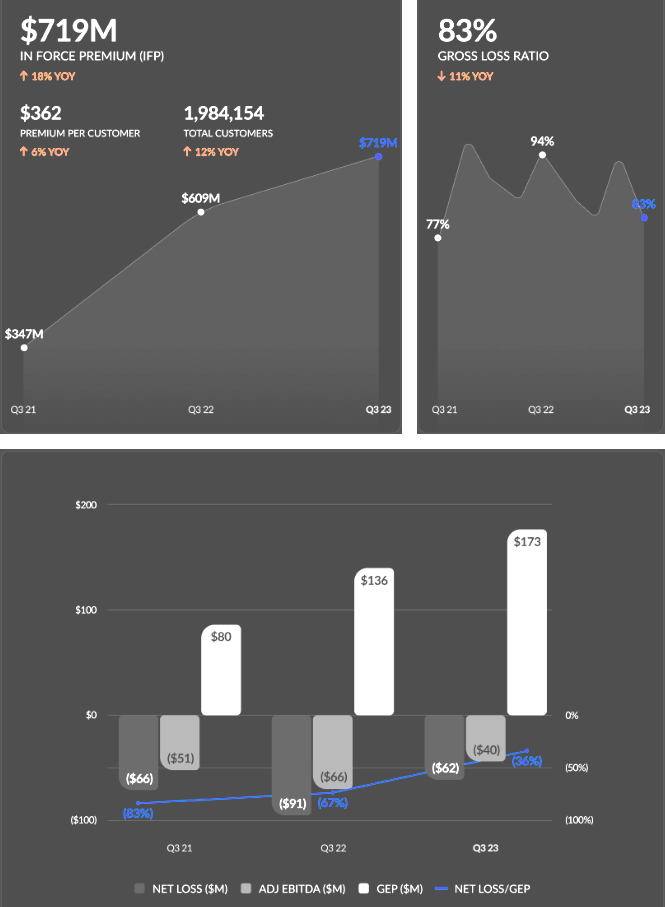

Insurtech Lemonade announced the welcoming of its 2 millionth customer. The pace to achieve the second million customers was 35% faster than the first million, which was achieved in late 2020, while premium per customer increased approximately 70% over the same period.

Net operating loss, as compared to gross earned premium, roughly halved over the same period.

Taken together, these improvements are a testament to Lemonade’s structural technological advantage and overall scalability.

Lemonade reports that third quarter 2023 delivered strong results across a key metrics versus Q3 2022:

- Top line: At $719 million, in-force premium (IFP) grew 18%.

- Operating Expense: At $98 million, operating expense declined 11%.

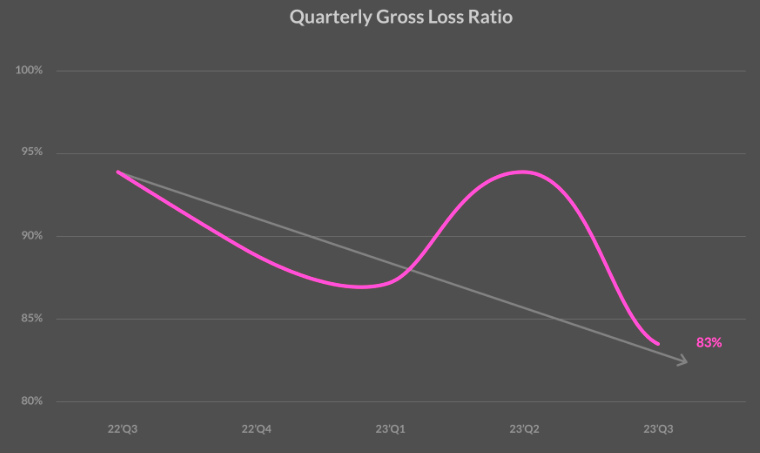

- Loss Ratio: At 83%, Gross Loss Ratio improved 11 percentage points.

- Gross Profit: At $22 million, Gross Profit was up 170%.

- Bottom line: At $40 million, Adjusted EBITDA loss improved 39%. Netloss was $62 million, a 33% improvement.

Gross Loss Ratio for the quarter was 83%, continuing the favorable trend we were seeing in recent quarters, which was rudely interrupted in Q2 2023.

