Trading automation protocol Umoja seed funding round has raised an additional $2 mn, bringing the total to $4 mn.

The round was led by Robby Greenfield, former Head of Social Impact at ConsenSys, with the participation of other notable investors including Coinbase and Blockchain Founders Fund.

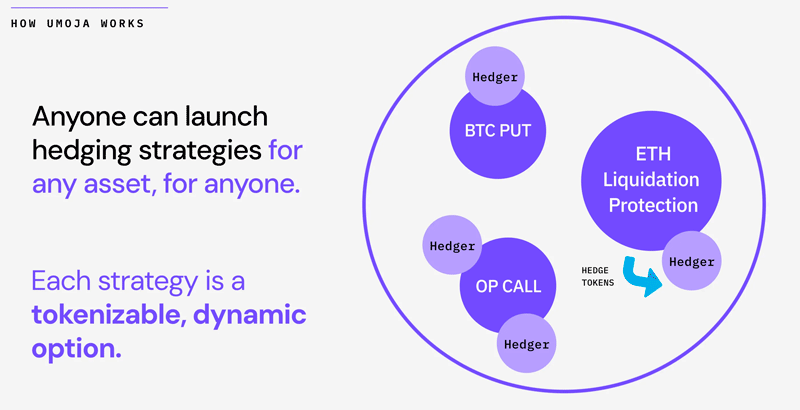

Umoja is a non-custodial, asset-hedging protocol that automates the hedging of everything — from crypto, to fiat, to tokenized RWAs. Using Umoja, anyone can deploy or utilize a hedging strategy based on their exposure risks — from protecting against asset depreciation to liquidation (see Why Do Insurers & Financial Institutions Need Tokenization?).

The protocol intends to break down the “ROI Paywall,” a term used to describe the phenomenon where retail investors, despite holding a $7.2 trillion market share, are often sidelined by institutional players, who have exclusive access to powerful tools that guide their investment strategies.

Umoja utilizes ‘Synths’ to enable financial instruments aimed to provide these retail investors with advanced wealth creation, with tools such as delta-neutral stablecoins and hedged assets.

Bitcoin opened the door to accessible money; Umoja is now paving the way for accessible wealth creation by making asset management as simple as holding the asset itself

Robby Greenfield, CEO of Umoja

“This marks the pivotal moment where traditional finance and decentralized finance converge”, Robby Greenfield explains.

With the asset management market projected to grow to $8.3 trillion by 2032, Umoja plans to offer tailored investment strategies to match individual risk tolerance.

The protocol faces the recent funding as investor’s confidence in its potential to transform the crypto industry and enhance social impact through broadened access to smart money.

Umoja empowers “Hedgers”, individuals seeking to mitigate their exposure to specific assets, with seamless access to competitive, automated, and cost-effective hedging services through “Hedge Funds,” investment funds developed to neutralize a particular asset’s risk.

“Our platform welcomes anyone to either establish their Hedge Fund or invest in existing ones to effectively hedge their asset exposure. Hedge Funds play a pivotal role in assisting Hedgers to strategically minimize their exposure risk by executing customized investment strategies precisely tailored to the assets they aim to hedge”, says Robby Greenfield.

The first Hedge Funds that will be deployed on Umoja will focus on hyper-cost effective BTC and ETH risk mitigation across spot and margin trading.

Additionally, we’ll deploy a limited set of Collateralized Debt Position (CDP) and Liquidity Provider token (LP) options to test the novelty of our approach in high-volume, but niche lending and DEX markets.