Global estimated insured losses from natural catastrophes in 2022 totaled USD 70 billion, 22% above average of past ten years (USD 58 billion), according to Swiss Re Institute’s preliminary estimates.

Man-made events triggered an additional USD 3 billion in insured losses, bringing total catastrophe insured losses to USD 38 billion.

Global economic losses from natural and man-made catastrophe events are estimated at USD 75 billion in the first half of 2022. This is below the average of the past ten years (USD 80 billion).

Swiss Re representatives affirmed that climate change is one of the biggest risks our society and the global economy is facing.

Martin Bertogg, Head of Catastrophe Perils at Swiss Re, said: “The effects of climate change are evident in increasingly extreme weather events, such as the unprecedented floods in Australia and South Africa. This confirms the trend we have observed over the last five years, that secondary perils are driving insured losses in every corner of the world. Unlike hurricanes or earthquakes, these perils are ubiquitous and exacerbated by rapid urbanisation in particularly vulnerable areas. Given the scale of the devastation across the globe, secondary perils require the same disciplined risk assessment as primary perils such as hurricanes.”

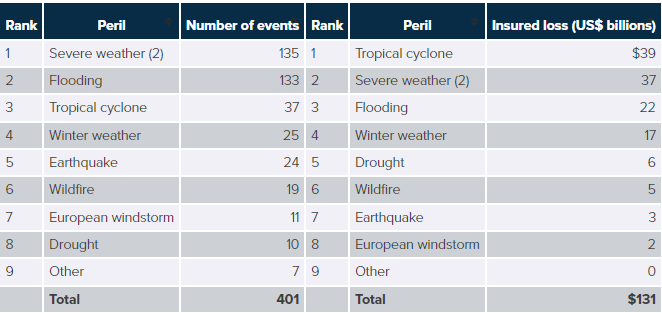

World Natural Disaster Events Ranked by Number Of Perils and Insured Losses

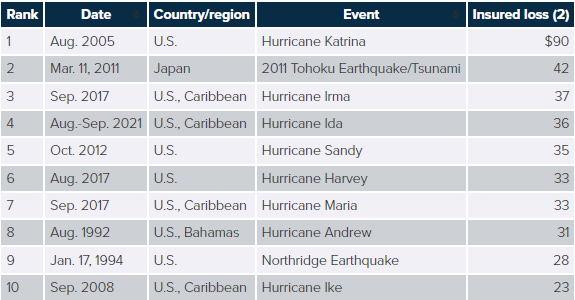

Top 10 Costliest World Natural Disasters By Insured Losses, 1900-2021

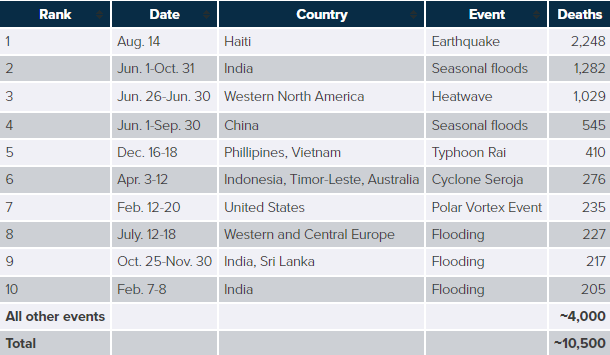

Top 10 Deadliest World Natural Catastrophes

“With 75% of all natural catastrophes still uninsured, we see large protection gaps globally exacerbated by today’s cost-of-living crisis. Partnering with the public sector, the insurance industry is critical for strengthening society’s resilience to climate risks, by investing in and underwriting sustainable infrastructure”, said Jerome Jean Haegeli, Swiss Re’s Group Chief Economist.