European life insurers have had to raise the capital they must hold under Solvency II to cover the risk of a surge in lapses. In the case of Italian life insurers, this led to a capital shortfall and regulatory intervention, according to Fitch Ratings.

It states that Europe’s insurers support the EU’s ambitious sustainability agenda and are committed to continuing to contribute and to build towards the transition to a more sustainable society, and to play their role in achieving the targets of the EU Green Deal.

Sustainability is a key element of the Solvency II review and insurers are supportive of changes that can help to clarify how sustainability risks, including climate-change risks, are appropriately integrated into the Solvency II framework, insofar as this is not already the case.

French life insurers are unlikely to experience a surge in customer lapses amid higher interest rates as their savings products offer valuable tax benefits and the prospect of rising bonus rates.

The rapid increase in interest rates in recent months could lead some customers to consider cashing in their old life insurance savings contracts and to seek new contracts offering better returns.

The main French life savings products with investment guarantees, ‘Fonds Euros’, account for about three-quarters of the French life sector’s reserves, and can be redeemed in full at any time.

Higher interest rates could lead to an increase in early redemptions combined with unrealised losses on some of the fixed-income assets that back the contracts, forcing insurers to liquidate assets at a loss.

However, Fitch expects the rise in lapse rates to be modest, and French life insurers’ ample liquidity, supported by cash-generative business, should limit realised losses. We therefore do not expect widespread credit implications, but there could be isolated cases of insurers with perceived weaknesses coming under pressure.

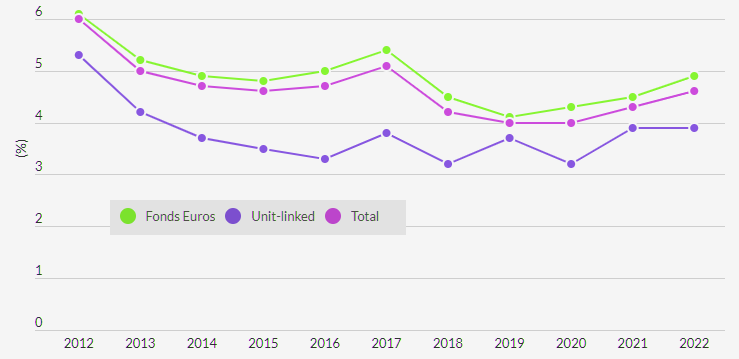

Higher interest rates did not lead to a significant increase in early redemptions in 2022. The sector surrender rate (surrender payouts/prior-year reserves) increased modestly to 5% for Fonds Euros and 4.6% overall – well below the peak levels during the eurozone sovereign crisis.

Deteriorating household purchasing power and increasing yields on government-regulated tax-free ‘Livret A’ savings accounts have had little effect on surrender rates.

Modest Increase in Surrender Rates in 2022

Fitch expects surrender rates on Fonds Euros to increase in 2023 as interest rates continue to rise.

Sector surrender rate for Fonds Euros to stay below 10%, while net outflows from Fonds Euros (2022: EUR20.3 billion) may continue to be offset by net inflows for unit-linked business (2022: EUR34.6 billion).

Surrender rates on unit-linked products remain low and are less sensitive to interest rates.

Fonds Euros products are designed as long-term savings contracts with significant tax benefits, which are lost on early surrender. This deters policyholders from surrendering contracts early as the tax advantage generally outweighs the potential gain from switching to an alternative product offering a higher investment return.

Insurers are increasing the bonus rates on Fonds Euros products to encourage policyholders to continue their contracts.

They have funded this by releasing some of the profit-sharing reserves they have built up from gains on fixed-income investments over several years of low interest rates. We expect bonus rates to increase further in 2023, although their ability to keep increasing crediting rates without eroding capital could be constrained in the longer term.

The industry supports transition plans, which a very wide range of companies, including insurers, will need to set up and disclose, as currently foreseen in the cross-sectoral directives of the Directive on Corporate Sustainability Due Diligence and the Corporate Sustainability Reporting Directive.

To avoid unnecessary duplication and inconsistencies, Insurance Europe adds that there is no need to include transition plans in sector specific legislation, such as Solvency II.

by Yana Keller