Vienna Insurance Group (VIG) reports strong results for the first half of 2023, presented for the first time in accordance with the IFRS 9 Financial Instruments and IFRS 17 Insurance Contracts accounting standards.

VIG anticipates a weak macroeconomic environment and volatile capital markets going forward and for 2023 as a whole.

The considerable number of uncertainties limits the ability to predict our business performance for the second half of 2023. Results are likely to be dampened due to the severe weather events this summer and the probability for further extreme weather. We expect a result before taxes for the Group between EUR 700 million and EUR 750 million for 2023 as a whole.

Against a backdrop of continuing challenges such as the ongoing war in Ukraine, high inflation and an uncertain economic outlook, VIG’s performance in the first half of 2023 is extremely positive. Our capital position and business model with a strong regional focus – which allows rapid, customised action where required – remain fundamental factors behind our continuing success in very challenging times

Hartwig Löger, General Manager and CEO of Vienna Insurance Group

All IFRS values reported refer to the IFRS 9 and IFRS 17 accounting standards, which have been applied for the first time. The 2022 figures have been adjusted on the basis of these standards and can no longer be compared to figures previously published for the 2022 financial year.

Increase in gross written premiums in all segments

VIG achieved gross written premiums in the amount of EUR 7,306.7 million in the first half of 2023. This represents a significant increase of 10.8% compared to the previous year’s figure of

EUR 6,595.1 million. All reportable segments show premium growth compared to the first half of the previous year. Poland, Extended CEE and Special Markets segments performed particularly well.

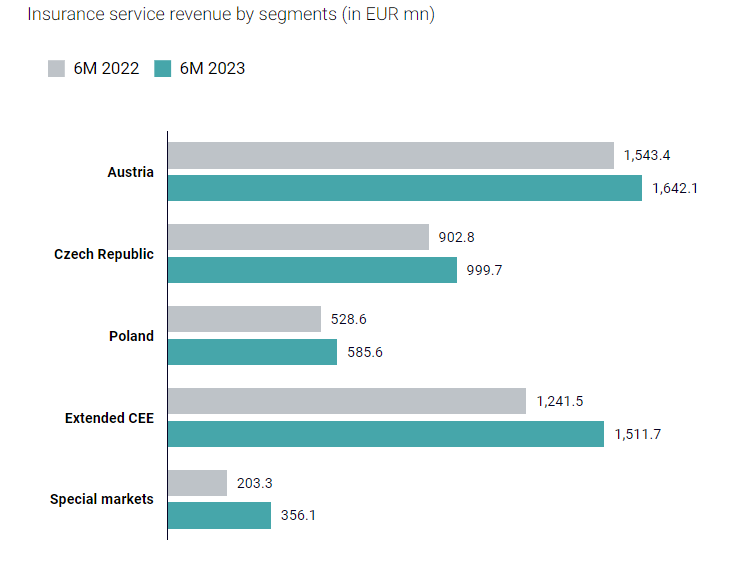

Insurance service revenue of EUR 5.4 billion up by 13.7%

Substantially improved result before taxes of EUR 462.9 million

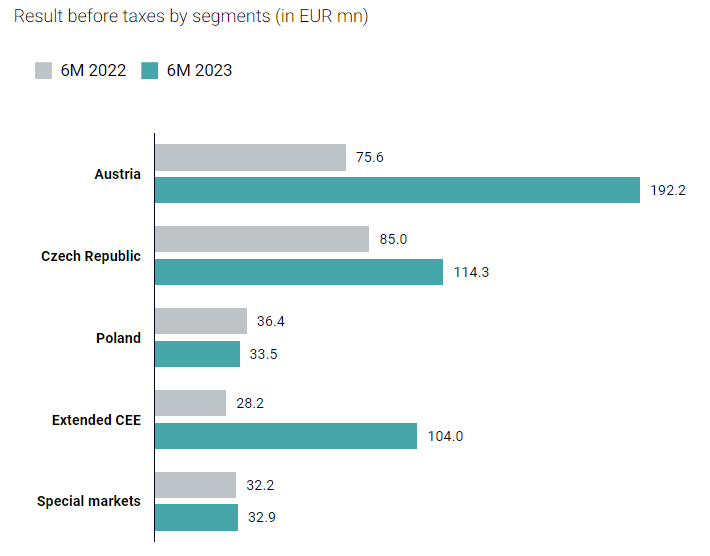

Result before taxes up significantly to EUR 463 million

The result before taxes increased significantly in the first half of 2023, improving by 118.4% to

EUR 462.9 million (first half of 2022: EUR 212.0 million). The result in the previous year was strongly affected by interest rate developments during the reporting period and by measures in the amount of EUR 126.1 million in connection with the Russian government and corporate bond exposure of. By contrast, a profit of EUR 20.3 million was generated in the 1st half of 2023 through the sale of Russian government and corporate bonds.

