Overview

To increase resilience, both adaptation and mitigation are needed in Latin America as insurance alone cannot help protect the region from disruption caused by severe weather events brought by El Niño and La Niña, which will also test the long-standing protection gaps, according to Swiss Re Institute report.

A rare event is expected to occur this year: a swift transition from a strong El Niño to La Niña weather conditions.

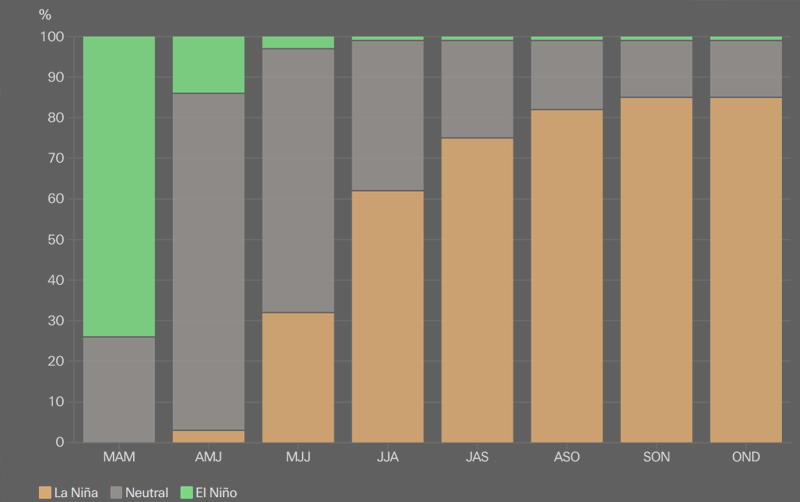

Weather projections suggest a return to El Niño-Southern Oscillation (ENSO) neutral conditions – starting in May – and also a more than 80% chance of swift transition to La Niña in late summer and the fall (see Impact of Climate Change on Insurance Industries).

NOAA Declares a “La Niña Watch” as Expected Transition Looms

NOAA officially declared the end of El Niño in June as ocean waters across the central and eastern Pacific Ocean had sufficiently cooled to mark the arrival of ENSO-neutral conditions. This signaled the end of the strongest El Niño phase since 2015/16.

The agency additionally noted the issuance of a “La Niña Watch” as the quick cooling of surface waters in the Pacific’s “Niño–3.4 Region” signaled the pendulum swing back towards La Niña.

NOAA noted that there was a 70% likelihood that La Niña conditions would arrive by the August–October timeframe. This would directly coincide with the peak of the Atlantic hurricane season. The agency cited that La Niña would be anticipated to persist into the Northern Hemisphere winter months in 2024/25.

It should be noted that a quick transition to La Niña is common in the immediate aftermath of a strong phase of El Niño. This quick shift also occurred following historical strong El Niño events in 1982/83 and 1997/98. The arrival of La Niña should help moderate the accelerated rate of record land and ocean warmth that was observed during the most recent El Niño.

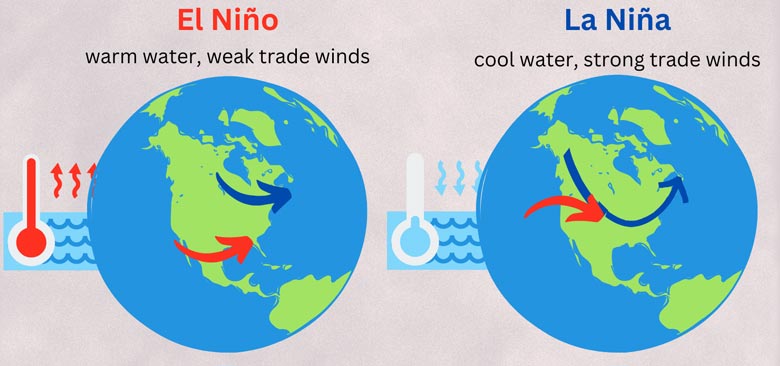

For background context, the El Niño-Southern Oscillation (ENSO) is a pivotal seasonal climate phenomenon that affects large-scale atmospheric and ocean circulations. This in turn greatly influences global temperature and precipitation patterns.

ENSO is a recurring oscillation involving changes in the temperature of waters in the central and eastern equatorial Pacific Ocean and their subsequent impacts on atmospheric conditions.

Warming periods are noted as El Niño cycles and cooling periods are known as La Niña cycles. The ENSO footprint historically has the greatest influence during the Northern Hemisphere winter months (December to March).

