Analysts at international insurance broker Howden are forecasting that reinsurance sector returns will rise significantly in the next few years, with the sector set to grow in spite of – or perhaps even because of – the deteriorating global economic picture.

Both underwriting returns and return on equity for the reinsurance and specialty insurance sectors could be set to benefit from the recent economic downturn.

Investment into underwriting including MGAs remains reasonably robust. Perhaps this shouldn’t be a surprise, as insurance and reinsurance – particularly specialty and reinsurance lines – can be anti-cyclical to the global economy.

As we enter periods of economic deterioration and stagflation, insurance can benefit from higher yields, and higher pricing.

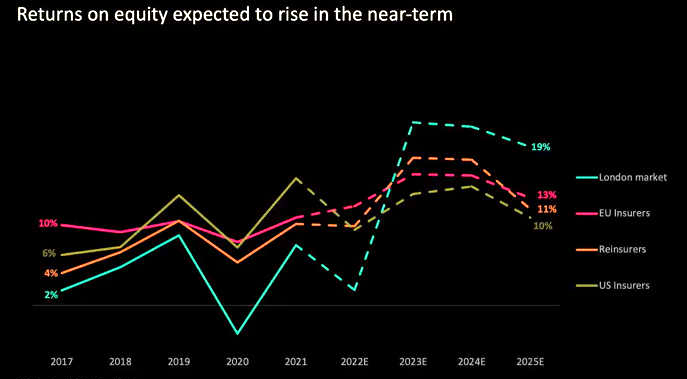

And indeed, a quick glance at analysts’ estimates for reinsurance and insurance carriers, shows higher anticipated returns on equity. Part of this is due to higher ‘R’ and part of it’s due to lower ‘E,’ at least in the short term.

Howden projects that returns on equity for reinsurers will have increased from 4% in 2017 to an estimated 11% by 2025, with US insurers also growing from 6% to 10% during this time, EU insurers from 10% to 13%, and London market firms enjoying a huge rise from 2% to 19%.

Notably, this growth is forecast at a time when reinsurance capital is seen as being impaired for the first time since the financial crisis,.

In fact, the premiums to surplus ratio of the reinsurance sector may now be above 100%. Analytics said, pointing to the impact of falling high grade fixed income securities, as well as falling cat bond price return indices, with capital again becoming trapped for the second time in recent memory.

But Howden data from the 2023 suggests that the drop in reinsurance capital is being driven almost entirely by unrealized losses, meaning there is still hope that the underwriting side of the balance sheet will recover and offset these costs.