The Financial Stability Board has published its regulatory framework for cryptoasset activities to promote the global harmonization of regulatory and supervisory approaches.

It incorporates lessons from events over the past year that highlighted structural vulnerabilities of cryptoassets and related players as well as feedback received during the FSB’s public consultation (see First Crypto Criminal Case).

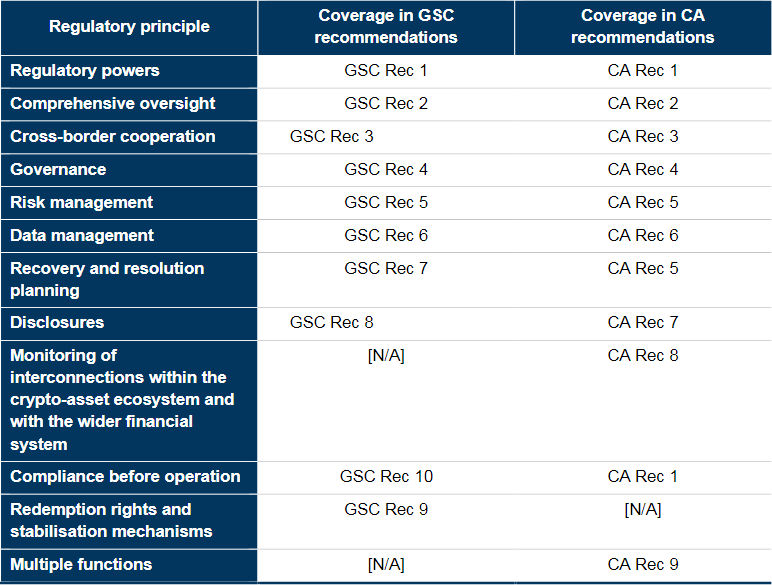

The framework consists of two groups of recommendations for the regulation, supervision and oversight of cryptoasset activities and markets, and “global stablecoin” arrangements respectively.

It draws on the implementation experiences of jurisdictions and builds on the principles of “same activity, same risk, same regulation”, and being high-level, flexible and technology neutral.

It consists of two distinct sets of recommendations:

- High-level recommendations for the regulation, supervision and oversight of crypto-asset activities and markets;

- Revised high-level recommendations for the regulation, supervision, and oversight of “global stablecoin” arrangements.

As many crypto-asset activities are still operating without being subject to comprehensive regulation, or being undertaken in non-compliance with applicable jurisdictional regulations, it is important that FSB members implement these high-level recommendations and relevant international standards fully and consistently.

Jurisdictional authorities may apply and enforce xisting requirements and laws, as well as develop new or additional regulatory approaches.

Earlier FATF Updates Guidance on Virtual Crypto Assets – NFT, DeFi & Stablecoin’s Standards. On June 27th 2023, the FATF published its report on country compliance with Recommendation 15 – including the Travel Rule – and updates on emerging risks and market developments. Global implementation and compliance remain relatively poor and behind most other financial sectors.

The FSB’s framework is based on the principle of “same activity, same risk, same regulation” and provides a strong basis for ensuring that crypto-asset activities and so-called stablecoins are subject to consistent and comprehensive regulation, commensurate to the risks they pose, while supporting responsible innovations potentially brought by the technological change.

Coverage of the crypto assets Recommendations

Specifically, in light of last year’s events, the FSB has strengthened both sets of recommendations in three areas, namely:

- adequate safeguarding of client assets;

- addressing risks associated with conflicts of interest; and

- cross-border cooperation.

The recommendations focus on addressing risks to financial stability, and they do not

comprehensively cover all specific risk categories related to crypto-asset activities.1 It takes account of lessons from recent events in crypto-asset markets. Central bank digital currencies (CBDCs) are also not subject to the recommendations.

U.S. lawmakers introduced legislation aimed at dispelling a cloud of regulatory uncertainty that looms large in the crypto assets industry. The 212-page bill titled the Financial Innovation and Technology for the 21st Century Act seeks to establish a “much-needed regulatory framework” for the digital asset space and marks a “significant milestone”.

The bill seeks to establish new definitions, covers digital asset exemptions, and outlines a path for digital asset intermediaries like cryptocurrency exchanges to register with both the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC).

The FSB and the IMF will deliver a joint report to the G20 in September 2023, which will synthesise the policy findings from IMF work on macroeconomic and monetary issues and FSB work on supervisory and regulatory issues published today

This will support a coordinated and comprehensive policy approach to crypto-assets by considering macroeconomic and regulatory perspectives, including the full range of risks posed by crypto-assets.

The FSB and the sectoral standard-setting bodies (SSBs) have developed a shared workplan for 2023 and beyond, through which they will continue to coordinate work, under their respective mandates, to promote the development of a comprehensive and coherent global regulatory framework commensurate to the risks crypto-asset markets activities may pose to jurisdictions worldwide, including through the provision of more granular guidance by SSBs, monitoring and public reporting.

The Financial Stability Board (FSB) coordinates at the international level the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies.

Its mandate is set out in the FSB Charter, which governs the policymaking and related activities of the FSB. These activities, including any decisions reached in their context, shall not be binding or give rise to any legal rights or obligations.