It is important to note that to be considered an ENSO phase, NOAA requires five consecutive three-month running mean averages of sea surface temperature (SST) anomalies in the Niño–3.4 region to be +0.5°C (El Niño) or -0.5°C (La Niña).

La Niña’s large-scale atmospheric circulations cause rising air in the western Pacific, leading to increased storms and rainfall.

This phenomenon is linked to wetter conditions in parts of northern South America and southern Africa. La Niña often results in drier, milder conditions in the US Southwest, raising concerns about drought, decreased snowpack, and strained water resources. In California, this can exacerbate wildfire risk.

In Australia, La Niña’s impacts extend into the warm months, with the east coast facing severe flooding during La Niña summers. According to the Australian Bureau of Meteorology (BoM), 12 of 18 La Niña events since 1900 have led to floods.

While NOAA is a global authority on tracking ENSO, regional weather and climate centers worldwide also monitor the phenomenon, often using different thresholds and metrics. Currently, international agencies agree on a likely La Niña development in the second half of 2024.

For example, BoM uses its own climate models, with three out of seven surveyed models indicating sea surface temperatures at La Niña levels starting in September. The Philippine Atmospheric, Geophysical and Astronomical Services Administration (PAGASA) predicts La Niña is most likely between October and December.

NOAA Climate Prediction Center ENSO probabilities

ENSO, a climate phenomenon marked by irregular sea surface temperature variations in the Pacific Ocean, manifests as El Niño during warmer periods and La Niña during cooler periods.

This year, a rare combination of both conditions is anticipated to impact Latin America, a region highly vulnerable to ENSO-triggered extreme weather.

Historical data since 1950 indicates that only in 1973 and 1998 has there been a single three-month period of ENSO-neutral conditions between these two phases (see how NatCat Insured & Economic Losses Increases Due to Climate Change).

The ENSO is a climate phenomenon

The ENSO is a climate phenomenon of irregular variations in sea surface temperatures (SSTs) in the Pacific Ocean, known as El Niño when warmer, and La Niña when cooler. The 2023-2024 El Niño has brought heat waves to Brazil, wildfires to Chile, Argentina, and Colombia, and floods in several others.

Heavy rainfall and warmer weather has created optimal mosquito breeding conditions in Brazil and Peru, with record high dengue cases and declaration of a national sanitary emergency.

Though near its end, in the last week torrential rains induced by the current El Niño have struck southern Brazil, causing deaths, floods, mudslides and dams to collapse.

The severe weather events brought by El Niño in 2023-2024 and potentially also by La Niña in the summer will likely accentuate already-high agriculture and property protection gaps across the region, the Swiss Re Institute highlighted (see Re/Insurers’ Survey about ESG Strategy & Climate Risk Modelling).

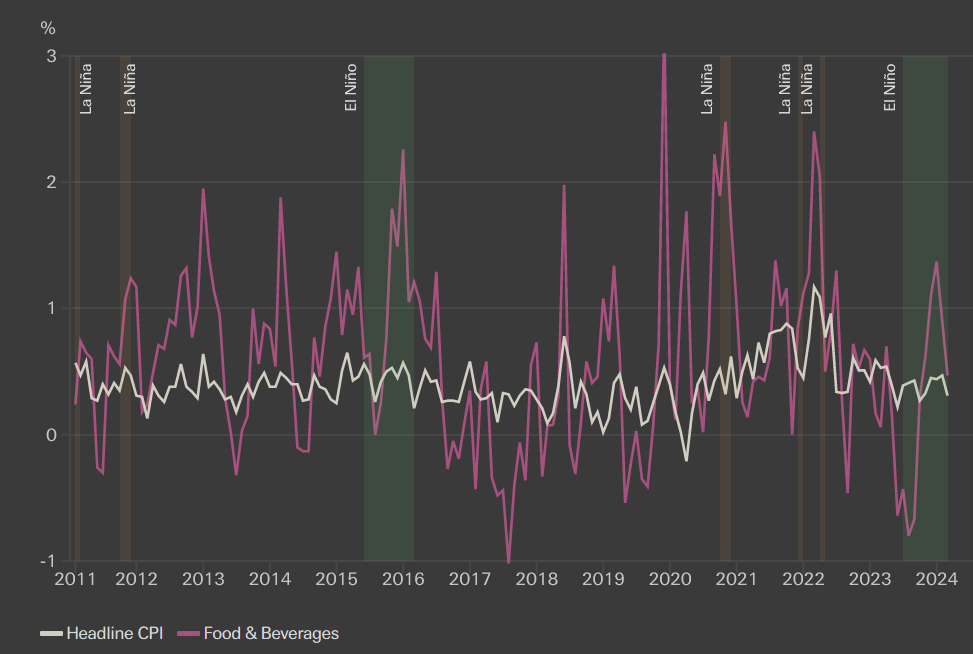

Further, a swift transition to La Niña could prolong a three-year period of high inflation as food and energy prices become subject to a supply shock.

