Fitch Ratings asserts that Korean insurers are equipped to handle decreased valuations in their international commercial real estate (CRE) investments and other real estate holdings without significant negative effects on their ratings in the near term.

Korean insurers are at risk of potential losses due to their CRE investments, influenced by factors such as rising interest rates and changes in work and consumption habits following the Covid-19 pandemic.

However, these expected CRE-related losses are likely to minimally affect their profitability.

Fitch anticipates that the ongoing increase in the release of contractual service margins (CSMs), supported by robust underwriting performance, will sustain the profitability of Korean insurers despite potential volatility in investment returns, including those from CRE impairments.

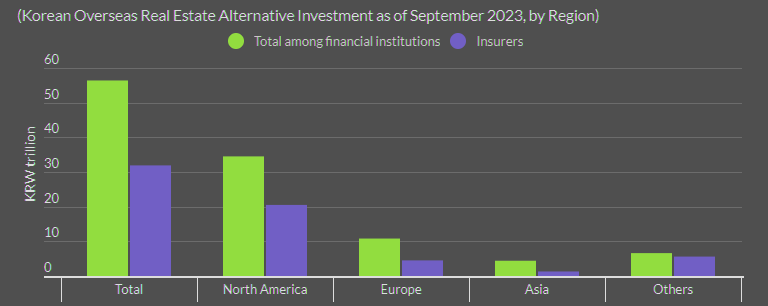

As of the end of September 2023, the Financial Supervisory Service (FSS) reported that insurers’ foreign CRE investments totaled KRW 31.9 trillion (approximately USD 23 billion).

This represents the largest investment value among Korean financial institutions, accounting for about 3% of the sector’s total invested assets and roughly 12% of the insurers’ total shareholder equity, factoring in CSMs net of tax.

Fitch Ratings anticipate a minimal impact on insurers’ solvency ratios and capitalization, as portfolio exposure to risky assets is low compared to their total investments.

Even in cases of significant downturns in overseas commercial real estate (CRE) markets, the overall Korean Insurance Capital Standard (K-ICS) ratio is expected to decrease by only a mid-single-digit percentage.

Insurers’ Overseas Real Estate Exposure Concentrated in North America

However, the specific impact will differ among companies depending on their investment choices and risk management strategies.

In 2023, high-quality fixed-income securities constituted about 60% of insurers’ asset portfolios, representing the largest asset class.

Nevertheless, since 2019, many Korean insurers have increased their investments in higher-risk assets, particularly beneficiary certificates, in response to low interest rates. These assets provide higher yields and diversify the portfolio, yet they offer less liquidity compared to traditional equities and bonds.

Most insurers’ exposure to overseas CRE is through indirect investments in such beneficiary certificates, typically via funds of funds. Direct exposure to CRE among Korean insurers is minimal, largely limited to properties owned for their use.

According to the FSS, Korean insurers’ overseas CRE exposure at end-September 2023 was concentrated in North America (64.2% of the total), with Europe (14.2%), Asia (4.2%) and other regions (17.6%, including Oceania) accounting for much smaller shares.

There was a high concentration of exposure to office assets within CRE exposure, a segment that has suffered a significant post-pandemic value decline in several countries. Moreover, a relatively high proportion of overseas CRE assets were in the form of mezzanine and sub tranches, which could be more fragile under the severe deterioration of credit conditions that is occurring in many overseas CRE markets.

Most of the insurers recognised part of their CRE-related impairment losses in 2023, after a decline in the market value of these assets. Korean insurers’ sound capitalisation levels will provide an important buffer in the event of a more severe CRE downturn. We believe strong capitalisation will continue to give Fitch-rated Korean insurers the headroom to absorb shocks from CRE impairment losses, given the scale of their exposure to CRE.