Quandri, a insurtech startup based in Vancouver, Canada, is working in the field of robotic process automation (RPA) by offering a specialized solution for the insurance industry.

Insurtech recently secured an $8.5 mn Series A funding round in 2023, led by FUSE and joined by Defined Capital, along with continued support from previous investors such as Aviso Ventures, Rebellion Ventures, N49P, and Good News Ventures.

This latest round of funding brings Quandri’s total capital raised to $10 mn.

Founded by Jackson Fregeau, who serves as CEO, and Jamieson Fregeau, the President, Quandri has embarked on a mission to refine the use of RPA within the insurance sector.

Jackson Fregeau, with his background as the COO of Revenue Accelerator, and Jamieson Fregeau, with experience in various hardware-focused companies including Open Ocean Robotics, have leveraged their expertise to address a specific challenge in the industry.

Quandri was founded to bring this technology to small to medium-sized businesses. Quickly after starting, we pivoted to serving the insurance brokerage market.

Underserved by technology vendors and inundated with manual and repetitive work, brokerages don’t have the tools to make the changes they want.

Quandri fixes that by partnering deeply with brokers and giving them the freedom to build their business on their terms.

The insight came from Jackson Fregeau’s time at Revenue Accelerator, where he developed bots for automating repetitive data entry tasks, leading to the realization that there was a gap in the market for specialized, customer-focused automation solutions.

Quandri’s approach differs from traditional RPA by offering what could be described as “robot-as-a-service.”

This model involves providing pre-built automation tools to their clients, thereby eliminating the need for companies to develop these solutions in-house.

This strategy not only saves time and resources but also opens up access to automation technology for companies that may lack the technical capabilities to implement it on their own.

The decision to focus on the insurance industry came after the Quandri team identified a significant need within this sector.

Many insurance brokers and agencies continue to rely on manual processes and face challenges with data silos, despite advances in consumer-facing aspects of the industry. Quandri aims to modernize these backend operations with its tailored digital workers.

Currently, Quandri offers three pre-configured bots designed to streamline operations for insurance professionals.

These include the Renewal Reviewer, which assists agents in comparing policies upon renewal; a tool for ensuring files are named accurately and contextually; and the Download Director, which automates the matching of policies and eDocs to correct accounts, as well as verifies claims and producer commission amounts.

Jackson Fregeau highlights that Quandri is fully committed to serving the North American insurance market, particularly focusing on brokerages. While there is potential for expanding their technology to other industries in the future, their current priority is to address the specific needs of insurance agencies.

While there are plenty of other companies in the bots-as-a-service industry, including firms like Chicago’s Thoughtful Automation and New York-based Roots Automation, but neither focus specifically on insurance.

The impact of Quandri’s automation solutions is already being felt by their clients. Angela Trimble, president of Trustpoint Services, praised the effectiveness of Quandri’s bots, noting that they have significantly reduced the need for hiring additional staff for tasks that involve tedious paperwork.

Quandri’s targeted approach to RPA in the insurance industry represents a notable shift towards specialized automation solutions. By addressing the unique challenges faced by insurance brokers and agencies, Quandri is poised to play a key role in driving efficiency and innovation within the sector.

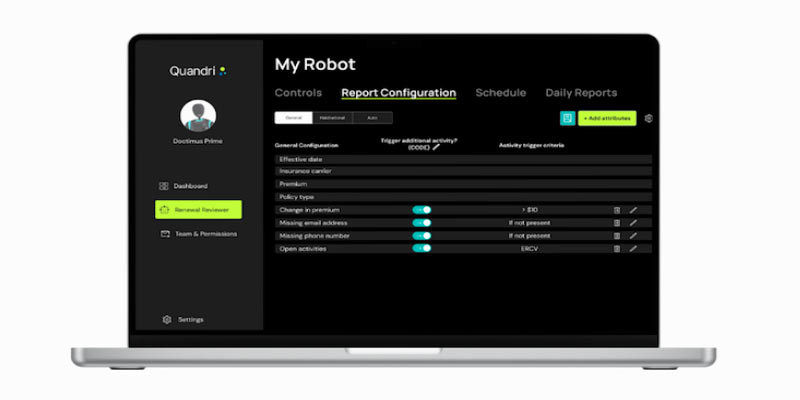

Quandri has launched the Control Room—a game-changer giving customers control and insight into managing their own AI-powered robots.

The Control Room redefines the way insurance brokerages engage with automation and robotics. The tool allows brokerages to launch their own AI-powered robots, adjust the configuration of their robots in real-time, control when they are working, and gain insights into the performance of their bots.

The control room makes it easy for brokers to implement AI-robotics into their business to complete time-consuming tasks, such as renewal reviews, without relying on technical resources for setup and configuration.

The Control Room is easy to use. Its intuitive user interface and permission settings empower brokers to effortlessly fine-tune their robots while upholding stringent quality control standards. With user-friendly controls, brokers don’t need to be technical experts to make updates and changes to their bots.

“Quandri’s Control Room shows our commitment to empowering our customers,” says Quandri CEO, Jackson Fregeau. “With our automation technology so integrated in our customers’ day-to-day operations, we understand how critical control and adaptability are. This is one of many upcoming product enhancements that will continue to make brokers’ and agents’ lives easier by giving them more control over their time and businesses.”