Lloyd’s of London announced a strong set of results for the six months of 2023, with an underwriting profit of £2.5bn (HY 2022: £1.2bn), an investment return of £1.8bn (HY 2022: £3.1bn loss) and a profit before tax of £3.9bn (HY 2022: loss of £1.8bn).

The market’s combined ratio improved 6.2 percentage points to 85.2% (HY 2022: 91.4%) demonstrating continued progress in underwriting performance.

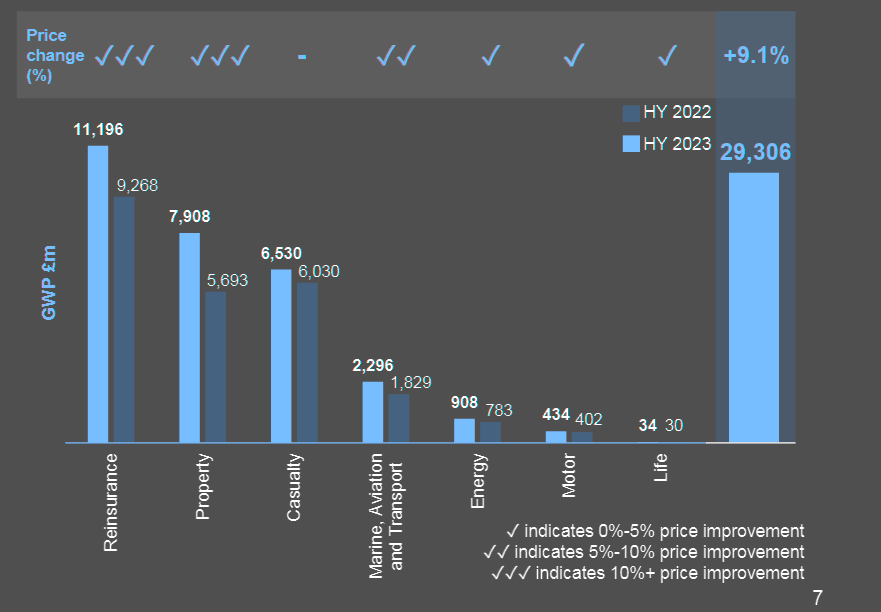

Lloyd’s continued to support profitable underwriting growth, with gross written premium increasing 21.9% to £29.3bn driven by growth from existing syndicates (6.5%), new syndicates (2.2%), foreign currency movements (4.1%) and risk-adjusted rate increases (9.1%). Major claims represented 3.6% of losses in the first half of the year.

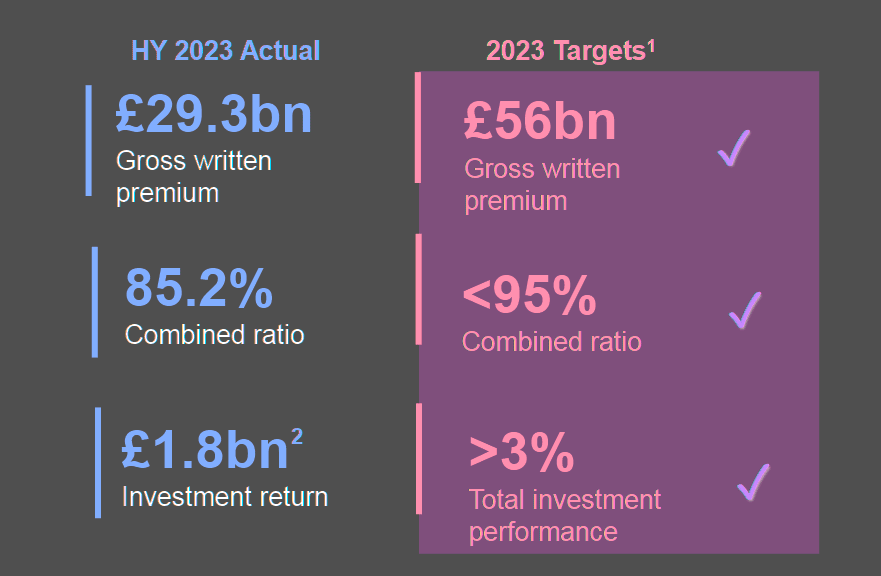

Lloyd’s 2023 half year results

- Gross written premium of £29.3bn (HY 2022: £24.0bn)

- Underwriting profit of £2.5bn (HY 2022: £1.2bn)

- Combined ratio of 85.2% (HY 2022: 91.4%)

- Net investment return of £1.8bn (HY 2022: loss of £3.1bn)

- Profit before tax of £3.9bn (HY 2022: loss of £1.8bn)

- Total capital of £40.8bn (FY 2022: £40.2bn)

- Central solvency ratio of 438% (FY 2022: 412%)

- Market-wide solvency ratio of 194% (FY 2022: 181%)

On track to deliver the growth, underwriting and investment outlook outlined in our FY results

2023 targets taken from Outlook provided at FY22. Subject to financial markets, F/X, unpredictable economic developments, and major losses within normal expected range. Investment return at HY23 is 1.9% investment performance.

Sustainable performance supports a digital, inclusive and purpose-led market

Lloyd’s balance sheet continued to strengthen with a central solvency ratio of 438% and market-wide solvency ratio of 194%, showing the market’s capital discipline and resilience through a range of market conditions.

We’re pleased to be reporting a strong set of results for the year so far – with profitability in both our underwriting and investments; a leading combined ratio, strong premium growth and a bulletproof balance sheet that means we can support customers through a range of shocks and scenarios

John Neal, CEO of Lloyd’s

“Combined with the market’s progress in driving sustainable performance, digitalisation and showing leadership from climate transition to culture change – these results set us up to deliver on our positive financial outlook for 2023”, John Neal says.

22 consecutive quarters of positive price improvement

A combined ratio is a measure of an insurer’s underwriting profitability based on the ratio of net incurred claims plus net operating expenses to net earned premiums. A combined ratio of 100% is break even (before taking into account investment returns). A ratio less than 100% is an underwriting profit.

Lloyd’s strong financial strength ratings are A+ (Strong) stable outlook with Standard & Poor’s, A (Excellent) positive outlook with A.M. Best, AA- (Very Strong) stable outlook with Fitch Ratings and AA- (Very Strong) stable outlook with Kroll Bond Rating Agency.