QBE Insurance Group has announced its 2022 (FY22) statutory net profit after tax of $770mn, compared with $750mn in FY21.

Adjusted cash profit after tax increased to $847mn from $805mn in the prior year, resulting in an adjusted cash return on equity of 10.5%, compared to 10.3% in the prior year.

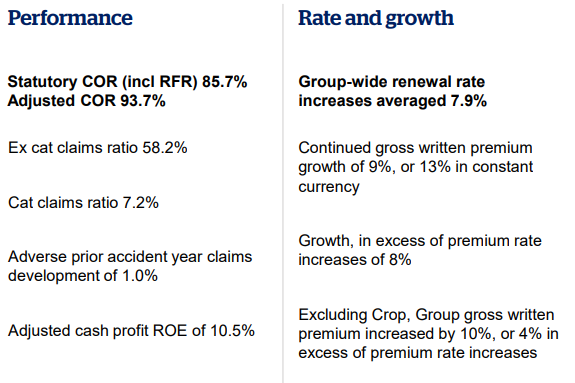

In a backdrop underscored by heightened inflation, geopolitical tensions and elevated catastrophe activity, QBE’s underwriting performance demonstrated improved resilience, with the adjusted combined operating ratio of 93.7% improving by 1.3ppt compared to the prior period.

This reflected strong rate increases, lower total acquisition costs, and a reduced level of adverse prior-year development, partially offset by elevated catastrophe costs.

Strong premium growth continued, with group-wide renewal rate increases of 7.9% in FY22, which supported gross written premium growth of 13% to $20,054mn. Growth continued across all divisions, with North America, International and Australia Pacific achieving growth of 16%, 14% and 9% respectively.

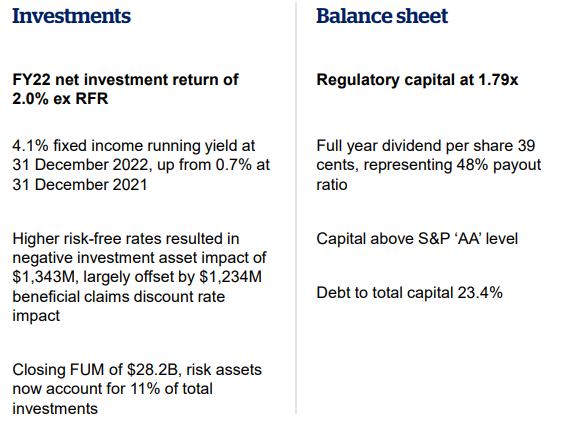

The total investment loss for the year was $(776)m or (2.7)%, compared with a return of $122m or 0.4% for the prior period. The result was heavily impacted by unrealised losses associated with the significant increase in bond yields over the year.

QBE’s indicative regulatory capital PCA (Prescribed Capital Amount) multiple was 1.79x as of 31 December 2022 compared to 1.75x as of 31 December 2021 and toward the upper end of the Group’s 1.6-1.8x target range.

The Board has declared a final dividend of 30 Australian cents (20.6 US cents) per share, compared with the FY21 final dividend of 19 Australian cents per share.

The combined interim and final dividend of 39 Australian cents per share equates to a total dividend payout ratio of 48% of adjusted cash profit and reflects the current strength of the Group’s capital position and continued positive outlook for growth.

QBE says that the recent momentum will continue. In FY23, QBE expects constant currency GWP growth in the mid-to-high single digits, with a group combined operating ratio of 93.5%.

by Yana Keller