Overview

Personal auto insurance underwriting profitability appears to finally be headed in a positive direction after recent years of record underwriting losses. But while these gains show improvement, it will likely take time for them to be reflected in flattening premium rate, according to the Insurance Information Institute (Triple-I) Issues Brief.

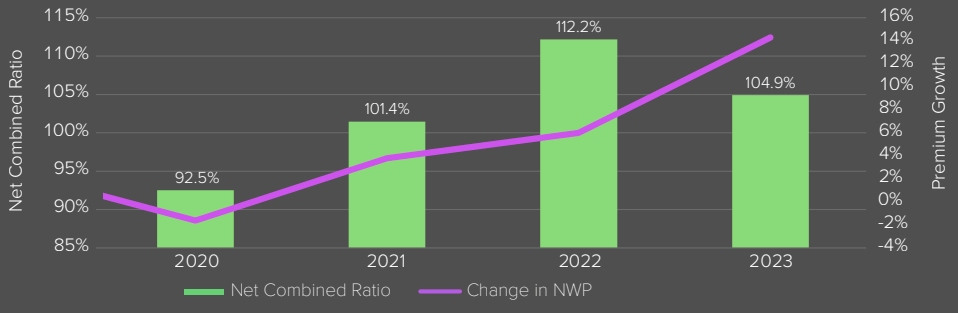

Auto insurers’ 2024 net combined ratio of 104.9 is 7.3 points better than 2023. Additionally, 2024 net written premium growth of 14.3% is the highest in over 15 years and six points higher than the next-highest during that period, reflecting rate increases to offset inflationary loss costs.

- Combined Ratio: Measure of underwriting profitability. Calculated by dividing claim-related losses and expenses by earned premium; dividing operating expenses by written premium; and adding the two ratios. A combined ratio under 100 indicates a profit, and one above 100 indicates a loss.

- Direct Premium Growth: Growth of an insurance line during a given period.

- Underlying Growth: The rate of growth that can be maintained without inflationary pressures.

- Replacement Costs: How much insurance pays to replace a damaged piece of property with a new one.

Drivers of Premium Rates Turning in the Right Direction

Several metrics that influence auto insurance premium rates are starting to improve, but it will take time for these improvements to be reflected in flattening premium rates (see US Auto Insurance Rates by States in 2025).

Direct premiums written and insurers’ underwriting profitability as measured by the combined ratio (definition at right) improved dramatically in 2024.

Auto insurers’ net combined ratio in 2025 improved to 104.9, a 7.3-point increase from 2022. The net written premium growth in 2024 reached 14.3%, the highest in over 15 years and 6 points higher than the previous record, due to rate increases to counter inflation-related loss costs.

These improvements follow 2022, which had the worst results in recent years. In 2020, the industry issued $14 mn in rebates and discounts to policyholders, anticipating lower losses due to reduced driving during the COVID-19 pandemic lockdown.

While insurers’ personal auto loss ratios fell briefly and sharply in 2020, they quickly deteriorated as a result of riskier driving behavior.

The number of drivers on the road has returned to pre-pandemic levels – but the driving behavior that led to the high losses has not improved (see how Technologies Transforms Auto Insurance).

More accidents with severe injuries and fatalities have driven up claims and losses in terms of both vehicle damage and liability, while attracting greater attorney involvement and legal system abuse.

Compounding this has been historically high inflation, which puts upward pressure on the material and labor costs.

We know that telematics can help improve driving behavior. An IRC survey found 45% of drivers said they made significant safety-related changes in how they drove after participating in a telematics program

Dale Porfilio, FCAS, MAAA, chief insurance officer at Triple-I and president of the Insurance Research Council (IRC)

Research also indicates that policyholders became more comfortable during the pandemic with allowing their driving to be monitored in exchange for the potential of lower insurance costs.

Personal Auto Underlying Growth and Replacement Costs

| Personal Auto (Change YoY%) | 2023 | 2024 | 2025 | 2026 |

| Underlying Growth | 10.2% | 4.0% | 4.7% | 5.5% |

| Auto and Light Truck Sales | 12.9% | 4.0% | 5.0% | 6.0% |

| Motor Vehicle Personal Expenditures | 4.8% | 4.0% | 4.2% | 4.5% |

| Replacement Costs | -0.2% | -0.5% | 1.8% | 2.7% |

| New Vehicles | 3.7% | 0.4% | 2.0% | 3.0% |

| Used Cars and Trucks | -7.1% | -1.4% | 1.5% | 2.5% |

| Motor Vehicle Parts and Equipment | 2.9% | -0.5% | 2.0% | 2.5% |

In 2025, new vehicle sales experienced their best year since 2019 – a development that benefited auto insurers’ DPW, as more cars sold means more cars insured.

