Insurtech Faura, which uses climate and property analytics to better understand disaster risk, has raised $500k in its first round of funding to help insurance companies and homeowners reduce their natural disaster risk.

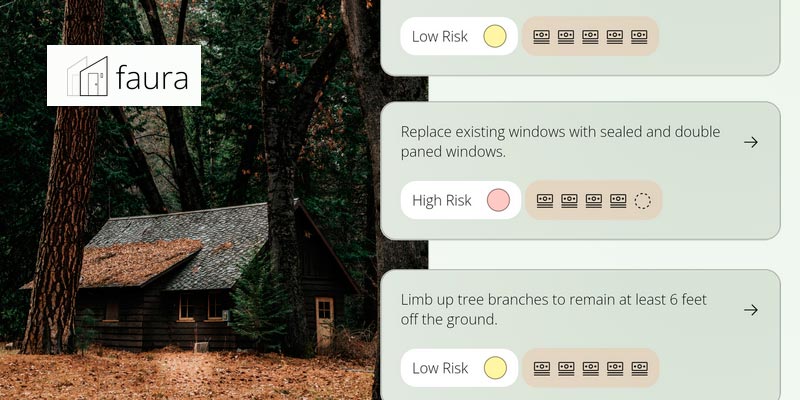

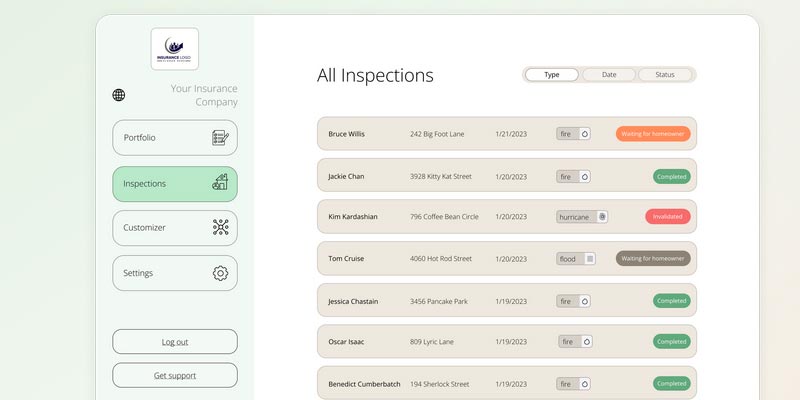

Faura is already working with insurers on wildfire and wind-related risk, offering risk assessments that translate into action items that tie directly into the policy of hundreds of homeowners.

The pre-seed round was led by Honors Fund by CEAS Investments, with participation from MetaProp, Dorm Room Fund, Responsibly Ventures, and a group of angel investors.

The funding will enable Faura to expand its operations and further its mission of transforming the property insurance landscape.

In addition, Faura has been accepted into the MetaProp Accelerator program, where it will join six other startups in the proptech space for the 2024 program.

Cities throughout the US have been impacted by natural catastrophes, like wildfires in Maui and flooding across the Northeast and Florida, in recent years; disaster activity that only keeps growing.

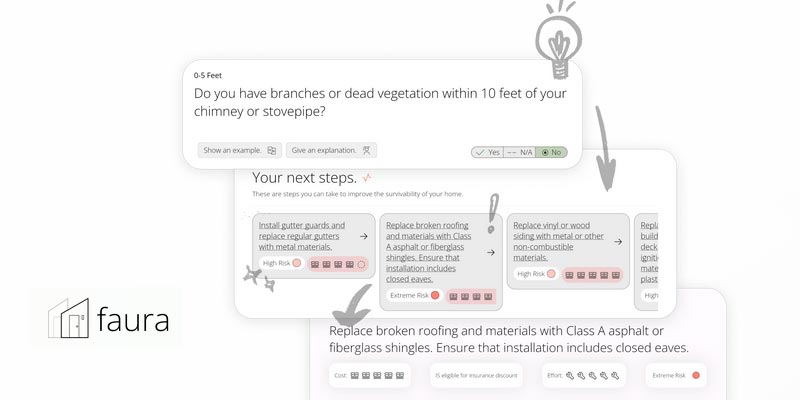

This has left homes in need to add retrofits to enhance their protection and survivability, Faura highlights. As of right now, there are very few enhancement programs that add value and reduce friction for the homeowner without sacrificing more time and energy.

Faura aids in this effort by integrating with insurance policies and offering incentives for homeowners that reflect in their policies.

Our goal is to help carriers acquire the data they need to better understand their portfolio risk. Climate change isn’t going anywhere, so we need to give underwriters better tools to aid in the decision-making process

Valkyrie Holmes, Faura co-founder and CEO

“We help insurance companies and homeowners reduce their natural disaster risk by providing them with property and climate risk data and better incentivizing the end policyholder”, Valkyrie Holmes says.

During the pre-bind process, homeowners get a notification and a risk assessment from their insurance company to help gather more information about the policy.

Faura has begun onboarding its first insurance companies and agencies onto its platform. The company is now serving homeowners and agents in Hawaii, California, Oregon, and Texas, with plans to expand into Florida soon.

Through this process, Faura has gained insight into the vast and multifaceted insurance industry.

Navigating the complexities of personal, commercial, property, auto, and renters insurance, as well as specialty insurance, has posed a challenge in meeting the diverse needs of various stakeholders.

Despite these challenges, Faura has made significant progress. The number of assessments conducted has grown from around 100 per month to over 600 per month in the last quarter.

By catering to both insurance companies and agencies, Faura has successfully diversified its approach and doubled its deals in the past month.

Faura’s completion of its $500k round marks a fundamental step in their building and will allow them to serve more homeowners and integrate more underwriters into a comprehensive solution.

The company has been recently accepted into the Metaprop Accelerator program in New York City, where it will work with senior proptech angel investors and executors to accelerate growth.