outsourced underwriting, and greater use of brokers and MGAs are unlocking efficiency gains. Captive insurers add $60bn–$80bn in premiums by letting corporates self-insure and tap reinsurance for larger risks.

In 2025, the U.S. P&C sector recorded its best underwriting results in 15 years, with an ROE of 14%. Forecasts suggest 9.5% in 2024 and 10% in 2025, driven mainly by personal lines, while commercial growth is slowing.

Reinsurers remain a shock absorber with strong capital bases, while alternative risk solutions broaden capacity. Reinsurance premiums grew 7% CAGR in the past decade, compared to 4.2% for primary P&C.

In advanced markets, property insurance leads growth due to rising exposures and natural catastrophe schemes, while liability gains momentum from litigation inflation. In emerging markets, motor penetration and corporate exposures drive growth, keeping the commercial-to-personal split at 46/54.

Adoption of AI in underwriting may push the industry toward data-rich global carriers versus nimble specialists. Rising reliance on capital markets introduces new dependencies, while risk modeling advances make wholesale risk transfer more efficient.

…………..

AUTHORS: Jérôme Jean Haegeli – Swiss Re’s Global Chief Economist, Gianfranco Lot – Swiss Re’s Chief Underwriting Officer P&C Reinsurance