The 2023-2024 El Niño has brought heat waves to Brazil, wildfires to Chile, Argentina, and Colombia, and floods in several others.

In Brazil and Peru heavy rainfall and warmer weather has created optimal mosquito breeding conditions, with record high dengue cases and declaration of a national sanitary emergency.

Though near its end, El Niño has caused torrential rains in the last week that have struck southern Brazil, causing deaths, floods, mudslides and dams to collapse.

At the other extreme, in 2023-2024 Panama has seen unprecedented droughts, which has caused low water levels in the Canal, disrupting a key global trade route.

ENSO can trigger extreme weather events with global reach. Variations in commodity exports due to ENSO weigh on growth and inflation; moreover, disruption to agriculture weighs particularly heavily on rural communities.

In 2021/2022, the last La Niña caused record droughts in Latin America, resulting in crop yield shortfalls and, in turn, higher global food prices. For example, in Brazil agriculture insurance claims increased 47% in 2022.

At a macro level, variations in commodity exports due to ENSO weigh on growth and inflation. The disruption to agriculture weighs particularly heavily on rural communities. The last La Niña in 2021/22 caused record droughts in the region, resulting in crop yield shortfalls and, in turn, higher global food prices.

In Brazil, agriculture insurance claims increased 47% in 2022. For Latin America, our estimates show crop resilience (34%) has improved since 2016 due to higher insurance penetration and government policies to promote uptake.

The index is still well below the global average (41%), with an estimated USD 6 billion crop protection gap in premium equivalent terms.

For Brazil and Mexico, weather-related insurance resilience indices are 10% and 18%, respectively, well below advanced economy levels (eg, US (53%); Switzerland (80%)), but also lagging emerging market peers like South Africa (20%) and Turkey (30%).

Research finds the economic effects of ENSO to be non-linear and heterogeneous, with some countries facing more adversity than others.

However, losses generally entail damage to infrastructure, disruption to agriculture and inflation via higher food and energy prices. The timing of this year’s anticipated back-to-back ENSOs could prolong the remnants of a three-year-long fight against inflation.

Monthly rate of inflation in Latin America, and ENSO periods

For Latin America, estimates show crop resilience (34%) has improved since 2016 due to higher insurance penetration and government policies to promote uptake. However, the index is still well below the global average (41%), with an estimated USD 6 billion crop protection gap in premium equivalent terms.

For Brazil and Mexico, weather-related insurance resilience indices are 10% and 18%, respectively, well below advanced economy levels (eg, US (53%); Switzerland (80%)), but also lagging emerging market peers like South Africa (20%) and Turkey (30%).

The effects of ENSO climate events are non-linear and heterogeneous, but typically entail damage to infrastructure, weaker growth and inflationary pressures, according to research.

The timing of this year’s anticipated back-to-back ENSOs could prolong the remnants of a three-year-long fight against inflation. Swiss Re expect the disinflation trend in the region to prevail, but with added bumpiness. The estimates show that, a +/- 1°C anomaly in SSTs can add anywhere between 0.24 and 0.47 ppts of annualized headline inflation to the region.

Greater adoption of insurance products, such as parametric solutions, can expedite the recovery from economic losses. However, building resilience also requires adaptation and loss mitigation strategies.

For example, the Panama Canal Authority is considering constructing a multi-purpose reservoir to manage dry seasons and maintain operations during droughts.

Additionally, regional infrastructure urgently needs enhancement. In 2023, the gap between actual spending and the required investment is projected to be 1.3% of GDP, the second highest among emerging regions after Africa.

For insurers, the direct impact of food and energy inflation should be small. However, experts warn, the second-order effects on core CPI via wage growth would add to claim costs for some non-life lines of business.

Analysts suggest that insurance products like parametric solutions can facilitate swift recovery of economic losses. However, increasing resilience, building adaptation and loss mitigation measures are also needed, the Institute concluded.

………………..

AUTHORS: Fernando Casanova Aizpun – Senior Economist, Swiss Re Institute & Caroline De Souza Rodrigues Cabral – Senior Economist, Swiss Re Institute