Israeli insurtech company Honeycomb, specializing in multi-family properties, has sequred $36 mn in a Series B funding round led by Zeev Ventures and participation from Arkin Holdings and Launchbay Capital, as well as existing backers Ibex Investors, Phoenix Insurance, and IT-Farm. Honeycomb’s total funding to date to $55 mn.

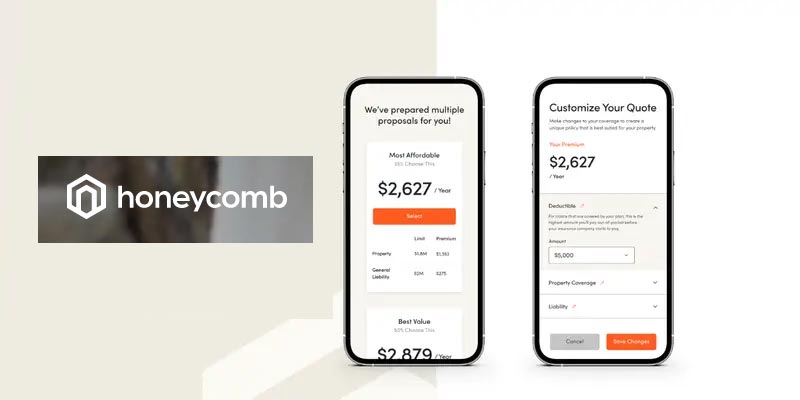

Leveraging AI-driven technology, Honeycomb offers precise risk management and underwriting at the individual building level, enabling competitive pricing for well-maintained properties.

This technology streamlines the traditionally time-consuming insurance process, allowing brokers to bulk-quote numerous submissions in real time, thus enhancing efficiency and profitability.

The new funding will be used to further improve the end-user experience, driving enhanced profitability to insurance broker partners, and broadening the type and size of policies offered.

The company intends to use the funds to expand its workforce, aiming to double its staff from 90 to 180 over the next 18 months, with many new hires stationed at its development center in Herzliya.

Honeycomb, founded by CEO Itai Ben-Zakan and CTO Nimrod Sadot, began offering real estate insurance in the U.S. in June 2021 and now operates in 16 states, covering 60% of the U.S. market.

We plan to deepen our technological advantage with proprietary AI models leveraging unique first-party data and expand into new insurance markets, turning Honeycomb into a one-stop shop for everything related to commercial real-estate insurance in the U.S.

Itai Ben-Zakan, CEO Honeycomb

The insurtech has issued policies for $21 bn worth of real estate and expects to triple this amount within the next year. The company primarily focuses on landlord insurance, operating in a U.S. market valued at $34 bn annually.

The company distributes its policies through its platform and an expanding network of insurance brokers. Insurance brokers can rapidly bulk-quote numerous submissions in real time, a task that traditionally required weeks.

This efficiency boosts brokers’ profitability and provides significant value to customers.

Zeev Ventures founding partner Oren Zeev also commented, saying, “Honeycomb is an example of an insurtech company that solves a major problem in a huge market, thus allowing it to increase ARR at a fast pace and progress to operational profitability in a short time.”