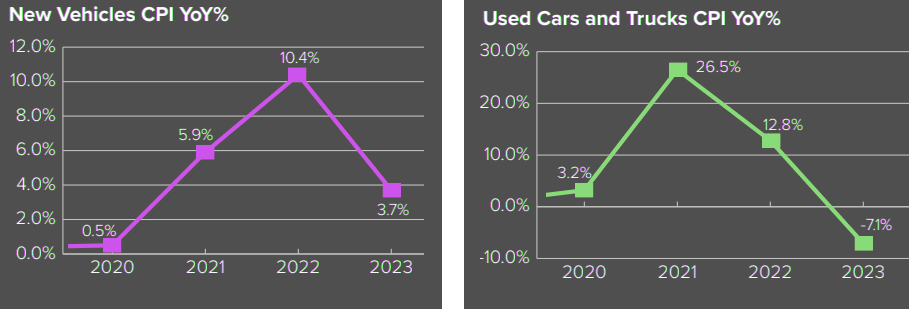

The consumer price index (CPI), a frequently used measure for inflation, has stabilized and prices of new and used vehicles have declined sharply.

But high interest rates continue to limit sales, and when and by how much the U.S. Federal Reserve will reduce rates remains an open question.

Net Combined Ratio and Change in NWP

Car insurance is like a fingerprint. Although your circumstances may seem similar, your personalized rating factors will cause your premium to vary from that of friends, family and the national average.

Even if insurance rates were to fall and spur more car buying, the negative trends in riskier driver behavior would still be a factor in premium pricing – in an environment with even more vehicles on the road.

The rise in premiums can be attributed in part to carriers continuing to produce strong top-line growth as they attempt to catch up to fast-rising private auto loss costs via rate increases.

Telematics can help address driving behavior

Distracted driving increased during the pandemic, resulting in more accidents, injuries, and fatalities. Research indicates that telematics insurance can mitigate this issue and other unsafe driving behaviors.

Telematics technologies enable insurers to assess risk profiles and adjust rates based on individual driving patterns.

By offering feedback that influences driving habits, telematics has been shown to reduce risk and lower insurance costs.

A survey by the Insurance Research Council (IRC) revealed that 45% of drivers made significant safety-related changes after joining a telematics program, while another 35% made minor changes.

According to IRC survey, 80% of drivers who participated in an auto insurer-sponsored telematics program reported changing how they drive, but not all the changes were permanent: 42% of those who made changes while in the program said that they now drive “pretty much” the same way as before.

34% reported that either their changes are permanent (15%) or they only rarely engage in their old driving habits (19%). 24% admitted to occasionally reverting to old driving habits.

Under a typical insurer-sponsored telematics program, insurers provide participating drivers with individualized recommendations on how they can reduce the risk of accidents by changing how they drive.

New Vehicles CPI vs Used Cars and Trucks CPI

The feedback is based on information about actual driving behavior collected during program participation.

These findings suggest that telematics programs play a beneficial role in promoting safe driving and reducing the frequency of auto accidents and their associated costs

David Corum, Vice President of the Insurance Research Council

“The findings also highlight an opportunity for insurers to find ways to help drivers make positive changes permanent”, said David Corum.

Policyholders also became more comfortable allowing their driving to be monitored in exchange for potentially lower insurance costs during the pandemic.

Car insurance consumer impact

It’s important to remember that the current hard market wasn’t created overnight, and it will take time for insurers’ performance to improve further and drivers’ rates to stabilize. Premium rates are not just affected by inflation.

According to Triple-I’s Issues Brief, several factors have contributed to the rise in auto insurance premiums, including:

- Rising accident frequency and severity

- More fatalities and injuries, leading to increased lawsuits

- Supply-chain issues and high labor costs

- More costly auto repairs due to increased technological sophistication in vehicles

Insurance is unique in that one-size-fits-all pricing would not be sustainable. If insurers had to come up with a single price for auto coverage that didn’t consider vehicle type and use, lower-risk drivers would inevitably subsidize riskier ones.

Confusion around rates is understandable

Risk-based pricing and state-by-state regulation – along with economic conditions and other factors – complicate insurance pricing.

The industry hires actuaries and data scientists and uses cutting-edge modeling technology to cut through the complexity and ensure that rates are accurate and fair.

Policyholders and policymakers need to understand how insurance pricing works – particularly the impact of driving behavior and

the role of inflation and other considerations that are not driver specific – to inform rate setting. Reduction of risk and underlying cost factors will be key to any future rate reductions.

FAQ

Several factors, including higher accident frequency and severity, supply-chain disruptions, increased labor costs, and more expensive vehicle repairs, have led to the rise in auto insurance premiums.

The 2024 net combined ratio improved to 104.9, a 7.3-point increase from 2023, driven by rate increases to offset inflationary loss costs and improved underwriting profitability.

Telematics programs collect data on individual driving behavior and help insurers adjust rates. These programs promote safer driving habits, reducing accidents and potentially lowering insurance costs for participants.

While inflation has stabilized and vehicle prices have declined, high interest rates continue to limit vehicle sales, impacting insurance premiums as fewer cars are sold and insured.

Riskier driving behaviors, such as distracted driving, have led to more severe accidents, increasing claims and legal involvement. This has driven up premiums, despite fewer drivers on the road compared to pre-pandemic levels.

Net written premium growth in 2024 reached 14.3%, the highest in over 15 years, due to rate increases aimed at countering inflation-related loss costs.

Premium rates are influenced by complex factors, including inflation, rising loss costs, and riskier driving behaviors. While rate increases have helped, it will take time for these metrics to stabilize and result in flattening premiums.

………………..

AUTHOR: Dale Porfilio – FCAS, MAAA, chief insurance officer at Triple-I and president of the Insurance Research Council (IRC)