UK life insurers’ recently announced 2023 results, which featured strong growth in bulk annuity transactions, reinforce the sector’s improving outlook assigned by Fitch Ratings.

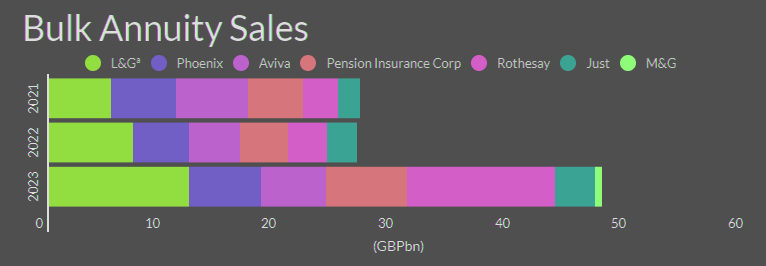

Bulk annuity sales last year were close to GBP50 bn, the highest ever. Demand from corporates to offload their pension liabilities to insurers was strong, spurred by better affordability due to improved pension scheme funding levels following interest rate rises.

Fitch Ratings expect transaction volumes to exceed GB60 bn in 2024, with demand remaining strong.

Royal London recently announced its entry into the bulk annuity market and we expect the sector to allocate more capital to the market, attracted by the prospect of profitable growth.

As the bulk annuity market grows, we expect the use of funded reinsurance (‘funded re’) to become more prominent. This could pose risks if insurers become over-reliant on a small number of credit-focused reinsurers.

However, tight regulation and the use of diversified panels of highly rated reinsurers will limit the risks, and Fitch expect the sector’s use of funded re to stay below 30% of bulk annuity premiums in 2024-2026.

UK life insurers maintained strong Solvency II (S2) ratios in 2023, supported by high interest rates, resilient capital generation from in-force business and a reduction in the ‘risk margin’ under post-Brexit S2 reforms.

Fitch expect insurers to maintain strong S2 ratios in line with their cautious risk appetites.

Notwithstanding the credit positives of bulk annuity growth and strong S2 ratios, the sector faces a dent to profitability from consumer duty rules introduced in 2023.

These require UK financial services companies to show that their prices represent fair value to customers, according to UK Life Insurance Sector Outlook for 2024.

Several insurers operating in wealth management have been asked to respond to the Financial Conduct Authority’s (FCA) review of ongoing customer advice, which may require charges to be refunded where there is a lack of evidence that correct procedures were followed. St James’s Place has made a material provision for this.

Legacy products, sold before 31 July 2023 but not marketed or sold to new customers since then, will come into the scope of the consumer duty rules this July, and some insurers are likely to reduce customer charges as a result.

Fitch generally expect reductions to be modest and we do not expect a spate of compensation claims from customers arguing that charges had been too high.

The FCA has made it clear that the consumer duty rules will not have a retrospective effect. It is unclear how losses could be quantified without a directly comparable product as a reference point.

by

by