Property and casualty insurance statutory earnings will materially improve in 2024 amid recovery in personal lines results and only modest deterioration in commercial lines underwriting, according to Fitch Ratings outlook.

Losses in personal lines underwriting, particularly in auto insurance, are expected to reduce substantially as natural catastrophe losses return to more typical levels.

Revenue growth in the sector is anticipated to decelerate in 2024, yet it will still surpass historical averages with an estimated 7% rise in both direct and net written premiums, a decrease from the 10% growth observed in 2023.

The revenue boost in 2023 stemmed from robust commercial lines performance and sharp increases in personal lines premiums due to significant price hikes, according to U.S. P&C Insurancee Outlook.

For 2024, the U.S. P&C insurance sector holds a neutral outlook across both commercial and personal lines, expecting stable or better results, especially with the anticipated recovery in personal auto and steady performance in commercial lines.

The sustained favorable performance in the commercial lines sector is linked to an unusually extended hardening phase of the market pricing cycle, which is projected to continue into 2024.

In 2023, underwriting outcomes faced challenges due to less favorable results from personal lines, which showed signs of improvement, and higher-than-average losses from natural catastrophes.

However, these were partly mitigated by substantial profits from commercial lines.

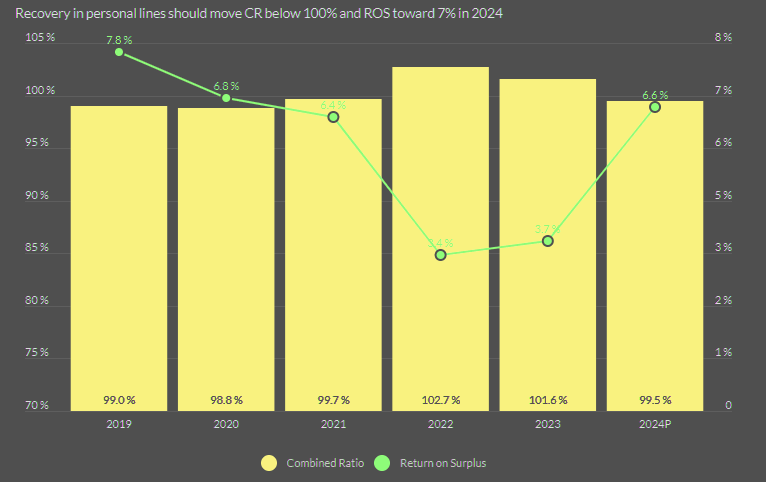

Property and casualty (P&C) insurers experienced a slight enhancement in statutory underwriting performance and a minor increase in net earnings for the year, achieving a combined ratio of 101.6% and a return on surplus of 3.7%, which remained significantly lower than historical averages.

P&C Industry Aggregate Statutory Profitability

The exposure to natural catastrophes continued to add volatility to the property insurance sector. In 2023, significant insured losses were driven by large inland convective storms, even though there were no major hurricane landfalls.

Rising claims severity in multiple segments tied to inflation and expansion of litigation activity, and settlement costs also create challenges in pricing coverage and projecting loss costs.

Adverse reserve experience in longer tail casualty segments are likely to continue over the near term.

Statutory earnings retention combined with material unrealized gains on investments contributed to a 5.5% increase in policyholders’ surplus to surpass $1 trillion again, while lower investment returns led to a 6.7% decline in surplus. Industry statutory leverage measures remained at relatively conservative levels at YE 2023.

by

by