“Our reinsurance is in place to blunt the impact of such unwelcome surprises (as our Q2 results demonstrated), making our long term trend line more important than any turbulence we may experience on our way down”, Lemonade says.

Given the favorable cash flow dynamics of insurance (customers pay us before we pay them), Adjusted EBITDA profitability is expected to follow in 2026, a few quarters after our cash-flow turns positive.

A few highlights achieved as Lemonade scaled from 1 to 2 million customers:

- Lemonade Car launched with telematics-enabled auto insurance in the United States and continues rolling out across the country

- Lemonade expanded across the pond, offering contents insurance in the UK in addition to other markets in Europe

- Metromile joined the family as the company’s first acquisition

- The Company continued its work with AI, implementing large language models trained to interact with customers, creating a seamless and delightful experience along the way

Reaching two million customers around the world is an exciting milestone, and one we achieved much faster than our first million and with significant expansions, of both product and geography, along the way

Shai Wininger, co-founder and co-CEO of Lemonade

“We’ve doubled our customers while increasing our premium by 3.5x. This is indicative of the strong progression of the business in recent years, and outlines a clear path to profitability.”

Lemonade was founded by tech entrepreneurs and is imbued with an engineering culture; the company operates a vertically integrated proprietary system that has spawned dozens of AIs that delight customers, predict outcomes and quantify risks.

It is doubtful any major insurer in the United States could credibly claim any one of these elements, let alone all of them. That’s no coincidence.

“Lemonade’s difference is a byproduct of its startup origins, and of its coming of age in the era of apps, bots, and AI. Companies with different origin stories, that came of age before smartphones, the internet, or even computers, often struggle to graft digital and AI best practices onto foundations forged in a bygone era”, insurtech says.

“And Lemonade’s difference amounts to a defensible competitive advantage. An insurance company that is foundationally digital and AI-native holds the promise— not to say the inevitability—of industry-leading precision and automation. These, in turn, already deliver a best-in-class customer experience; and over time, we believe, will deliver excellent loss ratios and expense ratios”, Shai Wininger says.

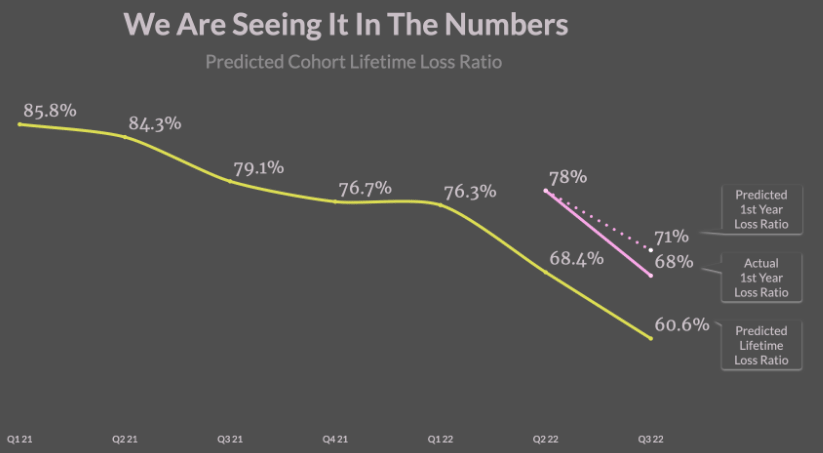

A key slide we showed a year ago offered a prediction of Lifetime Loss Ratios for different cohorts.

While ‘lifetime loss ratios’ take a lifetime to materialize, embedded within them are predictions for ‘first-year’ loss ratios, and a year later we’re able to evaluate these.

The predicted ‘first-year loss ratio’ for the Q2 ‘2022 cohort was 78%, and their actual first year loss ratio was exactly that, 78%.

The predicted ‘first-year loss ratio’ for the Q3 ‘2022 cohort was 71%, and their actual first year loss ratio was 68%. So far LTV6 has proved highly prescient, with loss ratios materializing in line with its predictions, or slightly better.

