Verisk, a leading global data analytics and technology provider, announced the launch of its new ClaimSearch system in Israel.

Developed in collaboration with the Israel Insurance Association and with the backing of the government, this state-of-the-art, cloud-based system aims to revolutionize the fight against insurance fraud in the country with advanced analytics and data contributions from across the Israeli insurance industry.

Insurance fraud in Israel has been a significant concern, costing insurers hundreds of millions of New Israeli Shekels (NIS) annually and leading to higher premiums for policyholders.

Verisk’s new ClaimSearch system, leveraging powerful computing resources and deep domain expertise, aims to swiftly analyze auto claims and detect indications of fraud, with the goals of ultimately reducing fraudulent activities and benefiting the entire insurance industry.

One of the key features of the new system is its ability to authenticate details provided by insurance applicants.

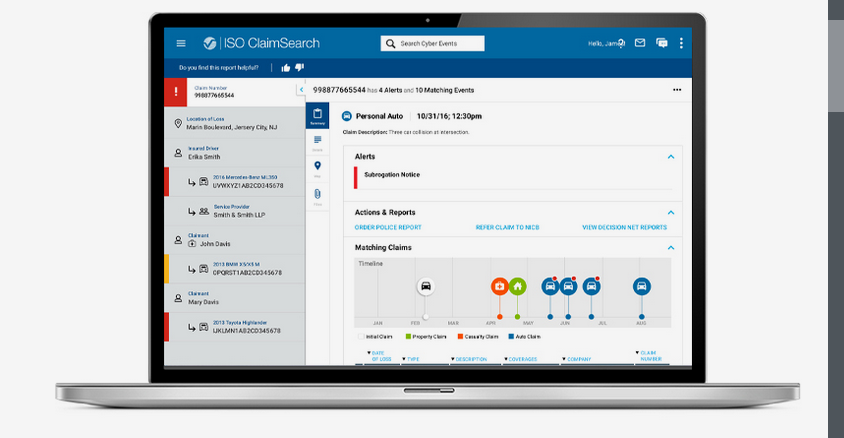

Visual ClaimSearch – Claims Alerts Dashboard speeds decision making

Determine if claims can be fast-tracked or if they require a closer look with at-a-glance insight.

Each claim is color-coded (next to the claim number in the upper left-hand corner) to reflect whether it has the following:

Alerts (with or without additional matches) –

Matches, but no alerts –

Neither matches nor alerts –

The dashboard includes a list of specific alerts (if applicable) as well as a timeline of any matching claims with loss type. You can drill down to learn more about both alerts and matches.

If claim status is green, consider fast-tracking. Yellow claims with matches may need a quick review—or more, depending on the matching claims found. Red claims with alerts may need to be slowed down for evaluation and possibly referred to SIU.

By comparing this information with data from the database and other sources such as the Ministries of Interior, Transportation, and Public Security, the system seeks to provide accuracy and reliability.

Claim adjusters will also benefit from advanced tools for investigation, data visualization, and business intelligence reporting.

Verisk’s broad suite of anti-fraud solutions is built upon a wealth of industry data and cutting-edge analytics. This unique foundation empowers SIU to combat claims fraud with speed, precision, and efficiency. Verisk emphasized the importance of robust data and advanced analytics in combating insurance fraud.

Preventing insurance fraud today requires a combination of robust data, advanced analytics, and solid industry partnerships.

We’ve taken our anti-fraud engine to the next level, enabling insurers to monitor claims in real time, check claims histories on-demand, and cross-check information from public sources. The result is better service and faster payments for the overwhelming majority of consumers with meritorious claims

Helena Cornell, vice president and general manager for anti-fraud analytics at Verisk

Since 2006, Verisk has been operating a central industry claims database for compulsory insurance in Israel. Building on its success, the company was awarded a contract in 2017 to develop an enhanced system with advanced analytics and capabilities. The new system has been designed to provide secure, fast, and integrated IT services.

by

by