Indemn, a insurtech platform, has closed a $1.9 mn pre-seed funding round, marking its continued growth in delivering insurance products through natural conversation powered by AI.

The round was led by Markd, with participation from Afterwork Ventures, Everywhere Ventures, and a group of prominent entrepreneurs and insurance leaders from Australia and the U.S.

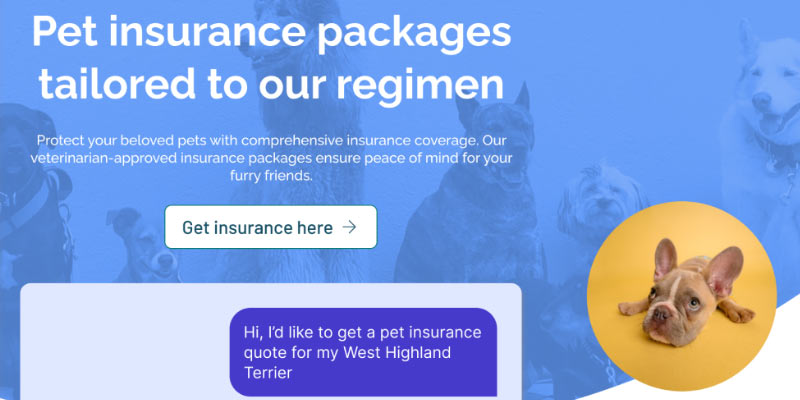

Established in 2021, Indemn’s AI-driven platform revolutionizes engagement with digital insurance products by making information, product configuration, and underwriting accessible through natural conversation.

Indemn’s collaboration with innovative insurance carriers has resulted in a transformative customer experience.

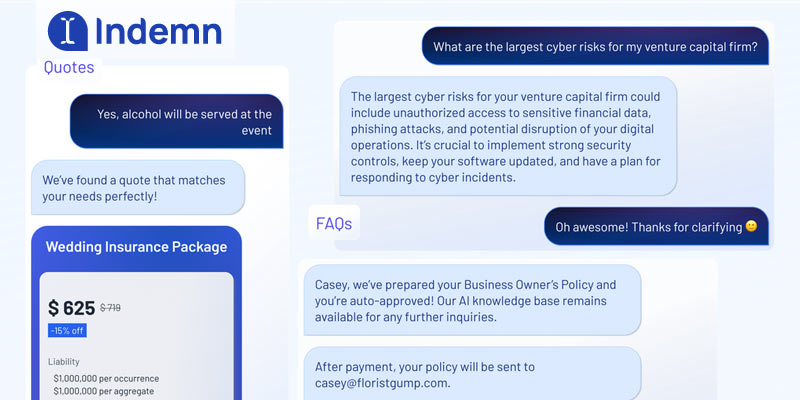

Their platform, built around Large Language Models, includes AI agents supporting all aspects of digital insurance, from quoting to purchase, thereby driving growth and reducing operational costs across distribution channels.

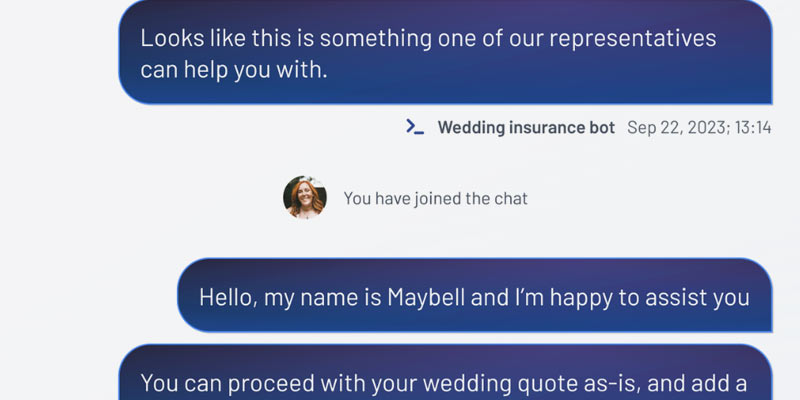

The customer experience delivers AI agents directly to the user, and when desired, seamlessly connects the customer to human agents supported by an AI powered Copilot.

Kyle Geoghan, Co-founder & CEO of Indemn, shared his excitement: “Our new investors believes in our vision to transform the insurance acquisition experience with Large Language Models. Creating a better way for people to interact with insurance has been a long time coming and we couldn’t be more excited to continue building the solution.”

Kyle Geoghan, Co-founder & CEO of Indemn, expressed enthusiasm over the initial funding, emphasizing the investor’s confidence in the company’s mission to revolutionize how individuals acquire insurance with the aid of Large Language Models. Geoghan highlighted the ambition to innovate the insurance interaction process, a development eagerly anticipated by many.

We’re thrilled with support from investors who believe in our vision to transform the insurance acquisition experience with Large Language Models

Kyle Geoghan, Co-founder & CEO of Indemn

The Indemn team, with its innovative product and early adoption of generative AI, is poised to improve the way insurance is purchased online.

Far before the hype, the team’s expansive work with this tech was driven by a need to find a solution for the primary challenges within insurance distribution.

Parker Beauchamp, Managing Partner at Markd highlighted Indemn’s potential: “This work is bolstered by Kyle’s deep understanding of insurance, accumulated from his background in a family agency and as an early employee at Coverwallet.”

Beauchamp further remarked on Kyle Geoghan’s profound insurance knowledge, gained from his family-run agency background and his tenure at Coverwallet, emphasizing how this experience aligns with Markd’s commitment to reinforcing traditional insurance channels.

This work is bolstered by Kyle’s deep understanding of insurance, accumulated from his background in a family agency and as an early employee at Coverwallet. All this aligns perfectly with our belief in supporting long-standing, existing insurance channels.

Parker Beauchamp, Managing Partner at Markd

The Indemn platform enables multi-channel digital distribution with Large Language Models at its core. Together with forward-looking insurers they’re pioneering a new model for insurance engagement.

Indemn is an insurtech SaaS provider delivering innovative, AI-driven solutions to insurance carriers.

Markd is a venture capital company focused on funding and partnering with transformative insurtechs. It pays homage to the insurance industry’s legacy while helping design its future.

For instances requiring additional guidance, Indemn has implemented a smooth handoff to human agents, who are enhanced by an AI-powered Copilot. This ensures that users receive comprehensive support, combining the best of AI efficiency and human insight.

Kyle Geoghan excited about the future, highlighting the company’s commitment to revolutionizing the way people interact with insurance services.

Indemn’s approach, grounded in leveraging cutting-edge AI for a more accessible and user-friendly insurance acquisition process, positions it as a significant player in the insurtech industry.