Singapore’s life insurance industry is set to grow at a compound annual growth rate (CAGR) of 9.8% from $47.2 bn in 2022 to $77 bn in 2027 in terms of gross written premium.

According to GlobalData, the rise will be driven by the upsurge in demand for life insurance, which in turn is caused by awareness from the global pandemic.

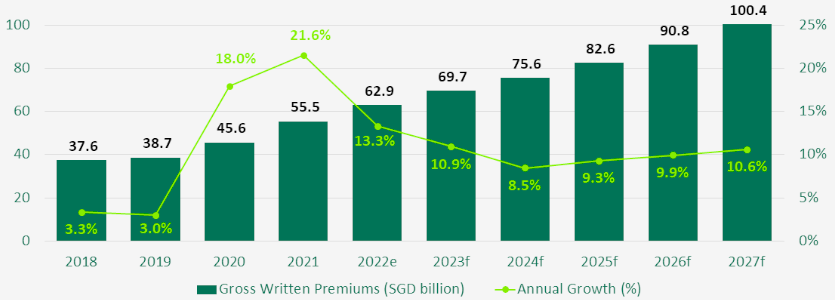

Last year, the state recorded an increase of 13.3% for its life insurance sector, with a further 10.9% growth in 2023.

This growth is equal to a CAGR of 9.8%, accounting for the period between 2022 and 2027.

Singapore’s life insurance industry has shown resilience and recorded its fastest growth in recent years despite the pandemic. After witnessing high growth of 18% and 21.6% in 2020 and 2021 respectively, the industry growth is expected to slowdown from 2022 onward due to slowing economic growth, rising inflation, and global geopolitical uncertainties.

The share of single premium policies in the overall life insurance GWP has increased from 32.3% in 2019 to 49.7% in 2022.

Singapore life insurance industry premiums

Whole life insurance is the largest segment within the Singapore life insurance market, accounting for a 50.3% share of the GWP in 2022.

The demand for whole life insurance is driven by the pandemic-induced awareness of the need for financial protection from life-threatening events and diseases. Whole life insurance is expected to grow at a CAGR of 10.0% during 2022-2027.

Singapore life insurance industry growth is expected to slow down from 2022 onwards due to slow economic growth, rising inflation, and global geopolitical uncertainties.

Shabbir Ansari, GlobalData senior insurance analyst

A large proportion of whole-life premiums in Singapore come from single premium policies, driven by the presence of a large affluent population. Singapore has one of the largest concentrations of high net-worth individuals (HNWI).

Endowment insurance accounted for a 33.1% share of the overall life GWP in 2022. Non-linked endowment policies are preferred insurance products in Singapore as they provide guaranteed returns along with life insurance cover.

Non-linked endowment insurance accounted for more than 80% of the total endowment GWP in 2022.

Shabbir Ansari, GlobalData senior insurance analyst

In order to compete with bank products that offer attractive interest rates on savings and fixed deposits, insurers are innovating their product offerings to increase sales.

For example, insurers are offering short-term endowment plans with maturity durations between 2-6 years, which has made these products an attractive option for guaranteed returns. Endowment insurance is expected to grow at a CAGR of 10.8% over 2022-2027.

Personal Accident and Health (PA&H) accounted for an 8.6% share of the overall life GWP in 2022. The rise in healthcare costs, which are expected to increase by 9% in 2023, and increasing health awareness have pushed the demand for private health insurance in Singapore. PA&H insurance is expected to grow at a CAGR of 5.3% during 2022-2027.

Term life as well as other life and annuity insurance accounted for the remaining 8% share of the life insurance GWP in 2022.

The Singaporean life insurance industry is expected to witness strong growth over the next five years, supported by increasing awareness for financial protection, product innovations, and a growing affluent population in the country.

by Yana Keller