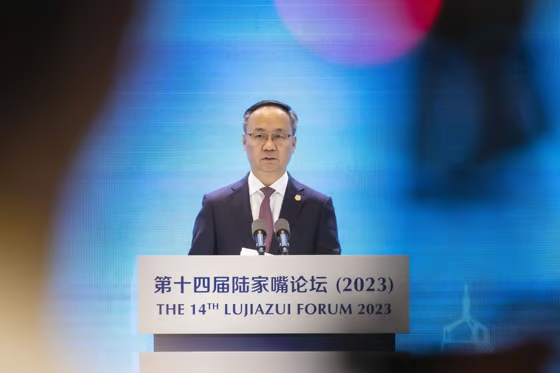

Shanghai saw the official launch of the international board for reinsurance trading, with detailed implementation rules also released to accelerate the city’s development in reinsurance, according to Head of China’s National Financial Regulatory Administration, Li Yunze.

The Shanghai Banking and Insurance Regulatory Bureau and the city’s Financial Regulatory Bureau jointly released a set of implementation rules for building the city into a global reinsurance center.

The rules allow for a global reinsurance business transaction market to be established in the city, marking another significant milestone in the construction of the Shanghai international reinsurance center.

With the aim to build a globally competitive international reinsurance trading market and by establishing Chinese regulations and standards, the rules are expected to guide the transformation and upgrading of China’s reinsurance market from “one-way opening” to “two-way opening,” and promote global reinsurance industry cooperation.

Specifically, the implementation rules include 22 measures aimed at improving the reinsurance market infrastructure and institutional systems, deepening the supply of and innovation in reinsurance products, promoting high-level opening-up of reinsurance systems, and enhancing the attraction and training of reinsurance talent.

For instance, on improving the reinsurance market infrastructure and institutional systems, the rules focus on constructing a new digital reinsurance trading system for the future, enhancing market transparency and operating efficiency, and building a new type of reinsurance trading market that integrates trading and clearing.

It will also support various types of insurance and reinsurance institutions to establish reinsurance operation centers in Shanghai, and attract reinsurance resources from across the country to the Lingang International Reinsurance Functional Zone to support global risk redistribution.

Regarding deepening the supply of and innovation in reinsurance products, the city will establish a data exchange mechanism and resource integration mechanism for key national areas and projects, to enhance reinsurance underwriting capabilities and service levels.

The rules also include supportive policies for talent introduction, entry and exit, while also encouraging local governments, universities and enterprises to jointly strengthen Shanghai’s reinsurance talent team.

China’s premium revenue from overseas was approximately $15.7 billion, and its overseas reinsurance premium revenue was about 28.3 billion yuan, with a reinsurance deficit of nearly four times, suggesting the need for further deepening its two-way integration with the global reinsurance market.

The Shanghai Banking and Insurance Regulatory Bureau, together with the Shanghai Local Financial Regulatory Bureau, will rely on a digital and technological international reinsurance business platform, to build a transparent, convenient, and efficient international reinsurance trading market, and promote the high-level opening-up and high-quality development of China’s reinsurance market.

China will appoint Li Yunze as the head of a new financial regulator as part of a broader restructuring of its financial regulatory regime.

Li, 52, a banking veteran and currently vice governor of southwestern Sichuan province, will take the helm of the National Financial Regulatory Administration (NFRA), the sources told Reuters.

The NFRA is a new government body under the State Council tasked to supervise the multi-trillion dollar financial industry, excluding the securities sector. The creation of the NFRA comes amid a sweeping reform of central government institutions spearheaded by the ruling Communist Party.

The State Council Information Office, which handles media queries on behalf of the government, did not immediately respond to a faxed request for comment.

by

by