The European Insurance and Occupational Pensions Authority (EIOPA) in the beginning of the year the results of a Europe-wide comparative study on non-life underwriting risk in internal models.

While the study showed the most undertakings’ capital allocation has been stable, it also revealed that some companies rely too much on uncertain future profits when calculating premium risk and thus underestimate their capital requirements.

Non-life underwriting risk contributes significantly to the SCR of insurance undertakings and is of material importance for the majority of internal model undertakings. The study analyzed internal models for the non-life underwriting of 75 European insurers belonging to 31 insurance groups.

The aim of the study was to evaluate the differences between internal models to understand whether and to what extent these capture similar risks in a consistent manner.

Additionally, it examined the non-life underwriting risk profiles to identify the reasons that influenced the risk capital over the first five years since the introduction of Solvency II.

The study showed the following key conclusions:

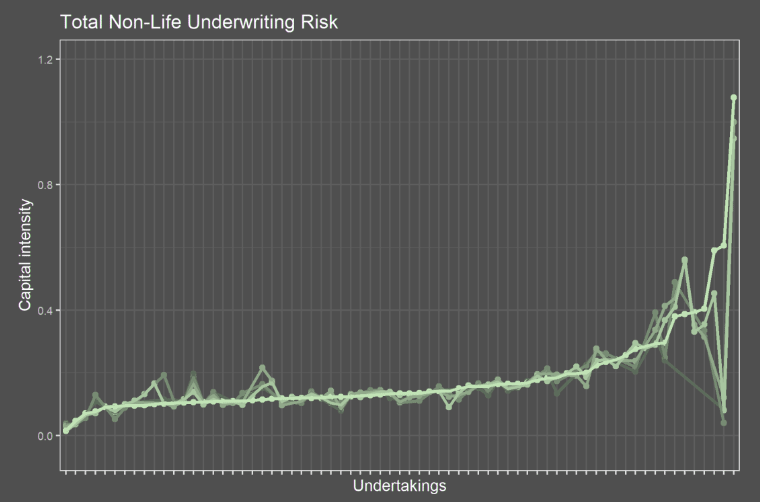

- Capital intensity: Undertakings with similar economic profit and loss distributions (and profit levels) showed notable differences in their capital intensities. Capital intensities did not increase or decrease over time, which suggests that undertakings’ capital allocation has been stable.

- Differences in risk measurement: Many undertakings with lower capital intensity were relying on uncertain future profit estimates in the calculation of their premium risk. Such differences in how future profits are accounted for have led European supervisors to carry out further analysis on the matter.

- Standard formula comparison: Undertakings using internal models showed significant variation and generally lower capital intensities for premium and reserve risk compared to standard formula calculations.

- Reporting: Most undertakings were well prepared for the introduction of quantitative reporting templates for internal models at the end of 2023 at the EU level, with a few exceptions. The EEA-wide harmonized templates allow a common approach in reading and processing the data and therefore reduce additional reporting burden.

- Inflation: Most undertakings model inflation based on past trends and may rely on ad-hoc expert judgement when the path of inflation changes. Analyses showed that long-lasting moderate inflation can affect undertakings more than temporary spikes. Therefore, undertakings should monitor inflation risk and their exposure to it as changes in the development of inflation could lead to an increase in the Solvency Capital Requirement.

EIOPA and national supervisors have held individual feedback sessions with all participants. The conclusions of the study will be further addressed by the national supervision of individual undertakings and groups (e.g. in colleges of supervisors).

Total NL risk capital Intensity over the 5-year analysis horizon (IM + SF) net of reinsurance

Undertakings identified as outliers have been notified and relevant national supervisors are currently conducting follow-up actions. Some supervisory actions have also already led to changes in internal models. EIOPA will support national supervisors on the follow up and monitor the development of the findings.

by

by