S&P Global Ratings report that persistent pressures from inflation, tightening financial conditions and slower economic growth in China and other markets are likely to cause constraints on operating conditions for property/casualty insurers in emerging markets.

Ratings are stable, but some markets are seeing weakening trends. The P&C insurance sectors in China, Colombia, and Turkey continue to display negative credit trends

This is mainly driven by relatively weak underwriting results in China and Colombia and the weaker credit quality of the Turkish sovereign.

Higher inflation is set to increase the premium rates for P&C insurers as risks are being repriced. Short-term underwriting results are also anticipated to be constrained by increased claim costs, particularly in motor and property lines, and potential reserving shortfalls for longer-tail lines.

Elevated interest rates will gradually support investment results, though S&P suspect more volatile capital markets will lead to some revaluation losses.

New regulatory developments will continue to enhance risk awareness and policyholder protection, but the implementation of more sophisticated requirements comes at a cost. New regulations with higher capital requirements may prompt capital raising. For some, re-evaluation of business models could lead to consolidation

S&P Global Ratings credit analyst, Emir Mujkic

Capital adequacy remains a key strength for many, as 80% of S&Ps rated insurers in emerging markets maintained at or above the ‘A’ confidence level in 2021, due to the build-up of earnings in previous years. The overall size of capital remains small for insurers in most emerging markets, making capital buffers potentially more vulnerable to large single losses.

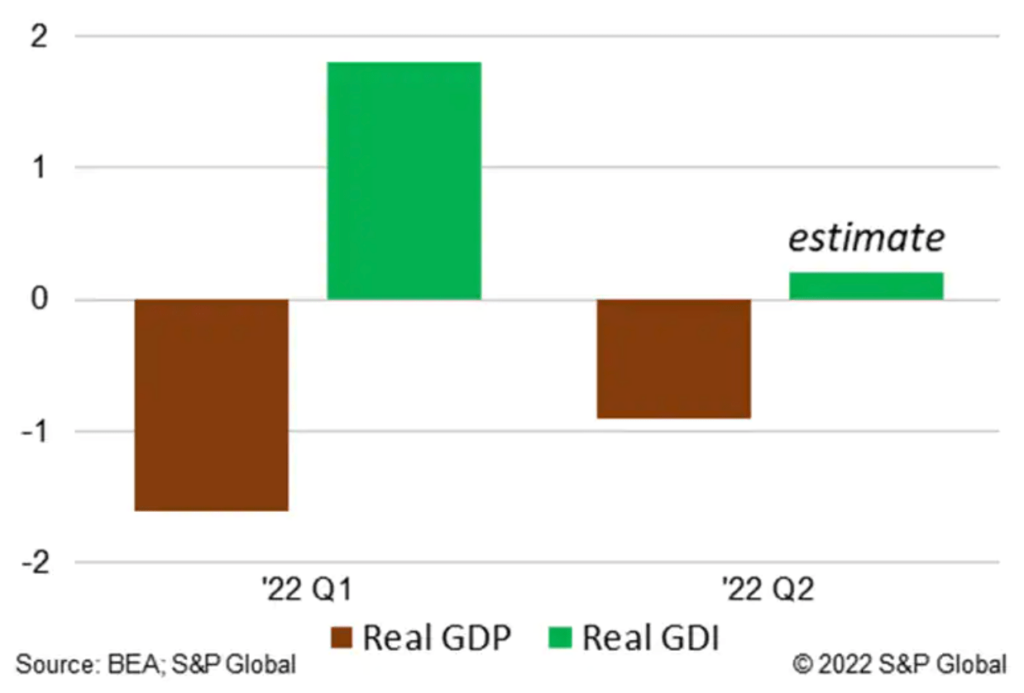

On July 28 the Bureau of Economic Analysis (BEA) reported that the nation’s inflation-adjusted (or “real”) Gross Domestic Product (GDP) fell at a 0.9% annual rate in the second quarter (Q2). This follows a decline of 1.6% in Q1, thereby satisfying the popular—although not the official—definition of a recession. But did the economy actually contract over the first half of the year?

GDP is spending on domestically produced final goods & services. A less familiar measure—Gross Domestic Income, or GDI—is payments to the domestic labor and capital that produced those goods & services. Since one person’s spending is another’s income, in principle the two measures are the same. However, because they are based on different data sources, GDP and GDI can—and sometimes do—differ by enough to give conflicting reads on the economy’s direction.

Alternative Measures of First-Half Economic Growth (% Change Annual Rate)

S&P expect capital buffers will remain robust in 2022 and 2023, though cushions could narrow if capital market volatility leading to lower asset valuations persists, completions remain high, and insurers are unable to adjust their rates for inflation.

While GDP contracted during the quarter, a corresponding estimate of GDI won’t be available from the BEA for another month. This delay arises because profits are compiled with a lag following the close of the Q2 reporting season.

However, for the S&P 500, a “mixed” estimate—one that combines earnings of those companies that have already reported (representing 72% of the value of S&P companies) with analysts’ estimates for those companies that haven’t—suggests that S&P 500 operating earnings grew 31% in Q2 before seasonal adjustment.

Now, GDI includes the profits of all corporations—large and small, public and private, C-corps and S-corps—not just the 500 public, large-cap, C-corps covered by the S&P 500.

Furthermore, the BEA adjusts reported earnings not only to remove seasonal variation, but also downwards to reflect the cost of replacing inventories and depreciated fixed assets at current rather than book prices. In today’s inflationary environment, these latter adjustments are large.

Nevertheless, our estimate is that corporate profits, as measured in the National Accounts, grew enough that GDI increased a modest 0.2% in Q2 following the stronger rise in Q1.

So, did the economy contract over the first half of 2022? It’s a tale of two measures, and we’ll have a better idea of the story’s ending come the 25th of August when the BEA releases its estimate of second-quarter Gross Domestic Income.