The stable liability profile and strong liquidity position of North American life insurers should mitigate near-term challenges associated with rapidly rising interest rates, Fitch Ratings says.

Insurers face interest rate-related declines in bond values and shareholders’ equity, reductions in assets under management and fee income, and lower variable investment income.

However, higher interest rates over a prolonged period are broadly positive for the life insurance industry as investment yields improve.

Policyholder behavior remains consistent with insurers’ original pricing assumptions, although rising rates and opportunities for robust returns in non-insurance investment products may cause consumers to review guarantees and returns associated with their life and retirement products and to potentially lapse or surrender their policy.

Annuity writers and insurers with large variable life blocks are typically more exposed to disintermediation risk, which varies across different mixes of business.

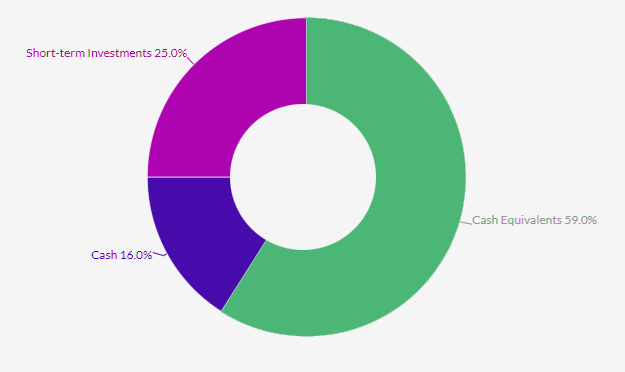

Liquidity is strong, and the aggregated industry’s risk-weighted liquidity ratio was 157%, which is consistent with ‘a’ category guidelines in our rating criteria at YE22.

Additionally, life insurers maintained robust contingent liquidity facilities, including access to Federal Home Loan Bank (FHLB) borrowing.

U.S. Life Insurers Short Term Assets, Liquidity Position

The North American life industry has strong asset/liability management frameworks, with the average duration of life insurers’ assets and liabilities well matched, with assets being shorter than liabilities by approximately 1.4 years.

In addition, cash flow testing results continue to indicate that rising rates will broadly be positive for insurers. The majority of Fitch’s surveyed insurers reported positive cash flow margins under the three prescribed deterministic rising interest rate scenarios.

by

by