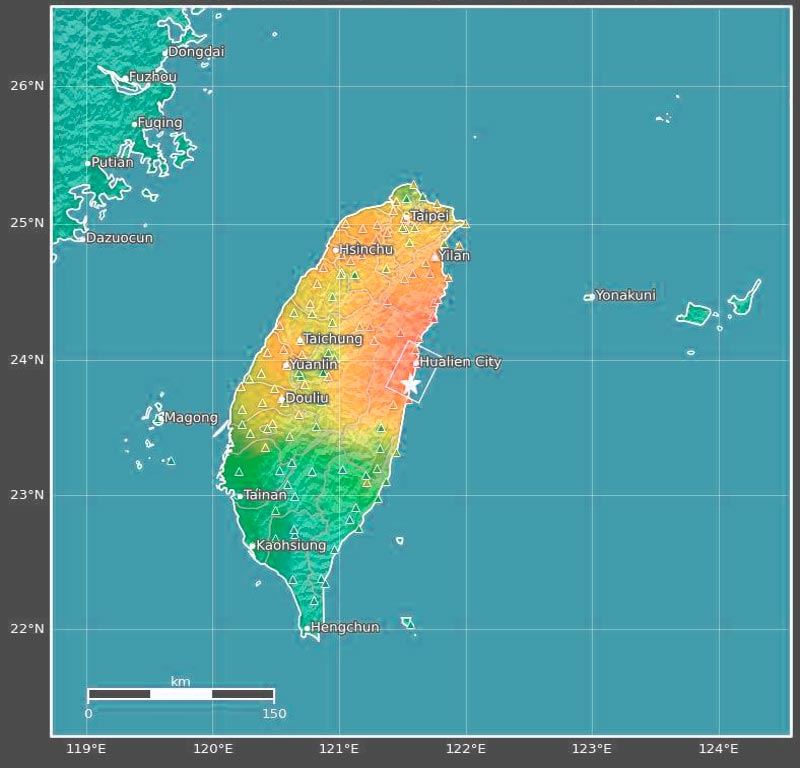

CoreLogic estimates insurable losses from the 7.2 magnitude earthquake that hit Taiwan on April 3, 2024 will be between $500 mn and $1 bn.

According to CoreLogic’s model loss from this earthquake, losses include ground shaking and fire-following damage to only residential, commercial, industrial, and agricultural properties in Taiwan.

Estimated losses do not include any damage to government buildings and transportation infrastructure such as bridges or roads. Demand surge is included.

The insurable losses represent ground up damage and do not consider the application of policy deductibles or limits (see NatCat Insured & Economic Losses Increases Due to Climate Change).

Additionally, the estimate does not exclude losses ceded to the Taiwan Residential Earthquake Insurance Fund, a non-profit organisation which operates as an earthquake insurance pool system designed to build consensus to strengthen the earthquake insurance mechanism.

The country has relatively high levels of insurance penetration, yet this catastrophe has caused meaningful loss for the local insurance industry (see Top Risks for the Global Insurance Industry).

Large semiconductor manufacturing companies in Taiwan are said to have temporarily halted operations and evacuated a number of their plants after the earthquake, which could be a possible source of BI.

Taiwan manufactures over 60% of the semiconductors in the world, with most of its capacity coming from one company, Taiwan Semiconductor Manufacturing Company (TSMC).

TSMC, the main contract chipmaker to Apple Inc. and Nvidia Corp., reportedly moved staff out of certain areas after the earthquake. The firm observed in a statement, “There is no damage to our critical tools including all of our extreme ultraviolet lithography tools.”

A small number of tools were damaged at some facilities, but the company is deploying all available resources to ensure a full recovery.

AM Best has stated that its market segment outlook for Taiwan’s non-life insurance segment stands at negative, owing to rising reinsurance costs and declining investment assets.

Following the segment’s huge pandemic insurance losses in 2022, the industry’s capitalization has weakened, despite number of players receiving capital injections from parent companies.

Special reserves, treated as a capital buffer to support large losses, have also been reduced materially by reserve releases that offset pandemic insurance claims.

The diminished special reserve buffer resulted in an increase in catastrophe reinsurance purchase at the upper layers in past renewals. However, some insurers increased the retention level of their catastrophe reinsurance programmes, due to rising reinsurance costs in hard market conditions, which may translate to higher volatility in their net profit.

Strong Seismic Codes May Mitigate Some Loss

Hualien County will likely see the most damage from the Mw 7.4 earthquake. Fortunately, Taipei’s strong building codes for modern buildings mitigated major damages.

Taiwan has a long history of development, implementation, and enforcement of seismic codes. However, there remains a mix of modern, well-designed buildings and older, unreinforced masonry and non-ductile concrete buildings.

Taiwan introduced the first seismic code in 1974. This code was based on the U.S. Uniform Building Code and was later revised in 1982 to incorporate the importance factors for various building occupancy classes.

A major update in 1997 included the dynamic analysis procedures using the response spectrum method; a change in seismic zoning and the associated zoning factor; and the adjustment of force reduction factor. The most modern version of the Taiwan seismic code was released in 2005.

Taiwan residential, commercial, industrial, and agricultural construction practices primarily rely on reinforced concrete for building materials.

Unreinforced masonry is also common in residential construction, though to a lesser degree than reinforced concrete. Commercial and industrial properties rely on steel construction as the next most common building material. Agricultural properties can use a range of different materials, including both reinforced and unreinforced masonry and steel.

Earthquakes Are Common in Taiwan

A reverse thrusting mechanism along the subduction zone boundary of the Eurasia Plate and Philippine Plate characterizes this earthquake sequence. However, given the shallow depth of the earthquake, it is likely that the source originated within the Eurasia plate above the subduction zone.

Taiwan has a long history of disastrous earthquakes. In the past 50 years, there have been six Mw 7.0 or stronger earthquakes that have struck within 250 km of the April 2024 Mw 7.4 event.

The most recent catastrophic earthquake was the Mw 7.6 Chi-Chi Earthquake in 1999. This earthquake caused approximately 2,400 deaths and 11,000 injuries.

The earthquake also damaged over 100,000 buildings — destroying approximately 52,000 buildings and severely damaging another 54,000 — at an estimated cost of $14.1 billion, according to the International Disaster Database, EM-DAT as of 2012.

Initial monetary impact estimates from the April 3 Mw 7.4 earthquake and subsequent aftershocks are not expected to be as devastating as the Chi-Chi Earthquake.

Reports from Taiwan indicate some severe damage and travel disruptions in eastern Taiwan, especially in Hualien County. Some of the most impacted buildings were the Hualien Hospital, the Hualien Cultural Center, and the Marshal Hotel.

Disruption to the power, water, and communication networks, as well as the transportation system have been reported. Officials temporarily closed the Hualien Airport and the Taiwan Railway, and landslides damaged or blocked roads and bridges.

by

by