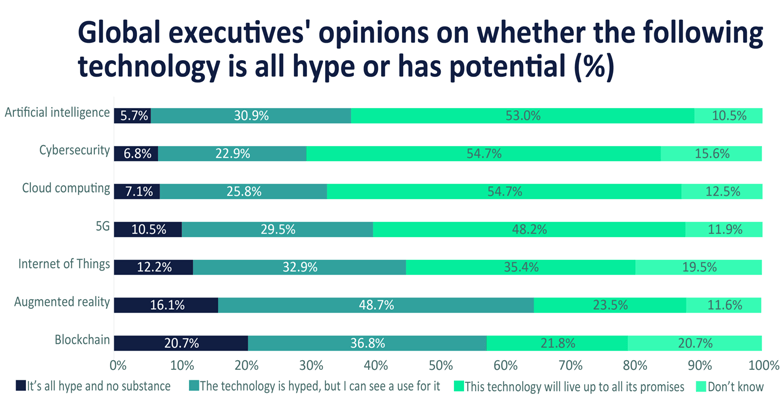

More than 20% of global executives are of the opinion that blockchain technology is all hype, as doubts about its industrial applicability increase due to the recent collapse of the Blockchain Insurance Industry Initiative (B3i), says GlobalData.

B3i has announced that it has filed for insolvency after failing to raise new capital in recent funding rounds.

Formed in late 2016, B3i represented a collaboration between various insurers and reinsurers to explore the potential of using Distributed Ledger Technologies (DLT) within the industry.

The Initiative successfully raised tens of millions of dollars in funding over its first few years of activity, and gained the support of some of the world’s largest insurance and reinsurance firms.

GlobalData’s Emerging Technology Trends Survey reveals that out of seven upcoming but leading technologies, blockchain was most widely believed to lack any real industry use-cases by business executives (see Agility Time for Blockchain in Insurance).

The company notes that the B3i episode leaves a question mark hanging over for the technology’s role in the industry.

Whilst blockchain and distributed ledger technology is certainly complex, uses have emerged in the insurance industry, notably in parametric insurance for natural disasters and catastrophes.

B3i consisted of many key players in the (re)insurance industry. That none of them seem to have the impetus to revive the project suggests many do not see a viable endgame to the initiative.

A further 20.7% of global executives responded “don’t know” when asked about the hype and substance of blockchain. This suggests that there is a significant level of misunderstanding regarding the technology.

How Industries Benefit from Blockchain? Moreover, respondents were also asked how their sentiment towards the seven technologies had changed in the past year, with 32.4% of respondents indicating that their sentiment towards blockchain is more negative than it was compared to the year before – the highest of all technologies in question.

Blockchain has often been a poorly defined and misunderstood topic. It’s association with the world of cryptocurrencies and digital assets has left it with a poor reputation among many people.

After a few years of hype around 2019 and 2020, negative sentiment appears to be creeping back in for blockchain, which is likely also driven by the collapse of cryptocurrency values in 2022.

Although this may set back the development and implementation of blockchain in insurance, use cases will remain and continue emerging in the future. As regulation is gradually introduced and strengthened within the space, some firms may get the confidence in the technology they need to reconsider the power of blockchain.

by Peter Sonner