As an extension of its rankings of insurance providers worldwide, and based in part on guidance from some of the largest underwriters in the sector, Insuramore has completed a global ranking of insurer (carrier) groups as measured by cyber insurance gross direct premiums written (GDPW).

- Globally, over 180 insurer groups were underwriting cyber risks by the end of 2021

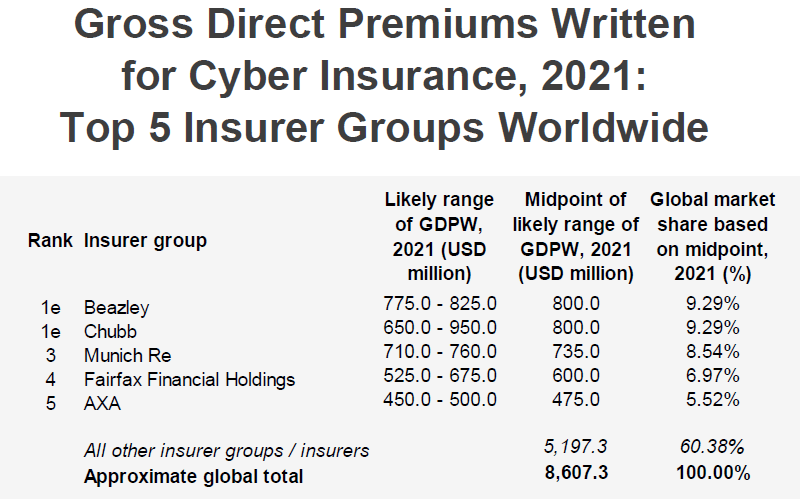

- Worldwide GDPW amounted to around USD 8.6 billion with the top 20 groups in the sector accounting for almost 77% of this value

- Several factors point to a continuing upward trajectory for cyber insurance albeit recent growth rates are unlikely to be sustainable

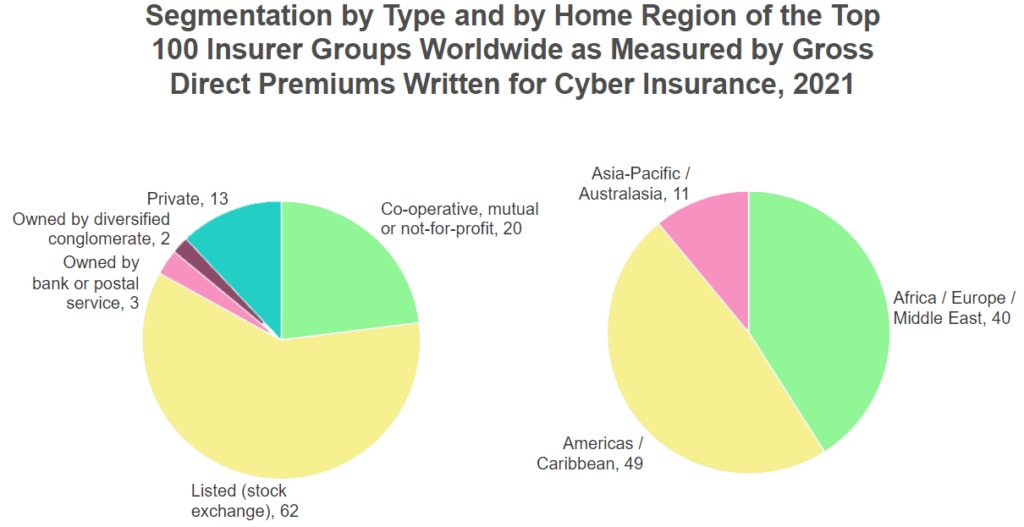

This analysis indicates that GDPW for cyber insurance can be estimated globally at around USD 8.61 billion in 2021 rising to almost USD 9 billion if captive insurers are also included, and with the US alone likely to make up over a half of the total. With regards to the competitive structure of the market, it shows that the top 20 groups for this class are likely to have accounted for almost 77% of premiums worldwide and the top 100 groups for over 98%.

Cyber insurance is defined as cover designed to protect organizations and individuals from digital threats such as data breaches, malicious cyber hacks on computer systems or denial-of-service attacks.

This insurance may include first-party cover for the cost of investigating a cybercrime, recovering data lost in a security breach, restoration of computer systems, loss of income incurred by a business shutdown, reputation management, extortion payments demanded by hackers and notification costs, in case of a requirement to notify third parties affected.

It may also include third-party cover for damages, settlements and associated legal costs arising from claims against the policyholder. Moreover, the definition extends to both cyber cover acquired on a stand-alone basis and cover integrated within other types of insurance (e.g. commercial multi-risk).

Beazley and Chubb are likely to have been the global market leaders by GDPW, followed by Munich Re, Fairfax Financial Holdings and AXA.

The relatively new and specialized nature of cyber cover plus its geographic skew to the US make it a more concentrated sector than most other categories of insurance. For instance, the equivalent percentages (in 2020) for the top 20 and top 100 groups in total commercial P&C insurance worldwide were 40% and 70%, respectively, while for auto (motor) insurance they were a respective 47% and 71%.

However, due to high rates of ceded reinsurance and, to a lesser extent, securitization of cyber risks, the apparent concentration of GDPW is, of course, only a partial indicator of where insured cyber risks ultimately lie.

Overall, the research established that over 180 insurer groups were underwriting cyber risks on a direct basis by the end of 2021 including over a half of the world’s top 250 groups by total P&C (non-life) GDPW. Several significant insurer groups that were not underwriting cyber risks themselves were found to act as distribution partners for it.

For instance, as of May 2022, Progressive (ranked 8th globally by total P&C GDPW) was offering quotes from Cyber Policy, a trading name of CoverHound, an intermediary, while MATMUT (one of the largest mutual insurers in France) had a white-labelled offer backed by Chubb.

During 2022, and over and above pure demand for additional capacity in this risk category, the number of insurer groups underwriting cyber cover is likely to increase for several reasons:

- demand for and penetration of cyber insurance may grow in countries in which it remains relatively under-developed, such as in the Asia-Pacific region, thereby attracting local market entrants;

- there is potential for cyber cover to be marketed more actively to private customers, perhaps on an embedded basis within home insurance or cyber security software, or as an enhancement to high-end credit cards or bank accounts, or even as an employee benefit;

- several MGAs with a focus on cyber insurance (e.g. Coalition, Cowbell Cyber, Resilience) have been setting up their own carriers with a view to potentially retaining a proportion of risk themselves, joining a few other MGAs (e.g. CFC Group) that have already taken this step.

On the other hand, trying to precisely forecast the growth of the global cyber insurance market beyond the next year or two is problematic as the explosive growth witnessed in 2021 and the first half of 2022 is unlikely to be sustainable. Nevertheless, it seems certain to remain on a strong upward trajectory.

Definition – cyber cover is designed to protect organizations and individuals from digital threats such as data breaches, malicious cyber hacks on computer systems or denial-of-service attacks. This insurance may include first-party cover for the cost of investigating a cybercrime, recovering data lost in a security breach, restoration of computer systems, loss of income incurred by a business shutdown, reputation management, extortion payments demanded by hackers and notification costs, in case of a requirement to notify third parties affected. It may also include third-party cover for damages, settlements and associated legal costs arising from claims against the policyholder. Moreover, the definition extends to both cyber cover acquired on a stand-alone basis and cover integrated within other types of insurance (e.g.commercial multi-risk).

………………………..

by

by