Arbol, a climate risk solutions insurtech, has sequred of a $60 mn Series B funding round co-led by Giant Ventures and Opera Tech Ventures, with additional participation from Mubadala Capital.

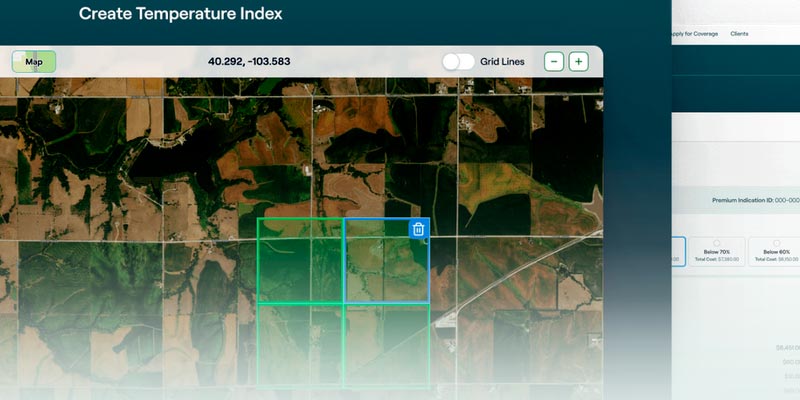

Established in 2018, Arbol specializes in parametric risk transfer along with climate and weather insurance and reinsurance.

In 2023, the company recorded $250 million in gross written premiums, with notable expansion in the renewable energy and reinsurance domains. Arbol Insurance Services, its wholly-owned subsidiary, achieved a significant milestone by becoming an approved Lloyd’s of London cover holder in May of the previous year.

Arbol has launched Lilypad Insurance, a new firm targeting homeowners and property investors in coastal regions. Following its authorization in Louisiana, Lilypad has initiated operations there.

Arbol is set to acquire Centauri Specialty Insurance Company and Centauri National Insurance Company, subject to regulatory approval.

Arbol has secured new funding, which will facilitate its growth in the agricultural and renewable energy sectors by developing tailored products for emerging risks and new markets.

This financial boost will also support Arbol’s international expansion and its investments in property and casualty (P&C) and home insurance sectors both domestically and abroad.

Sid Jha, the founder and CEO of Arbol, stated that the Series B funding is a crucial milestone for the company, underscoring its accomplishments and advancing its goal to globally standardize parametric financial products and insurance as essential approaches in managing climate risks.

Our ambition extends from empowering the world’s smallest subsistence farmers in underserved regions to securing the assets of the world’s largest corporations, ensuring they all have access to unmatched protection amidst the unpredictability of climate change

Sid Jha, Arbol’s founder and CEO

“Our approach is not just about offering insurance; it’s about creating a safety net that spans the entire spectrum of economic participants affected by climate volatility,” Sid Jha, Arbol’s founder and CEO added.

Cameron McLain, Co-founder and Managing Partner of Giant Ventures, stated that extreme weather events are frequently reported, presenting challenges for traditional insurers.

He highlighted Arbol’s innovative approach as a solution that allows businesses of various sizes to manage climate risk where conventional insurance methods fall short.

McLain praised Arbol’s achievements and emphasized its role as a critical component of climate adaptation and the global financial infrastructure.

Thibaut Schlaeppi, Managing Director of Opera Tech Ventures, noted the increasing visibility of climate change and the growing necessity for scalable and economically viable hedging solutions. He mentioned that integrating insurance and capital markets provides Arbol’s clients with a crucial opportunity to enhance their financial resilience.

Arbol is a platform to bring farms and businesses exposed to weather risk with capital providers looking for diversified returns.

Using a wide variety of datasets and smart contracts, we aim to get you paid rapidly for unexpected weather.

Arbol aims to bring scale, transparency, and efficiency to the weather risk market by creating customized, local contracts based on high resolution datasets covering events such as droughts, floods, heat and frosts.