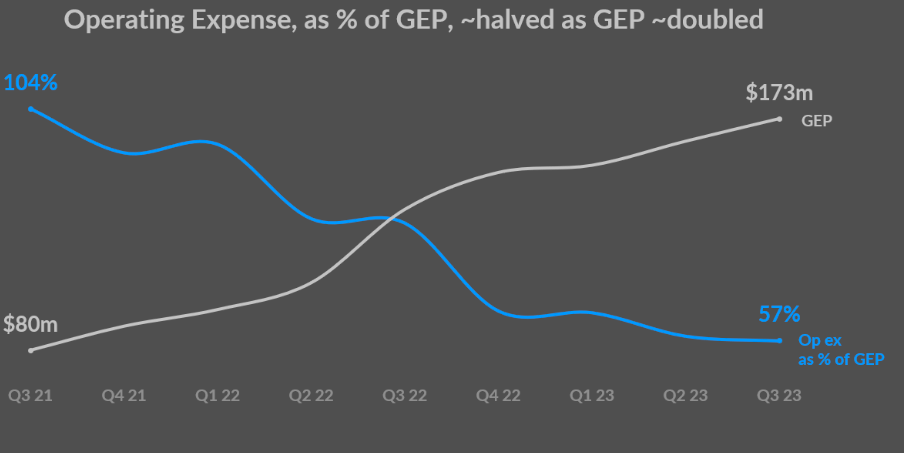

And that’s exactly what we have done. In the past 24 months our Gross Earned Premium (GEP) grew 118%, while our Operating Expense increased a mere 19% in comparison

Premium per customer, defined as in force premium divided by customers, was $362 at the end of the third quarter, up 6% from the third quarter of 2022.

Lemonade Q3 2023 key figures

- Q3 2023 gross earned premium of $173.2 million increased by $36.8 million or 27% as compared to the third quarter of 2022, primarily due to the increase of IFP earned during the quarter.

- Q3 2023 revenue of $114.5 million increased by $40.5 million or 55% as compared to the third quarter of 2022, primarily due to the increase of gross earned premium during the quarter, coupled with greater investment income.

- Q3 2023 gross profit of $21.9 million increased by $13.8 million or 170% as compared to the third quarter of 2022, primarily due to higher earned premium and improved loss ratio in the third quarter this year.

- Q3 2023 adjusted gross profit of $24.9 million increased by $11.7 million or 89% as compared to the third quarter of 2022, primarily due to higher earned premium and improved loss ratio in the third quarter.

- Adjusted gross profit is a non-GAAP metric. Reconciliations of GAAP to non-GAAP financial measures, as well as definitions for the non-GAAP financial measures included in this letter and the reasons for their use, are presented at the end of this letter.

- Total operating expense, excluding net loss and loss adjustment expense, of $98.2 million decreased by $11.6 million or 11% as compared to the third quarter of 2022. The decrease was primarily driven by lower growth spend for customer acquisition.

- Net loss in the third quarter was $61.5 million, or $(0.88) per share, as compared to $91.4 million, or $(1.37) per share, in the third quarter of 2022, an improvement in net loss of nearly 33% in just a year.

- Adjusted EBITDA loss of $40.2 million decreased by 39% as compared to an Adjusted EBITDA loss of $65.7 million in the third quarter of 2022, primarily due to higher revenue and lower growth spend in the third quarter.

- The Company’s cash, cash equivalents, and investments totaled approximately $945 million at September 30, 2023, reflecting primarily the $103 million of net cash used in operations since December 31, 2022.

As of September 30, 2023, approximately $109 million is carried by our insurance subsidiaries as surplus to the benefit of its policyholders.

As of Q3 2023, we have earned about $45m in premium from our new rates, with a further $120m online but yet to earn in. Further rates await regulatory approval, so that during 2024 expects to earn an additional >$100m from increased rates.

“The actions we’ve taken and plan to sustain will, we believe, yield a return to healthy loss ratios, though the nature of the file-approval-implement-earn-in-cycle is such that it may be 18-24 months (depending on inflation rates, and approval rates) before we’re fully caught up”, Lemonade says.

“But even as we join in the industry’s ‘file, wash, rinse, repeat’ response to today’s ‘perfect storm,’ we continue to build our technological advantage, which will manifest fully only once the storm passes. Fortunately, inflation is on a downward trajectory, and, industry-wide, insurance rates are on an upward trajectory, so the beginning of a more favorable cycle may be within sight”.