Hungary’s insurance industry is poised for a strong recovery in 2022 driven by government support measures for economic recovery and buoyant consumer confidence.

After contracting by 4.7 per cent in 2020, the Hungarian economy is expected to grow by 7.4 per cent in 2021. The recovery in the economy, as well as government-initiated stimulus programs, will support the insurance industry’s growth in the country.

According to GlobalData, the Hungary’s insurance industry is projected to grow at a compound annual growth rate (CAGR) of 6.3 per cent from US$3.91 billion in 2020 to US$5.67 billion in 2025

The government initiated various stimulus programmes such as income tax reliefs, re-introduction of the 13th monthly pension scheme, and an increase in administrative wages are expected to improve household consumption and support the Hungarian insurance industry which is expected to grow by 5.3 per cent in 2021.

Rakesh offers their view on the key segments in Hungary’s insurance industry: “General insurance accounts for 56% of GWP in 2020 with life insurance accounting for the remaining 44% share.

Within general insurance, motor and property insurance are major lines of business and account for 85.6% of premiums.

Hungary’s insurance industry presents a positive-growth outlook over the next five years driven by economic recovery which has already reached pre-pandemic levels by the second quarter of 2021. Demand for general insurance will be driven by rising disposable income while the country’s aging population will support growth of life insurance in the country.

Insurers’ 2021 net profits compressed to EUR 217 million

Life GWP increased by 13.64% y-o-y to HUF 602.7 billion / EUR 1.6 billion while non-life portfolio expanded by 7.9% to HUF 726.8 billion / EUR 1.9 billion, according to the most recent statistics published by the National Bank of Hungary (MNB). Thus, during the analyzed period, the life insurance business accounted for 45% and the non-life insurance business for 55% of total GWP.

In terms of claims, overall, total incurred claims by 7.1% y-o-y to HUF 703 billion (EUR 1.9 billion): life incurred claims increased by 8.1% y-o-y to HUF 426 billion, while the same indicator in non-life totaled HUF 277 billion, 5.8% more y-o-y.

Insurance companies’ after-tax profit was nearly HUF 80.15 billion (EUR 217.2 million) in 2021 Q1-Q4, which indicates a decrease of nearly 2.6% year on year. 21 insurance companies made profits in 2021 Q1-Q4, and two insurers made a loss.

The 2021 aggregate technical result (life and non-life, summed-up) totaled HUF 78.8 billion (EUR 213.5 million), up by 1.3% vs. December 2021 (HUF 77.8 billion). Of this total, HUF 22.5 billion was related to life insurance segment (vs. HUF 28 billion), the remaining HUF 56.3 billion (vs. HUF 49.8 billion) being related to non-life subclasses.

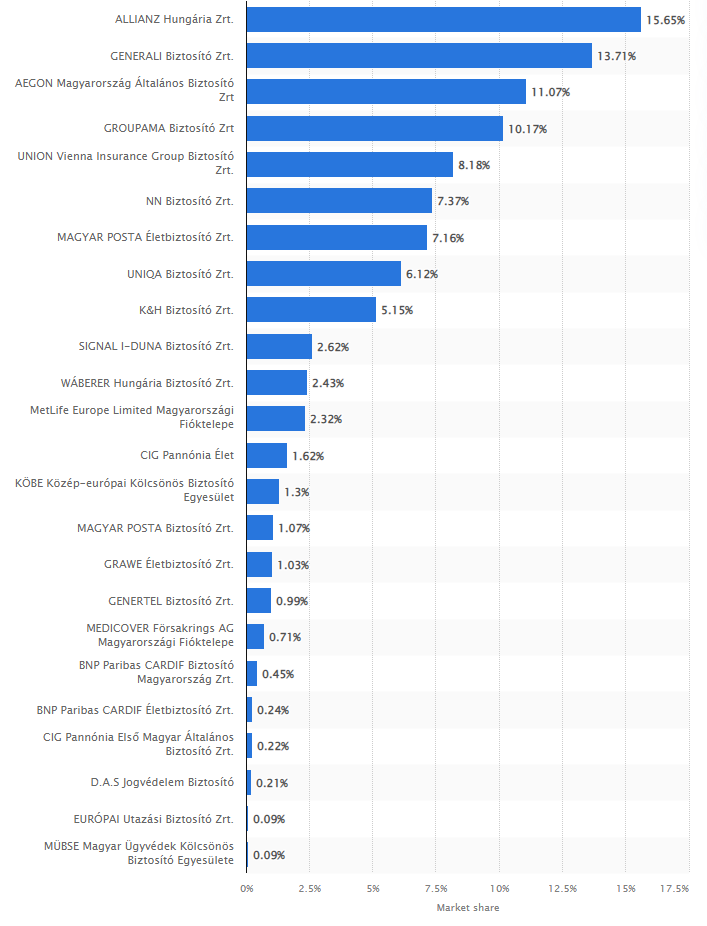

Market share of insurance companies in Hungary, by gross premiums written

At the end of 2021, the total contract portfolio of insurance companies rose by 1.2% from its level a year earlier, reflecting over 175,300 increases in the number of new contracts. This mainly resulted from a 1.73% rise in the number of non-life insurance contracts (to 12,277,158), accompanied by a declining number of life insurance contracts (a decline of 1.43% to 2,309,823). As a result, the total number of insurance contracts approached 14.6 million at the end of 2021 Q3 (see Global Insurance Markets Trends and Forcasts for Life & Non-Life Insurance).

At the end of 2021 Q4, the total contract portfolio of insurance companies rose by 1.5% from its level a year earlier, reflecting a growth of over 217,500 in the number of new contracts.

This mainly resulted from a 2% rise in the number of non-life insurance contracts (to 12.33 million), accompanied by a declining number of life insurance contracts (a decrease of 1.03% to 2.31 million). As a result, the total number of insurance contracts approached 14.65 million at the end of 2021 Q4.

At the end of 2021 Q4, the number of insurance companies subject to the Solvency II remained unchanged relative to the previous period, the number of supervised institutions was 22: 4 specialized life insurers, 9 non-life, and 9 composite insurers.

Based on the residence of owners of insurance companies, foreign ownership accounted for 75% within life insurers and 100% within composite insurers in 2021 Q4. This ratio for non-life insurance companies was only 56%.

The concentration of life insurance companies was little changed in 2021 Q4 from a year earlier: while the top five life insurance companies accounted for 61% of technical reserves under the Solvency II capital standard in 2021 Q4 compared with 62% a year earlier, the share accounted for by the top five insurance companies, active in the non-life business, of total premium income rose from 71% a year earlier to 72% in 2021 Q4.

by Yana Keller