Under IFRS 17, Vienna Insurance Group primarily applies the Variable Fee Approach (VFA) to its long-term life and health insurance business. This accounts for around 75% of technical reserves. Due to the significant rise in the yield curve last year, the contribution from these areas in the first half of 2022 was significantly lower.

Net combined ratio of 94%

The net combined ratio for the first six months of 2023 was 94.0% (first half of 2022: 90.6%). This is primarily due to the consideration of higher claims volatilities in the liability for incurred claims (LIC). With the application of IFRS 17, the net combined ratio calculation method has changed. It is now calculated on the basis of the insurance service expenses from issued business less insurance service expenses from reinsurance held, divided by the insurance service revenue from issued business less insurance service revenue from reinsurance held in property and casualty insurance.

Insurance Service Revenue – issued business

Under IFRS 17, the insurance service revenue includes the consideration that an insurance company receives or expects for the assumption of insurance risks or insurance-related services in a given period. This amounted to EUR 5,380.4 million in the first six months of 2023 (first half of 2022:

EUR 4,732.9 million), which is 13.7% higher than in the same period of the previous year. The increase results primarily from the dynamic development of the gross written premiums in the Premium Allocation Approach (PAA), which has a direct effect on the insurance service revenue and from increased releases of the Contractual Service Margin (CSM) in the General Measurement Model (GMM) and in the Variable Fee Approach (VFA).

Income Statement

| in EUR mn | 6M 2023 | Changes, % | ||||

| Insurance service result | 550.8 | 5.7 | ||||

| Insurance service revenue – issued business | 5,380.4 | 13.7 | ||||

| Insurance service expenses – issued business | -4,807.4 | 17.3 | ||||

| Insurance service result – reinsurance held | -22.2 | -80.3 | ||||

| Net investment result | 233.4 | – | ||||

| Investment result | 1,098.4 | – | ||||

| Income and expenses from investment property | 30.0 | 28.6 | ||||

| Insurance finance result | -910.8 | – | ||||

| Result from at-equity consolidated companies | 15.7 | 77.4 | ||||

| Finance result | -52.1 | 22.0 | ||||

| Other income and expenses | -269.1 | >100 | ||||

| Business operating result | 463.0 | >100 | ||||

| Adjustments | 0.1 | – | ||||

| Result before taxes | 463.1 | >100 | ||||

Contractual service margin (CSM)

The Contractual Service Margin (CSM) is the unrealised profit originally priced into the insurance contract, which is reported as a separate component of the technical provisions. As of 30 June 2023, it is EUR 5,934.9 million (31 December 2022: EUR 5,838.1 million).

Operating return on equity (Operating RoE)

The operating return on equity shows the profitability of the insurance group by measuring the business operating result in relation to the capital employed. This ratio is calculated by dividing the Group’s business operating result by the average shareholders’ equity. Shareholders’ equity adjusted for unrealised gains and losses recognised directly in shareholders’ equity is used as the basis for the calculation. The Group generated an annualised operating return on equity of 15.8% on the basis of the half-year result 2023 (end of 2022: 10.9%).

Total capital investment portfolio

The total capital investment portfolio was EUR 41.7 billion as of 30 June 2023. The increase compared to EUR 41.1 at the end of 2022 is attributable primarily to the increased market values of those investments that are measured at fair value.

Outlook for 2023

Subject to the aforementioned considerations and subject to substantial interest rate or market volatilities as well as in view of the prevailing weather extremes, VIG expects the Group’s result before taxes to be in the range of EUR 700-750 million for the full-year 2023 under IFRS 17/9. The first figures prepared in accordance with IFRS 17/9 for the first half of 2023 reveal the expected volatility increase of results based on the effects of the changed interest rate environment. VIG is therefore currently reviewing the objectives for the financial performance indicators and the dividend policy in accordance with the amended accounting standards.

by

by